Equity Volatility: What Lies Ahead in the Global Markets

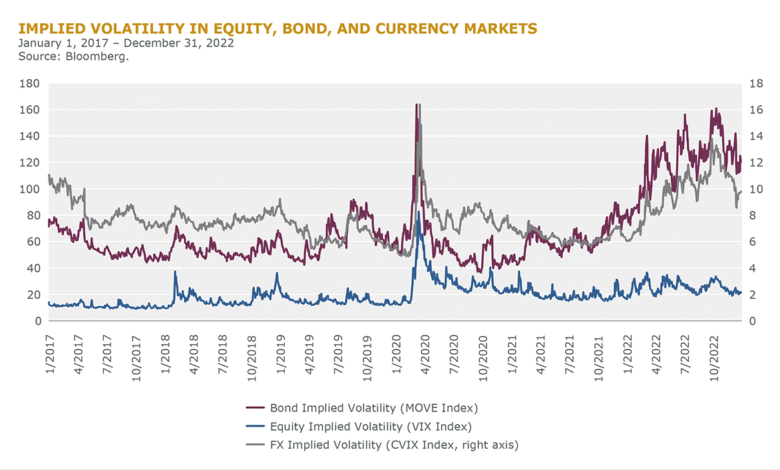

Equity volatility is expected to take center stage in the coming months as market fluctuations become ever more pronounced. Following significant intraday shifts in the first half of 2025, Goldman Sachs has predicted a rise in equity volatility, particularly as central banks gather in Sintra, Portugal, for their crucial economic forum. The interplay between monetary policy and market sentiments is heightened by recent debates surrounding trade tensions and global economic dynamics, commonly referred to as “geoeconomics.” Investors should be prepared for increased fluctuations as leading financial institutions assess policy directions amid ongoing uncertainties. With the spotlight on central bankers, the coming week promises to be pivotal for those navigating the turbulent waters of the equity markets.

Market fluctuations, particularly within the realm of stock trading, have shown a notable increase in unpredictability, often characterized as volatility in equity markets. As we look forward to the significant discussions set to unfold at the Sintra Forum, insights from central bank officials will likely influence investor sentiment and market behavior. The world of finance is currently grappling with intertwined challenges, revolving around monetary policy shifts and external economic pressures that shape the landscape of geoeconomics. As institutions like Goldman Sachs weigh in on these dynamics, traders and analysts alike are gearing up for the ramifications of potential policy changes. Understanding these elements is crucial for anyone keen on making informed investment decisions in this fluctuating environment.

Understanding Equity Volatility in 2025

In the rapidly evolving financial landscape of 2025, equity volatility has emerged as a pivotal factor influencing market dynamics. After experiencing tumultuous conditions in the first half of the year, Goldman Sachs forecasts an even higher degree of volatility in equity markets moving forward. Such fluctuations can significantly impact investor sentiment, effectively dictating trading strategies and asset allocation decisions. As investors prepare for these new challenges, understanding the drivers behind equity volatility becomes essential.

Factors such as political uncertainty, trade tensions, and shifting monetary policies contribute to this climate of increased volatility. Central bank actions—particularly those influenced by key players like the U.S. Federal Reserve—will be instrumental in shaping market expectations. The interplay of these components creates a landscape where informed decision-making is crucial for navigating the complexities of the second half of 2025.

Implications of Central Banks’ Monetary Policy

Central banks have a profound influence over the economic environment, especially during periods characterized by heightened volatility. As global policymakers gather at the ECB Forum in Sintra, Portugal, discussions surrounding monetary policy will take precedence. The outcomes of these meetings can shape market perceptions and alter the course of economic recovery. Investors will closely monitor the directions provided by figures such as ECB President Christine Lagarde, whose strategies could enable the euro to strengthen amidst a shifting geopolitical climate.

Moreover, the responses from central banks to external pressures—such as those exerted by President Trump—will play a crucial role in determining the stability of financial markets. Central banks must strike a balance between maintaining autonomy in their policy decisions while addressing the implications of international relations on their economies. The decisions made during this pivotal forum could set the tone for investor confidence and policy certainty, critical aspects in mitigating equity volatility.

Geoeconomics and its Market Influence

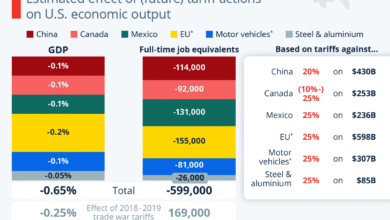

Geoeconomics has increasingly taken center stage in the world of finance, intertwining economic policies with political agendas. The tumultuous events on the global stage, particularly in the context of trade tensions and international alliances, influence market behavior significantly. In this environment, firms and investors must navigate the complexities of geoeconomic factors that could disrupt traditional market operations. As such, understanding these phenomena is no longer a luxury but a necessity for strategic positioning in volatile markets.

The discourse around geoeconomics will likely intensify as central banks deliberate on their approaches at the Sintra Forum. The potential ramifications of international trade policies, tariffs, and economic sanctions can ripple through global equities, affecting everything from stock performance to investor sentiment. Hence, staying informed about the shifting landscape of geoeconomics can empower investors to make proactive decisions, positioning them favorably as uncertainties loom.

The Significance of the Sintra Forum for Investors

The Sintra Forum serves as a crucial platform for central bankers and economic strategists to convene and discuss critical issues affecting monetary policy globally. This year, heightened scrutiny surrounds the role of central banks, particularly as they contend with shifting political landscapes and economic uncertainties. Investors should view the insights shared at this forum as valuable indicators of future market behavior, particularly regarding equity volatility.

As discussions unfold, key announcements and revelations can shape expectations around interest rates and economic interventions. For instance, if the ECB signals a shift toward aggressive monetary tightening, it could intensify already volatile equity markets, affecting investment strategies. Understanding the full implications of the decisions made at the Sintra Forum can equip investors with the foresight needed to adapt their portfolios in alignment with anticipated market shifts.

Labour’s Year in Office: Political Ramifications for Financial Markets

As the U.K. Labour Party celebrates its first anniversary in power, the impact of its governance on the financial landscape warrants attention. Economic reforms rolled out in the past year, while ambitious, have faced scrutiny from various factions, influencing public sentiment and market dynamics. Prime Minister Keir Starmer’s administration now stands at a crossroads; its decisions could sway investor confidence and stability in the pound, particularly amidst rising global uncertainty.

The fluctuating approval ratings reflect broader concerns about domestic economic conditions, which are compounded by international challenges. As the government navigates foreign relations with allies like the U.S. and faces pressure to deliver on economic promises, the relationship between politics and finance will remain intricate. Market participants will need to stay tuned to the developments within the Labour government, assessing how policy shifts could resonate within the broader economic framework.

Market Resilience Amidst Extremes

Despite the daunting equity volatility experienced in recent months, certain stock markets have demonstrated remarkable resilience. The impressive gains of Germany’s DAX index highlight the regional variations in market performance, driven by distinct economic fundamentals and investor confidence. As certain indices thrive, it sparks questions about the sustainability of such growth in the face of potential market corrections brought on by fiscal policy changes from central banks.

With the U.K. and broader European markets facing a mixture of political and economic challenges, investor focus will need to sharpen. The performance of resilient markets may offer a glimpse of investment opportunities, yet they also pose risks if corrections occur. Understanding regional market intricacies alongside the macroeconomic landscape will be paramount for stakeholders looking to capitalize on emerging trends amid uncertainty.

Navigating the Impact of Political Economics on Trading Strategies

The intertwining of political decisions and financial markets is becoming increasingly evident. As traders and investors adjust their strategies in response to geopolitical developments, understanding the dynamics of political economics is crucial. Events worldwide, from trade negotiations to domestic elections, can dramatically impact market sentiment and pricing strategies, particularly in volatile environments.

With central banks and political leaders influencing the economic landscape significantly, a thorough analysis of their actions and rhetoric can yield insights into future market movements. For example, shifts in monetary policy due to external pressures or economic conditions can prompt swift changes in equity markets, necessitating agile trading strategies. Investors must remain cognizant of these factors, adapting their approaches to reflect any emerging trends.

The Future of Global Trade Relations

In an era marked by uncertainty stemming from global trade relations, understanding the implications for the financial markets is essential. Trade agreements and tariffs continue to shape investor behavior, affecting everything from commodity prices to equity valuations. As key economies navigate complex relationships, the effects ripple through global markets, making it imperative for investors to stay informed.

The significance of trade relations will become particularly apparent at forums like Sintra, where central banks will discuss components that directly influence economic stability. The outcome of these talks, along with potential shifts in policy, will inform market expectations moving forward. Investors looking to hedge against volatility will need to closely monitor developments in global trade, adjusting their portfolios accordingly based on the geopolitical context.

Preparing for a Volatile Second Half of 2025

As the global economy transitions into the second half of 2025, the anticipation of increased volatility looms large in the financial markets. Previous trends suggest that the interplay of monetary policies and political factors can create drastic shifts in market behavior. Investors who prepare for these shifts will be better positioned to navigate the uncertainties that lie ahead. Understanding how equity volatility intertwines with economic data and central bank communications will be critical.

Additionally, with Goldman Sachs and other analysts forecasting turbulence in the markets, stakeholders must update their risk assessments and trading strategies. As they adapt to evolving conditions and leverage insights from key financial forums, strategic planning will be fundamental in capitalizing on potential opportunities even within a climate of heightened volatility.

Frequently Asked Questions

How does monetary policy affect equity volatility in the markets?

Monetary policy directly influences equity volatility by setting interest rates and influencing liquidity in the markets. When central banks adjust rates in response to inflation or economic conditions, it can lead to fluctuations in stock prices. For instance, an unexpected rate hike from a central bank may lead to increased equity volatility as investors react to the implications for future corporate earnings.

What role do central banks play in managing equity volatility during uncertain times?

Central banks play a crucial role in managing equity volatility by implementing monetary policy measures that stabilize the economy. Their decisions can help calm market fears, such as proactive interest rate adjustments or quantitative easing, especially during periods of high volatility influenced by geopolitical tensions or economic crises.

What insights did Goldman Sachs provide on equity volatility for the second half of the year?

Goldman Sachs has warned that elevated policy uncertainty and a deteriorating macroeconomic backdrop are likely to support increased equity volatility in the second half of 2025. Their assessment suggests that as geopolitical factors and central bank policies unfold, investors should brace for significant market fluctuations.

How can geoeconomic factors increase equity volatility in global markets?

Geoeconomic factors, such as trade tensions and international conflicts, can lead to increased equity volatility by creating uncertainty among investors. Fluctuations in trade policies or sanctions can disrupt market stability, prompting rapid price changes in equities as companies react to shifting economic landscapes.

What to expect from the Sintra Forum regarding its impact on equity volatility?

The Sintra Forum is expected to generate significant insights into global monetary policy from key central bankers. The discussions could impact equity volatility by signaling future monetary policy directions, which investors closely monitor for clues on interest rate changes and economic forecasts that affect market sentiment.

How do ‘black swan’ events contribute to equity volatility?

‘Black swan’ events, which are unforeseen incidents with significant impacts, contribute to equity volatility by creating abrupt market reactions. Such events, often tied to geopolitical tensions or natural disasters, force investors to rapidly reassess risk in their portfolios, leading to sudden price corrections and increased market fluctuations.

Why does equity volatility spike during periods of central bank meetings?

Equity volatility often spikes during central bank meetings because investors are attuned to the outcomes of these discussions, including potential shifts in monetary policy. Anticipation of changes in interest rates or remarks on economic conditions can lead to significant price movements in stocks as traders adjust their positions based on the perceived implications for the economy.

What implications does the U.K. Labour Party’s situation have on equity volatility?

The U.K. Labour Party’s declining approval ratings and political uncertainties can contribute to equity volatility as investors gauge the stability of the government and its potential impact on economic policy. Political unrest can lead to market fluctuations as policies affecting business environments are called into question, making investors wary.

| Key Point | Details |

|---|---|

| First Half of 2025 | Witnessed significant intraday fluctuations, indicating high volatility in equity markets. |

| Goldman Sachs Forecast | Predicted even higher equity volatility in the second half of the year due to macroeconomic uncertainties. |

| Central Banks’ Meeting | Central bankers will gather in Sintra, Portugal to discuss pressing monetary policy issues amidst global tensions. |

| U.K. Labour Party | Marking one year in office with declining approval ratings and facing significant domestic challenges. |

| Equity Market Performance | Some markets like Germany’s Dax showed resilience, while concerns arise over increased equity volatility as conditions worsen. |

Summary

Equity volatility is expected to remain a significant concern in the coming months as global events continue to affect market stability. With central banks preparing for discussions at the ECB Forum and various geopolitical tensions persisting, uncertainties loom over investors. The recent performance of equity markets, coupled with Goldman Sachs’ warning about policy risks, highlights the need for traders to stay vigilant as conditions unfold.