Federal Reserve Policy: Powell on Tariffs and Interest Rates

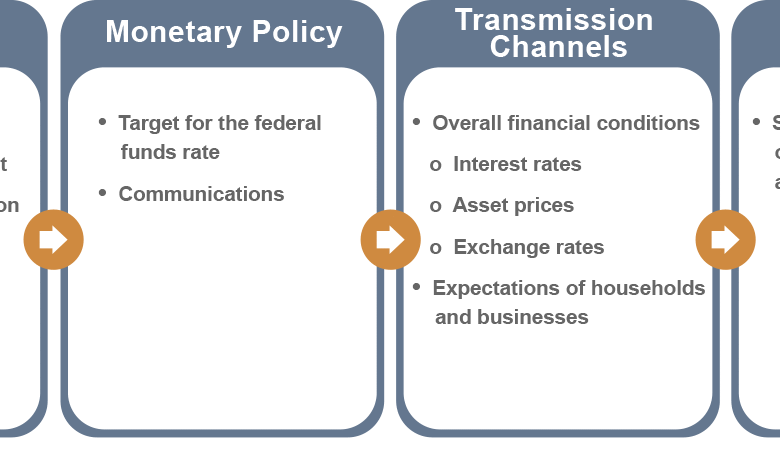

Federal Reserve policy has taken center stage as Chair Jerome Powell navigates complex economic waters in the wake of President Trump’s tariff impact. In recent discussions, he posited that easing monetary policy could have been a reality this year, had it not been for these tariffs that have significantly altered U.S. inflation forecasts. With the Federal Open Market Committee weighing potential FOMC rate cuts, every monetary policy decision is being scrutinized for its long-term implications. Currently, the Fed keeps interest rates steady within the 4.25% to 4.5% range, illustrating a cautious approach influenced by external pressures. As traders gauge market sentiments, it’s clear that the trajectory of interest rates remains closely tied to global economic dynamics and domestic fiscal policies.

In the domain of central banking, the strategies of the Federal Reserve are pivotal in shaping economic stability across the United States. Under the leadership of Jerome Powell, the bank’s response to the considerable impacts of tariffs introduced during the Trump administration has been a focal point of discussion. As inflation forecasts rise, Powell and the Federal Open Market Committee face critical choices regarding interest rates, hinting at a potential need for adjustments in the near future. The careful navigation of these monetary strategies, balancing both employment goals and inflation control, is essential to maintaining market confidence. Therefore, analyzing the interplay of trade policies and monetary decisions is crucial for understanding the broader economic landscape.

Impact of Trump Tariffs on Federal Reserve Policy

The influence of President Trump’s tariff policy has been profound on the Federal Reserve’s monetary policy decisions. Jerome Powell, the Fed Chair, acknowledged that the U.S. central bank would likely have implemented rate cuts if not for the inflationary pressures generated by the tariffs. This sentiment came during a recent panel discussion in Sintra, Portugal, where Powell addressed the intricate relationship between economic policies and interest rates. The tariffs have led to higher inflation forecasts, prompting the Fed to adopt a more cautious approach in adjusting interest rates, which currently remain unchanged within the range of 4.25% to 4.5%.

As Powell elaborated, the Federal Open Market Committee (FOMC) is acutely aware of the ramifications of the tariffs on the U.S. economy. The interplay between inflation, interest rates, and market confidence becomes pivotal when considering future monetary policy decisions. The Fed’s current hesitation to cut rates despite external pressures from the administration underscores its commitment to carefully evaluating economic indicators before taking any decisive actions. Thus, the tariffs not only affect trade dynamics but are also a key factor driving the Fed’s cautious stance on interest rates.

Jerome Powell’s Stance on Interest Rates Amid Economic Pressures

Amid mounting pressures from the White House, Jerome Powell remains steadfast in his approach to interest rates. The Fed’s decision-making process is shaped significantly by incoming economic data rather than political influence. Powell affirmed at the European Central Bank forum that the Federal Reserve is adopting a wait-and-see policy, assessing potential data impacts before implementing any rate cuts. This careful strategy reflects the complexities of managing U.S. inflation forecasts, which have been complicated by tariffs and other global economic factors.

Powell’s statement that the Fed will proceed ‘meeting by meeting’ emphasizes the unpredictability of future monetary policy. During this transition period, the Fed has signaled two possible rate cuts by the end of 2025, depending on how inflationary pressures evolve, particularly those linked to tariffs. This cautious approach serves not only to maintain price stability but also to support maximum employment. As Powell navigates these turbulent waters, his commitment to an impartial monetary policy underscores the Fed’s dedication to economic stability.

The Role of FOMC in Shaping Monetary Policy Decisions

The Federal Open Market Committee (FOMC) plays a crucial role in determining the trajectory of U.S. monetary policy. Comprised of members from the Federal Reserve Board, the FOMC meets regularly to assess economic conditions and make decisions regarding the key federal funds rate. Recent indications from the committee suggest that despite the ongoing uncertainty attributed to Trump’s tariffs, the FOMC is considering future rate cuts to bolster economic growth. The alignment of various economic indicators is essential to ensure that these decisions serve the broader goals of price stability and maximum employment.

During the recent panel discussion, Powell reiterated the importance of waiting for updated economic data before making any definitive decisions regarding interest rates. This reflects the FOMC’s cautious stance in a landscape where inflation forecasts remain subject to change. The potential for upward pressures on prices due to tariffs necessitates a thorough evaluation of how such factors might influence future monetary policy decisions. As the FOMC tracks these evolving economic patterns, its role remains pivotal in steering the U.S. economy toward stability.

Inflation Forecasts and Their Implications for Interest Rates

Inflation forecasts are critical in shaping the Federal Reserve’s interest rate policies. With the current inflationary pressures resulting from Trump’s tariffs, the Fed has adopted a more careful approach to managing monetary policy. Powell’s acknowledgment that the Fed’s decisions are heavily influenced by these inflation expectations underlines the complexity of the economic environment. As inflationary trends fluctuate, the Fed’s current key borrowing rate has remained unchanged, reflecting a desire to maintain economic stability amid uncertainty.

The Fed’s commitment to monitoring inflation closely indicates a proactive approach to potential interest rate adjustments. Market responses to inflation forecasts can affect borrowing costs, which in turn play a role in overall economic growth. Therefore, as the Federal Reserve strategizes on its monetary policy roadmap, understanding the correlation between tariffs, inflation forecasts, and interest rates becomes essential in ensuring long-term economic health.

Future Rate Cuts and Economic Indicators

Future rate cuts have been a topic of speculation among economists and traders alike, with expectations heavily influenced by evolving economic indicators. Powell’s statements suggest that the Fed aims to retain flexibility in its approach, signaling that two rate cuts might be possible by 2025, contingent on economic assessments. The Federal Reserve’s current posture is reflective of a broader strategy to navigate the complexities of a market affected by external shocks, such as tariffs imposed by the administration.

Traders’ perceptions of future rate cuts are also significantly influenced by real-time economic data. With over 76% probability indicated regarding a flat interest rate in July, market dynamics remain fluid. This scenario illustrates how quickly sentiment can shift based on consumer trends and inflation rates. The Fed’s decision to proceed cautiously reiterates its primary goal of ensuring consistent economic growth while managing inflation effectively.

The Economic Landscape Under Jerome Powell’s Leadership

Jerome Powell’s tenure as chair of the Federal Reserve has seen significant economic shifts, influenced by both global conditions and domestic policies. His leadership has been marked by navigating a complex landscape characterized by political pressures, notably from President Trump, as well as external economic variables such as tariffs. The tension between maintaining price stability and facilitating economic growth creates an ongoing challenge for the Fed under Powell’s guidance. His insights into the economic landscape provide valuable context for understanding the Fed’s approach to interest rates and inflation management.

Powell’s emphasis on data-driven decision-making allows the Fed to adapt its strategies based on real-world economic conditions. This responsiveness demonstrates a commitment to maintaining financial stability while ensuring that U.S. inflation forecasts align with broader monetary policy objectives. As Powell continues to lead, the implications of tariffs, trade relations, and economic data will persist as central themes in shaping the financial future of the country.

Challenges in Maintaining Price Stability Amid Tariffs

Maintaining price stability in the context of rising tariffs poses specific challenges for the Federal Reserve. Jerome Powell has indicated that the inflationary effects triggered by tariffs complicate the Fed’s ability to adjust interest rates. This complex dynamic requires a nuanced response from the Fed, as high tariffs can lead to increased costs for consumers, thereby impacting overall price levels and inflation rates. Powell’s insight into this issue highlights the Fed’s commitment to addressing potential inflationary pressures while balancing the need for economic growth.

The ongoing challenge of managing price stability amidst an evolving global trade environment underscores the Fed’s role as a stabilizing force in the U.S. economy. As Powell prepares for potential transition in leadership, the focus on sustaining price stability will remain a key priority. By closely monitoring the effects of tariffs and implementing strategic monetary policy decisions, the Fed strives to navigate through uncertainties while upholding its mandate for maximum employment and financial stability.

Impact of Market Expectations on Federal Reserve Decisions

Market expectations heavily influence the Federal Reserve’s monetary policy decisions, particularly in regards to interest rates. Investors are acutely aware of the relationship between the Fed’s policy actions and economic indicators, which can lead to significant fluctuations in market sentiment. As Jerome Powell mentioned, the Fed’s strategy is responsive to incoming data, indicating that market perceptions are closely intertwined with the central bank’s decision-making process. The anticipation surrounding future rate cuts plays a pivotal role in shaping financial market dynamics.

With traders estimating a high probability of unchanged interest rates in their upcoming meetings, the Fed’s communications regarding its policy stance must remain clear and consistent. Powell’s approach emphasizes transparency and a commitment to adapting to economic conditions, reinforcing the idea that market expectations are a critical component in the Fed’s strategic framework. This focus on communication and clarity aims to enhance market confidence, further stabilizing the economic landscape.

The Future of Federal Reserve Leadership and Economic Policy

As Jerome Powell approaches the end of his term as chair of the Federal Reserve, questions surrounding the future of its leadership become increasingly pertinent. The interplay between the Fed’s policy objectives and the current administration’s agenda could dictate the future direction of monetary policy. Powell has made it clear that the Fed’s focus remains on the long-term economic health of the country rather than political pressures, which is essential for maintaining credibility and trust in its monetary policy.

The dynamics within the Federal Reserve, especially during transition periods, often attract scrutiny regarding its independence and effectiveness. As the Fed prepares for potential changes in leadership, continuing to prioritize data-driven policies will be crucial for navigating the complex economic landscape shaped by tariffs, inflation, and employment rates. This emphasis on sustainable economic practices will guide the upcoming decision-makers to uphold the integrity of the Federal Reserve’s mission.

Frequently Asked Questions

How does Jerome Powell’s stance on interest rates relate to Federal Reserve policy?

Jerome Powell, as the Chair of the Federal Reserve, plays a pivotal role in shaping interest rate policies. His recent comments indicate that the Fed’s current monetary policy is influenced by external factors such as President Trump’s tariff plans, which have affected U.S. inflation forecasts. This cautious approach highlights how broader economic conditions interact with the Federal Reserve’s decisions on interest rates.

What impact do Trump’s tariffs have on Federal Reserve’s monetary policy decisions?

According to Jerome Powell, Trump’s tariff policies have led to increased inflation forecasts in the U.S., which in turn has caused the Federal Reserve to maintain a cautious stance on interest rates. These tariffs have created uncertainty in the economic environment, influencing the Fed’s monetary policy decisions and preventing more aggressive rate cuts.

What are the implications of FOMC rate cuts on Federal Reserve policy?

The Federal Open Market Committee (FOMC) rate cuts are one of the tools used by the Federal Reserve to influence economic activity. While the FOMC has indicated potential rate cuts by 2025, Powell has emphasized a careful monitoring approach based on economic data. This reflects the Fed’s commitment to adapting its monetary policy to ensure price stability and maximum employment.

How do U.S. inflation forecasts affect Federal Reserve policy?

U.S. inflation forecasts play a critical role in determining Federal Reserve policy, particularly regarding interest rates. As indicated by Powell, rising inflation due to tariffs has resulted in a more cautious monetary policy stance. The Fed’s ability to manage inflation effectively is central to its goals of ensuring financial stability and supporting economic growth.

What is the significance of Jerome Powell’s comments on monetary policy decisions?

Jerome Powell’s comments shed light on how external factors, specifically trade policies like Trump’s tariffs, impact the Federal Reserve’s monetary policy decisions. His insight reinforces the Fed’s commitment to data-driven policy-making and indicates that key decisions around interest rates may depend significantly on evolving economic conditions.

How will Federal Reserve policy respond to changing economic data according to Powell?

Jerome Powell has emphasized that the Federal Reserve will adopt a ‘meeting by meeting’ approach, making monetary policy decisions based on the latest economic data. This indicates a flexible strategy that allows the Fed to adapt its policies, such as interest rate adjustments, in response to ongoing economic changes.

| Key Point | Details |

|---|---|

| Federal Reserve Stance | Fed has not loosened monetary policy due to Trump’s tariff plan. |

| Interest Rates | Key borrowing rate held between 4.25% to 4.5% since December. |

| Rate Cut Projections | Fed projects two rate cuts by end of 2025, depending on data. |

| Market Reactions | 76% probability that rates will remain unchanged in July. |

| Tariff Impact | Tariffs have raised inflation forecasts, affecting Fed’s decisions. |

| Powell’s Future | Uncertainty about Powell’s role post-chair term. |

| Key Objectives | Focus on price stability, maximum employment, and financial stability. |

Summary

Federal Reserve policy has been kept cautious and unchanged by the central bank, primarily due to the influence of President Donald Trump’s tariff initiatives. Federal Reserve Chair Jerome Powell’s recent statements underline the delicate balance the Fed maintains as it evaluates economic data while being pressed for rate cuts. With the current monetary policy position firmly held since December, forward-thinking projections suggest potential rate adjustments contingent upon evolving economic conditions. Powell’s commitment to stability highlights the Fed’s overarching aim to navigate these turbulent waters in a complex economic landscape.