Bitcoin Price Analysis: Key Levels for July 2025

Bitcoin price analysis is essential for understanding the cryptocurrency’s volatile nature and future directions. With the latest close at $108,199, Bitcoin is navigating a narrow trading range, influenced by significant support and resistance levels. The cryptocurrency market capitalization has reached an impressive $2.151 trillion, complemented by a 24-hour Bitcoin trading volume of $21.145 billion, showcasing strong engagement from investors. As traders keep a close eye on the BTC/USD chart, the interplay between movement, volume, and market sentiment becomes increasingly relevant for strategic positioning. In this landscape, ensuring that you stay updated with the latest cryptocurrency news is vital for making informed trading decisions.

In the realm of digital assets, an informed perspective on Bitcoin performance is paramount when assessing market dynamics. The evaluation of Bitcoin fluctuating metrics, particularly concerning its trading activity and historical price points, can reveal vital insights into its future trajectory. With the current valuation hovering around $108,000, the ongoing analysis highlights crucial support and resistance thresholds that traders must navigate carefully. Furthermore, keywords like Bitcoin market capitalization and trading volume are indispensable as they encapsulate the asset’s overall health and investor interest. Engaging with real-time analytics related to Bitcoin can significantly enhance your market strategies and risk management.

Understanding Bitcoin Price Analysis in 2025

Bitcoin price analysis is essential for traders looking to navigate the complexities of the cryptocurrency market. As of July 5, 2025, Bitcoin has closed at $108,199, illustrating a tight intraday trading range that reflects market consolidation. This price action, alongside a substantial market capitalization of $2.151 trillion and a trading volume of $21.145 billion, signifies Bitcoin’s sustained relevance in the cryptocurrency ecosystem. Observing the price trajectory helps traders identify whether Bitcoin is poised for breakout or further consolidation within prevailing support and resistance levels.

Analyzing the dynamics of Bitcoin price movements reveals critical insights into market sentiment and potential trading strategies. Notably, the resistance levels at $108,500 to $109,000 are pivotal for day traders, as a breach may lead to bullish price momentum. Conversely, failing to hold above $108,000 may trigger a bearish sentiment, forcing a reversion to critical supports like $107,300. Thus, a thorough analysis of these price fluctuations can illuminate broader trends and help traders make informed decisions.

Bitcoin Trading Volume and Market Sentiment

Bitcoin trading volume serves as a barometer of market activity, influencing price volatility and liquidity. With a recorded trading volume of $21.145 billion, the current market shows a moderate level of engagement, which is essential for price discoveries, such as recent movements from $107,300 to highs of near $110,000. Elevated trading volume typically indicates stronger conviction in price trends, allowing traders to confidently assess whether the market is leaning bullish or bearish.

Understanding the interplay between Bitcoin trading volume and market sentiment can provide valuable signals for potential trading actions. For instance, the decreased volume accompanying price moves may suggest a lack of trader conviction in the current bullish recovery from the $107,300 level. Conversely, a spike in trading volume during upward price movements could point towards substantial buying interest, signaling potential breakouts. Thus, traders must keep a keen eye on trading volumes, particularly as they relate to key price levels.

The Importance of Bitcoin Support and Resistance

In the context of Bitcoin’s price action, support and resistance levels are critical for understanding potential price reversals and continuation patterns. Current analysis suggests strong resistance in the range of $108,500 to $109,000, while support is solidly anchored around $107,300. For traders, recognizing these levels provides a framework for decision-making — a bounce from support could signal buy opportunities, whereas rejection at resistance might indicate selling pressure.

Moreover, observing how Bitcoin interacts with these levels can reveal investor sentiment and market trends. For instance, should Bitcoin successfully break above resistance with accompanying volume, it could ignite bullish momentum towards targets near $110,000. On the flip side, if Bitcoin fails to maintain its position above support, it raises the risk of a significant price drop, prompting traders to reconsider their positions. Therefore, diligent monitoring of support and resistance is essential for successful trading.

Analyzing the BTC/USD Chart for Trading Opportunities

The BTC/USD chart is a vital tool for traders seeking to capitalize on price movements within the cryptocurrency market. The recent 1-hour and 4-hour chart patterns indicate a developing structure that highlights resistance and support points crucial for trading decisions. For instance, the 1-hour chart shows a potential bullish breakout structure, while the 4-hour chart depicts a pattern of consolidation following heavy sell volume — both of which highlight conflicting signals for traders.

Technical indicators on the BTC/USD chart further enhance decision-making. Patterns such as higher lows juxtaposed with lower highs can signal an impending breakout or breakdown. As traders assess these nuances, key indicators like the relative strength index (RSI) and candlestick formations provide additional context for predicting future price movements. Thus, astute analysis of the BTC/USD chart is instrumental in formulating effective trading strategies.

The Role of Market Capitalization in Bitcoin Valuation

Market capitalization significantly influences Bitcoin’s valuation, rendering it a critical metric for investors and traders alike. As of July 2025, Bitcoin boasts a staggering market cap of $2.151 trillion, solidifying its position as the preeminent cryptocurrency. Understanding market cap trends helps traders gauge the overall market health and investor sentiment toward Bitcoin, making it a cornerstone of comprehensive price analysis.

Market capitalization provides insights into the asset’s strength relative to its peers and can help predict future price behaviors. A rising market cap often indicates growing interest and investment inflow, potentially driving price appreciation. Conversely, a declining market cap may signal waning interest and potential bearish sentiment, underlining the importance of this indicator in assessing Bitcoin’s market position and trends.

Navigating Cryptocurrency News to Predict Market Movements

Cryptocurrency news plays a pivotal role in shaping market sentiment and influencing Bitcoin price movements. For instance, developments surrounding regulatory changes, technological advancements, or market sentiment shifts can lead to significant price volatility. Keeping abreast of current events allows traders to react swiftly to market-moving news, thus improving their chances of capitalizing on fleeting opportunities.

Additionally, understanding the market’s reaction to news events can provide deeper insights into trading strategies. For example, positive news might trigger bullish price action, leading to an increase in trading volumes, whereas negative news may prompt downward corrections. Consequently, traders should integrate news analysis into their trading frameworks to construct a well-rounded approach to Bitcoin trading.

Technical Indicators for Bitcoin Trading Decisions

Utilizing technical indicators is vital for traders looking to make informed decisions in the ever-evolving Bitcoin market. Indicators such as the MACD, RSI, and moving averages can help traders discern market trends and potential reversal points. The current MACD levels indicate positive momentum, suggesting that bullish positions may still be valid, particularly if supported by volume.

Additionally, oscillators such as the Stochastic RSI play a crucial role in identifying overbought or oversold conditions, enabling traders to adjust their strategies accordingly. By analyzing these indicators alongside price action, traders can establish entry and exit points that are more aligned with market dynamics, maximizing profit potential while mitigating risks associated with trading.

Future Outlook for Bitcoin: Bullish Versus Bearish Scenarios

The future outlook for Bitcoin remains a topic of intense speculation, particularly as market actors weigh the implications of current price movements. A bullish scenario hinges on Bitcoin breaking decisively above key resistance levels like $109,000 and eventually $111,000, potentially ushering in a new uptrend. Positive market sentiment, coupled with robust trading volume, could promote further price appreciation, leading to new highs for the cryptocurrency.

Conversely, a bearish outlook rests on the failure to sustain above critical support zones, especially if Bitcoin breaks below $107,300. In such a case, traders should brace for possible declines toward psychological levels like $98,000. Given the current oscillators indicating overbought conditions, a substantial market correction could loom if selling pressure intensifies. Therefore, maintaining awareness of potential bullish or bearish scenarios is essential for navigating the complexities of Bitcoin trading.

Long-Term Investments: Strategies for Bitcoin Traders

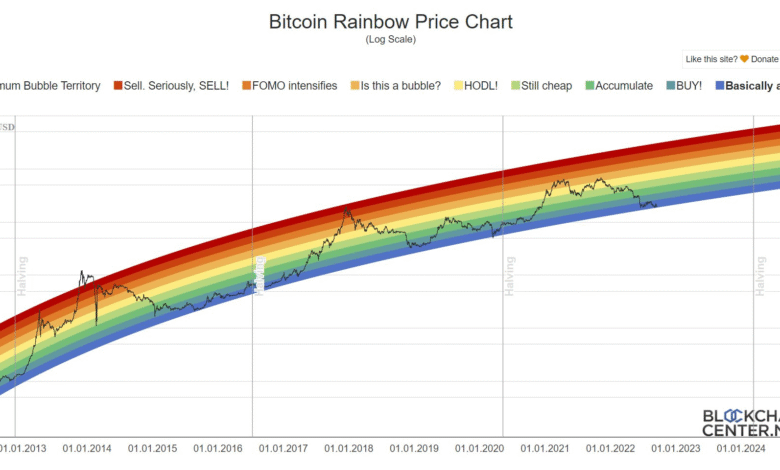

Long-term investment strategies in Bitcoin require a nuanced understanding of market trends and macroeconomic factors influencing cryptocurrency valuation. With Bitcoin frequently viewed as a hedge against inflation and global financial instability, many investors consider holding positions over extended periods. This strategy allows investors to benefit from the long-term appreciation potential of Bitcoin, particularly during bullish cycles that can lead to substantial returns.

However, long-term investors should remain vigilant in monitoring critical price levels and market sentiment. Periodic evaluation of major support and resistance points can provide insight into whether it is prudent to hold or reallocate investments. Additionally, understanding the broader economic landscape, including potential regulatory shifts and technological developments, is vital for making informed long-term investment decisions.

Frequently Asked Questions

What is the current price analysis of Bitcoin based on the BTC/USD chart?

As of July 5, 2025, Bitcoin’s price analysis shows it closing at $108,199 after fluctuating between $107,386 and $109,117 during intraday trading. The BTC/USD chart indicates that Bitcoin continues to consolidate near key resistance levels, particularly around $108,500 to $109,000, while support is established at approximately $107,300.

How does Bitcoin trading volume influence price analysis?

The Bitcoin trading volume plays a crucial role in price analysis, currently reported at $21.145 billion. A decrease in volume hints at a potential pause in momentum, signaling that traders should watch for significant volume increases during breakouts above resistance levels like $109,000, as it may lead to short-term upward price movements.

What are the key support and resistance levels to monitor in Bitcoin price analysis?

In the current Bitcoin price analysis, significant resistance levels are identified between $108,500 and $109,000, while critical support is around $107,300. Traders should closely monitor these levels for potential breakouts or breakdowns, which could indicate the next price direction.

How does Bitcoin’s market capitalization affect its price analysis?

Bitcoin’s current market capitalization of approximately $2.151 trillion reflects its substantial presence in the cryptocurrency market. This level of market cap, combined with current trading volumes, can help analysts gauge potential price movements and investor sentiment in Bitcoin price analysis.

What insights can be drawn from the recent Bitcoin price analysis and cryptocurrency news?

Recent cryptocurrency news suggests a cautious bullish outlook for Bitcoin, particularly following its rebound toward $108,000. Analysts suggest that while there are signs of bullish continuation, the potential for a bearish reversal remains if support levels below $107,300 are breached. Ongoing monitoring of market conditions and indicators is advised.

What does the consolidation phase in Bitcoin price analysis indicate?

The consolidation phase in Bitcoin price analysis indicates a stabilization of prices within a defined range, particularly between $98,000 and $110,000. This range-bound movement can imply indecision among traders and may precede significant price action following a breakout or breakdown from established support or resistance.

How should traders utilize Bitcoin price analysis for making decisions?

Traders should utilize Bitcoin price analysis by regularly reviewing the BTC/USD chart, focusing on key support and resistance levels, and observing trading volume trends. Combining technical indicators, such as the relative strength index (RSI) and moving averages, with market news can provide valuable insights for making informed trading decisions.

| Key Point | Details |

|---|---|

| Bitcoin Price | Closed at $108,199 on July 5, 2025, with an intraday price range of $107,386 to $109,117. |

| Market Capitalization | $2.151 trillion with a 24-hour trading volume of $21.145 billion. |

| Technical Resistance | Resistance between $108,500 and $109,000. |

| Technical Support | Support levels at $107,300 and $107,800. |

| Bullish Outlook | A breakout above $109,000 could indicate a short-term push towards $109,500 to $110,000. |

| Bearish Outlook | Failure to remain above $108,000 could lead to a drop toward $107,300 and potentially $98,000. |

| Oscillator Analysis | RSI at 55 indicates neutrality, with stochastic indicators suggesting overbought conditions. |

| Trend Indicators | Moving averages indicate bullish trends with significant buy signals across key timeframes. |

| Market Sentiment | Current market showing neutral consolidation with both bullish and bearish signals present. |

Summary

Bitcoin price analysis reveals a market currently in a consolidation phase, having closed at $108,199 on July 5, 2025. While there exists a potential for a bullish breakout if the price surpasses $109,000 with robust volume, any failure to maintain above $108,000 could lead to a bearish reversal. Investors should closely monitor support and resistance levels, along with oscillator indicators that currently suggest a neutral market sentiment. The outlook remains cautiously optimistic for bullish momentum in the near term, provided that key technical levels are respected.