iPhone Sales Growth in China Marks Apple’s Comeback

iPhone sales growth in China has marked a significant turnaround for Apple, as reported by Counterpoint Research, with sales increasing by 8% year-on-year in the latest quarter, the first growth in two years. This surge is primarily due to strategic promotions and discounts offered by Chinese e-commerce platforms, particularly for the newly released iPhone 16 models. To further entice consumers, Apple adjusted trade-in values, effectively boosting sales just prior to the major 618 shopping festival. Such growth comes at a critical time for the tech giant, as it faces intensified competition from rivals like Huawei. The rise in iPhone sales in China not only revitalizes Apple’s market presence but also reassures investors amidst broader industry challenges and a 15% decline in stock value this year.

The resurgence in iPhone sales in the Chinese market indicates a pivotal shift for Apple, reflecting heightened consumer interest and strategic marketing efforts. This growth highlights a robust demand for the latest Apple smartphone lineup, tailored through attractive trade-in programs and competitive pricing strategies during significant shopping seasons like the 618 festival. As e-commerce platforms ramp up efforts to promote the iPhone 16 models, the landscape of smartphone sales is rapidly evolving, challenging traditional market dynamics. Furthermore, the competitive landscape, especially with Huawei’s recent market strength, showcases the importance of innovation and timely promotions. Ultimately, Apple’s ability to navigate these shifts will be crucial in maintaining its position within this key global market.

Understanding Apple iPhone Sales Growth in China

Apple’s iPhone sales growth in China marks a significant turnaround for the tech giant, especially after experiencing stagnation in the previous two years. According to Counterpoint Research, iPhone sales surged by 8% year-on-year in the three months ending in June 2023, highlighting a strong recovery in one of Apple’s most critical markets. This growth is particularly notable as it signals renewed consumer interest in Apple’s flagship devices, driven by strategic promotions and competitive pricing during peak shopping events.

The increase in demand for iPhones was not merely a chance occurrence; it was strategically planned around major sales events in Chinese e-commerce. In May, discounts and trade-in promotions incentivized consumers to upgrade to the latest iPhone 16 models just before the annual 618 shopping festival, a period characterized by extensive discounts and massive sales volume. By raising trade-in values and offering attractive deals, Apple was able to effectively position its products against rising competition from domestic manufacturers like Huawei.

Impact of E-Commerce Promotions on iPhone Sales

Chinese e-commerce platforms played a crucial role in boosting Apple iPhone sales during the recent quarter. Promotions and offers from these platforms effectively captured consumer attention, encouraging many to consider upgrading their devices. Deals surrounding the launch of the iPhone 16 models provided an added incentive, tapping into the high purchase intent of Chinese consumers who are always on the lookout for the latest technology at competitive prices.

Moreover, the timing of these promotional efforts directly coincided with the 618 shopping festival, which is one of the most significant retail events in China. This festival not only drives online traffic but also significantly boosts sales across various categories. Apple’s calculated marketing strategies, including promotional partnerships with leading e-commerce sites, have allowed the brand to harness the power of online shopping efficiently, thus translating promotions into actual sales spikes.

Apple Vs. Huawei: Navigating Competitive Landscapes

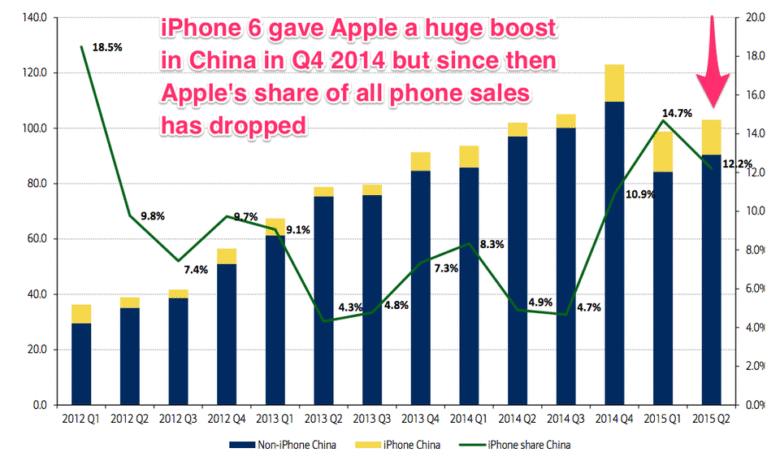

The competitive landscape in China has shifted dramatically as Huawei makes a notable comeback amid Apple’s resurgence. After facing considerable challenges due to U.S. sanctions, Huawei was able to grow its sales by 12% year-on-year during the same quarter that Apple recorded its growth. This renewed strength in Huawei’s offerings has intensified competition, presenting a formidable challenge to Apple as it fights for market share in this dynamic environment.

As Huawei continues to innovate and provide high-quality alternatives at various price points, Apple must remain vigilant. The company’s strategies in the Chinese market are crucial not only for maintaining its branch’s health but also for countering the competitive edge that Huawei has gained. With a focus on promoting the iPhone 16 models and leveraging successful e-commerce strategies, Apple aims to strengthen its foothold against not only Huawei but also other domestic competitors such as Vivo, as revealed by recent Counterpoint Research market share statistics.

Analyzing Market Trends: Insights from Counterpoint Research

Counterpoint Research provides valuable insights into the shifting dynamics of the smartphone market in China. Recent figures show that while Apple has managed a rebound, it is essential to consider the overarching trends that influence consumer behavior and market performance. In the current digital age, where e-commerce plays a pivotal role, brands that effectively leverage these platforms are more likely to succeed in capturing market share.

Emphasizing the importance of agile marketing strategies, Apple has shown it can pivot quickly to take advantage of market conditions. The research indicates that understanding local consumer preferences and adapting accordingly—through promotions and attractive financing options—can significantly impact sales outcomes. By analyzing such trends, Apple and other brands can better navigate the competitive landscape and position themselves for sustained growth.

Future Outlook for Apple in China: Challenges and Opportunities

Looking ahead, the future of Apple’s iPhone sales in China remains mixed with both challenges and opportunities. While the recent growth demonstrates a recovery, the ongoing pressure from rivals such as Huawei indicates that Apple must continuously innovate and adapt its marketing strategies to appeal to a tech-savvy Chinese consumer base. With technology evolving rapidly, consumer expectations are higher than ever, and Apple must meet these demands to retain its competitive edge.

Moreover, the economic environment in China, influenced by global market fluctuations, will also play a crucial role in shaping Apple’s strategic planning. The company must remain responsive to both consumer sentiment and competitive dynamics, ensuring that it can capitalize on opportunities, such as leveraging advancements in AI and enhancing its ecosystem of products and services. As Apple navigates these factors, its performance in China will be a testament to the brand’s resilience and adaptability in a fast-paced market.

The Role of Consumer Preferences in Shaping iPhone Sales

Consumer preferences in China are an essential driver of iPhone sales trends. The surge in sales seen in the past quarter aligns with shifting consumer behavior, where buyers are increasingly looking for brands that offer not only technological innovation but also strong value propositions. Apple’s understanding of these preferences, alongside its innovative marketing strategies, has enabled it to connect with Chinese consumers effectively.

Furthermore, the preference for premium devices in urban areas contrasts with value-seeking behavior in smaller towns, leading Apple to tailor its offerings and marketing messages accordingly. As more consumers in China seek the latest models and technology, Apple’s ability to respond to these preferences and deliver compelling reasons for upgrading will be critical in maintaining its growth trajectory in the highly competitive smartphone market.

Navigating Economic Challenges While Uplifting Brand Loyalty

Despite facing economic challenges and competition from rivals, Apple’s brand loyalty remains one of its strongest assets in the Chinese market. As seen in the recent sales resurgence, many consumers remain committed to the Apple ecosystem, driven by brand identity and the seamless integration of devices. This loyalty is nurtured through effective customer service, innovative product features, and an extensive ecosystem that supports long-term customer relationships.

However, to convert this brand loyalty into sustained growth, Apple must continue to listen to its customers and adapt its strategies in alignment with their expectations. Engaging customers with loyalty programs and tailored marketing efforts, especially during high-investment shopping periods, will ensure that Apple not only retains its existing user base but also attracts new customers in a competitive landscape.

Leveraging Collaboration with E-Commerce Players for Growth

Collaboration with key e-commerce players in China is vital for Apple’s growth strategy. The recent sales increase has been significantly driven by relationships with online retailers that can amplify promotional offers and attract consumer attention. By leveraging the extensive reach of e-commerce platforms, Apple can expand its visibility and encourage consumers to consider the latest iPhone models during peak shopping times.

Furthermore, cultivating partnerships that allow bundled promotions or exclusive offers can enhance consumer engagement. As China’s e-commerce landscape continues to evolve, Apple must evaluate which platforms align most effectively with its brand objectives to maximize outreach and drive sales. As highlighted by sales metrics from Counterpoint Research, a robust e-commerce strategy is integral for Apple’s continued success in the highly competitive Chinese smartphone market.

The Importance of Innovation in Driving Sales of iPhone 16 Models

Innovation is at the core of Apple’s strategy to invigorate its iPhone sales, particularly with the launch of the iPhone 16 models. These new releases not only reflect technological advancements but also serve to re-engage consumers who seek the latest features and performance enhancements. Apple’s commitment to innovation ensures that its products resonate with tech-savvy customers, which is crucial for maintaining a competitive edge amid rival offerings.

As demonstrated by the sales uptick following the iPhone 16 launch, timing and strategic features play a pivotal role in product reception. By continuously enhancing user experience through improvements in camera technology, battery life, and software transactions, Apple positions the iPhone 16 models as essential upgrades for current iPhone users as well as new customers. As the smartphone market evolves, keeping innovation at the forefront will be key to driving sustained sales growth in China and beyond.

Frequently Asked Questions

What factors contributed to the growth of Apple iPhone sales in China during 2023?

Apple’s iPhone sales in China grew by 8% year-on-year in the three months ending June 2023, primarily due to successful promotions by Chinese e-commerce platforms offering discounts on the latest iPhone 16 models. Additionally, Apple’s strategy to raise trade-in values for older iPhones ahead of the 618 shopping festival also played a crucial role in boosting sales.

How does Huawei competition impact Apple iPhone sales growth in China?

Huawei’s competition significantly impacts Apple iPhone sales growth in China. Despite Huawei’s resurgence with a 12% increase in sales during the same quarter, Apple managed to achieve its first growth in two years. This competitive dynamic highlights the ongoing challenges Apple faces in maintaining market share against strong rivals like Huawei, which has been recovering following U.S. sanctions.

What role did Chinese e-commerce play in the recent iPhone sales growth in China?

Chinese e-commerce platforms played a pivotal role in driving iPhone sales growth in China by offering substantial discounts on Apple’s latest iPhone 16 models, particularly during the promotional period leading up to the 618 shopping festival. These promotions helped attract new customers and facilitated the surge in sales during the quarter.

According to Counterpoint Research, how does Apple’s market position in China compare to Huawei and Vivo?

According to Counterpoint Research, Apple, Huawei, and Vivo are the top three smartphone brands in China, with Huawei currently leading the market in share. Despite facing increased competition, Apple’s recent growth in iPhone sales indicates its resilience, but it remains crucial for Apple to adapt to changing market conditions and competitive pressures.

What was the significance of the iPhone 16 models in boosting Apple’s sales growth in China?

The iPhone 16 models were significant in boosting Apple’s sales growth in China as they were featured prominently in promotional campaigns by Chinese e-commerce companies. The combination of discounts on these new models and the strategic increase in trade-in values contributed to the overall rise in sales, marking Apple’s recovery in the challenging Chinese market.

| Key Point | Details |

|---|---|

| Sales Growth | iPhone sales grew by 8% year-on-year in China for the first time in two years. |

| Promotions | Sales increase attributed to promotions and discounts offered in May, particularly for iPhone 16 models. |

| Trade-In Values | Apple raised trade-in values ahead of the 618 shopping festival, boosting sales. |

| Market Competition | Apple remains under competitive pressure from Huawei, which returned strongly with 12% growth. |

| Market Position | Apple, Huawei, and Vivo are the top three brands in the Chinese market, with Huawei leading. |

Summary

iPhone sales growth in China marks a significant milestone for Apple, indicating a positive shift in the company’s market trajectory. After two years of decline, the 8% growth year-on-year for the iPhone during the last quarter reflects effective promotional strategies and adjustments in trade-in values. As competition in the Chinese smartphone market intensifies, especially with Huawei’s resurgence, Apple’s ability to adapt to market demands and foster consumer interest remains crucial. This growth not only restores investor confidence but also sets a hopeful tone for Apple’s future in one of its key markets.