SIM-Swapping Scam: Canadian Pharmacy Manager Fights Back

In recent years, the alarming rise of SIM-swapping scams has sent shockwaves through the digital community, with devastating effects on unsuspecting victims. One particularly striking case involves a Canadian pharmacy manager, Raelene Vandenbosch, who claims to have lost 12.58 bitcoins—valued at over $1.36 million—due to this insidious tactic of digital identity theft. Filing a legal battle against Rogers Communications and Match Transact Inc., she alleges negligence and inadequate security measures that enabled a hacker to hijack her phone number and gain access to her cryptocurrency wallets. This scandal has not only sparked a flurry of concerns regarding cryptocurrency theft but has also led to major legal implications, including the ongoing Rogers Communications lawsuit. As more individuals fall prey to these scams, the urgency for enhanced consumer protection against such vulnerabilities has never been clearer.

The threat of identity theft via SIM swapping has grown significantly, affecting numerous individuals who entrust their digital lives to telecom providers. This method involves deceiving telecom employees to transfer a victim’s phone number to a new SIM card controlled by the hacker, which can lead to catastrophic losses, particularly in the realm of cryptocurrency. As seen in the case of Vandenbosch, essential data can be compromised and significant assets stolen, raising serious concerns about the responsibilities of carriers like Rogers Communications and companies like Match Transact Inc. As legal battles unfold, the implications of these incidents are far-reaching, highlighting the urgent need for robust privacy safeguards and consumer rights in the ever-evolving digital landscape. The rising number of such cases underscores the importance of vigilance in protecting one’s digital identity against nefarious schemes.

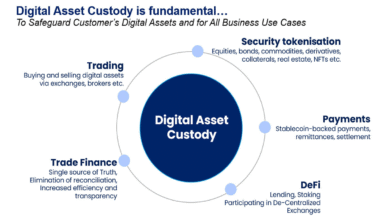

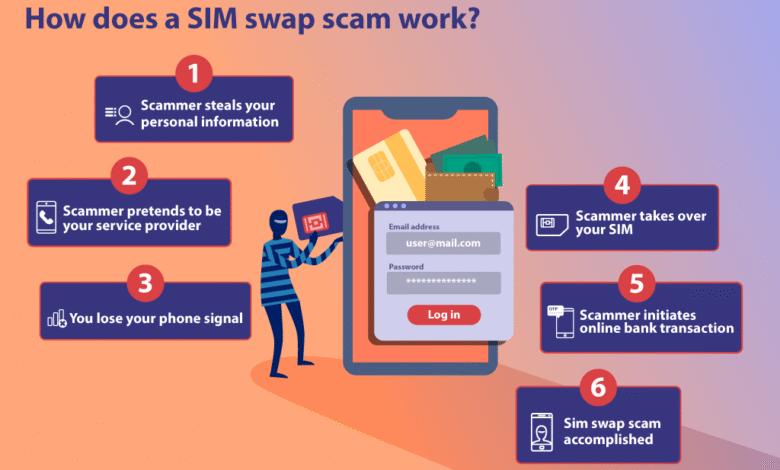

Understanding SIM-Swapping Scams

SIM-swapping scams have gained notoriety in recent years, particularly as digital asset investments such as cryptocurrencies proliferate. This type of fraud revolves around manipulating telecom providers to gain control over someone else’s phone number. Once the scammer has the number, they can intercept calls, texts, and access various online accounts, leading to devastating digital identity theft. The case of Raelene Vandenbosch starkly illustrates this danger, as she lost significant cryptocurrency assets valued at over $1.36 million due to this underhanded tactic.

In the world of cryptocurrency theft, SIM-swapping has emerged as a prevalent threat due to its execution ease and high rewards. The attackers typically exploit weaknesses in security protocols at telecom outlets, pretending to be the victim to convince employees to transfer the phone number to a SIM card they control. These tactics not only highlight vulnerabilities in customer service protocols but also emphasize the need for consumers to understand the importance of safeguarding their digital identities.

The Legal Battle Against Telecom Providers

Raelene Vandenbosch’s ongoing legal battle against Rogers Communications and Match Transact Inc. encapsulates the complexities surrounding liability in cases of SIM-swapping scams. Her allegations point to a significant lapse in security—claiming that Rogers failed to implement adequate safeguards despite knowing the increasing incidence of such fraud. Vandenbosch is suing for negligence, breach of privacy, and breach of contract, underscoring the telecom provider’s responsibility to protect its customers from potential digital identity theft.

Beyond seeking reparations for her losses, Vandenbosch’s case brings to light critical conversations about how corporate entities must evolve to counter the sophisticated nature of digital crimes. With the rise of cryptocurrency and digital transactions, the legal implications of negligence, particularly relating to customer information security, must be rigorously addressed by major telecom companies.

Implications of the Rogers Communications Lawsuit

The lawsuit involving Rogers Communications is not just about an individual loss; it casts a spotlight on industry-wide failures and the urgent need for reform in data protection policies. The telecom sector must recognize its crucial role in mitigating risks associated with SIM-swapping scams and ensuring a secure environment for digital consumers. Raelene Vandenbosch’s plight represents a wake-up call for both companies and regulators to reassess existing frameworks governing data privacy and cybersecurity.

Furthermore, the response from Rogers and Match Transact Inc. to push for arbitration could set a dangerous precedent in how companies manage accountability in the digital age. If firms are allowed to sidestep public scrutiny by channeling cases into private arbitration, it could inhibit meaningful discourse and the establishment of stricter regulations that might protect consumers from further digital identity theft.

The Role of Match Transact Inc. in the Scandal

As a critical player in the unfolding scandal, Match Transact Inc. is under immense scrutiny regarding its processes for protecting customer data at its kiosks. Vandenbosch’s allegations highlight a severe oversight in training employees to prevent unauthorized disclosures of sensitive personal information. In a realm where digital identity theft is a growing concern, companies like Match must prioritize robust training protocols and security measures to protect against SIM-swapping scams.

Moreover, the involvement of Match Transact in this case illustrates the interconnected nature of telecom and digital transaction sectors. It raises essential questions about the responsibilities of businesses that facilitate financial transactions via cryptocurrency. To build consumer trust, these entities must demonstrate unwavering commitment to safeguarding customer data and responding promptly to potential breaches.

Consequences of Digital Identity Theft

The consequences of digital identity theft can be far-reaching and devastating, as evidenced by the losses incurred by Vandenbosch. Following the breach, she found herself not just locked out of her phone but facing significant financial and emotional stress from the loss of her cryptocurrencies. The psychological impact of such incidents is often overlooked but can lead to a lasting sense of vulnerability and distrust in digital financial systems.

Furthermore, victims of SIM-swapping scams often grapple with the aftermath of compromised accounts that extend beyond financial losses. The potential for identity theft can lead to cascading issues, including compromised personal information that can harm credit scores and create legal entanglements. This emphasizes the critical importance of preventative measures such as two-factor authentication and heightened vigilance when managing digital assets.

Navigating the Court System: Arbitration vs. Public Trials

Vandenbosch’s case has highlighted the tension between arbitration agreements and the pursuit of public accountability in cases involving considerable consumer harm. While Justice Chan’s ruling mandates most of the case be resolved through arbitration, her allowance for claims seeking public admission of wrongdoing signifies a critical intersection between corporate accountability and consumer rights. This legal dance showcases the complexities individuals face when asserting their rights against powerful corporations.

The implications of this legal battle extend beyond Vandenbosch, as it may influence other victims of fraud to consider the viability of pursuing similar claims in court. Understanding the balance between arbitration and public disclosure is essential for consumers seeking justice and holding companies accountable for negligence, especially in cases related to digital identity theft and financial fraud.

The Future of Cybersecurity in Telecom

The fallout from the Vandenbosch case underscores the urgent need for enhanced cybersecurity measures across the telecom industry. As more consumers leverage digital platforms to manage their finances, telecom providers must evolve to provide more robust defenses against SIM-swapping and other cyber threats. Companies must invest in sophisticated identity verification processes and continuously update their security protocols to mitigate risks associated with personal data breaches.

Additionally, the discourse surrounding the Vandenbosch lawsuit may inspire regulatory bodies to implement stricter guidelines governing how telecom providers handle customer data. The establishment of a cybersecurity framework that emphasizes consumer protection and corporate accountability could reshape the landscape of the industry, making it more resilient against the increasing sophistication of cyber criminals.

Consumer Awareness and Protection Strategies

In light of the ongoing threat posed by SIM-swapping scams, consumer awareness is paramount. Individuals must take proactive steps to fortify their online accounts, such as using two-factor authentication and regularly reviewing security settings across all digital platforms. Educational campaigns by telecom companies can further empower users with the knowledge needed to recognize red flags and take preemptive action against potential breaches.

Furthermore, staying informed about the latest scams and tactics employed by cybercriminals can help consumers safeguard their digital identities effectively. As seen in Vandenbosch’s case, understanding the vulnerabilities within telecom and trading platforms is essential for minimizing risks associated with cryptocurrency theft and digital fraud.

The Importance of Legal Representation in Cyber Fraud Cases

Navigating the complexities of a legal battle in the wake of digital identity theft requires adept legal representation. Victims like Raelene Vandenbosch need knowledgeable attorneys who understand the intricacies of cyber laws, digital privacy rights, and the obligations corporations have toward their customers. Legal experts can help victims craft compelling arguments to hold negligent parties accountable for their roles in allowing such scams to occur.

Moreover, skilled legal counsel can provide strategic guidance on navigating case progression, particularly when dealing with arbitration clauses or seeking public justice. Vandenbosch’s reliance on a dedicated legal team highlights the critical role that sound legal advice plays in fighting against systemic failures that contribute to losses from SIM-swapping scams and related digital crimes.

Frequently Asked Questions

What is a SIM-swapping scam and how does it relate to cryptocurrency theft?

A SIM-swapping scam is a form of digital identity theft where a hacker gains control of a victim’s mobile number by tricking a mobile carrier into transferring the number to a new SIM card. This allows the hacker to access sensitive accounts, including cryptocurrency wallets, leading to significant financial losses, as seen in recent cases involving victims who lost substantial amounts in cryptocurrency theft.

How can a legal battle arising from a SIM-swapping scam impact victims?

Victims like Raelene Vandenbosch who lose large sums in a SIM-swapping scam may face lengthy legal battles against telecom companies and third-party platforms, seeking compensation for negligence and breach of privacy. The case highlights the need for accountability in preventing digital identity theft.

What steps can telecom companies take to prevent SIM-swapping scams?

Telecom companies, such as Rogers Communications, can enhance security protocols to prevent SIM-swapping scams by implementing stricter verification processes, ensuring kiosk employees are trained to handle sensitive information securely, and regularly updating security measures to protect customer data.

What legal issues can arise from SIM-swapping scams?

Legal issues stemming from SIM-swapping scams often include negligence claims against telecom carriers and involved third-party services, with victims pursuing lawsuits for security lapses. Cases may involve arbitration agreements, which can complicate the victims’ pursuit of remedies for their financial losses.

How have companies like Match Transact Inc. responded to allegations related to SIM-swapping scams?

Companies like Match Transact Inc. typically respond to allegations of negligence related to SIM-swapping scams by denying wrongdoing and advocating for arbitration to resolve disputes. This approach raises questions about accountability in cases of digital identity theft and customer protection.

Why is the case of Raelene Vandenbosch significant in the context of SIM-swapping scams?

The case of Raelene Vandenbosch is significant as it highlights the vulnerabilities inherent in telecom services and raises awareness about the immense risks of SIM-swapping scams, particularly regarding how easily a hacker can exploit security failures to access and steal digital assets like cryptocurrency.

What can individuals do to protect themselves from SIM-swapping scams?

Individuals can protect themselves from SIM-swapping scams by regularly monitoring their accounts, using two-factor authentication, and not sharing personal information with anyone claiming to be from their telecom provider. It’s also advisable to set up a PIN or password with carriers to add an extra layer of security.

How does a SIM-swapping scam impact a victim’s digital identity?

A SIM-swapping scam can have a devastating impact on a victim’s digital identity, as it allows hackers to intercept messages and gain access to secure accounts, including financial and personal information, often leading to significant financial losses and difficulties in regaining control.

| Key Points | Details |

|---|---|

| Lawsuit Details | Raelene Vandenbosch is suing Rogers Communications and Match Transact Inc. after losing 12.58 bitcoins (worth over $1.36 million) due to a SIM-swapping scam. |

| Nature of the Scam | The scam involved a clerk at a WOW! Mobile Boutique kiosk being tricked by a hacker posing as a technician, leading to unauthorized access to Vandenbosch’s Rogers account. |

| Date of Incident | The scam occurred around June 30, 2021. |

| Personal Data Breach | The hacker gained control of Vandenbosch’s phone number, digital identity, and access to her cryptocurrency wallet. |

| Legal Claims | Vandenbosch is claiming negligence and breach of contract against Rogers, and negligence from Match Transact Inc. |

| Arbitration Aspect | The case is mostly directed to arbitration, although a claim for public admission of wrongdoing is allowed to proceed in court. |

| Legal Representation | Vandenbosch’s legal team is led by Alexia Majidi of Hammerco Lawyers. |

Summary

The topic of SIM-swapping scam is highlighted by the unfortunate case of Raelene Vandenbosch, who lost a staggering amount of 12.58 bitcoins to such an elaborate deception. This incident underscores the vulnerabilities in telecom security and the significant consequences that arise from inadequate protection of personal data. As the lawsuit progresses, it raises awareness about the need for stronger safeguards against SIM swapping, which can rapidly deplete victims’ digital asset holdings.