Dividend Increases: Wells Fargo and Goldman Sachs Lead

Dividend increases are a clear signal of a company’s financial health, particularly when observed in major players like Wells Fargo and Goldman Sachs. Recently, both banks announced their latest dividend hikes, a move that underscores their robust operational performance and commitment to shareholder value in the banking sector. Such increases often reflect not only confidence in ongoing financial stability but also a strategic outlook for continued growth. For investors, these developments can significantly influence investment strategies, especially in terms of evaluating potential returns compared to other assets. Understanding the implications of these dividend shifts is crucial for anyone looking to enhance their portfolio’s performance through dividends.

Recent announcements regarding elevated shareholder payouts highlight an encouraging trend for investors seeking stability in the financial sector. As Wells Fargo and Goldman Sachs expand their distributions, these developments mark an important moment in assessing the investment landscape. Notably, heightened banking sector dividends are often indicative of solid corporate health and long-term growth potential. Investors should closely monitor these changes, as they may adjust their financial strategies to incorporate these lucrative opportunities. Ultimately, awareness of such advancements is vital for optimizing portfolio returns and navigating market conditions.

Understanding the Recent Dividend Increases

The recent decision by Wells Fargo and Goldman Sachs to increase their dividends is a noteworthy development for investors who keep a close eye on banking sector dividends. A dividend increase often signals a company’s confidence in its financial stability and future prospects. When a bank announces a higher dividend, it typically reflects its strong earnings performance and a solid outlook for sustained profitability. This not only boosts investor sentiment but also can enhance the bank’s reputation within the financial services industry.

Both Wells Fargo dividend increase and Goldman Sachs dividend raise come at a time when investors are evaluating their portfolio strategies. Increasing dividends can indicate a shift in a company’s financial health, suggesting that they have the capacity to return excess capital to shareholders. For investors, recognizing these signals is crucial in assessing their overall investment strategies, especially in sectors like banking, where stability can be paramount.

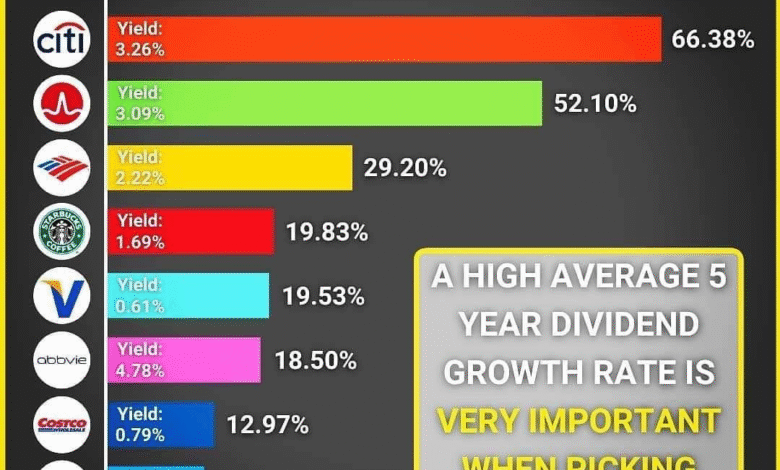

Comparing Dividend Policies of Major Banks

The dividend policies of major banks, such as Wells Fargo and Goldman Sachs, are pivotal in shaping investors’ perceptions regarding financial stability. These banks have historically had robust dividend payouts, and their recent increases could potentially set a benchmark for other financial institutions. Evaluating how these dividend hikes compare with industry standards is key for investors looking to maximize their returns. Moreover, understanding the transactional landscape of these banking giants reveals a trend towards prioritizing shareholder returns amidst competitive pressures.

In comparing the dividend increases of Wells Fargo and Goldman Sachs with other banking institutions, investors can derive insights into which companies exhibit stronger fundamentals and operational efficiencies. Banks that consistently increase dividends tend to attract more investment as they communicate a stable and growing financial performance. Therefore, examining these trends not only provides clarity on individual banks but also helps shape wider investment strategies within the banking sector.

The Role of Dividend Increases in Investment Strategies

Dividend increases play a significant role in formulating effective investment strategies, especially in sectors known for their reliability, such as banking. Investors often use dividends as a measure of a company’s financial health, and increases can prompt re-evaluation of investment philosophies. For instance, an investor who focuses on stability might be more inclined to shift their capital toward firms like Wells Fargo or Goldman Sachs following their recent dividend hikes. This reflection on the banking sector underscores the importance of aligning individual investment goals with the performance indicators provided by dividend policies.

Moreover, incorporating dividend increases into investment strategies can enhance overall portfolio returns. Investors often seek steady returns and lower volatility, which dividends typically provide. By prioritizing banks with consistent dividend growth, investors may mitigate risks associated with market fluctuations. Understanding the dynamics of how banks like Goldman Sachs manage their dividends allows investors to make informed decisions, optimizing their exposure to financial stability and potential growth.

Market Confidence Reflected in Higher Dividends

The recent dividend increases by major players like Wells Fargo and Goldman Sachs reflect a broader market confidence that has been building within the banking sector. Such increases are often viewed as indicators of a resilient economic environment, where corporations can afford to return more cash to their shareholders. This, in turn, fosters investor trust in the financial markets, as companies demonstrate their capacity to generate sustainable profits even in challenging global conditions.

Higher dividends also attract potential investors who are looking for sound investment opportunities that promise stability along with returns. Companies that can assure increased dividend payouts often find themselves in a favorable position to weather economic uncertainties. As the banking sector continues to navigate through various challenges, including regulatory scrutiny and economic fluctuations, these dividend increases serve as a reassurance of both operational viability and strategic foresight.

Evaluating Dividend Returns Against Market Conditions

As investors analyze the recent dividend increases from Wells Fargo and Goldman Sachs, it is essential to evaluate these returns against current market conditions. The banking sector is particularly sensitive to changes in economic policies and interest rates. Therefore, an increase in dividends could be interpreted as an optimistic stance on the future state of the economy, not just for the banks themselves but for the market as a whole. Investors must consider how external economic factors could influence these dividend strategies moving forward.

Understanding the interplay between dividend increases and market conditions allows investors to make predictions about future performance trends. In times of economic growth, companies are more likely to provide higher dividends, which can serve as indicators of healthy market activity. Conversely, any fluctuations or uncertainties in market conditions can lead to adjustments in these strategies. Thus, assessing a bank’s dividend policy in the context of prevailing economic indicators remains an integral aspect of designing a successful investment strategy.

Lessons from Wells Fargo and Goldman Sachs

The recent actions by Wells Fargo and Goldman Sachs provide valuable lessons for investors looking to enhance their investment portfolios through strategic dividend plays. These banks have demonstrated that maintaining financial health, even through challenging periods, can lead to favorable outcomes in shareholder value. For current and prospective investors, understanding how these companies navigate their operational challenges while committing to dividend increases is crucial for making informed decisions.

In particular, observing the methods employed by Wells Fargo and Goldman Sachs to manage their dividend distributions can help shape broader investment insights. These strategies may include cost management, operational efficiency, and proactive risk assessments that contribute to stronger financial performance. By applying such lessons, investors can position themselves better in the banking sector, ensuring that their portfolios not only yield dividends but also capitalize on potential growth opportunities.

The Impact of Dividend Increases on Financial Markets

Dividend increases from prominent banks like Wells Fargo and Goldman Sachs can significantly impact the financial markets, providing positive signals not just for their shareholders but also for the broader investment community. When major firms raise their dividends, other companies may follow suit, prompting a wave of confidence that can enhance overall market stability. This ripple effect often leads to increased investment flows into the banking sector, reflecting heightened investor optimism.

Additionally, the impact of these increases can lead to changes in market sentiment, attracting both long-term and short-term investors seeking reliable returns. As banks raise dividends, it may encourage hesitant investors to enter the market, invigorating trading activity. This highlights the critical role that banking sector dividends play in shaping investor behavior and overall market dynamics.

Assessing Shareholder Value in a Dividend-Centric Approach

A dividend-centric investment approach focuses on maximizing shareholder value, which is increasingly relevant as demonstrated by the recent dividend increases from Wells Fargo and Goldman Sachs. This strategy emphasizes not only the income generated from dividends but also the signals that these increases send about a company’s overall health. For investors, understanding the implications of these increases can be crucial in evaluating their long-term investment strategies and aligning them with their financial goals.

Investors adopting a dividend-centric approach often prioritize companies that consistently reward their shareholders with higher payouts. This model is especially appealing in the banking sector, where companies like Wells Fargo and Goldman Sachs showcase their financial strength and stability through regular dividend increases. By assessing these banks’ commitments to delivering shareholder value, investors can gain confidence in their choices and leverage dividend income as a pivotal component of their investment portfolios.

Future Outlook for Banking Sector Dividends

Looking ahead, the future of banking sector dividends appears promising, especially with the recent increases by Wells Fargo and Goldman Sachs signaling positive financial trajectories. As the economy shows signs of stability, banks are likely to continue focusing on shareholder returns, creating a favorable environment for dividend growth. Investors should stay informed about potential regulatory changes and economic factors that may influence these decisions, thereby protecting and expanding their investments.

Moreover, as the banking sector adapts to evolving market conditions, firms with a clear commitment to maintaining and increasing dividends will likely emerge as preferred choices for investors. Identifying these banks early on can be advantageous, as they may not only provide consistent income but also exhibit resilience against market volatility. Understanding industry trends and being proactive in adjusting investment strategies will be essential for navigating the future landscape of banking sector dividends.

Frequently Asked Questions

What does the Wells Fargo dividend increase indicate about its financial stability?

The recent Wells Fargo dividend increase is a strong indicator of the bank’s financial stability. By raising its dividend, Wells Fargo signals to investors that it has confidence in its earnings potential and operational performance, making it a favorable option for those focused on dividend investing.

How does the Goldman Sachs dividend impact investment strategies in the banking sector?

The Goldman Sachs dividend increase enhances investment strategies within the banking sector by attracting investors seeking regular income. Such increases often indicate solid company performance, which can positively influence broader market trends and investment decisions.

What are the implications of dividend increases from Wells Fargo and Goldman Sachs for banking sector dividends?

Dividend increases from Wells Fargo and Goldman Sachs enhance the appeal of banking sector dividends, showcasing the sector’s potential for growth. These moves reflect a competitive edge in retaining and attracting investors who prioritize consistent income from dividends.

How can investors gauge financial stability through dividend increases?

Investors can gauge financial stability through dividend increases as these actions typically reflect a company’s strong earnings and robust operational health. For instance, Wells Fargo and Goldman Sachs’ recent raises are reassuring signs of their stability, guiding investors in making informed decisions.

What factors drive Wells Fargo dividend increases compared to other bank dividends?

Wells Fargo dividend increases are often driven by solid financial performance, effective management strategies, and favorable economic conditions. Compared to other bank dividends, Wells Fargo’s increases may signify stronger operational resilience and growth potential, aligning with broader trends in the banking sector.

Why are dividend increases important in evaluating investment opportunities?

Dividend increases are crucial in evaluating investment opportunities as they often indicate a company’s financial health and earnings potential. For example, Wells Fargo and Goldman Sachs’ recent dividend hikes suggest strong market positions, providing investors with confidence in their choices.

What should investors consider when analyzing banks’ dividend increases?

When analyzing banks’ dividend increases, investors should consider the overall financial health of the institution, historical dividend performance, and the economic environment. The recent increases by Wells Fargo and Goldman Sachs should be viewed in the context of their operational stability and growth strategies.

How do external economic challenges affect banking sector dividends like those from Wells Fargo and Goldman Sachs?

External economic challenges can influence banking sector dividends, but firms like Wells Fargo and Goldman Sachs often respond by adjusting their dividend policies to reflect their financial stability and performance. Recent increases indicate these banks’ ability to thrive despite such challenges.

| Bank | Dividend Increase | Impact on Investors | Overall Market Implications |

|---|---|---|---|

| Wells Fargo | Increased | Positive signal of strong performance | Reflects confidence in financial stability |

| Goldman Sachs | Increased | Indicates healthy earnings potential | Strengthens investor confidence in banks |

Summary

Dividend increases reflect a positive trend in the banking sector, particularly with Wells Fargo and Goldman Sachs leading the charge. Such enhancements not only highlight the banks’ strong operational performance but also serve as reassuring signals to investors about potential future earnings. As these companies prioritize shareholder value, understanding their dividend policies can assist investors in navigating the financial landscape and optimizing their investment strategies.