Riot Platforms Power Strategy Boosts Bitcoin Production Insights

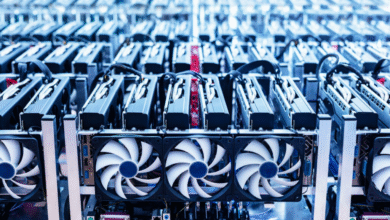

Riot Platforms’ Power Strategy plays a crucial role in navigating the challenges of Bitcoin mining performance during fluctuating market conditions. In June, the company mined 450 bitcoin, marking a 12% decrease from May’s output of 514 BTC, primarily attributed to a dip in their daily production rates. Despite this setback, Riot’s effective power management and participation in ERCOT demand response programs allowed for a higher average BTC price in June, reaching $105,071 per coin. This strategic focus on economic curtailment not only aids in grid stability but also enhances Riot’s competitive positioning. As the landscape of cryptocurrency mining evolves, Riot’s innovative power strategy remains pivotal in maximizing profitability even amid a decrease in Bitcoin mined.

Exploring Riot Platforms’ energy management approach reveals their commitment to sustaining efficiency in Bitcoin production at a time of market volatility. The firm has adopted advanced strategies to optimize their mining capabilities while adapting to the dynamics of ERCOT’s demand response initiatives. Analysis of their June activities shows a notable 12% reduction in mined Bitcoin, with 450 BTC produced alongside a higher average sale price—demonstrating a calculated response to market shifts. By improving operational strategies and leveraging power credits, Riot reinforces its position in the competitive landscape of cryptocurrency mining. The focus on balancing operational costs and revenue generation illustrates Riot’s adaptability and strategic foresight in the evolving blockchain mining sector.

Riot Platforms Power Strategy and Its Impact on Production

Riot Platforms has implemented a robust power strategy that not only focuses on economic curtailment but also emphasizes participation in ERCOT’s Four Coincident Peak (4CP) program and other demand response initiatives. By doing so, the firm enhances grid stability while optimizing its operational efficiency. These strategies are particularly vital in a challenging market where Bitcoin mining performance can fluctuate, as evidenced by the 12% decrease in the number of bitcoins mined in June compared to May.

Despite a noticeable decline in daily bitcoin mining production—from 16.6 BTC in May to 15 BTC in June—Riot Platforms’ commitment to its power strategy has allowed the company to maintain a strong competitive edge in the sector. Riot mined a total of 450 BTC in June, which, while lower than the previous month, still represents a 76% year-over-year increase compared to the same period last year. This showcases how a well-structured power strategy can mitigate potential losses during periods of reduced output.

Understanding Riot Platforms June Production Results

In June, Riot Platforms reported mining 450 bitcoins, reflecting a 12% decrease from May’s production of 514 BTC. This decline in performance is significant as it highlights the volatility in the market and the impact of external factors on mining operations. However, the firm achieved an average BTC price in June of $105,071, up from $102,591 in May, which is an encouraging sign amidst decreased production numbers. This indicates that even though the quantity mined decreased, the monetary value derived from each bitcoin sold improved.

The reduction in the number of bitcoins mined can be partially attributed to Riot’s strategic decisions regarding production and power use, especially under increased ERCOT demand response programs. The combined impact of maintaining high average BTC prices and implementing a strategic power management approach showcases Riot’s agility in navigating the dynamic landscape of bitcoin mining. Moreover, even as production dipped slightly, total power credits increased dramatically by 549% in June, signifying effective use of power resources.

Analysis of Mining Performance and Economic Factors

An examination of Riot Platforms’ mining performance reveals the intricate balance between production output and economic viability. The firm mined 450 BTC in June at a time when overall demand for mining operations is fluctuating due to market conditions. The average BTC price reached $105,071, providing a beneficial cushion amid the 12% drop in production. This result underscores how economic factors can significantly influence bitcoin mining strategies and profitability.

With total BTC sales dropping from 500 BTC in May to 397 BTC in June, Riot experienced a 19% reduction in net proceeds from sales, decreasing from $51.3 million to $41.7 million. While these numbers may appear discouraging, focusing on operational efficiencies and adopting innovative power strategies, such as participation in ERCOT’s demand response efforts, could position the company for better outcomes in subsequent months. Riot’s ability to adapt will be critical in sustaining its profitability as the landscape of bitcoin mining evolves.

The Role of ERCOT’s Demand Response Programs in Mining Success

Riot Platforms’ involvement in ERCOT’s demand response programs illustrates a proactive approach to managing operational costs and enhancing profitability in a challenging mining environment. By engaging with these programs, Riot is not only maximizing its power credits—which surged by 549% to $3.8 million in June—but also contributing to broader grid stability. This participation reflects a growing trend among miners to align their energy usage with regional demands to optimize their operational expenses.

The adaptation to ERCOT’s Four Coincident Peak (4CP) program and other demand response initiatives also allows Riot to effectively mitigate some risks associated with fluctuating bitcoin prices and mining performance. As the firm navigated a decrease in total BTC mined, the ability to harness power credits and lower power costs—down to 3.4 cents per kWh in June—demonstrates the value of strategic engagement with energy programs to create a resilient business model. This tactical focus on energy management can significantly enhance Riot’s positioning in the competitive landscape of bitcoin mining.

Future Outlook for Riot Platforms Amid Market Fluctuations

As the bitcoin mining landscape continues to evolve, Riot Platforms is positioned to leverage its robust power strategy to weather future market fluctuations. The company’s focus on sustaining higher average bitcoin prices while optimizing production through effective power management will be critical. While the recent decrease in total bitcoins mined presents challenges, the resilience demonstrated through significant power credit surges and strategic participation in demand response programs suggests a positive long-term outlook.

Going forward, Riot’s strategic initiatives aimed at enhancing operational efficiencies and reducing costs will likely play a significant role in maintaining and increasing its market share. The impact of ERCOT’s demand response programs coupled with innovative energy utilization strategies holds promise for not only stabilizing production levels but also enhancing profitability. With a keen awareness of market conditions and a strong commitment to power management, Riot Platforms is set to navigate the complexities of bitcoin mining effectively.

Impact of Bitcoin Market Dynamics on Riot Platforms

The dynamic nature of the bitcoin market significantly influences the production strategies employed by firms like Riot Platforms. The company’s recent report of mining 450 BTC in June, despite a 12% decrease from May, reflects the broader market’s volatility which often dictates mining viability. This backdrop emphasizes how miners must remain adaptable, particularly in navigating daily production averages that can fluctuate due to market pressures.

Furthermore, Riot’s proactive strategies, such as engaging with ERCOT demand response programs, not only buffer against adverse market conditions but also demonstrate the company’s commitment to innovation in maximizing profitability. As average bitcoin prices soar, having resilient operational strategies becomes paramount. Riot’s focus on maintaining higher averages, even amidst production dips, is a testament to its understanding of the intricate relationships between market dynamics and mining success.

The Importance of Operational Efficiency in Bitcoin Mining

Operational efficiency is critical in Bitcoin mining, particularly for companies like Riot Platforms that are navigating complex economic scenarios. The firm’s recent mining performance highlighted a strategic shift during a month where the average BTC price increased even while production numbers dropped. The ability to reduce energy costs and enhance operational efficiencies—even in times of decreased BTC output—underscores the importance of effective management within mining operations.

Riot’s efforts to streamline processes and optimize power consumption not only aid in mitigating losses when actual BTC production is low, but also strengthen its competitive position in the market. With rising energy costs and fluctuating bitcoin prices, operational efficiency will be key to producing a sustainable profit margin. Riot’s strategy reflects an understanding that, regardless of mining output, maintaining effective energy use can buffer against market downturns and operational disruptions.

Riot Platforms’ Strategic Price Management for Sustainability

Riot Platforms recognizes that strategic price management is crucial for sustainability within the ever-evolving cryptocurrency market. Having achieved a higher average btc price in June compared to May, the strategy reflects the firm’s operational adjustments and market awareness. The increase in the average price per bitcoin, despite a decrease in the total mined, underscores how strategic engagement can serve as a hedge against market volatility.

By prioritizing effective price management and focusing on the nuances of bitcoin’s market performance, Riot can better navigate fluctuations that could affect overall profitability. This approach not only boosts immediate financial returns but also sets a foundation for future growth. By aligning their market strategies with operational actions, Riot Platforms aims to foster a more resilient business model capable of weathering challenges in the bitcoin mining sector.

The Financial Metrics Behind Riot Platforms’ Mining Operations

To appreciate the performance of Riot Platforms, it’s essential to analyze the financial metrics that underpin its mining operations. The company reported a significant decrease in BTC production from 514 in May to 450 in June, leading to a decline in total sales and net proceeds, which fell from approximately $51.3 million to $41.7 million. However, the increase in average BTC price sold provides a contrasting perspective that highlights the complexity of the financial landscape in which Riot operates.

Additionally, Riot’s substantial rise in power credits—549% in June—illustrates that efficient power management is equally critical in determining financial outcomes. The ability to achieve lower operational costs while maximizing revenue from bitcoin sales emphasizes the significant leverage that financial metrics provide in evaluating the effectiveness of Riot’s strategies. In navigating the cryptocurrency market, understanding these figures is vital for making informed decisions that impact the firm’s long-term success.

Frequently Asked Questions

What is Riot Platforms Power Strategy and how does it influence Bitcoin mining performance?

Riot Platforms Power Strategy focuses on optimizing energy consumption during Bitcoin mining, particularly through programs like ERCOT’s Four Coincident Peak (4CP) program. This strategy not only aims to enhance Bitcoin mining performance but also to improve grid stability, allowing Riot to remain competitive even during fluctuating Bitcoin prices.

How did Riot Platforms June production compare to previous months in terms of Bitcoin mined decrease?

In June, Riot Platforms experienced a decline in Bitcoin mining, producing 450 BTC which was a 12% drop from 514 BTC in May. This decrease reflects not just the operational changes but also the impact of market conditions on average BTC prices and mining efficiency.

What was the average BTC price in June for Riot Platforms and how did it affect their overall production?

Riot Platforms achieved a higher average BTC price of $105,071 in June, compared to $102,591 in May. This increase helped mitigate the effects of lower Bitcoin production, as Riot’s year-over-year performance metrics remained strong despite a decline in the amount mined.

How does the ERCOT demand response program benefit Riot Platforms’ Power Strategy?

The ERCOT demand response program is integral to Riot Platforms’ Power Strategy, allowing the firm to participate in grid stability initiatives. By curtailing energy use when needed, Riot enhances its power credits, thereby lowering operational costs and improving overall financial performance in Bitcoin mining.

What are the implications of Riot’s total power credits increasing by 549% in June?

The significant 549% increase in Riot’s total power credits, rising from $0.6 million to $3.8 million in June, reflects the effectiveness of its Power Strategy, particularly in participating in demand response programs. This increase provides Riot with leverage in managing costs associated with Bitcoin mining, despite the decrease in BTC mined.

How does Riot Platforms’ average operating hashrate impact its Bitcoin mining strategy and efficiency?

Riot Platforms reported a decline in average operating hashrate from 31.5 EH/s in May to 29.8 EH/s in June, which can influence mining efficiency. A reduced hashrate typically means less competition in the network and can affect both mining performance and energy consumption strategies, highlighting the importance of Riot’s Power Strategy in adjusting operational efficiency.

What was the effect of Riot Platforms’ all-in power cost in June on its Bitcoin mining profitability?

Riot Platforms managed to reduce its all-in power cost to 3.4 cents per kWh in June, an 11% decrease from May. This reduction in energy costs, paired with a higher average BTC price, ultimately contributes positively to the profitability of its Bitcoin mining operations, despite the lower output.

| Key Point | Details |

|---|---|

| Bitcoin Production Decline | Riot Platforms mined 450 BTC in June, a 12% decrease from 514 BTC in May. |

| Daily Average Production | Average daily BTC production fell from 16.6 BTC in May to 15 BTC in June. |

| Year-over-Year Production Comparison | Production in June was still 76% higher than the same period in 2024. |

| BTC Sales | Riot sold approximately 397 BTC in June, down from 500 BTC in May, resulting in net proceeds dropping from $51.3 million to $41.7 million. |

| Average BTC Sales Price | Higher average net price per BTC sold in June was $105,071, up from $102,591 in May. |

| Hashrate Performance | Deployed hashrate slightly increased from 35.4 EH/s in May to 35.5 EH/s in June, but average operating hashrate dropped by 5%. |

| Power Credits | Total power credits surged 549% from $0.6 million to $3.8 million in June. |

| Demand Response Credits | Total demand response credits increased by 6% from $1.7 million to $1.8 million in June. |

| Power Cost Reduction | Riot’s all-in power cost fell 11% from 3.8 cents per kWh in May to 3.4 cents per kWh in June. |

| CEO Comments | Jason Les emphasized the significance of Riot’s strategy for grid stability and competitive positioning through demand response programs. |

Summary

Riot Platforms Power Strategy focuses on enhancing operational efficiency and stability within the Bitcoin mining landscape. The strategic implementation of demand response programs not only aids in grid stability but also significantly boosts the company’s financial performance despite a decline in production. With improved average prices per Bitcoin and a robust increase in power credits, Riot Platforms is strategically positioning itself for future growth and resilience in an evolving market.