Crypto Privacy: Supreme Court Upholds IRS Access Without Warrant

Crypto privacy has become a pressing issue in today’s digital landscape, as recent legal decisions underscore the tension between governmental surveillance and individual rights. A notable case, where the Supreme Court opted not to intervene, solidified the IRS’s ability to access bitcoin user data without a warrant, igniting debates around the implications for cryptocurrency user privacy. This situation raises essential questions about crypto data rights and the protections afforded by the Fourth Amendment against unreasonable searches and seizures. As discussions surrounding the Supreme Court crypto case unfold, many are left pondering how to uphold their privacy amidst expanding governmental oversight. The first step in ensuring crypto privacy hinges on understanding these legal frameworks and advocating for reform to better align them with the realities of cryptocurrency transactions.

In the realm of digital assets, the concept of privacy is being rigorously tested, notably through the lens of governmental access to financial records. The refusal of the Supreme Court to reconsider a significant case regarding cryptocurrency user confidentiality highlights the ongoing battle between maintaining user rights and regulatory transparency. This scenario not only raises concerns about crypto data rights but also taps into essential protections granted under legal frameworks such as the Fourth Amendment. As the crypto community grapples with these issues, it is crucial to explore alternative solutions that safeguard token holders’ information privacy while balancing compliance obligations. The discourse surrounding this sensitive topic continues to evolve, reflecting broader societal challenges in an increasingly interconnected world.

The Impact of the Supreme Court’s Ruling on Crypto Privacy

The recent decision by the Supreme Court to decline the review of a significant crypto privacy case leaves many questions unanswered regarding user data rights in the cryptocurrency space. With a ruling that effectively allows the IRS to access bitcoin user data without a warrant, it sets a concerning precedent for the privacy of cryptocurrency transactions. This ruling raises alarms about the boundary between government oversight and personal privacy, particularly when financial and personal information is shared with third-party platforms.

As the legal landscape surrounding crypto privacy evolves, users may feel increasingly exposed under the current enforcement frameworks. The implications of this ruling echo through the community, fueling debates on the necessity for stronger privacy protections in line with both the Fourth Amendment and modern data security needs. Advocates for cryptocurrency user privacy stress the importance of establishing clearer guidelines that protect individual rights without granting excessive power to government agencies.

IRS Authority and its Implications for Crypto Users

The IRS’ authority to demand access to user transaction data without consent points to a broader issue of surveillance within the cryptocurrency realm. This enforcement action, as illustrated by the Harper case, underscores the government’s capacity to track user activities in ways that many deem intrusive. As cryptocurrency continues to gain traction as a financial alternative, the ramifications of such government oversight become ever more pressing for users concerned about their data privacy.

Furthermore, the increasing scrutiny from tax authorities worldwide reflects a growing trend where governments seek to exert more control and visibility into cryptocurrency transactions. This push for transparency can often clash with the foundational principles of privacy that many cryptocurrency advocates uphold. Moving forward, cryptocurrency users may need to adopt more stringent privacy practices to shield their personal and financial data from governmental agencies.

Challenges Faced by Cryptocurrency Users Under the Current Legal Framework

The legal challenges faced by cryptocurrency users like James Harper highlight significant gaps in user protections within the existing framework. As the Harper v. Faulkender case demonstrates, users often lack the necessary legal grounds to contest data summons, which opens the door for potential abuses. The emphasis placed on the third-party doctrine suggests that individuals may lose their privacy expectations the moment they share their information with exchanges or other platforms, raising concerns about individual liberties.

Moreover, with the Fourth Amendment’s protections being interpreted in relation to the third-party doctrine, users may find themselves in vulnerable positions without any recourse to secure their data. The outcome of this case threatens to set a precedent where cryptocurrency transactions are treated similarly to traditional banking activities, potentially stripping away unique privacy rights associated with decentralized finance. The need for reform in how these legal principles are applied is ever more evident as the crypto landscape continues to develop.

Understanding the Third-Party Doctrine in Crypto Transactions

The third-party doctrine plays a crucial role in the legal discourse surrounding cryptocurrency privacy, impacting how user data is treated under U.S. law. This doctrine asserts that once information is shared with a third party, such as a cryptocurrency exchange, users relinquish their privacy rights regarding that data. As seen in the Harper case, the courts used this doctrine to justify the IRS’ access to user information without a warrant, which critics argue undermines the essential privacy rights that have evolved alongside digital innovation.

In a world where the majority of transactions occur online, the implications of this doctrine raise significant concerns among cryptocurrency users. Many believe that the third-party doctrine fails to reflect the realities of today’s digital economy and the unique privacy expectations that arise in the context of blockchain technology. As voices advocating for reform grow louder, it becomes increasingly clear that potential legal reshaping may be necessary to safeguard user privacy in an era defined by digital finance.

The Role of the IRS in Regulating Cryptocurrency Transactions

The IRS plays a pivotal role in shaping the regulatory landscape of cryptocurrency transactions. By asserting its authority to access user data, the agency positions itself as a critical player in ensuring tax compliance among cryptocurrency users. However, this regulatory responsibility comes with ethical considerations regarding personal privacy and user rights, particularly as more individuals turn to blockchain technologies for their inherent privacy features.

As the IRS continues to expand its reach into the crypto space, the delicate balance between governmental oversight and user privacy becomes increasingly contested. Users may find themselves navigating a complex environment where tax obligations are coupled with newfound concerns about data sharing and potential government surveillance. The dialogue surrounding IRS regulation is expected to evolve as both regulatory authorities and cryptocurrency advocates push for clarity and better protections for user rights.

Future Implications for Crypto Policy and User Privacy

The refusal of the Supreme Court to engage with the crypto privacy case opens the door to discussions about the need for comprehensive policy reform in the cryptocurrency space. As regulatory actions and legal precedents continue to shape the landscape, the future of individual rights in cryptocurrency remains uncertain. Advocates argue that it is imperative to create policies that not only ensure tax compliance but also protect the fundamental privacy rights of users.

Moreover, the ongoing discourse about the balance between regulation and user empowerment is essential as the cryptocurrency ecosystem matures. The evolving nature of technology necessitates a re-evaluation of existing laws and their application to digital assets, particularly concerning the impact on user privacy expectations. By addressing these concerns, the industry can move towards a more equitable framework that respects both regulatory needs and the rights of cryptocurrency users.

Examining the Fifth Amendment Rights in Crypto Data Cases

The intersection of cryptocurrency regulation and the Fifth Amendment raises critical concerns regarding self-incrimination and due process for users. With cases like Harper’s questioning the legality of data access requests from the IRS, it becomes essential to explore how these constitutional protections apply in the context of digital assets. The Fifth Amendment is fundamental in safeguarding individuals from being compelled to provide incriminating information, yet its relevance is often challenged in cryptocurrency cases.

As the legal landscape continues to shift, users must remain vigilant about their rights in the face of regulatory scrutiny. This situation emphasizes the need for legal clarity surrounding how the Fifth Amendment can be applied to the unique dynamics of crypto transactions. Enhanced awareness and advocacy for user rights in light of these constitutional protections are crucial as individuals navigate the complexities associated with cryptocurrency regulations.

The Importance of Adapting to New Privacy Technologies in Crypto

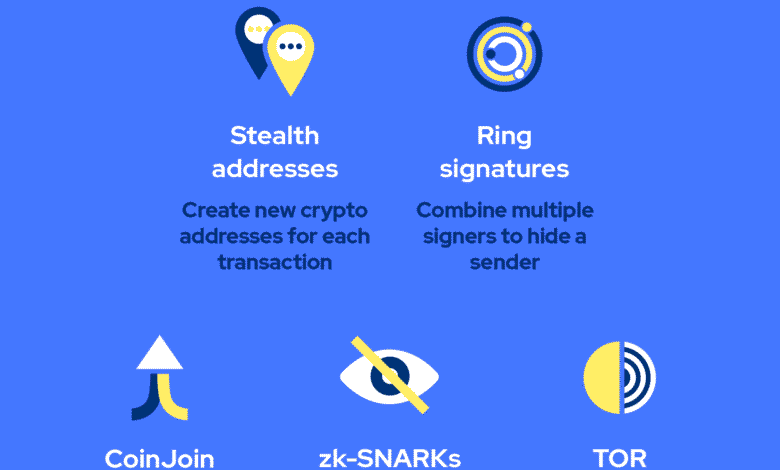

As the crypto market matures, so does the need for new privacy technologies that align with regulatory compliance while still protecting user information. Innovations like zero-knowledge proofs and privacy-focused coins like Monero and Zcash are becoming increasingly relevant as users seek to maintain anonymity in their transactions. These technologies can create a viable solution for the growing concerns around crypto data rights and user privacy issues highlighted in recent legal cases.

Moreover, the ongoing dialogue on cryptocurrency privacy challenges reflects a critical turning point for both users and regulators. By investing in adaptive privacy measures that promote both compliance and individual rights, the industry can better meet the expectations of privacy-conscious consumers. Engaging with emerging technologies could pave the way for a future where regulatory frameworks are aligned with the foundational principles of cryptocurrency, ensuring that user privacy remains intact amidst evolving governmental oversight.

Potential Reforms Needed to Protect Crypto User Rights

The landscape of cryptocurrency is evolving, but with this change comes the pressing need for reform to protect users’ rights. The decisions made in cases like Harper v. Faulkender provide an opportunity for lawmakers to reevaluate outdated legal frameworks that encompass digital assets. Establishing clearer definitions of user data rights in the context of third-party interactions could significantly enhance individual privacy protections while still meeting compliance expectations.

Furthermore, advocacy for legislative change is paramount to establish a more balanced approach that emphasizes both the necessity of regulatory oversight and the safeguarding of user privacy. As the world becomes increasingly digitized, it is imperative that lawmakers address the unique challenges posed by the intersection of cryptocurrency and privacy rights. Through proactive reform, the inherent values of decentralization and privacy within the crypto space can be preserved.

Frequently Asked Questions

What are cryptocurrency user privacy issues related to IRS access to Bitcoin records?

Cryptocurrency user privacy issues arise from the IRS’s ability to access Bitcoin transaction data without a warrant or user consent. This raises concerns about the invasion of privacy, as the IRS can obtain user data from exchanges like Coinbase through summonses, posing significant risks to individuals’ financial privacy.

How does the Supreme Court’s decision affect crypto privacy rights?

The Supreme Court’s decision to decline the review of the crypto privacy case reinforces the existing legal framework that allows the IRS to access cryptocurrency user data without a warrant. This upholds previous rulings that prioritize the IRS’s authority over individual privacy rights, thereby limiting protections for cryptocurrency user privacy.

What implications does the Fourth Amendment have on cryptocurrency user privacy?

The Fourth Amendment provides protections against unreasonable searches and seizures, but the Supreme Court’s refusal to hear the crypto privacy case suggests that users may have diminished expectations of privacy regarding data shared with third-party crypto exchanges. This interpretation aligns with the ‘third-party doctrine’ that complicates the privacy landscape for cryptocurrency users.

What is the significance of the Harper v. Faulkender case for crypto data rights?

The Harper v. Faulkender case underscores the challenges facing crypto data rights, as the Supreme Court’s refusal to intervene affirms the IRS’s ability to collect user data without consent. This legal precedent raises ongoing concerns regarding the protection of personal data in cryptocurrency transactions.

Can cryptocurrency users protect their privacy amid IRS data collection practices?

While it is challenging for cryptocurrency users to protect their privacy against IRS data collection practices, users can take steps such as using privacy-focused cryptocurrencies, understanding the data-sharing policies of exchanges, and advocating for stronger legislative protections for digital asset privacy.

How does IRS access impact the future of cryptocurrency user privacy?

IRS access to cryptocurrency data without user consent sets a concerning precedent for cryptocurrency user privacy, potentially leading to greater surveillance and diminished privacy rights in the digital finance space. As these practices evolve, discussions around enhancing privacy protections for users remain crucial.

| Key Points | Details |

|---|---|

| Supreme Court Decision | The Supreme Court declined to hear the case, upholding the IRS’s right to access user data without a warrant. |

| Case Overview | The case, Harper v. Faulkender, involved James Harper contesting the IRS’s access to his crypto data. |

| IRS Authority | The IRS can collect crypto transaction records without warrant or user consent, following a summons to Coinbase. |

| Fourth and Fifth Amendment Challenges | Harper claimed the IRS violated his constitutional rights regarding unreasonable searches and due process. |

| Legal Outcome | Lower court rulings were upheld; no reasonable expectation of privacy for data shared with third parties. |

| Third-party Doctrine | The case reflects ongoing issues with the ‘third-party doctrine’ and privacy in the digital age. |

Summary

Crypto privacy hangs in the balance following the Supreme Court’s recent refusal to hear a significant case concerning the IRS’s ability to access cryptocurrency transaction data without a warrant. The decision underscores a critical issue in contemporary legal discourse surrounding digital privacy and highlights the challenges individuals face regarding their rights in the era of digital finance. As legal interpretations evolve, the intersection of cryptocurrency and privacy rights will continue to provoke debate and scrutiny.