Bitcoin Price Prediction: $200K by Year-End with ETF Surge

Bitcoin price prediction remains a hot topic as experts speculate on the cryptocurrency’s potential trajectory. Insights from Standard Chartered indicate that the price of Bitcoin may soar beyond $135,000 by the third quarter of 2023, eventually hitting a staggering $200,000 by year’s end. This ambitious forecast stems from a surge in institutional demand for Bitcoin and the anticipated impact of Bitcoin ETFs, which are expected to drive significant inflows into the market. With U.S. regulatory developments on the horizon, the combined momentum could reshape the landscape for digital assets. As analysts continue to monitor market trends, the Bitcoin price forecast is generating excitement and debate among investors eager to understand the future of this digital currency.

As the realm of cryptocurrency evolves, Bitcoin’s valuation projections have become increasingly relevant to traders and investors alike. The future outlook for Bitcoin, underscored by its potential new highs by the end of 2023, is influenced heavily by increased interest from institutional investors and the potential launch of Bitcoin exchange-traded funds (ETFs). The dynamic interplay of market forces and regulatory changes is poised to significantly affect this digital asset’s price movement. Experts have noted that the landscape for Bitcoin is shifting, as both institutional treasury allocations and a more favorable regulatory environment signal a new era for the cryptocurrency market. Navigating these developments will be crucial for anyone looking to capitalize on Bitcoin’s potential rise.

Bitcoin Price Prediction: Standard Chartered’s Bold Forecast

Standard Chartered’s recent projections for Bitcoin have created considerable buzz within the cryptocurrency community. With expectations for Bitcoin to surpass $135,000 by the third quarter and potentially reach a staggering $200,000 by year-end, analysts are eager to decipher the variables fueling this forecast. Central to this optimism is the anticipation surrounding Exchange-Traded Funds (ETFs) and their impact on the market. As institutional demand for Bitcoin grows, fueled by companies looking to invest in cryptocurrency as part of corporate treasuries, the influx of funds is expected to drive the price significantly higher.

Geoff Kendrick, the Global Head of Digital Assets Research at Standard Chartered, cites U.S. regulatory catalysts as a pivotal factor influencing their forecast. He identifies the possible early resignation of Federal Reserve Chair Jerome Powell and the imminent approval of a U.S. stablecoin regulatory bill as critical developments. These factors are likely to create a more favorable environment for Bitcoin and other digital assets, fostering further growth. While skeptics warn of a potential market overheating, Kendrick’s analysis indicates that this bullish trend is backed by foundational shifts rather than speculative trading.

The Impact of Bitcoin ETFs on Price Trajectory

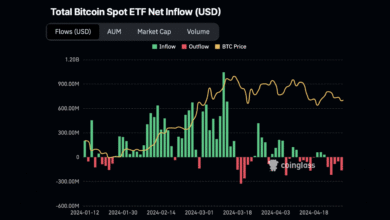

The introduction of Bitcoin ETFs has the potential to reshape the cryptocurrency landscape significantly. They not only enable a wider range of investors to gain exposure to Bitcoin but also provide institutional investors with a regulated avenue for investment. Increased ETF inflows have been a driving force behind Standard Chartered’s Bitcoin price prediction, and the correlation between ETF approval and Bitcoin price appreciation is becoming increasingly apparent. As organizations allocate more funds into Bitcoin through ETFs, a robust upward trajectory in the asset’s pricing is expected, influencing market sentiment positively.

Moreover, Bitcoin ETFs are instrumental in stabilizing the price, drawing institutional investments, and aligning Bitcoin more closely with traditional financial markets. This phenomenon indicates a shift in Bitcoin’s perception from a speculative asset to a legitimate vehicle for investment. The soaring institutional demand for Bitcoin, particularly driven by ETF investments, suggests that the market is entering a new maturity phase. Institutional players are increasingly recognizing Bitcoin’s potential as a digital store of value, which could further propel its price in the coming months.

Assessing Institutional Demand for Bitcoin and its Ramifications

The role of institutional demand in the Bitcoin market cannot be overstated. Standard Chartered’s estimates reflect a noticeable uptick in interest from institutions, which is a crucial factor underpinning their $200,000 price prediction. Corporates diversifying their treasury allocations into Bitcoin signify a paradigm shift in adoption trends. As companies recognize Bitcoin’s value proposition as a hedge against inflation and currency devaluation, they are increasingly willing to allocate substantial resources, thereby affecting supply and demand dynamics.

Additionally, with institutional investment comes a need for clearer regulatory frameworks, which is expected to contribute to the overall acceptance and stability of Bitcoin. As institutional players gear up to enter the Bitcoin market, their expertise and capital infusion are likely to bolster Bitcoin’s maturity as an asset class. This evolving landscape enhances Bitcoin’s allure, attracting even more institutional participants and aligning its market movements with traditional finance.

Understanding Bitcoin’s Regulatory Landscape in 2023

The regulatory environment surrounding Bitcoin plays a crucial role in determining its market behavior and price dynamics. As 2023 progresses, the anticipation of key regulatory advancements has fueled optimism among investors. Standard Chartered highlighted the potential approval of a U.S. stablecoin regulatory bill as a major catalyst for Bitcoin’s price surge. Such regulatory clarity could pave the way for more institutional participation and increased market stability, ultimately propelling Bitcoin prices higher.

Additionally, the prospect of regulatory changes fosters a safer investment climate, leading to enhanced investor confidence. As the cryptocurrency market matures and regulatory bodies navigate the complexities of digital assets, the potential for Bitcoin to thrive in a more regulated landscape remains high. Observers are keenly watching how these developments unfold and impact Bitcoin’s price trajectory as the year progresses.

Bitcoin’s Price Outlook by Year-End 2023

As we forge ahead into the latter half of 2023, analysts and investors alike are turning their attention to Bitcoin’s price outlook. The consensus from experts at Standard Chartered suggests a bullish sentiment, predicting Bitcoin could reach $200,000 by the year-end. This projection is primarily driven by increasing ETF participation and a growing institutional appetite for Bitcoin, which are both expected to intensify as the year progresses.

The indicators for this forecast are numerous—ranging from rising institutional investments to expected regulatory approvals. These elements not only validate Standard Chartered’s predictions but also suggest a longstanding shift in market dynamics. Bitcoin’s potential price trajectory is likely intertwined with broader economic factors and evolving regulatory structures, providing a fertile ground for a resilient and upward-moving market.

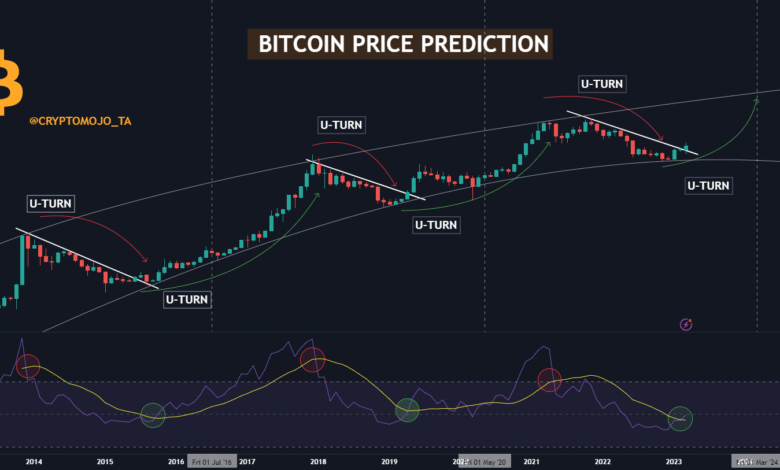

Analyzing Bitcoin’s Performance Post-Halving

Historically, Bitcoin’s price performance following its halving events has been meticulously analyzed by traders and investors. Standard Chartered asserts that Bitcoin has entered a new phase, moving beyond the typical patterns of post-halving price declines. Instead, the current market is shaped by increased institutional demand and clearer regulations, which they believe will contribute to new all-time highs for Bitcoin in the latter half of 2023 and into 2024.

The changing landscape indicates that Bitcoin’s trajectory may evolve with each halving event, largely influenced by foundational shifts in investment behavior and market structure. With the growing influence of institutional investors and the adoption of advanced trading mechanisms, Bitcoin’s post-halving cycle may see a different outcome this time. Such shifts in market sentiment underscore the varying interpretations and ramifications of Bitcoin’s halving events.

The Future of Bitcoin: Beyond Speculation

As Bitcoin continues to gain traction, the narrative surrounding it is shifting from mere speculation to substantive adoption as a financial asset. The increasing interest from institutional investors illustrates a broader acceptance of cryptocurrency as part of mainstream finance. Standard Chartered’s predictions reflect this transformation, suggesting that factors such as regulatory developments and ETF approvals are pushing the narrative beyond basic investment trends.

Investors are now approaching Bitcoin with a long-term perspective, recognizing its potential as a significant component of diversified portfolios. This shift is instrumental in shaping Bitcoin’s future, as it is increasingly viewed not only as a digital currency but also as a safeguard against inflation. The merging of traditional finance with cryptocurrency represents a fundamental evolution in the financial landscape, marking a new era for Bitcoin.

Geopolitical Factors influencing Bitcoin’s Price

Geopolitical circumstances invariably affect financial markets, and Bitcoin is no exception. Standard Chartered’s price prediction could be influenced by various international politics, market stability, and evolving economic policies. Events such as legislative changes in key economies, tensions between nations, and global economic shifts could alter investor sentiment and impact Bitcoin’s demand.

In light of recent global happenings, Bitcoin’s role as a hedge against geopolitical uncertainties is becoming increasingly evident. Investors may look toward Bitcoin as a safe haven asset during turbulent times, similarly to how gold has been perceived historically. This multi-faceted influence underscores Bitcoin’s evolution into a strategic asset accessible to investors looking to navigate complex market environments.

Investment Strategies for Bitcoin in 2023

As Bitcoin’s price predictions stir excitement, investors are reevaluating their strategies for engagement in the cryptocurrency market. Understanding market trends and institutional activity can be pivotal in shaping investment strategies. With projections suggesting a Bitcoin price surge, aligning one’s investment strategy to capitalize on predicted movements becomes crucial. Investors are advised to closely monitor the developments around ETF approvals and institutional allocations, as these factors have profound implications on market behavior.

Additionally, diversifying investment across various cryptocurrencies while maintaining a strong position in Bitcoin could mitigate risk. As the landscape continues to evolve, possessing a dynamic approach that accommodates regulatory changes and market sentiment is essential for maximizing gains. The projected rise in Bitcoin’s price, coupled with a diversified investment portfolio, positions investors favorably to ride the expected waves of growth.

Comparative Analysis: Bitcoin vs. Traditional Assets

As institutional interest in Bitcoin grows, a comparative analysis between Bitcoin and traditional assets is increasingly relevant. Standard Chartered’s price forecast for Bitcoin suggests that institutional investors may be diversifying their portfolios by allocating funds towards this digital asset, highlighting a shift from conventional investment strategies. By examining Bitcoin’s performance against traditional assets like stocks and gold, investors can gauge its potential as a viable alternative investment class.

In recent years, Bitcoin’s volatility has been both a draw and a deterrent for investors, and understanding this dynamic is essential for strategic planning. With a growing acceptance of Bitcoin as a store of value akin to gold and its increasing integration into institutional finance, comparing risk and return profiles between Bitcoin and traditional assets becomes a vital exercise. This analysis not only reflects changing investor behavior but also underlines the potential longevity and significance of Bitcoin in diversified investment portfolios.

Frequently Asked Questions

What is the latest bitcoin price prediction according to Standard Chartered?

Standard Chartered projects that bitcoin will surpass $135,000 by the end of Q3 2023, with a potential rise to $200,000 by the end of the year. This bullish forecast is driven by increasing ETF inflows and strong institutional demand for bitcoin.

How do bitcoin ETF impacts influence price predictions?

The potential approval of bitcoin ETFs is significantly impacting price predictions by encouraging institutional investment. Strong ETF inflows are expected to drive demand for bitcoin, pushing its price higher, as highlighted in Standard Chartered’s forecast of $200,000 by year-end.

What is the bitcoin 2023 prediction according to financial experts?

Financial experts, particularly those at Standard Chartered, predict that bitcoin could reach $200,000 by the end of 2023. This prediction is influenced by factors such as institutional demand and favorable U.S. regulatory changes.

How does institutional demand for bitcoin affect its price forecast?

The growing institutional demand for bitcoin is a key factor in its price forecast, contributing to higher valuations. With corporate treasury allocations increasing and anticipated ETF inflows, analysts predict a significant price surge, potentially reaching $200,000 by year-end.

What are the implications of U.S. regulatory changes on bitcoin price predictions?

U.S. regulatory changes are expected to create a supportive environment for bitcoin, boosting confidence among investors. Standard Chartered highlights this in their projection of bitcoin hitting $200,000 by year-end, attributing it to favorable regulatory developments.

Will bitcoin’s price trend continue past previous halving events?

Experts at Standard Chartered indicate that bitcoin may not follow the historical trend of price declines post-halving. They suggest that rising institutional interest and clearer regulatory guidelines could lead to new all-time highs, such as their prediction of $200,000 by the end of 2023.

What is Standard Chartered’s view on the future of bitcoin prices?

Standard Chartered maintains a highly optimistic view on bitcoin prices, forecasting that it could reach $135,000 by Q3 2023 and potentially $200,000 by year-end, driven by ETF momentum and burgeoning institutional demand.

| Key Factors | Projection | Expert Commentary | Key Events |

|---|---|---|---|

| ETF Momentum, Institutional Demand, U.S. Regulatory Catalysts | $135,000 by Q3, $200,000 by end of the year | “We continue to see BTC rising to around USD 135,000 by end-Q3 and to USD 200,000 by end-Q4.” – Geoff Kendrick | Potential early resignation of Fed Chair Jerome Powell; likely approval of U.S. stablecoin regulatory bill |

| Increasing corporate treasury allocations | |||

| Institutional interest and regulatory guidance shifting trends |

Summary

Bitcoin price prediction indicates a potential surge, with forecasts suggesting it could exceed $135,000 by Q3 and possibly reach $200,000 by year-end. This optimistic outlook is supported by increasing ETF inflows and strong institutional demand, which are instrumental in driving the digital asset’s value. Additionally, upcoming regulatory changes and macroeconomic developments are expected to provide a favorable environment for bitcoin’s growth, positioning it for significant milestones in the near future.