Bitcoin Price Prediction: Could It Hit $250,000 by 2025?

Bitcoin price prediction has become a topic of fervent discussion among crypto enthusiasts, especially with recent forecasts hinting at extraordinary heights. A leading trader asserts that the flagship cryptocurrency could soar to $250,000 by the end of 2025, backed by compelling market data and historical Bitcoin cycles. This bullish sentiment stems from the intricate connectivity between Bitcoin’s value and the M2 money supply, which includes various forms of money in circulation and is crucial to understanding crypto market dynamics. Analysts are now eyeing the potential impact of Bitcoin ETFs, as their introduction is believed to enhance liquidity and attract larger institutional investors. As the crypto landscape continues to evolve, factors such as inflation hedges and investment influxes could significantly shape the market trajectory, making the feasibility of this Bitcoin price prediction more intriguing than ever.

Forecasting future Bitcoin valuations has caught the attention of investors worldwide, especially as digital currencies gain more prominence. With projections suggesting Bitcoin could reach $250,000 in the coming years, experts are analyzing various influences including historical trading patterns and the implications of money supply fluctuations. This landscape, influenced by the increasing M2 money supply and emerging Bitcoin ETFs, signals a critical turning point for cryptocurrencies. As the crypto sector adjusts to new market forces, anticipating shifts due to investment demand and the historical performance of Bitcoin offers invaluable insights for traders. Ultimately, understanding these dynamics is essential for anyone seeking to navigate the evolving world of cryptocurrency investment.

Bitcoin Price Prediction for 2025: What to Expect

As the cryptocurrency market experiences a resurgence, many analysts are throwing their predictions into the mix. One of the most audacious forecasts comes from prominent trader Michaël van de Poppe, who posits that Bitcoin could reach a staggering $250,000 by the end of 2025. This bullish stance hinges on the current market dynamics—specifically, Bitcoin’s consolidation period near the psychologically significant $100,000 level. Historically, substantial price movements tend to follow extended periods of sideways trading, suggesting that Bitcoin is poised for an explosive breakout.

Van de Poppe highlights the connection between the M2 money supply and Bitcoin prices, asserting that an increase in the money supply often fuels investment in assets perceived as inflation hedges, such as Bitcoin. As the Federal Reserve appears ready to pivot on interest rates, the influx of capital into the crypto market could reach unprecedented levels, pushing Bitcoin toward its predicted high. The projected trajectory isn’t merely based on speculation, but rather on historical patterns that indicate such growth is not only possible but backed by real economic shifts.

Understanding the Crypto Market Dynamics Impacting Bitcoin

The cryptocurrency ecosystem is known for its volatility, and current market dynamics present a unique landscape for traders. The anticipation of new U.S. spot Bitcoin exchange-traded funds (ETFs) is a critical factor influencing investor sentiment, which has already propelled Bitcoin’s value significantly. Such institutional interest serves as a lubricant for increased liquidity within the market, potentially allowing Bitcoin to tap into mainstream investment channels further. This reflects a growing confidence in Bitcoin as a legitimate asset class, further reinforcing market bullishness.

In addition to ETF impacts, other elements like the value of the U.S. dollar and macroeconomic indicators contribute extensively to Bitcoin’s price trajectory. As the dollar shows signs of decline and M2 money supply trends indicate monetary expansion, Bitcoin is set to flourish. Investors should keenly observe these macroeconomic cues because they significantly shape crypto market dynamics, influencing not only Bitcoin but other cryptocurrencies as well. Such interconnected factors underscore the complexity of predicting price movements in this ever-evolving market.

The Influence of Historical Bitcoin Cycles on Future Predictions

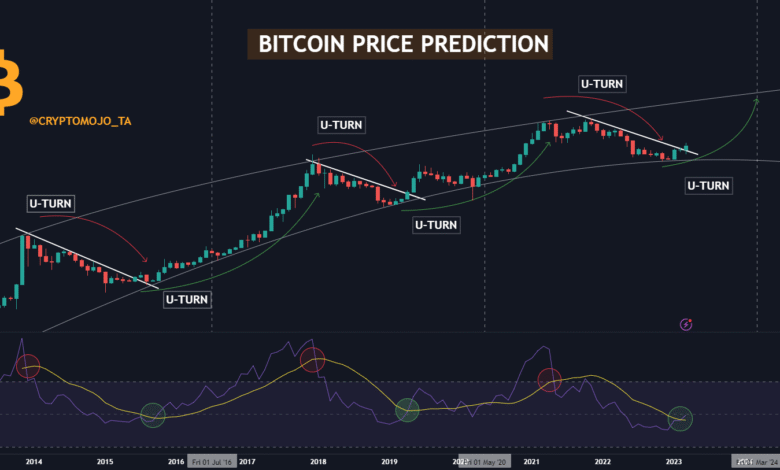

Historical Bitcoin cycles provide critical context for today’s market predictions. Historically, Bitcoin has exhibited patterns of consolidation followed by explosive growth, and analyst Michaël van de Poppe believes we are at a similar juncture now. Drawing parallels to past cycles, he notes how prior price surges initiated after prolonged periods of stability. The current market scenario, characterized by Bitcoin hovering near $100,000 for an extended period, mirrors those past behaviors that preceded significant price escalations in Bitcoin.

Van de Poppe’s analysis maps out how crucial historical support levels define Bitcoin’s trajectory. For instance, the price consolidation near $10,000 before the 2020 bull run illustrates this phenomenon perfectly. Such historical analysis emphasizes that current behaviors in the crypto market are reflective of past patterns; they serve as an indicator of what could follow. Thus, understanding these cycles not only aids in the prediction of future prices but also assists investors in navigating the market with informed strategies.

The Role of Bitcoin ETFs in Shaping Price Expectations

The introduction of Bitcoin exchange-traded funds (ETFs) has been a game changer for the cryptocurrency market. With institutional investors increasingly favoring this investment vehicle, Bitcoin’s market accessibility has expanded widely. The influx of capital through ETFs is not just a minor shift; it’s a paradigm change that can lead to significant upward adjustments in Bitcoin’s price. Michaël van de Poppe emphasizes how ETF-driven funds have already contributed considerably to the current valuation and could potentially carry Bitcoin to new heights.

As these financial products gain popularity, they foster a more robust price structure for Bitcoin by connecting it to traditional financial markets. Investors are more likely to perceive Bitcoin as a secure asset when it is included in regulated ETFs, increasing overall trust and investment flow. This anticipated growth, given the current push for Bitcoin ETFs, aligns perfectly with Van de Poppe’s prediction of reaching $250,000, underscoring the profound impact these funds may have on Bitcoin’s future valuation.

Evaluating the M2 Money Supply’s Correlation with Bitcoin Prices

The M2 money supply directly affects Bitcoin valuation, and understanding this relationship is crucial for predicting market movements. As the M2 metrics indicate a resurgence in the flow of money, traders like Michaël van de Poppe posit that Bitcoin stands to benefit from this trend tremendously. A rise in the money supply typically leads to greater investment in lucrative assets seen as hedges against inflation, with Bitcoin emerging as a prime candidate. With the recent contraction in M2 finally giving way to potential expansion, Bitcoin may very well be primed for another significant bull run.

Van de Poppe articulates that the implications of a rising M2 supply coupled with the recent shifts in economic policy could set the stage for Bitcoin to soar. The anticipated Federal Reserve interest rate cuts may further stimulate investment, inflating Bitcoin’s market value. This interplay illustrates why stakeholders should keep a close eye on M2 money supply trends, gauging their potential impact on Bitcoin price fluctuations in the coming quarters.

How Altcoin Performance May Affect Bitcoin’s Bullish Outlook

While Bitcoin’s performance often steals the spotlight in the crypto market, analyzing how altcoins fare is equally as important in forming a complete market outlook. Currently, there is a noticeable underperformance in altcoins, which suggests a pricing disconnect in the market. This could serve as a pivotal moment where funds flow back into Bitcoin from altcoins, further boosting its price. Michaël van de Poppe’s insights highlight the significance of such movement as it may greatly influence Bitcoin’s ability to achieve new all-time highs.

The scenario unfolds a unique opportunity for traders and investors, as the capital chasing growth opportunities may find its way into Bitcoin, benefiting both its price and market capitalization. Considering the historical trends where Bitcoin frequently outperformed altcoins during bullish phases, the current undervaluation of altcoins may lay the groundwork for Bitcoin’s continued rise, especially as market dynamics lean favorably toward Bitcoin’s strength.

Preparing for Potential Bitcoin Volatility Amid Predictions

As we venture deeper into the predictions of Bitcoin hitting $250,000 or more by 2025, it’s crucial to prepare for the volatility that may accompany such growth. Historical patterns have shown that Bitcoin is notorious for its wild price swings—balancing periods of rapid ascension with sharp declines. Understanding and accommodating this fact of the cryptocurrency market is essential for investors, particularly those who place significant weight on price predictions. Michaël van de Poppe’s bold outlook must be tempered with a word of caution: the road to substantial gains can often be tumultuous.

Therefore, alongside bullish predictions, investors must also adopt an adaptable strategy that reflects the stark realities of the crypto landscape. Successful navigation through anticipated highs and potential lows will require sound risk management and a willingness to stay informed about changing market conditions. Awareness of external factors—including economic indicators and regulatory news—will be critical in this journey, ensuring that investors are prepared for the unpredictable nature of the crypto markets.

Conclusion: Should You Invest in Bitcoin Now?

In conclusion, with prominent analysts like Michaël van de Poppe predicting significant price hikes for Bitcoin by 2025, many investors are left questioning whether now is the time to jump on the bandwagon. Analyzing the current market dynamics, including the growing M2 money supply, the looming impact of Bitcoin ETFs, and historical price cycles, it becomes clear that the foundation for Bitcoin’s future growth is forming. Investors may find substantial opportunities among these shifts, especially as Bitcoin consolidates in a range that has historically preceded major bull runs.

However, just as important as recognizing potential for growth is understanding the risks involved. The crypto market remains highly volatile, and those entering must be prepared for price fluctuations. For those willing to adopt a strategy that considers both the bullish projections and the volatile nature of Bitcoin, the prospect of entering now could be promising. Navigating this complex landscape requires patience, thorough research, and the ability to adapt in real-time to market developments.

Frequently Asked Questions

What is the Bitcoin 250,000 prediction and what factors contribute to it?

The Bitcoin 250,000 prediction is a bullish outlook for Bitcoin’s price, forecasting that it could reach $250,000 by the end of 2025. This prediction is supported by factors such as the correlation between Bitcoin and the M2 money supply, which is expected to increase as more liquidity floods into the market. Analysts also cite historical Bitcoin cycles that show significant price hikes following periods of consolidation.

How does the M2 money supply impact Bitcoin price predictions?

The M2 money supply significantly impacts Bitcoin price predictions as it measures the total amount of money in circulation, including cash and deposits. An increase in the M2 money supply often leads to more investment in assets like Bitcoin, which are viewed as hedges against inflation. This correlation suggests that as the M2 supply increases, Bitcoin’s price could surge, aligning with predictions such as the $250,000 target by 2025.

What are the crypto market dynamics influencing Bitcoin price predictions?

Crypto market dynamics, including investor sentiment, regulatory changes, and technological advancements, play a crucial role in Bitcoin price predictions. For instance, the introduction of Bitcoin exchange-traded funds (ETFs) in the U.S. has been shown to drive inflows and enhance price stability, fueling predictions of significant price targets like $250,000 by the end of 2025. Additionally, historical trends in Bitcoin price cycles often repeat during times of economic change.

How do historical Bitcoin cycles inform current price predictions?

Historical Bitcoin cycles inform current price predictions by demonstrating patterns of price behavior following specific market conditions. Analysts often compare current price consolidations to past phases before major price surges. For example, Bitcoin’s recent consolidation around $100,000 mirrors past ranges prior to upward movements, suggesting the potential for hitting targets like $250,000 by the end of 2025 as market conditions stabilize and investor interest grows.

What role do Bitcoin ETFs play in price predictions like the $250,000 target?

Bitcoin ETFs play a pivotal role in price predictions such as the $250,000 target by increasing market access and liquidity for investors. The anticipated inflows from Bitcoin ETFs have already shown significant positive impacts on Bitcoin’s price, and analysts believe that continued investment through these funds could further propel prices upward, reaffirming bullish predictions for the end of 2025.

Can Bitcoin really reach $250,000 by 2025, or is it overly optimistic?

While forecasts like Bitcoin reaching $250,000 by 2025 might seem overly optimistic, they are based on current market dynamics, increasing M2 money supply, and previous historical patterns that favor significant price growth. Analysts suggest that if conditions stay favorable, such as easing interest rates and continued adoption through ETFs, this target is achievable. However, market fluctuations and external economic factors could influence the actual outcome.

| Key Points | Details |

|---|---|

| Prediction | Bitcoin could reach $250,000 by the end of 2025. |

| Market Analysis | Michaël van de Poppe identifies a potential surge due to Bitcoin’s current consolidation around $100,000 and historical market patterns. |

| Influencing Factors | The analysis points to M2 money supply increase, anticipated Federal Reserve interest rate cuts, declining U.S. dollar, and new ETF inflows as key factors. |

| Historical Context | Comparing present conditions to previous bull runs, particularly the pre-2020 surge after consolidation near $10K. |

| Short-Term Projection | Expecting Bitcoin to hit $160,000-$180,000 within three months. |

| Long-Term Outlook | While predicting a peak of $250,000 by 2025, he also suggests a potential extended cycle peaking in 2027-2028. |

Summary

Bitcoin price predictions are soaring, with analysts expecting that it may hit $250,000 by the end of 2025. This optimistic forecast stems from current market dynamics that mirror past bull runs, paired with a favorable macroeconomic environment. With significant correlations established between Bitcoin’s value and the increasing M2 money supply, as well as the influx from exchange-traded funds, many believe we are poised for substantial gains. The historical patterns observed provide further credence to these predictions, indicating that Bitcoin is ready for a remarkable upward trajectory.