Trump Tax Cuts: How They Benefit the Wealthy

The Trump tax cuts, a pivotal legislation enacted under President Donald Trump, aimed to drastically reshape the American tax landscape. By offering significant financial breaks primarily to the top 1% of earners, this tax overhaul has sparked intense debate among economists and policymakers alike. For instance, an average cut of approximately $66,000 is projected for the wealthiest households, particularly benefiting those in states like Wyoming and Texas. However, while affluent taxpayers thrive under these changes, many lower-income families find themselves at a disadvantage, suffering from reductions in essential programs like Medicaid and SNAP. As we analyze the tax legislation impacts, it becomes evident that the distribution of these benefits mirrors a stark division along income lines, raising questions about equity and fiscal responsibility in America.

The tax reforms championed by the Trump administration have undeniably transformed the financial framework for high-income individuals in the U.S. Dubbed a game-changing initiative, this legislation is particularly favorable for wealthy households, with many in the upper echelons of income distribution reaping substantial tax advantages. The infamous “One Big Beautiful Bill,” as referred to by supporters, has led to notable fiscal benefits for affluent residents while concurrently complicating the financial situation of lower-income families. As we dissect the evolving narrative surrounding these wealthy tax cuts, it becomes crucial to understand the broader implications of such tax legislation on American society. Moreover, the dichotomy between the tax benefits afforded to the top earners versus those available to the economically vulnerable remains a central theme in discussions about the future of tax policy.

The Impact of Trump’s Tax Cuts on Wealth Distribution

The tax cuts initiated under President Trump’s administration are structured in a way that significantly favors the wealthier segments of society, especially the top 1% of earners. Analysis by the Institute on Taxation and Economic Policy reveals that these high-income households are projected to receive an average tax cut of around $66,000 by 2026. States with fewer personal income taxes, such as Wyoming and Texas, present a favorable landscape for these tax advantages, allowing the wealthiest residents to benefit disproportionately while facing minimal taxation burdens.

Conversely, the implications for lower-income families are starkly different. While the wealthiest revel in their substantial tax savings, households earning less are expected to face financial strain due to reduced benefits from essential programs like Medicaid and SNAP. This disparity raises critical questions about the equity of tax legislation and its long-term impacts on wealth distribution across different income levels.

Frequently Asked Questions

What are the primary financial benefits of the Trump tax cuts for the wealthy?

The Trump tax cuts, part of the legislation previously known as the One Big Beautiful Bill, primarily benefit the top 1% of U.S. households by providing an average tax cut of about $66,000. For specific states like Wyoming, South Dakota, and Texas, the wealthiest might see reductions exceeding $100,000, amplifying the financial advantages for high-income earners.

How do Trump tax cuts affect lower-income families?

Although the Trump tax cuts are structured to benefit the wealthy notably, lower-income families may face adverse impacts. Analyses indicate that while high-income households enjoy substantial tax benefits, changes in programs like Medicaid and SNAP result in lower earners losing financial assistance, ultimately disadvantaging them under these tax reforms.

What is the One Big Beautiful Bill in relation to Trump’s tax cuts?

The One Big Beautiful Bill refers to the tax legislation championed by President Trump that was passed by Congress. This bill delivers significant tax cuts primarily to the wealthiest Americans, marking an extension and expansion of the tax cuts introduced in 2017, which further favors the top 1% of taxpayers.

How do the Trump tax cuts disproportionately favor the top 1% of earners?

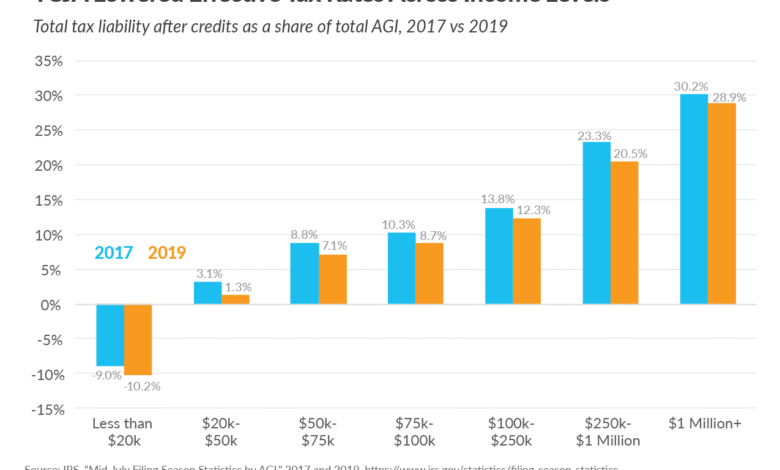

The Trump tax cuts disproportionately benefit the top 1% by reducing their effective tax rate significantly, with analyses showing an average tax cut of approximately 2.4% of their income. Wealthy individuals, particularly in states like Wyoming and Texas, receive greater benefits due to the lack of state income taxes, allowing them to retain more of their income.

What are the implications of Trump’s tax legislation for state and local tax deductions?

Trump’s tax legislation includes a $40,000 cap on deductible state and local taxes (SALT), which primarily disadvantages taxpayers in states with high income and property taxes. Conversely, residents in states like Wyoming, South Dakota, and Texas, where there is no state income tax, are largely unaffected and continue to enjoy substantial tax benefits.

Can the Trump tax cuts lead to changes in social safety net programs?

Yes, the Trump tax cuts have implications for social safety net programs such as Medicaid and SNAP, as the tax legislation is accompanied by reductions in funding for these programs. This could negatively affect lower-income families who rely on such assistance, often leaving them worse off despite the tax cuts for higher earners.

What percentage of tax reductions do the wealthiest Americans receive from Trump’s tax cuts?

The wealthiest 20% of U.S. households are projected to receive a tax reduction amounting to about 3.4% of their after-tax income due to Trump’s tax cuts. In contrast, lower-income households will see much smaller tax reductions, reflecting a significant disparity in financial benefits across income levels.

How does the tax legislation impact states with high taxes compared to those with low or no taxes?

The tax legislation tends to favor states with low or no income taxes, like Wyoming and Texas, enabling wealthy residents to retain more savings under the Trump tax cuts. In states with higher taxes, the cap on state and local tax deductions results in a larger burden for affluent taxpayers, contrasting with the advantages enjoyed in tax-friendly states.

What has research shown about the overall effect of Trump tax cuts on federal tax revenue?

Research indicates that the Trump tax cuts could result in over $4 trillion in net tax cuts over the next decade, primarily benefiting higher-income households. These changes could exacerbate income inequality, as revenue reductions may limit funding available for essential programs that support lower-income Americans.

How do demographic factors influence the benefits of Trump’s tax cuts?

Demographic factors, including income levels, geographic location, and state tax policies, heavily influence the benefits of Trump’s tax cuts. Wealthy individuals in states with low taxes gain disproportionately large benefits compared to those in higher-tax states, indicating a significant alignment of tax advantages with regional economic conditions.

| Key Point | Details |

|---|---|

| Top 1% Tax Cuts | Average tax cut of $66,000 or 2.4% of income in 2026. |

| High Earning States | Wyoming, South Dakota, and Texas households to receive cuts over $100,000. |

| Impact on Lower Earners | Lower earners lose money due to smaller cuts and changes in Medicaid and SNAP. |

| Total Tax Cuts | Over $4 trillion in net tax cuts over a decade, heavily favoring higher-income households. |

| SALT Deduction Cap | $40,000 cap on deductions for state and local taxes impacts high-tax states. |

| GOP Benefits | The bill reduces income tax rates and provides exemptions for wealthy estates. |

Summary

The Trump tax cuts, championed by President Donald Trump, have significantly reshaped the U.S. tax landscape, primarily favoring the wealthiest households. By providing substantial tax breaks for the top 1%, these cuts have exacerbated income inequality, while lower-income families may suffer due to reductions in crucial support programs. As the legislation rolls out, it’s clear that the wealthiest individuals in certain states stand to gain the most, highlighting the ongoing debate over tax policy and equity in the United States.