XRP Price Analysis: Bullish Momentum at $2.21 and Beyond

XRP price analysis reveals a robust bullish momentum as the cryptocurrency recently surged to $2.21, reflecting a 1.3% increase on June 29, 2025. With a healthy trading volume of $1.32 billion and a strong market capitalization of over $130 billion, XRP has proven it’s a contender in the crypto space. Investors are closely watching the XRP price chart for indications of future movements, as recent trends suggest a continuation pattern forming that may lead to significant gains. Furthermore, effective XRP trading strategies hinge on understanding these market dynamics, as the interplay of buying and selling pressures continues to shape trader sentiment. As traders delve into XRP price predictions, the future trajectory remains centered around key resistance levels and the broader sentiment within market trends.

In this cryptocurrency landscape, the analysis of XRP’s valuation presents a fascinating case study for traders and analysts alike. Currently on an impressive trajectory, XRP’s recent price action underscores the importance of technical indicators in determining potential price routes. By assessing metrics such as trading volumes, market caps, and chart formations, enthusiasts can decode promising signals for future price adjustments. The increasing interest in XRP trading strategies highlights the relevance of understanding both short and mid-term trends that could influence the cryptocurrency’s performance. As we navigate these market conditions, the exploration of XRP’s price forecasts becomes imperative for those looking to capitalize on forthcoming opportunities.

XRP Price Analysis: Recent Trends and Indicators

The recent surge in XRP’s price to $2.21 on June 29, 2025, represents an important milestone, not only showcasing a 1.3% daily gain but also highlighting a broader bullish sentiment in the cryptocurrency market. The competitive trading volume of $1.32 billion further underscores the increasing interest from traders and investors, as they speculate on price movements amidst this volatile landscape. XRP’s technical analysis suggests that it has made significant gains while also maintaining a solid market capitalization of $130.54 billion, contributing to overall market confidence.

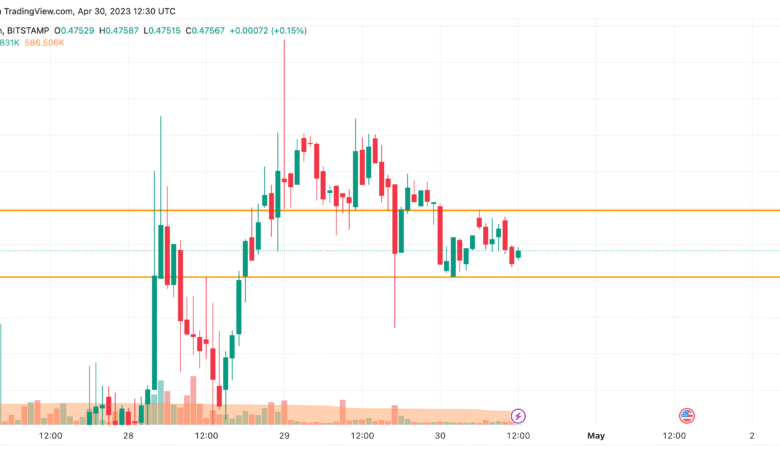

In examining the price chart of XRP, particularly focusing on its recent bullish spike to $2.22, it becomes evident that the cryptocurrency is forming a bullish flag which is indicative of potential further upward movement if certain resistance levels are breached. Continuous volume increase during recent trading sessions supports this bullish outlook, confirming that buyers are willing to step in. Analysts suggest that watching the key support area around $2.175 will be crucial for projecting whether XRP can maintain momentum toward higher price targets in the near term.

Key XRP Trading Strategies for Upcoming Trends

With the current market dynamics favoring potential upward trends in XRP, traders are advised to leverage strategic entry points that coincide with potential breakout scenarios. The formation of tight clustering in the order book around the $2.20 to $2.22 zone indicates that many traders are keenly watching these levels—this could lead to significant positions being established as traders react to price movements. Incorporating technical indicators, such as RSI and moving averages, can assist traders in timing their entries and exits more effectively in a fluctuating market.

Adopting a careful trading strategy that includes stop-loss orders just below key support levels, such as $2.175, can help mitigate risk during inevitable pullbacks. Moreover, considering the implied volatility suggested by Bollinger Bands, it is crucial for traders to remain flexible, adapting their approaches based on volume confirmation. Utilizing profit targets within the suggested resistance zones ($2.25–$2.30) could enhance a trader’s profitability while navigating potential corrections.

Understanding XRP Market Trends and Predictions

XRP’s market trends have shown resilience with a noticeable shift from bearish to a sideways-to-bullish outlook on the daily chart, primarily after hitting a crucial support level near $1.908. Analysts project that this transition could pave the way for continued upward momentum as XRP approaches the key resistance zones of $2.22 and $2.25. This trend not only reflects broader market conditions but also XRP’s unique position within the cryptocurrency ecosystem, where it consistently draws attention for its utility in cross-border transactions.

Price predictions for XRP in the immediate future hinge largely on its ability to maintain above the $2.22 resistance level. Should it successfully break through this barrier, forecasts place XRP in the $2.25-$2.30 range, signaling a potential price rally. Market participants are keenly watching for updates and fluctuations in trading patterns that could either solidify the bullish outlook or indicate adjustments in trader sentiment.

Technical Analysis of XRP’s Price Movements

A thorough technical analysis of XRP reveals key patterns that traders should consider while assessing future price actions. The formation of higher lows and the presence of bullish candlestick patterns signify growing momentum. Currently positioned between the Fibonacci retracement levels of 0.236 and 0.382, XRP’s price behavior suggests a critical juncture that could dictate short-term price volatility. Breakouts above established resistance points correlate with increased volume, enhancing confidence in positive price projections.

Additionally, oscillator readings suggest that while the market currently hovers around neutral levels, a bullish crossover could be imminent based on moving average convergence divergence (MACD) signals. Traders analyzing these technical indicators should remain vigilant for shifts in the market that may imply a significant move, especially following the formation of bullish flags or patterns indicating continued strength in buying sentiment.

The Importance of Volume Analysis in XRP Trading

In the world of cryptocurrency trading, volume analysis serves as a critical indicator of market sentiment and potential price movements. For XRP, recent trading volumes have surged alongside price increases, which often signals robust buyer interest. This correlation suggests that when volume increases significantly during bullish price action, it can validate the strength of a move. Traders should thus regard volume data as essential in supporting or contradicting price movements in their trading strategies.

In the context of XRP’s price climbing towards the $2.22 mark, observing volume can alert traders to potential breakouts or reversals. A sustained increase in trading volume might reinforce predictions of bullish continuation, while declining volume during price rises might raise red flags for potential pullbacks. Such insights can provide traders with actionable information to optimize their strategies in real-time market conditions.

Risk Management Strategies for XRP Traders

When trading cryptocurrencies like XRP, implementing effective risk management strategies is paramount. Successful traders often set stop-loss orders to protect themselves from significant losses, especially in volatile conditions. Given XRP’s proximity to current resistance levels, traders should consider placing stop-loss orders slightly below key support points such as $2.175. This allows them to minimize losses while maintaining exposure to potential upward movements.

Additionally, diversifying trading strategies and keeping a disciplined approach can greatly improve long-term outcomes. For instance, traders may opt to utilize a tiered approach where they lock in profits at multiple levels while monitoring the broader market trends for XRP. Combining these strategies can deliver a balanced opportunity for gains while protecting against unforeseen market shifts.

XRP Historical Performance and Future Projections

Studying XRP’s historical performance provides valuable insights into future projections. After dipping below crucial support levels during market retracts, XRP has shown notable resilience through its ability to rebound. Historical price movements indicate that following retracement, XRP often experiences recovery characterized by strong upward surges, indicating potential bullish sentiment following negative trends. As traders evaluate these past behaviors, they can form educated hypotheses regarding future price movements.

Moreover, comparing past peaks to current movements reveals an interesting trend—a consistent pattern of reaching significant resistance followed by periodic corrections. As XRP’s price hovers near its resistance zones, traders can anticipate potential breakout scenarios that mirror previous historical behaviors. Investors familiar with these patterns may be better equipped to capitalize on advantageous buying opportunities leading further to potential gains.

Analyzing XRP’s Correlation with Broader Market Trends

XRP does not exist in a vacuum; its price movements are often influenced by broader market trends within the cryptocurrency landscape. As more investors gravitate towards digital assets, the correlation between major cryptocurrencies often intensifies, affecting trading behaviors and price actions. In this regard, XRP’s recent performance aligned with market optimism can offer a glimpse into how external factors may perpetuate upward momentum or prompt bearish corrections.

Additionally, the relationship between XRP and major players like Bitcoin can provide insights into market sentiment. When Bitcoin surges, other altcoins, including XRP, usually see cascades of investor interest driving prices upward. This interconnected nature emphasizes the importance of monitoring the wider cryptocurrency environment when making predictions or executing trades involving XRP.

The Role of News and Events in XRP Trading

News and market events play a significant role in influencing XRP’s price movements. Developments related to regulations, technology advancements, or partnerships can drastically shift trader sentiment and impact XRP’s market performance. For instance, announcements about Ripple’s partnerships or legal resolutions have historically resulted in notable price volatility, highlighting the sensitivity of XRP to external catalysts.

Traders must remain aware of upcoming events in the cryptocurrency industry that have the potential to sway market dynamics significantly. Keeping ahead of major news releases and alignment with market trends can enhance trading decisions, particularly during volatile periods where XRP price might react sharply to external stimuli. Such preparations can provide traders with a competitive edge in the fast-paced trading environment.

Frequently Asked Questions

What is the current XRP price prediction based on technical analysis?

As of June 29, 2025, XRP shows a bullish price prediction. The price recently climbed to $2.21, with strong support at $2.175, indicating potential upward movement. If XRP can maintain volume and break through resistance at $2.22, it may target the $2.25–$2.28 range.

How can I use XRP technical analysis to inform my trading strategies?

XRP technical analysis reveals critical levels of support and resistance. Currently, support is seen at $2.21 and $2.175, while resistance lies near $2.22. Traders should consider looking for entry points at $2.208–$2.210, targeting short-term gains around $2.218–$2.220, supported by recent bullish candlestick formations.

What are the latest XRP market trends to watch?

The latest XRP market trends indicate a shift from bearish to sideways-to-bullish momentum. The daily chart displays higher lows and increasing volumes, suggesting strengthening market sentiment. Moreover, oscillators like the RSI and Stochastic are leaning bullish, indicating potential for continued upward movement.

What does the XRP price chart indicate about future trading opportunities?

The XRP price chart suggests strong bullish momentum, especially if the price breaks above $2.22. Successful breakout above this level could lead to price targets in the $2.25–$2.30 range. Traders should be cautious of potential pullbacks if the price fails to hold above $2.21.

What factors influence XRP’s price movements on chart analysis?

XRP’s price movements are influenced by various factors, including market volume, trader sentiment, and key technical indicators. Current chart analysis shows an increase in volume during bullish candles, strong support levels, and the impact of Fibonacci retracement levels, all of which inform potential price action.

How do moving averages affect XRP price analysis?

Moving averages play a crucial role in XRP price analysis by identifying trend direction and potential reversals. Currently, shorter-term averages show bullish signals across multiple periods, suggesting upward momentum. However, longer-term averages like the 100-period SMA signal caution, highlighting the need for careful monitoring.

What should traders look for in XRP trading strategies at this time?

Traders should focus on key technical levels and volume patterns when developing XRP trading strategies. With current strength indicated in the 1-hour and 4-hour charts, look for entry opportunities near support levels like $2.175, while being mindful of resistance around $2.22 for potential breakout trades.

Are there any risks associated with XRP price analysis?

Yes, risks in XRP price analysis include the potential for short-term pullbacks despite bullish signals. Key resistance levels must be monitored, and failure to maintain support at $2.21 could lead to retracement towards $2.13 or lower. Traders should manage risk effectively by setting appropriate stop-loss orders.

| Date | XRP Price | Price Change (24h) | Trading Volume (24h) | Market Cap | Intraday Range | Key Indicators |

|---|---|---|---|---|---|---|

| June 29, 2025 | $2.21 | +1.3% | $1.32 billion | $130.54 billion | $2.18 – $2.22 | Bullish momentum with volume increase, strong support at $2.175, bullish candle confirmations. |

Summary

XRP price analysis indicates that the cryptocurrency is showing strong bullish momentum as it approaches key resistance levels. On June 29, 2025, XRP climbed to $2.21, reflecting a significant upward trend. With healthy trading volume and critical price levels established, traders should watch for potential breakouts above $2.22 to sustain gains and further extend the upward movement.