Dogecoin Technical Analysis: Key Levels and Signals

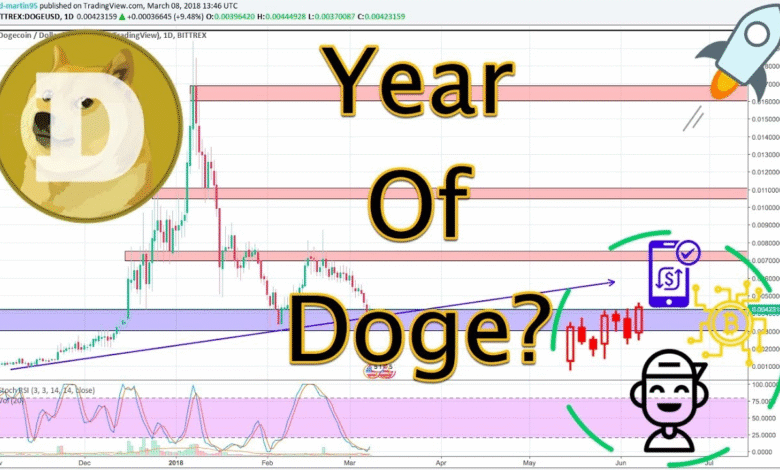

Dogecoin technical analysis is generating significant interest among traders as the cryptocurrency approaches a critical juncture. Currently, the price nears a vital resistance level around $0.171, coinciding with the upward trajectory of the 800 EMA. A decisive breakout beyond this resistance could trigger a robust bullish trend, opening pathways for potential gains toward the 50 EMA. Traders should pay close attention to market behavior following a pullback to this breakout level, as maintaining support at $0.171 is crucial for sustaining momentum. By closely monitoring Dogecoin price predictions and breakout signals, investors can refine their crypto trading strategies accordingly.

Exploring the intricacies of Dogecoin’s price dynamics reveals a fascinating landscape for technical trading enthusiasts. This beloved meme coin is currently situated at a pivotal point, with the price on the verge of testing established resistance barriers. As traders strategize to capitalize on potential market movements, understanding Dogecoin’s resistance levels and corresponding breakout indicators becomes paramount. Monitoring these technical signals not only informs decisions but also enhances the likelihood of successful trades within the crypto sphere. By focusing on the latest trends and reverse patterns, investors can better navigate the volatility of this exciting digital asset.

Understanding Dogecoin Price Levels and Patterns

Dogecoin’s price action is currently highlighting crucial levels essential for traders to watch. The resistance level at $0.171 is particularly significant; it not only coincides with the 800 EMA but also represents a psychological threshold that many traders monitor closely. A decisive breakout above this level would signify a bullish trend, potentially attracting new buying interest and pushing the price even higher. In the context of Dogecoin price prediction, this breakout could lead to a rapid ascent towards the next resistance tied to the 50 EMA, creating a substantial opportunity for crypto traders.

Moreover, understanding the behavior during pullbacks is vital for effective Dogecoin trading strategies. If prices retrace after nearing $0.171, it’s critical for them to hold above this level to maintain bullish momentum. Such price action could confirm a solid support formation, encouraging investors to enter or add to their positions. Additionally, the technical setup on the daily chart reflects a transition phase for Dogecoin; thus, traders should adapt their strategies to harness potential fluctuations in market sentiment.

Dogecoin Technical Analysis: Daily and 4-Hour Insights

Through meticulous Dogecoin technical analysis, traders can glean insights from both the daily and 4-hour charts. The daily chart shows a significant resistance challenge, prompting traders to assess potential breakout signals associated with a rise above $0.171. An established trendline combined with the 800 EMA sets the stage for crucial decision-making moments. If this level is breached with high volume, it may result in a prolonged bullish scenario, as traders may anticipate further upward pressure leading to the next target near the 50 EMA.

On the 4-hour chart, Dogecoin is presented with an immediate challenge. With the price testing the 50 EMA, it has established itself as a key hurdle. If Dogecoin can transcend this resistance, momentum could shift positively, reaffirming a bullish outlook. Conversely, a failure to break above could lead to a pullback toward the established support zone, where traders should be on the lookout for breakout signals that may suggest a W-reversal pattern, indicating the potential for price upward direction.

Identifying Breakout Signals for Dogecoin

In the context of Dogecoin trading strategies, identifying breakout signals is crucial for taking advantage of price movements. As previously discussed, the resistance at $0.171 serves as a vital benchmark. If Dogecoin successfully breaks and closes above this level, it would signal to investors that a bullish trend is likely underway. Moreover, the presence of increasing long positions may suggest that traders are anticipating higher prices, potentially setting off a wave of buying which could further propel the price action.

Furthermore, monitoring the liquidation profile is essential in such scenarios. The current market activity indicates a buildup of long positions, alongside a notable short delta. A sudden move above $0.171 could trigger a short squeeze, leading to rapid price escalation as short sellers cover their positions. This kind of dynamic underlines the importance of timing and market sentiment in crypto trading, allowing traders to align their strategies with emerging trends and signals.

The Role of EMAs in Dogecoin Trading Strategies

Exponential Moving Averages (EMAs) play a pivotal role in Dogecoin technical analysis. Both the 50 EMA and the 800 EMA are key indicators that highlight potential support and resistance areas. Traders often incorporate these averages into their trading strategies to gauge market momentum. For instance, when the price consistently holds above the 50 EMA, it indicates a bullish trend, while sustained movement below this line signals a bearish outlook. Hence, understanding how these indicators interact with Dogecoin’s price is crucial for making informed trading decisions.

Additionally, the interplay between various EMAs can provide insights into future price movements. A golden cross, where a shorter-term EMA crosses above a longer-term EMA, typically suggests a bullish trend. Conversely, a death cross indicates a bearish trend. Thus, tracking how Dogecoin’s price behaves relative to the 50 EMA and the 800 EMA can empower traders to fine-tune their strategies, positioning themselves advantageously within the market, and aligning their trades with potential breakout points.

Assessing the Impact of Liquidation Levels on Dogecoin

Liquidation levels are an essential element in understanding price movements within Dogecoin trading. As the crypto markets experience volatility, liquidation levels often dictate how price reacts to resistance or support zones. In the case of Dogecoin, the current composition of long and short positions suggests an impending short squeeze could trigger significant price surges. As traders adjust their strategies based on liquidation risks, monitoring these levels becomes crucial in anticipating market movements and potential buying opportunities.

Moreover, as Dogecoin approaches critical resistance at $0.171, the risk of a short squeeze intensifies. If the price moves successfully above this threshold, those holding short positions may be forced to cover, which adds upward pressure to the price. This dynamic highlights how liquidation levels can amplify price volatility and influence Dogecoin’s market behavior. Consequently, savvy traders must not only focus on price action but also remain aware of liquidation signals to optimize their trading strategies.

Market Sentiment and Its Effects on Dogecoin

Market sentiment plays a crucial role in the day-to-day fluctuations of Dogecoin. The emotional state of traders, driven by news, social media trends, and market movements, can create waves of buying or selling pressure. When sentiment turns bullish, as seen during media coverage or community endorsements, Dogecoin often experiences price surges. Conversely, negative sentiment can weigh heavily on prices, creating hesitant market conditions. Understanding these sentiment shifts is vital for traders who aim to position themselves advantageously during market changes.

Additionally, market sentiment can influence how traders respond to technical signals. For instance, if Dogecoin is approaching key resistance, a bullish sentiment can lead to increased buying activity, effectively breaking through that resistance level. Conversely, bearish sentiment might lead to caution, resulting in traders holding back despite positive technical indications. Therefore, keeping an ear to the ground and gauging market sentiment is invaluable for anyone involved in the Dogecoin trading landscape.

Long-Term Projections for Dogecoin Price

Long-term projections for Dogecoin price remain a hot topic among investors and analysts alike. The community’s sentiments, technological developments, and broader market trends heavily influence these projections. Many analysts speculate that if Dogecoin maintains its current technical setup and manages to establish a firm footing above resistance levels, it could ultimately benefit from a sustained uptrend. Observers are keenly waiting to see how events unfold, especially in relation to market adoption and overall crypto sentiment.

In considering the long-term future of Dogecoin, the interaction between key resistance levels and broader market indicators will prove critical. Should Dogecoin consistently hold positions above key EMAs, particularly the 50 EMA, along with supporting bullish fundamentals, its long-term outlook could reflect significant growth potential. For traders, adapting to these longer-term dynamics can provide opportunities for enduring profits and strategic positioning in ongoing market conditions.

Navigating Dogecoin Volatility in Trading

Navigating the volatility associated with Dogecoin can be challenging yet rewarding for traders. Due to its community-driven nature and speculative trading habits, Dogecoin often experiences sharp price swings which can lead to substantial opportunities or risks. Successful traders learn to leverage this volatility to their advantage, employing techniques such as stop-loss orders and position sizing to manage risk effectively. The key lies in understanding both the broader market environment and the micro-movements particular to Dogecoin.

Furthermore, traders need to remain agile and adapt their strategies frequently due to the unpredictable nature of the cryptocurrency markets. Engaging with various technical indicators, such as EMAs and support/resistance levels, helps traders pinpoint entry and exit points that align with their volatility strategies. Ultimately, those who can effectively navigate Dogecoin’s often turbulent waters stand to capitalize on its unique trading opportunities while also managing associated risks.

Learning from Experts: Dogecoin Trading Insights

Learning from experienced traders can provide significant insights for those interested in trading Dogecoin. Bastian Keller, known as Bitbull, shares valuable lessons derived from years of experience in both Forex and crypto trading. His focus on technical analysis and strategic risk management resonates with many aspiring traders. Engaging with educational content, such as his video courses, can enrich one’s understanding of the intricacies involved in the crypto market, specifically tailored towards Dogecoin and similar assets.

Additionally, the community aspect of learning from experts in crypto trading fosters a supportive environment. Forums, social media, and trading platforms all serve as resources for sharing knowledge and strategies among traders. By experiencing real-time market analysis alongside expert insights, novice traders can refine their skills and develop more robust trading strategies. This knowledge can ultimately empower traders to make more informed decisions in their approach to Dogecoin trading, enabling them to better navigate market complexities and anticipate potential shifts.

Frequently Asked Questions

What is the current outlook for Dogecoin technical analysis?

The current Dogecoin technical analysis shows a promising setup with the price approaching a significant resistance level at $0.171, coinciding with the 800 EMA. A breakout above this level would signal a strong bullish trend, setting the stage for further upward movement towards the 50 EMA.

What does Dogecoin price prediction look like based on technical analysis?

Based on recent Dogecoin technical analysis, price predictions suggest that if DOGE breaks above the crucial resistance at $0.171, we could see a rise towards the 50 EMA. This would indicate a bullish continuation if supported by a pullback to the previous breakout level.

How do crypto trading strategies apply to Dogecoin’s technical analysis?

Incorporating crypto trading strategies into Dogecoin’s technical analysis means identifying resistances, such as the $0.171 mark. Trading strategies may include anticipation of breakout signals above this resistance and monitoring for pullbacks to establish new entry points.

What are the key resistance levels in the Dogecoin technical analysis?

The key resistance levels identified in the Dogecoin technical analysis include the $0.171 area, which is reinforced by the 800 EMA. Prices that manage to break above this zone could indicate potential for further bullish momentum.

What signs indicate a Dogecoin breakout according to technical analysis?

A Dogecoin breakout can be indicated by closing prices above significant resistance levels like $0.171, ideally with strong volume. Confirmation may also come from bullish patterns forming, such as the W-reversal pattern on the 4-hour chart, which may signal upward momentum.

How do EMAs impact Dogecoin’s technical analysis?

Exponential Moving Averages (EMAs) play a critical role in Dogecoin’s technical analysis. Currently, the price is testing the 50 EMA as a short-term resistance. A breakout above this average could validate bullish sentiment and encourage further price increases.

What potential challenges does Dogecoin face in its technical analysis?

Challenges in Dogecoin’s technical analysis include the risk of rejection at resistance levels like $0.171 and the potential for a pullback if it fails to maintain momentum. Additionally, existing short positions could create volatility with a possible short squeeze pending a strong upward movement.

What is a W-reversal pattern in Dogecoin technical analysis?

A W-reversal pattern is a technical signal indicative of a potential bullish reversal. In Dogecoin’s case, should the price pull back to its established support zone, the formation of a W-reversal could suggest a shift in momentum towards the upside.

| Aspect | Description |

|---|---|

| Current Price Situation | Dogecoin is approaching a significant resistance level around $0.171, coinciding with the 800 EMA. |

| Technical Implications of Breakout | A convincing breakout above $0.171 could signal bullish momentum and target the 50 EMA next. |

| Support Level Importance | The previous breakout level around $0.171 is crucial to maintain positive momentum and avoid pullback. |

| 4-Hour Chart Insights | Testing the 50 EMA as short-term resistance; a breakout could lead to renewed focus on $0.171. |

| Potential Patterns | If DOGE retraces, a potential W-reversal pattern could emerge, signaling a bullish reversal if confirmed. |

| Risk of Short Squeeze | Current liquidation profile suggests a risk of a short squeeze if DOGE breaks above $0.171 with volume. |

| Trend Continuation | Strong technical setup could support continued uptrend if key levels hold. |

Summary

Dogecoin technical analysis indicates that the cryptocurrency is currently navigating a pivotal moment on the daily chart. As the price nears the $0.171 resistance level, which aligns with the 800 EMA, traders are eagerly watching for a breakout. Such a divergence could trigger a bullish trend, facilitating further upward movement towards the 50 EMA. Conversely, maintaining support at this level is critical for sustaining momentum. Therefore, the current setup offers strategic insights for traders, highlighting the importance of key levels and possible pattern formations in determining future price directions.