SEC Reserve Rule Deadline Extended for Broker-Dealers

The SEC reserve rule deadline has been officially extended, giving broker-dealers much-needed breathing room to comply with the new requirements set forth under Rule 15c3-3. Previously slated for December 31, 2025, the updated deadline now falls on June 30, 2026, allowing firms to revamp their operational frameworks effectively. This critical extension enables broker-dealers to adapt their processes for daily reserve computations, ensuring compliance with the SEC’s Customer Protection Rule. Moreover, with the increasing complexities of digital asset custody, the additional time allows firms to implement robust systems that not only meet regulatory standards but also enhance the overall safety of customer assets. As the SEC continues to evolve its regulatory landscape, staying abreast of these significant rule changes is essential for broker-dealers to navigate compliance successfully.

The recent revision to the compliance timeline regarding reserve calculations presents a significant milestone for broker-dealers in the finance sector. By pushing back the deadline, the SEC allows these firms to address the challenges associated with the daily verification of customer reserves as stipulated in the amended Customer Protection Rule. This adaptable approach aligns with the SEC’s broader goals of enhancing broker-dealer compliance amidst evolving financial environments, especially with the rise of digital securities. Furthermore, the new framework provides firms the flexibility to manage digital asset custody more effectively, which is crucial given the burgeoning interest in these non-traditional investment products. As broker-dealers gear up for these changes, understanding the implications of the rule and preparing adequately will be vital for their operational success.

Understanding SEC Reserve Rule Deadline Extension

The SEC’s recent extension of the compliance deadline for the Customer Protection Rule, known formally as Rule 15c3-3, is a significant development for broker-dealers. Originally set to take effect by December 31, 2025, the new deadline of June 30, 2026, offers firms a much-needed interval to prepare for the transition from weekly to daily reserve computations. This adjustment is essential as it aligns operational practices with the growing complexities of financial markets, particularly in the realm of digital assets.

Furthermore, the extended timeline serves as a strategic buffer, allowing broker-dealers the opportunity to upgrade their systems and processes accordingly. Implementing daily reserve computation is not merely a technical task; it encompasses a broader range of compliance measures that ensure customer assets are adequately protected. With the intricacies associated with digital asset custody gaining prominence, this extension is a necessary acknowledgment of these challenges.

Implications of the Customer Protection Rule for Broker-Dealers

The amended Customer Protection Rule requires broker-dealers to focus on the daily computations of customer reserve requirements, thereby enhancing overall financial safeguards within the industry. This change is particularly relevant in light of the SEC’s decision to withdraw its restrictive guidelines imposed on digital asset securities. Now, broker-dealers can employ more flexible custody arrangements, further integrating digital asset securities into their offerings without the previous hurdles.

Moreover, this pivot signifies a critical shift in how broker-dealers can manage assets designated as securities, particularly as they relate to digital currencies. The SEC’s earlier stance on digital asset custody posed substantial limitations; however, the new guidelines empower firms to leverage qualified custodians to assert control over these assets effectively. In doing so, broker-dealers can meet the Customer Protection Rule’s demands while ensuring compliance with evolving regulatory landscapes.

Strategic Changes Required for Daily Reserve Computations

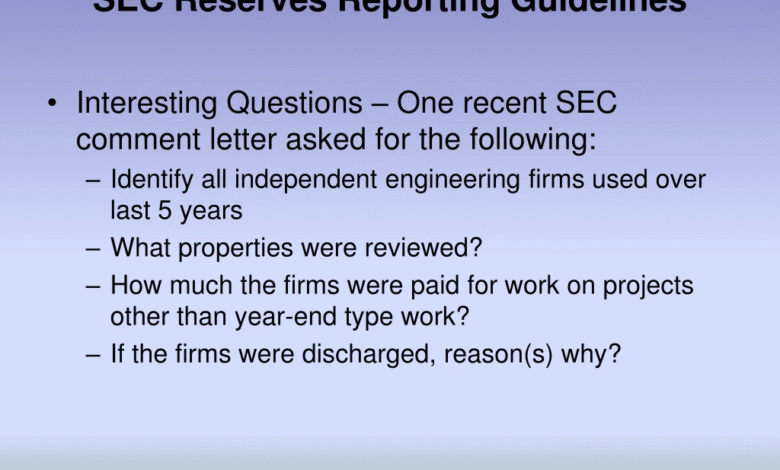

With the impending transition to daily reserve computations, broker-dealers must undertake comprehensive evaluations of their operational frameworks. These strategic changes include bolstering technology infrastructure that can accurately handle daily reserve calculations, a shift that necessitates training for staff and possible system updates. The intricacies involved in calculating reserves daily add a layer of complexity to brokerage operations, emphasizing the need for robust reporting and compliance capabilities.

In addition, broker-dealers must remain vigilant about their liquidity positions and customer asset management, ensuring that reserves are appropriately aligned with daily transaction volumes. A failure to execute these computations accurately could lead to severe regulatory repercussions, making it critical for broker-dealers to invest in both human and technological resources to meet these challenges effectively.

Importance of Digital Asset Custody in the New Rule Framework

The SEC’s recent adjustments underscore the growing importance of digital asset custody in the evolving landscape of financial regulations. By welcoming broker-dealers to utilize Rule 15c3-3(c) compliance methods for digital assets classified as securities, the SEC is facilitating broader participation in the market. This shift allows firms to incorporate digital innovation while ensuring that they meet compliance standards set forth by the regulatory body.

This regulatory flexibility is particularly beneficial as the market for digital asset securities continues to expand. Broker-dealers now have the opportunity to establish more streamlined custody processes, enabling them to manage and safeguard these assets more effectively. By utilizing qualified custodians, they can fulfill the requirements of the Customer Protection Rule, ultimately leading to enhanced investor confidence in digital asset trading.

Operational Challenges for Broker-Dealers Facing SEC Rule Changes

As compliance deadlines approach, broker-dealers are grappling with a myriad of operational challenges brought about by the SEC’s rule changes. This includes the pressure to solidify daily reserve computations accurately while maintaining compliance with the Customer Protection Rule. These challenges are magnified by the incorporation of digital assets into the mix, demanding that firms not only update existing systems but also adapt to new regulatory expectations.

Moreover, broker-dealers face the daunting task of ensuring staff members are adequately trained in the nuances of these changes. Creating a culture of compliance within their organizations is paramount as they navigate the intricacies of new requirements. Ensuring that every team, from operations to compliance, understands these changes will be key to fostering a resilient approach to operational challenges.

Future of Broker-Dealer Compliance in a Digital Asset Era

Looking toward the future, the SEC’s regulatory framework appears set to embrace a more inclusive approach towards broker-dealers managing digital assets. The recent amendments indicate a recognition of the significant role that digital asset securities will play in the financial markets. As regulations evolve, firms will need to stay informed and agile to maintain compliance while seizing growth opportunities.

This proactive stance not only helps broker-dealers safeguard their operations but also positions them favorably as trustworthy custodians of digital assets. By aligning themselves with regulatory expectations, these firms can build robust operational models that effectively respond to both current demands and future trends within the dynamic landscape of finance.

Balancing Compliance and Innovation in Broker-Dealer Operations

In an era where financial innovation rapidly evolves, broker-dealers must find a delicate balance between compliance and adaptability. As the SEC’s rules tighten on customer protection, organizations must ensure their operational models can withstand regulatory scrutiny while also integrating innovative practices. Embracing technology can lead to efficiencies in daily computations, ultimately improving overall compliance performance.

Investing in advanced reporting tools and automation systems is essential to navigate the complexities of the Customer Protection Rule effectively. Broker-dealers who can successfully merge innovation with compliance efforts will not only meet regulatory standards but also enhance their competitive edge within the marketplace.

Training and Development Needs for Broker-Dealer Staff

As broker-dealers prepare for the implementation of daily reserve computations, the necessity for targeted training and development programs is increasingly evident. Staff at all levels must understand the implications of the SEC’s amendments to the Customer Protection Rule to ensure seamless integration into existing operations. These training initiatives should cover the fundamentals of compliance, the importance of digital asset custody, and the methodologies behind daily reserve calculations.

By fostering a culture of continuous learning, broker-dealers can empower their teams to approach compliance with confidence and competence. Given the evolving nature of finance, ongoing professional development will be fundamental in equipping employees with the skills necessary to navigate the regulatory landscape effectively.

Evaluating the Impact of SEC Rules on Market Dynamics

The SEC’s amendments to the Customer Protection Rule and the extension of the compliance deadline are poised to shape market dynamics considerably. These changes will likely enhance the operational transparency of broker-dealers while ensuring that customer assets are diligently safeguarded. As firms adapt to the daily computation requirements, market participants can expect a shift toward more rigorous compliance standards across the board.

Additionally, as broker-dealers embrace these changes, we may witness a ripple effect across the broader financial ecosystem, cultivating a more secure environment for digital asset transactions. The interplay between regulation and innovation will ultimately determine the trajectory of broker-dealer operations in this new landscape.

Frequently Asked Questions

What is the new deadline for broker-dealers to comply with the SEC reserve rule changes?

The SEC reserve rule deadline for broker-dealers is now set for June 30, 2026. This extension from the original December 31, 2025, deadline provides broker-dealers with additional time to comply with the Customer Protection Rule by transitioning to daily reserve computations.

How does the SEC reserve rule deadline affect daily reserve computations for broker-dealers?

The SEC reserve rule deadline requires that broker-dealers shift from weekly to daily reserve computations for customer assets classified as securities. This change aims to enhance financial safeguards and ensure better customer protection in the wake of updated SEC regulations.

What operational changes must broker-dealers implement due to the extended SEC reserve rule deadline?

Broker-dealers must implement new systems for daily reserve computations and ensure compliance with the Customer Protection Rule by the extended SEC reserve rule deadline. This includes testing new processes and possibly overhauling existing operational frameworks to accommodate the daily requirements.

Why has the SEC extended the deadline for broker-dealers regarding the reserve rules?

The SEC extended the deadline for broker-dealers to allow more time for necessary operational adjustments. Chairman Paul S. Atkins stated this was to help avoid unreasonable compliance pressures and operational challenges associated with the daily computation changes in the Customer Protection Rule.

What is Rule 15c3-3 and how is it related to the SEC reserve rule deadline?

Rule 15c3-3 is the SEC regulation requiring broker-dealers to compute customer reserve requirements. The recent extension of the SEC reserve rule deadline obligates broker-dealers to transition from weekly to daily computations, ensuring better customer protection and financial stability.

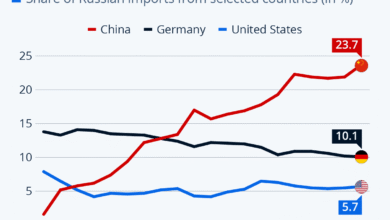

Are digital assets included in the SEC reserve rule changes for broker-dealers?

Yes, digital asset securities are included in the SEC reserve rule changes. Broker-dealers handling such assets must comply with the amended Customer Protection Rule by the new deadline, while non-security digital assets like bitcoin are excluded from these requirements.

What flexibility does the SEC reserve rule deadline offer regarding digital asset custody?

The extension of the SEC reserve rule deadline allows broker-dealers to adapt their custody arrangements for digital asset securities by utilizing methodologies compliant with Rule 15c3-3(c). This flexibility includes using qualified custodians to establish control over these digital assets.

How does the SEC reserve rule deadline impact customer protection for securities?

By extending the SEC reserve rule deadline, broker-dealers are given more time to implement daily reserve computations which enhance customer protection measures for securities. The transition ensures that customer assets are managed more securely, aligning with the objectives of the Customer Protection Rule.

| Key Points | Details |

|---|---|

| Extended Deadline | The SEC has extended the compliance deadline for the amended Rule 15c3-3 from December 31, 2025, to June 30, 2026. |

| Reason for Extension | SEC Chairman Paul S. Atkins stated the extension allows broker-dealers more time to implement necessary operational changes. |

| Impact on Broker-Dealers | The rule affects broker-dealers managing customer assets classified as securities, including certain digital asset securities. |

| Change in Computation Frequency | Broker-dealers must shift from weekly to daily computation of customer reserve requirements. |

| Custody of Digital Assets | The SEC allows broker-dealers to custody digital asset securities more easily under the revised rule. |

Summary

The SEC reserve rule deadline, initially set for December 31, 2025, has now been extended to June 30, 2026. This critical decision aims to provide broker-dealers the necessary time to adapt their systems and ensure compliance with the newly required daily reserve computations. The extended deadline signifies the SEC’s recognition of the operational challenges faced by broker-dealers, especially in light of evolving custody practices for digital asset securities. As the industry navigates these changes, the focus will remain on improving financial protection for customers while allowing for a smoother transition into the revised regulatory framework.