Trade Negotiations Heat Up as Deadlines Approach

Trade negotiations are at the forefront of Wall Street’s concerns as critical U.S. trade deadlines approach. With the pressure mounting, investors are closely watching the outcomes of these discussions, especially in light of President Trump’s tariff policies and their potential impacts on the stock market. As the expiration of the 90-day suspension on tariffs looms, the effects of these trade agreements—or lack thereof—are expected to ripple through the equity market, creating both opportunities and uncertainties. Recent market trends indicate that despite rising tensions around tariff agreements, stocks are hitting record highs, suggesting a complex relationship between trade policies and investor confidence. Investors remain cautiously optimistic, hoping that measures implemented will prevent harsh tariffs that could jeopardize economic stability.

In the context of international commerce, trade discussions exemplify the intricate balancing act nations undertake when negotiating economic agreements. As the U.S. grapples with imminent deadlines concerning tariff implications, stakeholders are analyzing the potential ramifications of these trade dialogues on future financial landscapes. Particularly, the anticipated decisions around import duties reflect broader geopolitical strategies, influencing both the equity and commodity markets. Observers speculate whether current tensions could lead to more substantial tariff barriers, reshaping trade dynamics not only with established partners but also emerging economies. The ongoing negotiations highlight the need for adaptable strategies in global trade relations and their subsequent effect on market performance.

Understanding Trade Negotiations and Their Impact on the Market

Trade negotiations play a crucial role in shaping the economic landscape, significantly influencing the stock market and investor confidence. As the U.S. approaches critical trade deadlines, many in the financial sector are closely monitoring the outcomes of discussions between the U.S. and key global partners, such as the European Union and China. Recent proclamations from the White House suggest that while negotiations are ongoing, they are not deemed urgent or critical, which has eased some of the investors’ concerns about immediate tariff impositions.

It’s important to recognize how trade negotiations directly affect tariffs and, consequently, the equity market. A prolonged negotiation period could mean the avoidance of steep tariffs that might otherwise impose a heavy burden on stocks. As market analysts note, clarity on tariff rates, especially in light of the approaching deadlines, can greatly influence investor sentiment and stock performance. Understanding the dynamics of these negotiations is essential for investors looking to navigate the potential volatility in the stock market.

Frequently Asked Questions

What are the key upcoming U.S. trade deadlines and why do they matter?

The key upcoming U.S. trade deadlines include the expiration of a 90-day suspension of ‘reciprocal’ tariffs and upcoming negotiations with the European Union on July 9. These deadlines are significant as they could determine whether tariffs will be imposed on imports, affecting trade agreements and the stock market.

How might Trump tariffs influence the equity market in the coming weeks?

Trump tariffs could create volatility in the equity market, especially as deadlines approach. Investors are concerned that higher tariffs could stifle economic growth, but as long as tariffs remain moderate, the stock market may absorb the impacts.

What is the significance of July 9 in the context of U.S. trade negotiations?

July 9 marks a crucial deadline for U.S. trade negotiations with the European Union to either reach an agreement or face a potential 50% levy on EU imports. This date is pivotal for assessing future tariff agreements and their potential consequence on the stock market.

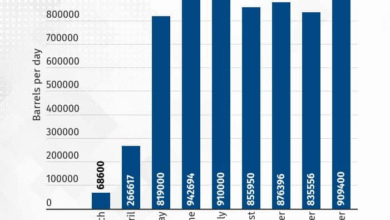

How do recent tariff agreements with Vietnam affect future trade negotiations?

The recent agreement with Vietnam, which set a 20% duty on imports, indicates that tariffs may rise rather than fall in future trade negotiations. This news raises concerns among investors about the potential complexity of upcoming agreements with other nations.

What impact will U.S. trade agreements have on the stock market outlook?

U.S. trade agreements, particularly those that affect tariff rates, can significantly influence the stock market outlook. While a higher effective tariff rate may initially create market volatility, many analysts believe the stock market can recover quickly, especially if supported by other economic factors.

How do tariff concerns affect investor sentiment towards the stock market?

Tariff concerns are leading to mixed investor sentiment towards the stock market. While some view rising tariffs as manageable, others see potential threats to economic stability, leading to cautious trading as deadlines approach.

What role does inflation play in the context of trade negotiations and tariffs?

Inflation may rise if higher tariffs are imposed, as they can weaken the U.S. dollar and increase prices for consumers. This inflationary pressure could impact the broader economy, but analysts suggest the stock market may still find a way to recover amidst these challenges.

| Key Points |

|---|

| Wall Street prepares for important trade negotiations as deadlines approach. |

| The 90-day suspension of tariffs by President Trump is set to expire soon. |

| Investors expect negotiations to extend beyond immediate deadlines. |

| Confidence has grown after the White House stated July deadlines are ‘not critical’. |

| Potential tariff rates are anticipated to settle around 10-15%. |

| Concerns regarding rising tariffs, especially connected to agreements with Vietnam. |

| July 9 is a key date for tariff clarity, especially with the EU. |

| The market could handle increased tariffs without triggering a recession, but volatility is expected. |

| Investors are increasingly cautious as the S&P 500 trades at record highs amid trade uncertainties. |

Summary

Trade Negotiations are currently at a critical juncture as Wall Street navigates upcoming deadlines and potential tariff changes. Investors remain hopeful that the administration’s stance will avoid the worst-case scenarios while they brace for market volatility in the days to come.