Private Sector Job Losses: ADP Reports June Decline

Private sector job losses have emerged as a concerning trend, particularly highlighted by the recent ADP report indicating a loss of 33,000 jobs in June 2023. This unexpected employment decline, diverging sharply from forecasts predicting a 100,000-job increase, raises questions about the health of the current job market. Service roles faced the brunt of these losses, especially in sectors such as professional services and education. As the economy navigates these changes, investors remain vigilant, with the upcoming nonfarm payrolls report set to provide further insight into the June job market. The implications of these trends not only affect individual livelihoods but also signal broader economic challenges ahead.

The recent downturn in employment figures, particularly within the private sector, signals a shift in hiring trends that has caught many analysts off guard. As companies face rising uncertainties, job reductions have become more apparent, especially in service-oriented industries. The ADP’s latest figures highlight a pivotal moment in the economy, suggesting that the previously optimistic projections for job growth may need reevaluation. With significant declines reported within professional and educational sectors, the landscape of employment is rapidly changing. Understanding these developments is essential for grasping the broader implications for the economy and the workforce.

Impact of Private Sector Job Losses on the Economy

The recent announcement from ADP that the private sector lost 33,000 jobs in June raises significant concerns regarding economic stability. This unexpected decrease starkly contrasts the expectations of a gain of 100,000 jobs, suggesting that the economy may not be as resilient as previously thought. The job losses represent a worrying trend as it marks the first decline since March 2023, indicating a sudden halt to the hiring momentum that has characterized the job market for the past few months. With economists already revising expectations for employment growth, these private sector job losses are likely to prompt a reevaluation of the overall economic outlook.

Moreover, this decline in private sector employment feeds into broader fears about the potential for a recession. Layoffs, while still not predominant, coupled with an unwillingness to hire and fill vacancies, contribute to a climate of uncertainty among businesses. Economists, analyzing data such as the forthcoming government nonfarm payrolls report, are now more cautious about predicting robust job growth, as they fear that these private sector trends might foreshadow a larger economic slowdown.

Analysis of June 2023 Job Market Trends

Analyzing the June 2023 job market trends reveals a complex situation, particularly for service roles. The data showed significant job losses in sectors like professional and business services, which saw a decline of 56,000 jobs, and health and education services, with a loss of 52,000 jobs. This concentrated job loss indicates that these areas are experiencing challenges that may require more than just temporary adjustments. As potential hiring freezes take hold, businesses may find themselves stretched thin, struggling to meet demand without the necessary workforce.

Additionally, the discrepancy between the ADP report and forecasts for the nonfarm payrolls report suggests that stakeholders should be cautious when interpreting labor data. With a forecast of 110,000 increases in government reports, the reality of service role losses could lead to a significant downward revision in understanding the job market. Combined with factors such as the slight expected rise in unemployment rates, these trends point toward a job market that is heating up at a slower pace than investors might have hoped, conflicting with the buoyant performance of the S&P 500.

Regional Job Loss Trends in June 2023

The geographical breakdown of job losses presented by ADP for June 2023 indicates that the Midwest and Western U.S. experienced the highest declines, with losses of 24,000 and 20,000 jobs, respectively. In contrast, the Northeast only saw a reduction of 3,000 jobs, while the Southern U.S. uniquely recorded a net gain of 13,000 positions. This regional disparity raises questions about economic resilience and growth potential in different areas. For instance, the Southern states’ ability to add jobs during a generally contracting environment might indicate localized strengths or industry shifts that are more favorable in that region.

Understanding these regional trends is crucial for businesses and policymakers alike. Regions experiencing significant job losses may require targeted economic strategies to stimulate hiring, while those with job gains could serve as models for success. Therefore, addressing the challenges faced by the Midwestern and Western states could play a pivotal role in bolstering the national economy and mitigating further job losses across other sectors.

Service Roles: A Sector Under Siege

Service roles have emerged as a particularly hard-hit sector within the job market, suffering a net decline of 66,000 jobs in June. This contraction reflects broader trends in the economy, where businesses are grappling with higher costs and changing consumer behaviors, prompting a reevaluation of their staffing needs. Industries tied to professional and business services have seen dramatic shifts, suggesting a potential long-term restructuring that could necessitate new skillsets and training programs for workers.

The losses in service roles underscore a troubling trend where jobs in health, education, and professional services are often seen as indicators of economic health. As these sectors contract, employees may face heightened job insecurity, prompting changes in consumer spending and economic engagement. The implications of these job losses extend beyond individual livelihoods, signaling potential downturns in local economies heavily reliant on service sector employment.

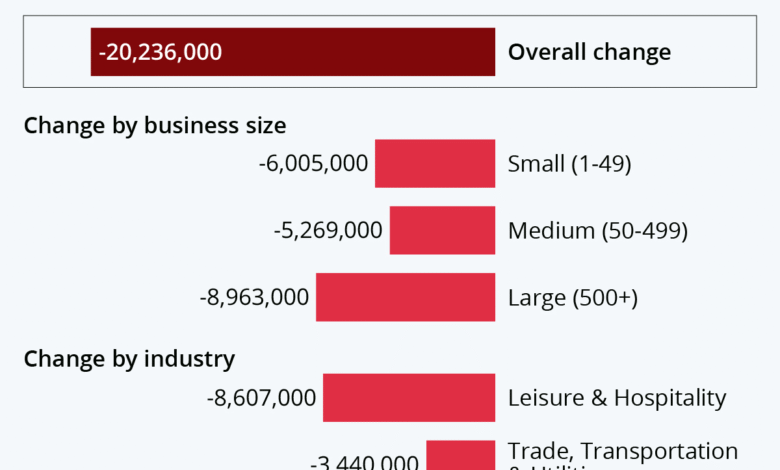

The Role of Smaller Firms in Job Losses

Smaller firms are experiencing a disproportionate amount of job loss in June, with businesses employing fewer than 20 workers accounting for a net loss of 29,000 jobs. In stark contrast, larger firms with over 500 employees added 30,000 jobs during the same period, highlighting the divergent impacts of economic challenges on different business sizes. This pattern suggests that while larger companies may have more resources to weather economic downturns and invest in workforce stability, smaller companies continue to struggle with tighter margins and a less scalable operational model.

Understanding the dynamics of smaller versus larger firms is critical for policymakers aiming to promote job growth and stabilize employment. By supporting small businesses through incentives or subsidies, governments might counterbalance the job losses in these vulnerable sectors. Additionally, fostering an ecosystem that encourages entrepreneurship could generate new job opportunities, providing much-needed resilience to the overall economy.

The ADP Report and Its Implications

The ADP report serves as an important bellwether for the health of the job market, although its track record is mixed when aligning with subsequent government job reports. The sharp contrast between the ADP’s 33,000 job losses and the anticipated 110,000 job gain in the government’s upcoming nonfarm payrolls report illustrates the importance of cross-referencing data points. Investors often leverage the ADP report to gauge immediate market sentiment, which can lead to volatility when its predictions diverge notably from actual employment figures.

Therefore, reliance on the ADP report should come with caution, as its discrepancies with later job figures can lead to misguided strategies. As stakeholders prepare for the latest employment data release, understanding the limitations and context of the ADP report is essential for formulating accurate predictions about economic trends and adjusting investment strategies accordingly.

The Importance of Job Growth Figures

Job growth figures are essential indicators of economic strength, reflecting consumer confidence and business sentiment. Following the release of the latest ADP report, the downward revision of May’s job addition to just 29,000 simply reinforces the precarious nature of the current labor market. With ongoing uncertainties in the job landscape, stakeholders, including economists and investors, should pay close attention to job growth figures to understand potential shifts in economic policies and market trends.

As the labor market reacts to overall economic conditions, the nuances of these employment statistics carry significant implications for future financial health. The anticipation surrounding the nonfarm payrolls report serves as a critical checkpoint, where analysts will assess whether June’s dynamics indicate broader trends of stability or potential decline. Even as optimism pervades financial markets, imbalances in job growth could provoke adjustments in fiscal strategies and consumer spending behaviors.

Anticipation for Upcoming Jobless Claims Data

The anticipation building around the upcoming jobless claims data is heightened, especially in light of the recent employment trends highlighted by the ADP report. Economists forecast that the weekly jobless claims will total around 240,000, pointing toward persistent challenges in the labor market. If actual claims exceed expectations, the potential for increased unemployment rates might become a reality, further complicating the economic landscape.

These jobless claims figures serve not only as a barometer for immediate economic conditions but also as a predictor of future job growth trends. Increased claims could lead to rising concerns over private sector job losses, prompting businesses to adjust their hiring plans. Therefore, keeping a close watch on the jobless claims will be essential for understanding how these broader employment trends translate into local and national economic performance.

Annual Wage Growth Trends Amid Job Losses

Amid rising concerns over job losses and economic stability, annual wage growth trends present a mixed picture as well. In June, the growth rate for those remaining in their jobs decreased to 4.4%, down from 4.5% in May. This slight decline signifies how fluctuations in job security can directly impact wage increases, as businesses become more conservative in their compensation strategies amid uncertain economic conditions.

For job switchers, the drop in pay increase rate to 6.8% from 7% further illustrates that while there may still be opportunities in the job market, the economic climate is causing a slowdown in wage growth. This trend can heavily influence consumer spending, as individuals may feel less confident about their financial security in light of stagnant wage growth. Consequently, it becomes imperative to monitor wage trends closely, as they provide a clearer picture of how the job market affects overall economic sentiment.

Frequently Asked Questions

What does the ADP report say about private sector job losses in June 2023?

The ADP report for June 2023 indicates that the private sector lost 33,000 jobs, significantly missing economists’ expectations of a 100,000 job increase. This marks the first decline in private payrolls since March 2023.

How did the employment decline in June affect service roles in the private sector?

The employment decline in June particularly affected service roles, which saw a net loss of 66,000 jobs. Most of these losses occurred in professional and business services, as well as in the health and education sectors.

What sectors contributed to the job losses reported in the private sector for June 2023?

In June 2023, the private sector’s job losses were mainly attributed to declines in professional and business services (56,000 jobs lost) and the health and education sectors (52,000 jobs lost), as per the ADP report.

What are the implications of the private sector job losses for the upcoming nonfarm payrolls report?

The significant private sector job losses reported by ADP could lead economists to revise their predictions for the nonfarm payrolls report, which is anticipated to show a solid job increase of 110,000 for June. This discrepancy indicates potential weaknesses in the economy.

Which regions experienced the largest private sector job losses in June 2023?

In June 2023, the Midwest and Western U.S. experienced the largest private sector job losses, with declines of 24,000 and 20,000 jobs, respectively. Conversely, the Southern U.S. was the only region to report a net increase in jobs.

How did smaller firms fare compared to larger firms in terms of private sector job losses?

Smaller firms experienced more job losses in June 2023 compared to larger firms. Businesses with fewer than 20 employees accounted for a net loss of 29,000 jobs, while those with over 500 employees added 30,000 jobs.

What was the trend regarding annualized income growth among job stayers and movers in June 2023?

Annualized income growth showed a slight decrease in June 2023. For job stayers, the pay increase rate dipped from 4.5% to 4.4%, and for those who switched jobs, it decreased from 7% to 6.8%. This indicates a moderation in income growth amid the job losses in the private sector.

| Key Points |

|---|

| In June, the private sector lost 33,000 jobs according to ADP, missing a projected increase of 100,000 jobs. |

| This was the first decline in private payrolls since March 2023. |

| Job growth in May was revised down to just 29,000 jobs added, from a previous figure of 37,000. |

| Service roles saw the largest losses, especially in professional and business services (56,000 jobs lost) and education/health sectors (52,000 jobs lost). |

| The Southern U.S. experienced a net increase of 13,000 jobs, while the Midwest and Western U.S. had significant losses. |

| Larger firms (over 500 employees) added jobs, while smaller firms (under 20 employees) accounted for most job losses. |

| Despite job losses, the S&P 500 rose over 4% this year, highlighting a complex economic landscape. |

Summary

Private sector job losses were significant in June, with a total of 33,000 jobs reported lost, which starkly contrasts with the anticipated growth of 100,000 jobs. This downturn flags potential concerns about the strength of the economy amidst fluctuating employment trends. With the data indicating heavy losses chiefly in service roles, attention now turns to upcoming reports which may further elucidate the state of the job market.