Sen. Lisa Murkowski Tax Vote: A Controversial Decision

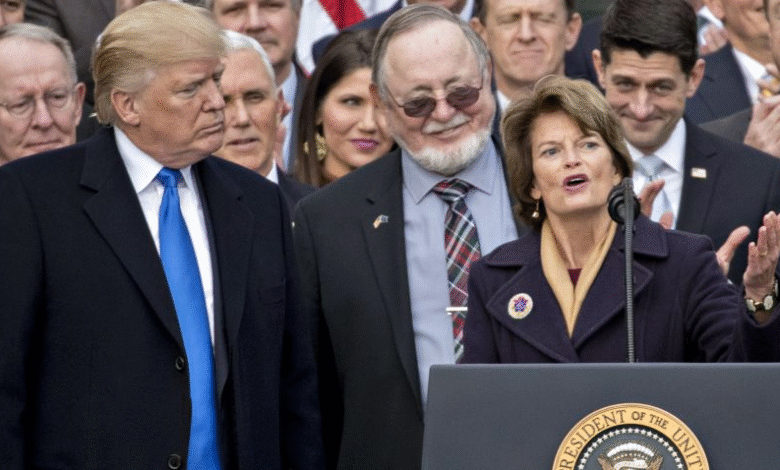

Sen. Lisa Murkowski tax vote cast a pivotal moment in the passage of President Donald Trump’s ambitious tax legislation. By supporting the bill, she played a crucial role in helping Republicans secure the necessary votes to push through the controversial measure, despite her personal reservations. Before finalizing her decision, Murkowski negotiated an exemption that shields Alaska from stringent new food stamp regulations for a two-year period, emphasizing her commitment to the welfare of her constituents. “Do I like this bill? No. But I tried to look out for Alaska’s interests,” she remarked, clearly navigating a complex political landscape. This vote not only reinforced her position within the Republican tax legislation but also highlighted the unique challenges faced by Alaskans relying on SNAP benefits in Alaska.

In a significant stance amidst political turbulence, Sen. Lisa Murkowski’s recent vote has sparked conversation regarding the Trump tax bill and its implications for Alaskan residents. With a backdrop of evolving Alaska food stamp regulations, Murkowski’s choice reflects a delicate balance between party loyalty and local needs. The Murkowski Senate vote, while controversial, showcases her efforts to advocate for Alaska’s interests in the face of broader national issues. Despite previous criticisms of Trump’s policies, she aimed to enhance the tax legislation for her state, particularly regarding SNAP benefits in Alaska. This intersection of state and national policy creates an intricate narrative about the practical impacts of tax reforms on everyday Alaskans.

Sen. Lisa Murkowski’s Tax Vote: A Controversial Decision

Sen. Lisa Murkowski of Alaska made headlines when she cast her pivotal vote in favor of President Trump’s tax bill, a decision that has stirred significant debate among her constituents and peers. The vote was crucial in achieving the necessary 50 votes to pass the legislation through the Senate, thanks to a tie-breaking vote from Vice President JD Vance. Murkowski, facing intense scrutiny, articulated her internal conflict, stating, “Do I like this bill? No.” This sentiment captures the essence of her dilemma, balancing party loyalty against the unique needs of her state.

In the lead-up to her vote, Murkowski was able to negotiate an exemption for Alaska from stringent food stamp regulations that would have adversely affected many of her constituents. By securing a two-year reprieve, she aimed to mitigate potential challenges for Alaskan families reliant on SNAP benefits. This maneuver highlights the complexities Murkowski navigates as she seeks to protect Alaska’s interests while participating in broader Republican tax legislation, which she personally criticized.

Impact of Trump Tax Bill on Alaska

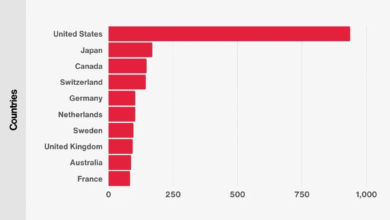

The passage of the Trump tax bill has far-reaching implications for states like Alaska, where economic conditions demand careful consideration of any legislative changes. For example, Alaska, which grapples with the highest SNAP payment error rate in the nation, faces potential increases in food insecurity as federal regulations change. With one-tenth of Alaskan residents depending on SNAP benefits, any adverse effects from the tax bill could exacerbate existing financial struggles for the state’s most vulnerable populations.

Moreover, the uncertainty about the future of funding for social programs, coupled with the anticipated reductions in welfare provisions, raises alarms among Alaskan lawmakers. Murkowski’s advocacy for amendments to the tax bill sought to bolster funding for essential services, such as rural hospitals, integral to the state’s healthcare infrastructure. By pushing for these changes, she aimed not only to ensure that her constituents’ healthcare needs are met but also to address the broader impact of tax reforms on Alaska’s economy.

Controversial Support for Republican Tax Legislation

Murkowski’s support for the tax bill has attracted criticism, especially considering her previous critiques of Trump and the GOP tax policies. Critics argue that her rationale for voting in favor of the bill undermines her credibility and sets a troubling precedent for future legislation. The tension between the political demands of her party and the welfare needs of her constituents illustrates the difficult waters she must navigate as a senator representing rural Alaska.

Despite the backlash, Murkowski maintains that her priority is ensuring that her constituents receive the support they need. She emphasizes that her vote is aimed at improving conditions in Alaska, saying, “My goal throughout the reconciliation process has been to make a bad bill better for Alaska, and in many ways, we have accomplished that.” This approach is indicative of her strategy to balance local interests against party dynamics within the Senate.

Alaska’s Food Stamp Regulations Amid Tax Changes

Alaska’s food stamp regulations have come under scrutiny in light of recent tax legislation that poses new challenges for the state’s welfare system. With Murkowski’s temporary exemption, there is a window of relief for those relying on SNAP benefits; however, the uncertainty surrounding the future of these regulations remains prevalent. By allowing Alaskan families a respite from harsh stipulations, Murkowski aims to alleviate immediate pressures but acknowledges the long-term implications that such tax reforms might entail.

The state’s high SNAP payment error rate underscores the need for systemic improvements in how food assistance is administered. Murkowski’s vote and subsequent negotiations point to a critical intersection where tax policy and social welfare collide, reminding Alaskans that their senator is actively engaged in safeguarding their needs while navigating the complexities of national legislation.

Tilting at Windmills: Murkowski’s Legislative Battle

Throughout her political career, Sen. Murkowski has often found herself in the midst of contentious debates, fighting to represent the unique needs of Alaskans in a predominantly partisan environment. Her willingness to challenge her party illustrates her commitment to her constituents, even when it means going against popular sentiment within Republican circles. The tax vote was yet another example of this delicate balancing act, where securing essential provisions for Alaska’s welfare became the guiding principle behind her decision.

Her diplomatic approach in the Senate reflects an understanding that Alaskan interests often differ from those of the broader Republican agenda. Murkowski’s motivations stem from a deep connection to her state, resulting in a legislative strategy that prioritizes pragmatism over party loyalty. This mindset may sometimes lead to controversy, but her constituents expect nothing less than a proactive advocate for Alaska’s unique challenges.

The Role of SNAP Benefits in Alaskan Economic Landscape

SNAP benefits play a crucial role in shaping the economic landscape of Alaska, where a significant portion of the population relies on food assistance to make ends meet. As Murkowski navigates the political terrain around the Trump tax bill, the impact of these benefits becomes increasingly relevant. Ensuring that Alaskans maintain access to vital resources is a central tenet of her legislative focus, especially given the challenges presented by fluctuating state budgets and federal constraints.

The implications of tax reform extend to the SNAP program, with potential cuts threatening the stability that many families have come to depend upon. Murkowski’s efforts to secure amendments in the tax bill are indicative of her commitment to protecting these necessary programs, underscoring the intersection of fiscal policies and their real-world effects on daily lives in Alaska.

Murkowski’s Legislative Strategy: Balancing Act

Sen. Murkowski’s strategic decision-making reflects a nuanced understanding of both local and national issues at play within the Senate. Her recent vote in favor of the Trump tax bill, rather contentious, was underpinned by her goal of securing modifications that would serve her constituents better. By negotiating for exemptions from strict food stamp regulations, she hopes to create a safety net for families that are particularly susceptible to economic fluctuations.

This balancing act requires her to continuously assess the repercussions of federal legislation against the backdrop of Alaskan realities. As she faces dissent from both party members and the public regarding her support for the bill, her aim of ensuring that Alaska’s voice is heard in a national dialogue is ever-present. Murkowski’s approach emphasizes adaptability and responsiveness, crucial traits for any legislator navigating the complex policy landscape.

Critique of Welfare Reductions Through the Tax Bill

The tax bill’s provisions have raised alarms regarding potential welfare reductions, particularly in states with high poverty rates like Alaska. Critics of Murkowski question how a senator so aware of her constituency’s reliance on SNAP could support legislation that might diminish those resources. This critique highlights a broader conversation about how welfare reforms might impact the most vulnerable populations in America, especially in regions that heavily depend on federal assistance.

By defending her vote as a necessary action for the betterment of Alaska, Murkowski positions herself in a contentious triangle of politics: the need for party allegiance, the demands of her constituents, and the overarching goal of economic stability. Her legislative decisions will continuously be scrutinized as the reality of welfare support becomes more precarious, demanding that she confront the implications of her choices head-on.

Future Implications of Murkowski’s Tax Vote

The future implications of Sen. Murkowski’s tax vote loom over the political landscape as Alaskans assess the outcomes of these legislative changes. With the House set to review modifications to the bill, the fate of key provisions affecting SNAP benefits and other welfare programs remains uncertain. Murkowski’s involvement in the process emphasizes her desire to advocate for a bill that mitigates adverse effects while contributing to economic growth in Alaska.

As discussions continue, constituents will likely keep a watchful eye on how these changes unfold, particularly regarding their dependency on federal assistance programs. Murkowski’s actions and decisions will inevitably shape the narrative of her political legacy, determining whether her compromises serve to strengthen or undermine the safety nets that many Alaskans rely on. This ongoing dialogue will be critical in shaping future legislative approaches to welfare and tax reforms.

Frequently Asked Questions

What was Sen. Lisa Murkowski’s tax vote on the Trump tax bill?

Sen. Lisa Murkowski of Alaska voted in favor of President Trump’s tax bill, which passed the Senate with a very narrow margin. Her support was crucial, particularly after she secured an exemption for Alaska from stringent new food stamp regulations, which influenced her decision to vote yes.

How did Sen. Lisa Murkowski balance her concerns with the Trump tax bill and the needs of Alaska?

Sen. Murkowski expressed her conflicted feelings about the Trump tax bill, stating she did not agree with many aspects. However, her primary focus was on securing benefits for Alaskan residents, including protections for SNAP benefits, illustrating her attempt to prioritize Alaska’s interests amid her reservations about the legislation.

What exemptions did Sen. Lisa Murkowski secure related to Alaska’s food stamp regulations?

Before casting her yes vote on the Trump tax bill, Sen. Murkowski successfully advocated for a two-year exemption from strict food stamp regulations for Alaska, which would temporarily relieve some pressures on SNAP benefits for the state’s residents.

Why did Sen. Lisa Murkowski support the Republican tax legislation despite her criticisms?

Sen. Murkowski supported the Republican tax legislation after negotiating exemptions and amendments that addressed the unique needs of her constituents in Alaska. She acknowledged the bill’s flaws but highlighted her efforts to make it more beneficial for Alaskans.

What impact does Sen. Murkowski’s tax vote have on SNAP benefits in Alaska?

Sen. Murkowski’s tax vote, in conjunction with securing a temporary exemption from stringent food stamp regulations, is significant for SNAP benefits in Alaska. Nearly one-tenth of Alaskan residents depend on these benefits, and her efforts aimed to alleviate potential disruptions caused by new regulations.

How did the Senate vote on the Trump tax bill affect Sen. Murkowski’s political standing?

The Senate vote on the Trump tax bill put Sen. Murkowski in a controversial position, as she faced criticism from her peers for supporting a bill she had previously condemned. Despite the backlash, she defended her actions by emphasizing her commitment to serving the interests of her constituents.

What were the results of the Murkowski Senate vote on the tax legislation?

The Murkowski Senate vote on the tax legislation contributed to a narrow passage with a 51-50 tie-breaking vote from Vice President JD Vance. This critical support reflected her effort to balance local concerns with national party lines.

Why did Murkowski want amendments in the Republican tax legislation?

Murkowski sought amendments in the Republican tax legislation to enhance its provisions for Alaska, including increased funding for rural hospitals. Her aim was to mitigate some of the negative impacts of the bill while maximizing its benefits for her state.

| Key Points |

|---|

| Sen. Lisa Murkowski voted for Trump’s tax bill despite personal reservations, prioritizing Alaska’s needs. |

| She secured a temporary exemption from new food stamp regulations for Alaska before casting her vote. |

| Murkowski expressed her conflicted feelings but aimed to improve the bill for her constituents’ benefit. |

| SNAP benefits are critical for 10% of Alaskans, and the state faces the highest error rate in the program. |

| The tax bill passed with a 51-50 vote, with Murkowski’s vote enabling a tie-breaking decision from the Vice President. |

| Murkowski advocates for amendments, including increased funding for rural hospitals to assist her state. |

| Criticism arose from peers regarding her support of a bill she had condemned, highlighting internal tensions. |

Summary

Sen. Lisa Murkowski’s tax vote was a pivotal moment in the Senate’s approval of President Trump’s tax bill. Despite her reservations about the bill’s impacts, she prioritized the needs of her Alaskan constituents, securing crucial provisions like the exemption from strict food stamp regulations. Murkowski’s balancing act exemplified the complexities politicians face, as they navigate party lines while addressing the specific needs of their states. Her vote facilitated a historic tiebreaker, ultimately demonstrating her commitment to improving outcomes for Alaska, despite the political resistance she faced.