Bollinger Bands Bitcoin Signal Upside Breakout Ahead

Bollinger Bands Bitcoin has become a focal point for traders and analysts as Bitcoin’s price shows potential signs of an upward breakout. Developed by John Bollinger in the early ’80s, this technical analysis tool offers vital insights into price volatility and market dynamics, helping investors assess potential Bitcoin price movements. Recent discussions around Bitcoin suggest that it may soon hit a critical resistance level, signaling the possibility of a breakout that could lead to significant gains. As investors keenly observe these crypto trading signals, understanding Bollinger Bands can provide a competitive edge in the fast-moving world of Bitcoin price analysis. With the market’s ever-changing landscape, technical analysis tools like Bollinger Bands remain crucial for predicting future price trends and making informed trading decisions.

The Bitcoin market is currently buzzing with speculation, especially following indications from the creator of Bollinger Bands regarding an impending bullish scenario. This technical chart pattern not only highlights price fluctuations but also empowers traders to decipher when Bitcoin might break through price ceilings. As enthusiasts dive into the world of cryptocurrency, recognizing signals from Bollinger Bands can significantly enhance their trading strategies. Those involved in crypto trading are increasingly turning to technical indicators like these to identify optimal entry and exit points. In a market where every movement counts, leveraging these tools can unlock opportunities for savvy investors.

Understanding Bollinger Bands in Bitcoin Trading

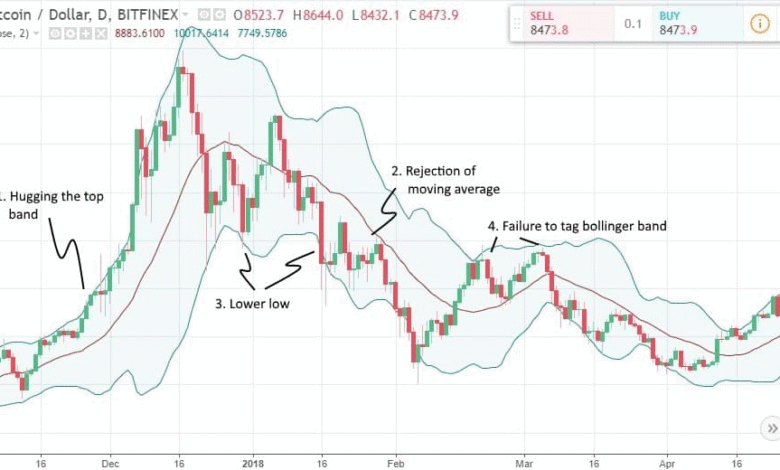

Bollinger Bands are a well-respected technical analysis tool used by traders to gauge market volatility, especially in volatile assets like Bitcoin. The bands consist of a simple moving average (SMA) in the middle, flanked by two lines that represent standard deviations. These lines expand and contract based on market conditions, allowing traders to identify whether the price is high or low on a relative basis. The benefit of using Bollinger Bands in Bitcoin trading comes from their ability to signal potential price breakouts, enabling traders to capitalize on upward or downward momentum.

When the price of Bitcoin approaches the upper band of the Bollinger Bands, it may indicate an overbought condition, while a move towards the lower band could suggest oversold conditions. This is crucial for Bitcoin price analysis, as understanding these conditions helps traders make informed decisions about when to enter or exit positions. Consequently, many Bitcoin traders leverage Bollinger Bands to create strategic trading signals, aiming to profit from potential market movements.

Current Bitcoin Sentiment and Breakout Potential

Recently, John Bollinger remarked on social media that Bitcoin appears to be setting up for an upside breakout. This statement references the current market’s price action, indicating a possible shift in momentum. Such sentiments are pivotal for traders looking to utilize technical analysis Bitcoin methodologies. By closely monitoring the price movement alongside Bollinger Bands, traders can better gauge when to initiate buy orders, particularly if the price breaks above the upper band.

Moreover, the dynamics surrounding Bitcoin are further complicated by macroeconomic factors, such as anticipated U.S. Treasury operations. With financial analysts like Arthur Hayes forecasting significant price moves, traders must stay vigilant. A breakout could lead to new all-time highs or substantial retracements, emphasizing the importance of using Bollinger Bands to confirm price strength or weakness in the ever-fluctuating Bitcoin market.

Leveraging Bollinger Bands for Effective Crypto Trading Signals

In the competitive landscape of crypto trading, leveraging Bollinger Bands can yield effective trading signals that inform decisions on Bitcoin investments. Traders often combine insights from Bollinger Bands with other indicators to develop comprehensive trading strategies. By analyzing historical price patterns and forecasting potential breakouts, traders can better position themselves to take advantage of rapid price increases or avoid steep declines. This blended approach underlines the importance of a well-rounded technical analysis framework.

For example, a trader might use Bollinger Bands to identify a narrowing band—a potential indicator of increased volatility. If this is accompanied by a breakout in Bitcoin price, it can serve as a robust signal to enter a position. The adaptability of Bollinger Bands allows for their integration with various trading strategies, increasing the potential for profitable trades in the volatile cryptocurrency market.

Bitcoin Price Analysis: How Bollinger Bands Fit In

Conducting Bitcoin price analysis involves understanding key indicators that signal market trends. Bollinger Bands serve as a valuable tool as they visually represent market volatility and price levels. Traders utilize them to identify possible reversal points or continuation patterns, especially during crucial breakout scenarios. By examining the behavior of Bitcoin prices in relation to the bands, traders can create actionable insights that influence their trading strategies.

For instance, if Bitcoin’s price consistently touches the upper band, it indicates strength and a potential bullish trend. Conversely, frequent interactions with the lower band may signal a bearish trend or a temporary pullback. This ongoing assessment is critical for traders looking to optimize their Bitcoin trades during times of market volatility, ensuring they can capture optimal entry and exit points.

The Impact of Market Trends on Bitcoin and Bollinger Bands

Market trends significantly influence the effectiveness of Bollinger Bands in Bitcoin trading. In an uptrend, the bands tend to widen, suggesting increasing volatility and potentially strong price movements. As Bitcoin continues to gain attention and popularity, traders should watch for patterns within these bands that reflect broader market sentiments. Understanding how trends interact with Bollinger Bands can aid traders in predicting future price movements.

Additionally, as market conditions change, so does the predictive power of Bollinger Bands. For instance, during market corrections, these bands can indicate oversold territories, allowing traders to recognize potential buying opportunities. Therefore, staying attuned to both Bitcoin price trends and Bollinger Bands is essential for any serious trader looking to navigate the evolving cryptocurrency landscape.

Decoding Bitcoin Breakouts with Bollinger Bands

Decoding potential Bitcoin breakouts often relies heavily on Bollinger Bands. When the price breaks out of the upper band, it signifies bullish momentum that traders shouldn’t overlook. The insights provided by Bollinger Bands can alert traders to act quickly, maximizing their profit potential while minimizing losses during these volatile periods. For many traders, setting alerts based on these breakout levels can be an efficient way to remain engaged with the market.

Furthermore, the context surrounding a breakout is critical; traders should consider volume and other technical indicators alongside Bollinger Bands. A price breakout accompanied by increased volume typically strengthens the validity of the signal, indicating that the movement is supported by substantial market interest. This multi-faceted approach to decoding Bitcoin breakouts can provide a strategic edge in an otherwise unpredictable market.

Combining Bollinger Bands with Other Technical Analysis Tools

Effectively analyzing Bitcoin with Bollinger Bands often involves combining this tool with others for a more comprehensive perspective. Many traders utilize moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) alongside Bollinger Bands to enhance their decision-making. By aligning signals from multiple indicators, traders can develop a more robust analysis framework that helps minimize risks associated with false signals.

For example, a trader might look for conditions where the RSI is in overbought territory while the Bitcoin price remains near the upper Bollinger Band. This combination could signal a potential price correction, prompting the trader to consider reducing their position. Integrating Bollinger Bands with other technical analysis tools creates a multidimensional strategy that can be particularly effective in the fast-paced world of crypto trading.

Future Trends for Bitcoin and Bollinger Bands: A Predictive Analysis

As Bitcoin continues to evolve, the future trends surrounding its price and the application of Bollinger Bands present exciting possibilities. Analysts are increasingly relying on these indicators not just for immediate trades but also for long-term forecasting. Understanding how Bollinger Bands can predict price fluctuations is becoming essential for traders anticipating future market conditions. With Bitcoin’s volatility remaining a constant, effective use of Bollinger Bands can illuminate potential trends.

Additionally, as the financial landscape shifts with changes in fiscal policies, the methodologies in which traders utilize Bollinger Bands could also adapt. Enhanced predictive analytics and the integration of artificial intelligence may lead to new strategies that further optimize trading outcomes. Embracing both traditional and innovative approaches will be vital for traders aiming to maintain a competitive edge as Bitcoin continues to reshape the financial markets.

Trading Strategies for Bitcoin Using Bollinger Bands

Implementing successful trading strategies for Bitcoin often hinges on the effective use of Bollinger Bands. Many traders prefer strategies that capitalize on price retracements towards the middle band, utilizing it as a potential entry point to capture upward movements. In contrast, exit strategies may be defined by proximity to the upper or lower bands. By formulating clear stop-loss orders based on these indicators, traders can safeguard their investments against extreme volatility.

Moreover, variation in trading styles among Bitcoin traders influences how they employ Bollinger Bands. Day traders might use shorter timeframes to react swiftly to price changes, while long-term investors may focus on weekly bands to identify more stable entry points. Whatever the strategy, understanding how to leverage Bollinger Bands can significantly enhance the potential for success in the dynamic world of Bitcoin trading.

Frequently Asked Questions

What are Bollinger Bands Bitcoin and how do they help in technical analysis?

Bollinger Bands Bitcoin refer to the use of Bollinger Bands as a tool specifically applied to Bitcoin price analysis. They consist of a moving average and two volatility bands (upper and lower) that help traders identify potential price levels and volatility in the crypto market. Traders often use Bollinger Bands to assess whether Bitcoin is overbought or oversold, thus enhancing their technical analysis of Bitcoin.

How can I use Bollinger Bands for Bitcoin breakout signals?

Traders can use Bollinger Bands to identify potential Bitcoin breakout signals by observing price movements relative to the bands. A breakout occurs when the Bitcoin price moves above the upper band or below the lower band, indicating increased volatility. This tool is essential for crypto trading signals, as it helps traders anticipate significant price movements, especially during periods of low volatility.

What does John Bollinger’s recent statement suggest about Bitcoin?

John Bollinger recently indicated that Bitcoin looks poised for an upside breakout, suggesting that traders should monitor price movements closely. His insights highlight the importance of Bollinger Bands in analyzing Bitcoin, as they provide a framework for understanding potential market trends and price levels.

What are the benefits of using Bollinger Bands in Bitcoin price analysis?

Using Bollinger Bands in Bitcoin price analysis offers several benefits, including visualizing price volatility and market trends. This technical analysis tool helps traders make informed decisions by showing high and low price levels, potentially predicting price breakouts or reversals in the Bitcoin market.

How often should Bollinger Bands be recalibrated for Bitcoin trading?

Bollinger Bands should be recalibrated based on market conditions for Bitcoin trading. In volatile markets, shorter time frames (like 1-hour or 4-hour charts) may be more effective, while longer time frames (such as daily charts) can be beneficial during stable periods. Continuous adjustment and observation are key to optimizing their effectiveness in technical analysis.

| Point | Details |

|---|---|

| Bollinger Bands Overview | A technical analysis tool developed by John Bollinger in the 1980s, consisting of a moving average and two standard deviation lines. |

| Bollinger’s Recent Statement | John Bollinger indicated that Bitcoin may be poised for an upside breakout based on current market conditions. |

| Market Implications | The use of Bollinger Bands can help traders assess price volatility and trends, potentially guiding investment decisions for Bitcoin. |

| Expert Predictions | Arthur Hayes warned of potential short-term dips in Bitcoin prices but predicts long-term surges due to U.S. fiscal operations. |

Summary

Bollinger Bands Bitcoin indicates that there are promising signals for a potential upside breakout in the price of Bitcoin. This conclusion is drawn from the technical analysis developed by John Bollinger, which suggests that current market volatility could lead to significant price movements. The combination of Bollinger’s insights and expert predictions from analysts highlights a positive outlook for Bitcoin in the coming weeks.