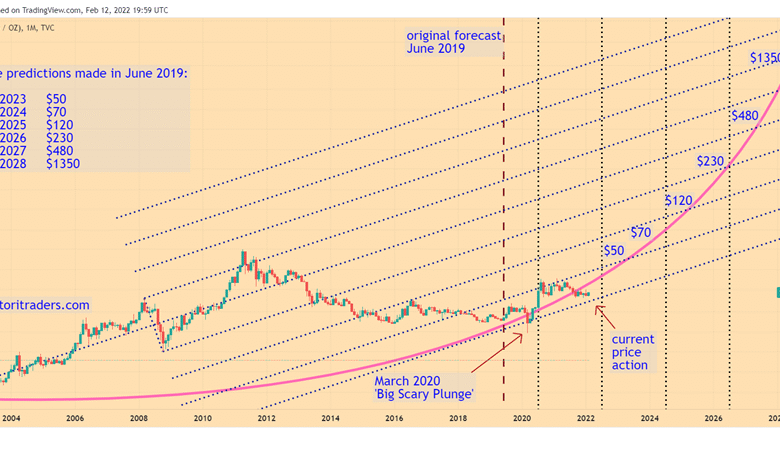

Silver Price Predictions Target $50 by Year’s End

Silver price predictions for 2025 are generating significant excitement among investors and market watchers alike. As analysts point to a potential surge, estimates suggest that silver could soar past the coveted $50 per ounce mark by the end of the year. This optimistic outlook is largely fueled by robust industrial demand alongside global economic uncertainties, prompting many to turn their attention toward investing in silver as a safe haven. With various forecasts indicating a wide range of silver price targets, it is clear that the silver market trends are shifting toward a bullish sentiment. Understanding these dynamics is essential, especially as the landscape continues to evolve, highlighting the strategic advantages of incorporating silver into investment portfolios.

As the silver market gains momentum, projections for its future price are capturing the interest of traders and enthusiasts alike. The focus is on upcoming trends that could lead to significant increases in value, primarily influenced by rising industrial requirements and fluctuating global market conditions. Investors are closely monitoring silver’s performance, as it stands poised to become a promising asset amid ongoing economic challenges. With various forecasts setting optimistic marks for the precious metal, the dialogue surrounding silver price targets is gaining traction as a critical element of investment strategy. Moreover, the intersection of silver’s industrial demand and market fluctuations presents a nuanced landscape that warrants careful analysis and consideration.

Understanding Silver Market Trends for 2025

The silver market is poised for significant changes as we head toward the end of 2025. Analysts are noticing a surge in industrial demand, particularly from sectors such as electronics and renewable energy. These industries require silver for conductive applications and solar panels, culminating in a potent mix of demand that could push prices upward. Silver’s unique properties make it irreplaceable in many industrial applications, ensuring that even as market conditions fluctuate, the foundation for a price hike remains solid.

Moreover, geopolitical tensions and persistent inflation are contributing to the bullish outlook for silver through 2025. Investors often turn to safe-haven assets when economic uncertainty looms, and silver’s historical performance during crises supports this behavior. As concerns about inflation rise globally, individuals and institutions may increasingly include silver in their portfolios, anticipating that ongoing market shifts will yield favorable conditions for price appreciation.

Frequently Asked Questions

What are the silver price predictions for 2025?

Silver price predictions for 2025 vary, with notable forecasts suggesting a potential target between $38.87 and $50.25 per ounce. Analysts, including those from Investinghaven, anticipate significant upward movement due to industrial demand and economic uncertainties.

How do silver market trends impact price forecasts?

Silver market trends, influenced by industrial demand from sectors like solar energy and electric vehicles, play a critical role in price forecasts. Increased demand and low supply conditions are expected to push silver prices higher, possibly reaching up to $50 per ounce by the end of 2025.

Is investing in silver a good decision based on current predictions?

Based on current silver price predictions and market trends indicating a bullish outlook, investing in silver could be a wise choice. With forecasts suggesting prices might reach as high as $50 per ounce, the growing industrial demand enhances silver’s attractiveness as an investment.

What is the silver price target set by analysts for 2025?

Analysts have set a range of silver price targets for 2025, with Investinghaven forecasting a high of $50.25 per ounce. Other predictions range from $38.87 to $48.20, reflecting optimistic, yet varied expectations among market experts.

How does silver industrial demand influence price predictions?

Silver industrial demand, particularly from renewable energy sectors, is a major factor influencing price predictions. As companies seek silver for solar panels and electric vehicles, this demand is expected to support upward price momentum, potentially exceeding $50 per ounce by the end of 2025.

What economic factors are affecting silver price predictions?

Economic factors such as persistent inflation and geopolitical unrest are driving interest in silver as a safe-haven asset. These conditions contribute to bullish silver price predictions, with forecasts indicating growth that could lead to prices around $50 per ounce by late 2025.

| Source | Price Prediction Range | Analysis Summary |

|---|---|---|

| Investinghaven | $48.20 – $50.25 | Bold prediction based on supply-demand trends and market research. |

| Coinpriceforecast | $42.78 | Moderate bullish outlook, reflecting stable industrial demand. |

| Just2Trade | $42.44 | Similar to Coinpriceforecast, showcasing conservative market optimism. |

| Citigroup / Saxo Bank | Around $40 | Cautious predictions, acknowledging economic uncertainty. |

| Priceprediction.net | $38.87 | Lower forecast, likely reflecting more conservative market analysis. |

Summary

Silver price predictions suggest that the metal could soar to $50 per ounce by the end of 2025, fueled by industrial demand and economic instability. Analysts are increasingly bullish on silver, indicating a potential for substantial growth as global market conditions evolve. With strong forecasts from multiple sources indicating upward trends, investors are advised to keep a close eye on silver as it may become a key player in the precious metals market.