AQR Capital Management Performance: Strategies Surging in 2025

AQR Capital Management’s performance has captured significant attention in the investment community as it reports impressive returns for 2025. The AQR Apex strategy, a hallmark of their investment approach, surged 11.4% in just the first half of the year, showcasing its resilience in fluctuating markets. In addition, the AQR hedge funds, notably the long-short Delphi equity fund, recorded a robust net gain of 11.6% after fees during the same period. Meanwhile, the alternative Helix strategy contributed a respectable return of 7.4%, further exemplifying AQR’s diverse investment strategies. These results not only highlight AQR’s adaptive strategies but also position it as a key player in navigating the complexities of the current financial landscape.

Highlighting the achievements of AQR Capital Management reveals a remarkable landscape in asset management. As the firm navigates the volatility of financial markets, its strategies such as the AQR Apex and Delphi equity fund have proven to be exceptionally lucrative in 2025. With significant gains reported, the alternative trend-following Helix method also underscores AQR’s innovative approach to investment. This impressive performance reflects a broader trend among hedge funds that aim to minimize risk while maximizing returns, particularly in challenging economic environments. Investors looking for reliable sources of growth can take a keen interest in the methodologies employed by AQR, as they exemplify the benefits of strategic asset allocation and diversified investment pathways.

Outstanding Returns of AQR Capital Management in 2025

AQR Capital Management has demonstrated remarkable performance in the first half of 2025, showcasing the effectiveness of its investment strategies. The firm’s Apex strategy, which focuses on a diversified approach blending stocks with macroeconomic strategies and arbitrage, recorded an impressive 11.4% return. This surge in performance is particularly noteworthy as it significantly outpaced the S&P 500, reflecting AQR’s adept navigation through the complexities of the current market landscape.

In addition to the Apex strategy, AQR’s Delphi equity fund also achieved remarkable results, posting a net gain of 11.6% after fees during the same period. This fund, which utilizes a long-short strategy, highlights the firm’s capability to adapt to market volatility and provide robust returns, even amidst challenging economic conditions. Such performance not only solidifies AQR’s reputation among hedge funds but also reaffirms investor confidence in its proven methodologies.

Performance Analysis of AQR’s Apex Strategy

The AQR Apex strategy operates with a sophisticated investment paradigm that combines various investment styles and risk factors to enhance returns. As of mid-2025, managing $4.3 billion in assets, this strategy has successfully capitalized on market fluctuations, obtaining substantial gains amidst geopolitical tensions and trade disputes. The impressive 11.4% growth in the first half of 2025 illustrates the strategy’s resilience and tactical advantage within the hedge fund sector.

Moreover, the integration of various asset classes within the Apex strategy allows AQR to mitigate risks while maximizing potential returns. Investors are increasingly recognizing the importance of such multistrategy approaches in navigating today’s unpredictable financial environment. AQR’s commitment to continuous innovation in investment strategies further supports its strong performance trajectory, making it a valuable player in the competitive landscape of hedge funds.

Insights into AQR’s Long-Short Delphi Equity Fund

The long-short Delphi equity fund has been a standout performer for AQR Capital Management, evidenced by its 11.6% return net of fees in the first half of 2025. This fund employs a strategic approach to take advantage of pricing inefficiencies in the equity markets, engaging in both long positions and short sales to enhance overall returns. The ability to exploit these market discrepancies is a hallmark of effective hedge fund strategies and underscores AQR’s expertise in this arena.

Additionally, the Delphi equity fund manages $4.1 billion in assets, demonstrating strong investor trust and capital inflow into well-performing funds. This confidence is justified as the fund’s performance stands resilient against market headwinds, making it a key component of AQR’s diverse investment offerings. The focus on performance-driven results through the Delphi equity fund further exemplifies AQR’s strategic vision in delivering sustainable returns to its investors.

Exploring AQR’s Trend-Following Helix Strategy

AQR’s Helix strategy is engineered to harness the power of alternative trend-following tactics, distinguishing itself in the realm of hedge funds. With a reported return of 7.4% in 2025, this strategy showcases AQR’s ability to adapt investment methodologies in response to shifting market dynamics. The approach aligns with contemporary trends in investment management, emphasizing flexibility and a data-driven understanding of market behavior.

The Helix strategy’s focus on trend-following techniques positions it favorably in environments characterized by volatility and rapid changes. As investors increasingly look for strategies that can perform well regardless of market conditions, AQR’s innovation in the Helix strategy underscores its commitment to providing diverse portfolio options. By integrating trend-following into its investment framework, AQR continues to set the bar high for performance and adaptability in the hedge fund industry.

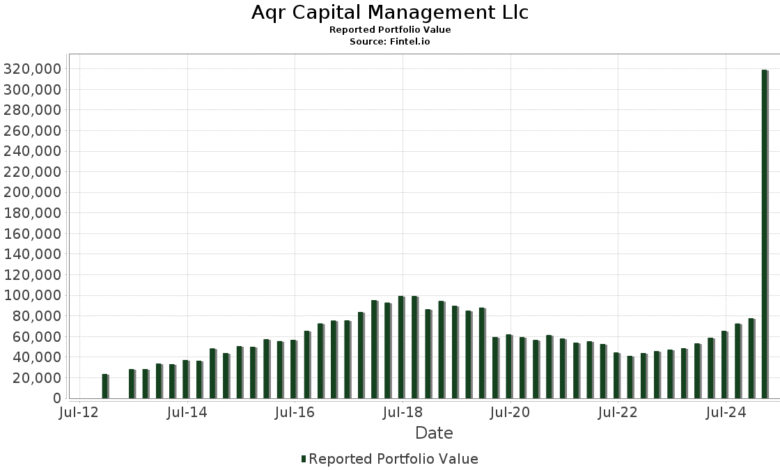

AQR Capital Management’s Growth and Asset Management

AQR Capital Management has seen exponential growth, managing $142 billion in assets as of 2025, up from approximately $99 billion at the start of the previous year. This growth trajectory reflects not only the performance of its funds, including the Apex, Delphi, and Helix strategies but also an increasing trust from investors seeking diversified, high-performing investment vehicles. The firm’s ability to attract and retain significant capital signals its robust market position.

The impressive increases in AQR’s asset management underscore the effectiveness of its multistrategy approach, which amalgamates various investment methodologies to appeal to a broad spectrum of investors. AQR’s ongoing emphasis on research-driven strategies ensures that it remains at the forefront of asset management, effectively leveraging market opportunities and delivering compelling returns in a challenging economic landscape.

Market Trends Impacting AQR’s Investment Strategies

The first half of 2025 was marked by significant market volatility due to geopolitical tensions and trade wars. Despite these challenges, AQR Capital Management has effectively adapted its investment strategies to navigate through uncertainty. The rebound of the S&P 500 from a nearly 20% decline earlier in the year signifies a pivotal moment for many investors, and AQR’s strategies have been positioned to capitalize on such market recoveries.

Additionally, as the stock market continues to evolve with trend shifts and behavioral changes, AQR’s commitment to innovation in its investment strategies remains paramount. By utilizing advanced data analytics and embracing a multistrategy framework, AQR positions itself to not only weather market storms but also to enhance returns for investors. The adaptability of AQR’s strategies exemplifies how firms can thrive even in unpredictable environments.

Investor Confidence and AQR’s Performance Metrics

Investor confidence in AQR Capital Management has surged alongside the firm’s strong performance metrics. With significant returns in the Apex and Delphi funds during the first half of 2025, investors have increasingly recognized the value of AQR’s diverse approach to investment. The ability to provide substantial returns, net of fees, further solidifies AQR’s reputation as a leading hedge fund among sophisticated investors.

Moreover, AQR’s transparent performance reporting and strategic insights foster trust and engagement from clients. As the firm continues to deliver impressive returns, the alignment of its investment philosophy with market realities enhances its standing within the hedge fund community. Such investor confidence, paired with performance metrics, positions AQR favorably for sustained growth and investment success.

The Role of Research in AQR’s Investment Strategies

Research plays a critical role in shaping AQR Capital Management’s investment strategies, fundamentally underpinning its approach to asset management. The firm’s founders, including Cliff Asness, established their investment philosophies during their academic tenure at the University of Chicago. This academic rigor has influenced AQR’s emphasis on empirical research, value strategies, and momentum, allowing it to remain competitive in a rapidly changing financial landscape.

As AQR continues to evolve, its commitment to in-depth research and analytics serves as a cornerstone of its strategic planning and execution. By leveraging data-driven insights, AQR can anticipate market trends, refine its investment strategies, and ultimately enhance performance across its hedge funds, including the Apex and Delphi offerings. The emphasis on research not only differentiates AQR from its competitors but also provides clients with a robust foundation for trust in their investment decisions.

Future Outlook for AQR’s Investment Strategies

As we look ahead, the future outlook for AQR Capital Management appears promising, particularly given its strong performance in the first half of 2025. With the firm diversifying its strategies and successfully navigating market disruptions, AQR is well-positioned to sustain its growth momentum. The effectiveness of its Apex, Delphi, and Helix strategies indicates that AQR’s investment philosophies are robust enough to adapt to dynamic market conditions.

Moreover, as investor preferences shift towards more alternative and multistrategy approaches, AQR’s established reputation for delivering competitive returns will likely continue to attract significant capital inflow. Continued innovation and rigorous research will play a vital role in AQR’s trajectory, ensuring it remains a formidable presence among hedge funds. Ultimately, the combination of strategic adaptability and performance excellence bodes well for AQR’s future in the hedge fund landscape.

Frequently Asked Questions

What is the recent performance of AQR Capital Management’s Apex strategy?

In the first half of 2025, AQR Capital Management’s Apex strategy achieved an impressive return of 11.4%. This performance indicates the strategy’s effectiveness in leveraging stocks, macroeconomic strategies, and arbitrage trades.

How did the AQR Delphi equity fund perform in 2025?

During the same period, AQR’s long-short Delphi equity fund recorded a net gain of 11.6% after fees, showcasing strong management and investment strategies compared to market benchmarks.

What is the return of the AQR Helix strategy in 2025?

The alternative trend-following Helix strategy from AQR Capital Management has produced a return of 7.4% so far in 2025, reflecting its performance amid market volatility.

How does AQR Capital Management’s performance compare to the S&P 500 in 2025?

AQR Capital Management’s strategies, particularly the Apex and Delphi funds, significantly outperformed the S&P 500, which has risen by 5.3% year to date, demonstrating effective investment approaches amidst a turbulent market.

What factors contributed to AQR Capital Management’s successful returns in 2025?

AQR Capital Management capitalized on the stock market’s recovery from a significant decline in April 2025, with successful strategies like the Apex and Delphi funds adapting to market conditions and benefitting from a surge in asset value.

What are the assets under management for AQR Capital Management?

As of mid-2025, AQR Capital Management manages $142 billion in assets, a substantial growth from approximately $99 billion at the start of 2024, highlighting the firm’s expanding influence in the hedge fund sector.

Who founded AQR Capital Management and what is its investment philosophy?

AQR Capital Management was co-founded by Cliff Asness and his partners, who developed the firm’s investment philosophy during their Ph.D. programs at the University of Chicago, emphasizing value and momentum strategies.

How has AQR Capital Management expanded its investment strategies over the years?

Over the years, AQR Capital Management has broadened its investment strategies, effectively integrating multistrategy approaches alongside traditional tactics, which contributed to its robust performance in various market conditions.

| Strategy | Return (%) | Assets Managed ($B) |

|---|---|---|

| Apex Strategy | 11.4 | 4.3 |

| Delphi Equity Fund | 11.6 | 4.1 |

| Helix Strategy | 7.4 | N/A |

Summary

AQR Capital Management performance displayed a notable resilience in the first half of 2025, with two of its hedge funds significantly outpacing the broader market. The Apex strategy and the Delphi equity fund both posted robust returns of 11.4% and 11.6%, respectively, showcasing AQR’s strategic investment capabilities amidst market turbulence. The Helix strategy also contributed positively with a commendable return of 7.4%. This exemplary performance reinforces AQR’s stature as a leading player in the asset management sector.