Aurora Mobile Bitcoin Allocation: 20% of Treasury to Crypto

Aurora Mobile Bitcoin allocation marks a significant step in the tech industry’s embrace of digital assets. The Nasdaq-listed Chinese company has announced its intention to convert up to 20% of its treasury reserves into Bitcoin and other cryptocurrencies, a move that reflects a growing trend among public companies investing in digital assets. By adopting a cryptocurrency treasury strategy, Aurora is not only aiming to enhance the value of its assets but also to expand its market footprint. This strategic decision aligns with broader changes in the financial landscape, where firms see potential in diversifying their reserves with Bitcoin. With the recent surge in Aurora Mobile news concerning this initiative, the market is set to watch keenly how this moves will impact their investment portfolio and overall company performance.

The decision by Aurora Mobile to allocate a portion of its financial resources toward Bitcoin exemplifies a notable shift in how companies are managing their treasury assets. As this China-based firm ventures into the realm of cryptocurrency, we see a surge in interest among other public companies looking to secure their financial future. The integration of crypto as part of a corporate asset strategy signifies a fundamental change in investment practices, emphasizing the importance of adopting innovative financial tools. With the potential for enhanced asset appreciation, companies like Aurora Mobile are paving the way for a new frontier in corporate finance. This evolution highlights the necessity for businesses to adapt to the increasingly digital economy, opening doors for further exploration in cryptocurrency treasury implementations.

Aurora Mobile Bitcoin Allocation: A Game-Changer for Corporate Treasury Strategy

Aurora Mobile’s decision to allocate 20% of its treasury to Bitcoin marks a significant shift in the corporate treasury landscape, particularly among public companies. This strategic move reflects growing confidence in cryptocurrencies as viable assets for preserving and enhancing value amidst economic uncertainty. By allocating cash reserves to digital assets, Aurora Mobile is not just participating in the crypto market; it’s aligning itself with a broader trend witnessed among tech firms and other industries prioritizing cryptocurrency treasury strategies.

This allocation to Bitcoin and other cryptocurrencies like ether and solana is seen as a crucial step for Aurora Mobile to mitigate risks associated with traditional fiat currency holdings. Investing in digital assets allows companies to diversify their portfolios and potentially capitalize on the rapid appreciation of these assets. As more public companies like Aurora Mobile jump on the crypto bandwagon, it signals a robust acceptance of cryptocurrency and its potential as a legitimate treasury asset.

The Rising Trend of Public Companies Embracing Crypto

The trend of public companies allocating portions of their treasury to cryptocurrencies is gaining momentum. This is evident from companies across various sectors that are increasingly investing in digital assets to diversify their revenue streams and hedge against inflation. As more firms disclose their cryptocurrency treasury strategy, it becomes apparent that this move is not just a fleeting trend but a long-term transformational shift in how corporations view and handle cash reserves.

Aurora Mobile’s proactive step positions it alongside other pioneering firms engaging with the cryptocurrency market. This alignment with digital currencies mirrors the growing interest among institutional investors and large corporations in harnessing the benefits of blockchain technology. By diversifying into Bitcoin, these companies not only benefit from potential value appreciation but also enhance their overall brand appeal in a tech-savvy marketplace.

With the unfolding dynamics in cryptocurrency markets, navigating this landscape requires careful consideration and strategic foresight, which Aurora Mobile seems to understand well as it updates investors on its bold move.

Investing in Digital Assets: The Future of Corporate Finance

Investing in digital assets is rapidly transforming corporate finance, offering new opportunities for companies to enhance their financial strategies. The cryptocurrencies space is evolving, presenting unique benefits such as liquidity, transparency, and the potential for substantial returns. Businesses like Aurora Mobile are leading the way by integrating Bitcoin and other cryptocurrencies into their financial reserves, ensuring they remain competitive in a fast-changing economic environment.

This forward-thinking approach provides several advantages. It not only acts as a hedge against inflation but also opens new avenues for investment diversification, allowing companies to balance their exposure to traditional markets. As corporations increasingly adopt these technologies, we can expect to see a more defined convergence between corporate finance and the digital currency economy.

Aurora Mobile News: Impacts of Crypto Adoption on Stock Performance

Aurora Mobile’s announcement regarding its Bitcoin allocation has already shown indicative effects on its stock performance. Following their decision to diversify their treasury strategy by investing up to 20% in digital assets, the company experienced a notable jump in pre-market trading. This responsive surge in share value demonstrates investor confidence and the growing impact of cryptocurrency alignment on public perception and market performance.

Such developments not only bolster Aurora’s financial standing but also signal to the market the importance of digital asset integration within corporate strategies. With increasing numbers of tech stocks exhibiting similar patterns, it is clear that integrating cryptocurrency into financial strategies is now becoming a critical factor for investors in assessing future growth potential.

Navigating Regulations in Cryptocurrency Investments

As public companies like Aurora Mobile continue to explore cryptocurrency allocations, navigating regulations becomes a pressing concern. The swift evolution of the cryptocurrency landscape presents opportunities but also regulatory challenges that companies must address proactively. Ensuring compliance with legal standards and financial monitoring is imperative for achieving a balanced approach to investing in digital assets.

The regulatory environment varies significantly across jurisdictions, making it crucial for companies to stay abreast of the latest rules impacting cryptocurrency investments. By implementing robust frameworks for compliance, corporations can mitigate risks associated with potential regulatory hurdles while benefiting from the promising aspects of digital asset investments. Aurora Mobile’s transparent approach to its cryptocurrency strategy serves as a helpful model for other companies seeking to capitalize on this emerging financial frontier.

Long-Term Predictions for Bitcoin and Digital Assets

The long-term outlook for Bitcoin and other cryptocurrencies remains a topic of keen interest and speculation among investors and financial analysts. As more public companies, like Aurora Mobile, embrace Bitcoin as part of their treasury, the cryptocurrency’s legitimacy continues to gain footing as a staple in corporate finance. Predictions suggest that as acceptance increases, so too may Bitcoin’s market value, leading to increased adoption and investment from institutional players.

Furthermore, the outlook for digital assets is promising, with rising technological innovations and burgeoning use cases in sectors like fintech and blockchain technology. As companies integrate cryptocurrencies into their financial frameworks, it is believed that these digital currencies will serve not only as a speculative asset but also as a vital component in the global economy, promoting financial inclusion and efficiency in various transactions.

The Competitive Edge: How Crypto Enhances Market Position

By allocating resources to cryptocurrency, Aurora Mobile and similar public firms are establishing a competitive edge. This innovative treasury management strategy helps differentiate companies in an increasingly crowded marketplace. Being early adopters of cryptocurrency not only positions these companies as forward-thinking but also allows them to leverage the potential growth and returns of these digital assets.

This competitive advantage extends beyond financial benefits; it enhances brand perception among consumers and investors who increasingly favor technology-driven, modern companies. As consumers continue to embrace digital transformation, aligning with cryptocurrencies positions these companies favorably in the eyes of tech-savvy individuals and potential investors.

The Role of Bitcoin in Protecting Asset Value

Investing in Bitcoin offers an effective strategy for companies like Aurora Mobile to protect and enhance their asset value. As traditional fiat currencies face devaluation pressures, cryptocurrencies provide an alternative store of value, driving interest across various sectors. With its finite supply and decentralized nature, Bitcoin stands as an appealing asset for firms aiming to insulate their holdings from inflationary risks.

The shift towards Bitcoin as a treasury asset also reflects changing investor sentiments and market realities. Companies are not simply chasing the latest market trend but are making calculated decisions to enhance financial resilience. This strategic wealth preservation through cryptocurrencies marks a pivotal moment in the evolution of corporate finance.

Future Corporate Strategies: The Intersection of Tech and Finance

Aurora Mobile’s allocation of treasury funds to cryptocurrencies exemplifies a significant intersection between technology and finance. As digital assets become more prominent, businesses that successfully integrate these innovations into their financial strategies can expect to thrive in tomorrow’s economic landscape. This synergy between tech and finance allows companies to innovate and adapt to ever-evolving market demands and consumer preferences.

Future corporate strategies will likely require an agile approach, leveraging technology not just for operations but as a core element of financial management. The successful navigation of this intersection by companies like Aurora Mobile may pave the way for new norms in corporate governance, pushing others to recognize the value of digital assets as essential contributors to overall financial strategy.

Frequently Asked Questions

What is Aurora Mobile’s new Bitcoin allocation strategy?

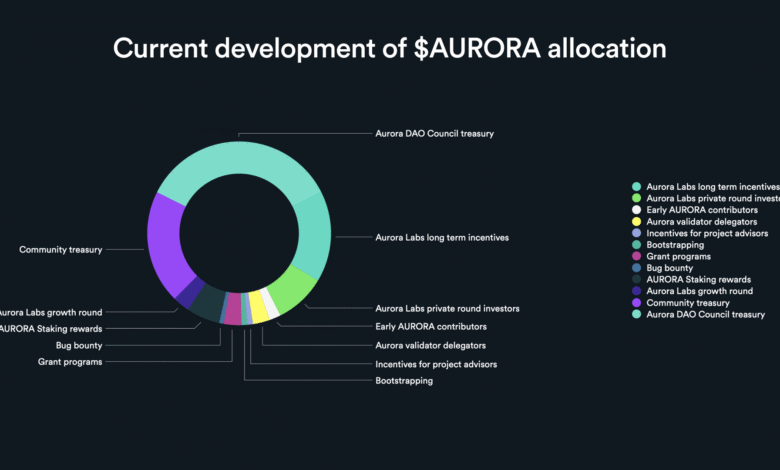

Aurora Mobile plans to allocate up to 20% of its cash reserves into Bitcoin and other cryptocurrencies as part of its treasury strategy. This decision aligns with the growing trend among public companies to diversify their asset holdings by investing in digital assets.

How much cash is Aurora Mobile planning to allocate to cryptocurrencies?

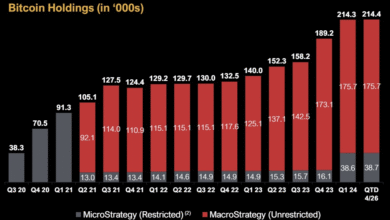

Aurora Mobile has approximately $15.8 million in cash reserves and aims to invest up to $3 million into Bitcoin and other crypto assets. This move is part of their strategy to preserve and enhance asset value.

Why is Aurora Mobile investing in digital assets?

Aurora Mobile is investing in digital assets like Bitcoin to diversify its treasury and enhance the value of its assets. The company believes that adding cryptocurrencies to its portfolio will support its strategy for expanding market coverage.

What cryptocurrencies will Aurora Mobile invest in besides Bitcoin?

In addition to Bitcoin, Aurora Mobile plans to invest in several other digital assets, including ether, solana, and sui, as part of its treasury allocation strategy.

How does Aurora Mobile’s Bitcoin allocation reflect broader market trends?

Aurora Mobile’s Bitcoin allocation is part of a larger trend where public companies are increasingly adopting cryptocurrencies as reserve assets. This shift indicates a growing acceptance of digital assets in traditional finance and investment strategies.

What impact did the Bitcoin allocation announcement have on Aurora Mobile’s stock?

After announcing its plan to allocate a portion of its treasury to Bitcoin and other cryptocurrencies, Aurora Mobile’s stock experienced a jump in pre-market trading, reflecting positive investor sentiment towards crypto-oriented strategies.

Is Aurora Mobile the first company to adopt a crypto treasury strategy?

No, Aurora Mobile is not the first company to adopt a cryptocurrency treasury strategy; however, it joins a growing list of public companies that are allocating portions of their reserves to Bitcoin and other digital assets.

What does investing in Bitcoin mean for public companies like Aurora Mobile?

For public companies like Aurora Mobile, investing in Bitcoin signifies a move towards innovative treasury management. It allows them to potentially increase their asset value and provides a hedge against inflation, aligning with modern investment strategies.

How will Aurora Mobile’s Bitcoin allocation affect its overall financial strategy?

Aurora Mobile’s Bitcoin allocation is expected to enhance its overall financial strategy by diversifying its asset base, which could lead to increased resilience in market fluctuations and support for growth initiatives in the tech sector.

Where can I find more news about Aurora Mobile’s cryptocurrency investments?

You can keep up with Aurora Mobile’s cryptocurrency investments and news through financial news websites, the company’s official press releases, and their investor relations page.

| Key Point | Details |

|---|---|

| Company Overview | Aurora Mobile is a Nasdaq-listed marketing technology firm based in Shenzhen, China. |

| Treasury Allocation | Aurora Mobile plans to allocate up to 20% of its cash reserves to Bitcoin and other crypto assets. |

| Objective of Allocation | The move aims to preserve and enhance asset value and support market coverage expansion. |

| Potential Investment | With approximately $15.8 million in cash reserves, the company may invest roughly $3 million into crypto. |

| Market Reaction | Aurora’s stock price increased in pre-market trading following the announcement, reflecting positive investor sentiment. |

Summary

Aurora Mobile Bitcoin allocation represents a strategic shift in how traditional companies view cryptocurrency. By committing 20% of their treasury to Bitcoin and other digital assets, Aurora Mobile aims to enhance its asset value and stay competitive in a rapidly evolving market. This move is part of a larger trend among public companies embracing cryptocurrency to diversify their financial resources, indicating growing confidence in digital assets as viable investment options.