Stock Market Outlook: July Promises Fireworks Ahead

The stock market outlook for July comes into focus as traders gear up for a potentially explosive month marked by the release of key economic indicators. With the S&P 500 climbing to new heights and the U.S. economy showing signs of resilience, eyes are set on the upcoming jobs report that could play a pivotal role in shaping market sentiment. Inflation concerns linger, adding an unpredictable layer to trading strategies, but experts remain optimistic about the momentum built in the first half of the year. Significant gains in employment data could bolster investor confidence, encouraging further rally within the index. As Wall Street prepares for what some analysts predict might be a historic month, the outlook appears both promising and uncertain.

As we transition into the latter half of the year, the financial landscape reveals a complex interplay of market dynamics that warrant close examination. Analysts are keenly observing the trends within the equities market, particularly in light of the forthcoming employment statistics that could signal shifts in consumer confidence and spending patterns. Amidst fluctuating inflation rates and evolving trading tactics, the U.S. economy presents an intriguing backdrop for investor activities. The latest performance of major indices such as the S&P 500 could either reinforce bullish attitudes or prompt caution, depending on the economic data released in the coming days. Therefore, understanding the intricate connections between economic indicators and market performance is essential for anyone looking to navigate this vibrant trading environment.

Stock Market Outlook: What Lies Ahead for Traders?

As traders approach the second half of 2025, the stock market is at a critical juncture. Following a volatile start to the year marked by the uncertainty of President Trump’s tariff policies, the S&P 500 has rebounded dramatically, closing last week at an all-time high. This momentum has investors buzzing about whether market confidence can endure, particularly as Wall Street now braces for potential policy shifts. Analysts, including Rick Rieder of BlackRock, hint at even further gains, attributing them to factors such as the burgeoning artificial intelligence sector which may help to alleviate inflation worries.

Despite the optimistic forecast, some market participants remain vigilant. The impending expiration of Trump’s 90-day tariff pause has cast a shadow over investor sentiment. With major indices showcasing solid year-to-date performance, heightened volatility could characterize trading sessions as the market navigates geopolitical concerns alongside local economic data. A surge in inflation or changes in employment trends reported next week could dramatically sway market confidence, compelling traders to revise their strategies to align with the evolving landscape.

Analyzing the Impact of Economic Data on the Market

The upcoming economic releases are pivotal as they influence market sentiment and trading strategies. Key indicators like the jobs report will provide insights into the U.S. economy’s health, determining if consumers remain buoyant or start cutting back on spending. Analysts expect nonfarm payroll figures from June to show a substantial gain, albeit lower than May’s. If job growth continues to exceed expectations, it might bolster confidence among investors, reinforcing the bullish outlook for the S&P 500 in the latter half of the year.

Additionally, other economic indicators such as the ISM Manufacturing and services reports will serve as barometers of economic vitality. A strong performance across these metrics could alleviate fears about inflation pressures and consumer spending, which are critical for maintaining market stability. Conversely, disappointing data could lead to recalibrated earnings expectations, setting off a chain reaction of nervous trading. This data will not only provide a glimpse into corporate health but also shape overall trading strategies for the second half of 2025.

Why July is Historically Strong for the Market

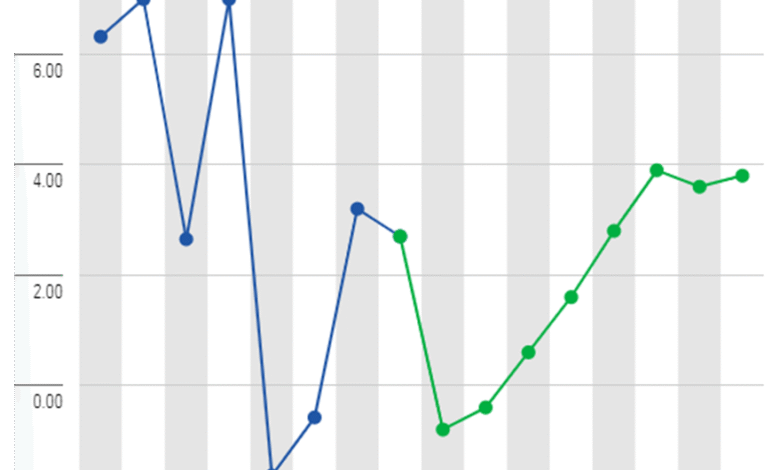

July has garnered a reputation as a month of strong performance for the stock market, particularly for the S&P 500. Historical trends show that as traders approach this traditionally positive period, confidence tends to build, especially following solid gains in the previous months of May and June. With positive data trends and a backdrop of post-election enthusiasm, many analysts believe the current market climate aligns well with this seasonal pattern. If previous years serve as a guide, July could very well mark the start of a powerful upward surge in equities.

However, despite these optimistic projections, several analysts are sounding a note of caution. The ending of tariff negotiations set for July 9 could introduce significant volatility, especially in response to any new trade policy announcements. The market’s reaction to these developments is uncertain, yet July’s consistent history of positive gains remains a strong factor for traders. Investors must prepare themselves for potential wild swings in stock prices, all while capitalizing on July’s favorable trading conditions.

Inflation Concerns and Their Influence on Trading

As the market gears up for the upcoming economic data, inflation remains a pressing concern. While some indicators suggest a moderation in price increases, the potential for inflation to spiral could greatly impact investor sentiment. If inflation fears are validated by the upcoming jobs and manufacturing reports, it could instigate a reevaluation of current stock valuations, particularly in high-growth sectors like technology and consumer discretionary. Differentiating between transient and persistent inflation pressures will be crucial for traders in optimizing their strategies.

Moreover, the Federal Reserve’s approach to managing inflation through interest rate adjustments will also weigh heavily on market performance. Any signal from the central bank indicating a tightening of monetary policy could drive stock prices lower. Conversely, if the Fed reassures markets with a looser policy stance, it could sustain the current rally. As analysts continue to monitor inflation trends, traders will need to remain adaptable, ready to pivot their strategies based on shifts in inflation data and Federal Reserve communications.

Job Growth and its Role in Economic Recovery

The health of the U.S. labor market will play a crucial role in forecasting the stock market’s trajectory in the coming months. As the jobs report is set to be released next week, market analysts are bracing for the figures to inform them about the broader economic narrative. Should the reported job growth align with or exceed expectations, it may provide much-needed reassurance to investors about the strength of consumer spending and economic resilience. A robust jobs report could catalyze further gains in major indices like the S&P 500.

On the other hand, any signs of weakness in job creation could provoke significant market reactions. If consumers begin to lose confidence in their job security, they are likely to curtail spending, directly impacting corporate revenues. In this context, the labor report serves not only as an economic indicator but as a gauge of market sentiment. Traders should prepare their strategies around the anticipated job growth figures, as positive or negative outcomes will likely shape the investing landscape for the foreseeable future.

The Role of Artificial Intelligence in Market Dynamics

Artificial intelligence (AI) is increasingly influencing market dynamics, particularly its potential impact on inflationary trends. Market analysts like Rick Rieder emphasize that advancements in AI technologies may lead to operational efficiencies that ultimately drive down costs for businesses. If successful, this could alleviate some inflationary pressures that have weighed heavily on investors’ minds. As corporations integrate AI into their operations, a transformative phase may unfold, characterized by sustained growth and enhanced profitability.

However, with new technologies comes volatility in equity markets. Investors must navigate the dual-edged sword of disruptive innovations that can lead to both aggressive growth and sharp corrections. The integration of AI into various sectors can produce rapid shifts in market valuations, as seen in tech-centric indices like the S&P 500. As such, traders should consider how AI advancements shape their trading strategies, taking into account the risks and rewards associated with this technological leap.

Understanding Valuations Amid Stock Market Peaks

As the S&P 500 approaches seemingly unsustainable valuation levels, concerns about over-optimism abound. Currently trading at a forward price-to-earnings ratio of 23.3, stocks are nearing valuations reminiscent of the late ’90s tech bubble. Such historical context obligates traders and investors alike to question whether this bull market can maintain its trajectory or if it is primed for a correction. While several analysts argue that current economic conditions differ significantly from those of 1999, the cautionary tale resonates with seasoned market players.

This backdrop calls for careful monitoring of earnings growth and overall economic data to justify ongoing high valuations. Investors must remain vigilant, as emerging economic data could either validate or dismantle the prevailing bullish narrative. As traders recalibrate their expectations and strategies, remaining aware of valuation metrics may prove vital to navigating potential market volatility in the latter half of 2025.

Trading Strategies for a Volatile Market

In a landscape marked by heightened volatility and policy uncertainty, adaptability in trading strategies becomes imperative. Successful traders will need to not only digest ongoing economic data but also respond swiftly to market shifts. Emphasizing a diversified approach can mitigate risks associated with sudden downturns while enabling participation in upswings when market conditions align favorably. Additionally, utilizing tactical options strategies may provide avenues to capitalize on anticipated volatility within the indices.

Moreover, remaining informed about macroeconomic factors, including interest rate changes and employment trends, will be critical for developing sound trading strategies. Traders could leverage sector rotations based on economic indicators; for example, switching to defensive stocks during turbulent periods may be prudent. As July unfolds, the infusion of positive economic reports could present multiple opportunities, making strategy recalibration essential to harness market movements for capitalizing on timely investments.

Keeping an Eye on Global Economic Factors

While the focus often centers on domestic economic indicators, global developments significantly influence U.S. markets. Trade negotiations, geopolitical tensions, and international economic health must remain at the forefront of traders’ strategic considerations. As the U.S. continues to navigate complex relationships with trading partners like China, shifts in foreign policy or unexpected trade agreements could impact stock performance considerably.

Furthermore, intertwined global economies mean that turmoil anywhere can ripple through to U.S. equities. For instance, if leading economies experience downturns, it could adversely affect consumer demand in the U.S., subsequently dampening corporate earnings. Thus, traders should maintain a holistic view of the global economic landscape while crafting their strategies in order to effectively weather and leverage international market fluctuations.

Frequently Asked Questions

What is the current stock market outlook for the second half of 2025?

The stock market outlook for the second half of 2025 appears optimistic, with analysts predicting further gains driven by factors such as strong economic data and the potential for lower inflation. Following a solid first half where the S&P 500 and Nasdaq Composite gained over 4%, market sentiment remains bullish as traders anticipate ongoing momentum.

How does the U.S. economy affect the stock market outlook?

The U.S. economy plays a crucial role in determining the stock market outlook. Key economic indicators, particularly the jobs report, significantly influence investor sentiment and trading strategies. A stable job market can support consumer spending and enhance market performance, while uncertainty can elevate volatility.

What impact does inflation have on the stock market outlook?

Inflation impacts the stock market outlook as it affects interest rates and purchasing power. Analysts believe that a declining inflation rate could support higher valuations in the stock market, especially for the S&P 500, thereby enhancing investor confidence and market rally potential.

How are trading strategies evolving in light of the current stock market outlook?

Trading strategies are evolving to adapt to the current stock market outlook, which includes an emphasis on sectors that may benefit from technological advancements and lower inflation. Investors are focusing on diversified portfolios while being mindful of potential volatility due to macroeconomic uncertainties.

What role does the jobs report play in shaping the stock market outlook?

The jobs report is a pivotal indicator in shaping the stock market outlook, as it reflects the health of the U.S. economy. A strong jobs report could signal consumer confidence and spending, which are crucial for sustaining market growth, while weaker figures may raise concerns about economic stability.

Will the S&P 500 continue to rise based on current stock market outlook trends?

Current stock market outlook trends suggest that the S&P 500 could continue to rise, especially if economic indicators remain positive and inflation continues to decline. Analysts predict that July could historically be a strong month for the index, supporting the potential for further gains.

What are the risks to the stock market outlook in the second half of 2025?

Risks to the stock market outlook include potential volatility stemming from geopolitical tensions, trade uncertainties, and valuation concerns. Analysts note that the expiration of tariffs and macroeconomic instability could impact performance, making it essential for investors to stay vigilant.

How frequently should investors reassess their trading strategies based on stock market outlook?

Investors should reassess their trading strategies regularly, especially when significant economic data is released that could influence the stock market outlook. With changing conditions in the U.S. economy, staying informed about labor markets and inflation can provide critical insights for strategic adjustments.

| Key Points |

|---|

| Stocks at all-time highs as traders move into second half of 2025. |

| The S&P 500 reached a new intraday high, boosted by optimism for trade agreements. |

| Major indexes are up: S&P 500(+4%), Nasdaq(+4%), Dow(+2%) year to date. |

| Analysts predict further market growth, citing AI as a potential driver of lower inflation. |

| July’s historical performance is strong; gains often follow positive results in May and June. |

| Economic uncertainties, especially related to tariffs, may affect market performance. |

| Upcoming nonfarm payrolls report is critical for assessing economic stability. |

| Leaders emphasize the importance of employment data for consumer spending habits. |

Summary

The stock market outlook appears promising as we head into the latter part of 2025, with stocks at all-time highs and optimistic projections for further gains. Despite some skepticism surrounding potential volatility due to tariff policies and macroeconomic uncertainty, analysts remain hopeful, supported by the historical strength of July for the S&P 500 and the influence of stable employment data on consumer behavior. As traders prepare for crucial economic reports next week, the landscape suggests that maintaining momentum and confidence will be vital for continued market growth.