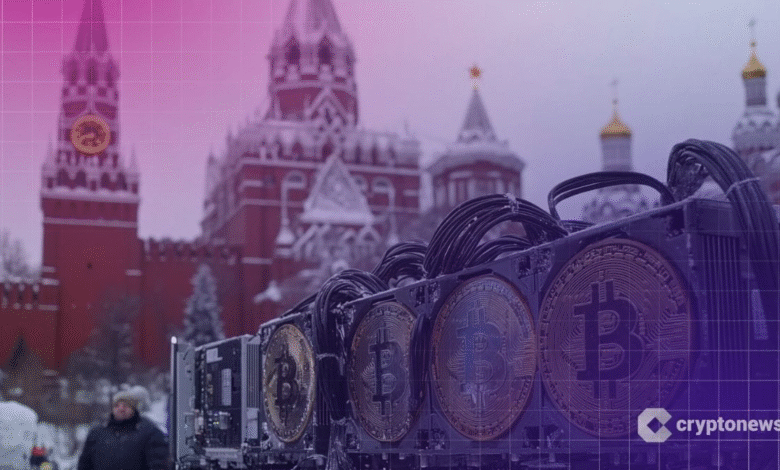

Russia Crypto Mining Register Boosts Regulatory Oversight

The recent establishment of the Russia crypto mining register marks a significant milestone in the country’s efforts to regulate its burgeoning cryptocurrency mining industry. This comprehensive register aims to identify electricity consumers engaged in mining activities, thereby enabling strict adherence to cryptocurrency mining regulations and taxation on cryptocurrency mining. By focusing on legal mining operations, the initiative seeks to curb illegal crypto mining operations that strain the energy grid and evade taxation. With an organized mining equipment register Russia hopes to create a framework that promotes responsible energy consumption limits mining practices, supporting both miners and government oversight. As the nation looks to improve its legal stance on digital currencies, this register is a critical step toward formalizing a sector previously shrouded in ambiguity.

In an effort to manage the cryptocurrency mining landscape effectively, Russia has initiated a detailed register documenting mining equipment utilized across the country. This action is part of broader legislative measures aimed at creating a streamlined system for monitoring energy use and enforcing compliance with existing mining equipment regulations. With growing concerns surrounding unregistered mining facilities, the government is focusing on implementing laws that will outline clear operational parameters for cryptocurrency miners. Moreover, these measures are anticipated to alleviate the burden resulting from excessive energy consumption and financial evasions that characterize unregulated mining practices. By legalizing and documenting mining activities, this register ultimately aims to foster a safer and more structured environment for cryptocurrency growth in Russia.

The Significance of the Russia Crypto Mining Register

The establishment of the Russia crypto mining register is a pivotal step in the country’s efforts to regulate cryptocurrency mining effectively. By maintaining a comprehensive list of mining equipment, the government aims to gain insight into energy consumption patterns among miners. This oversight is vital for implementing special regulations that can help curb illegal operations and enhance the transparency of the cryptocurrency mining landscape. With the increasing popularity of digital currencies, such measures are essential to ensure that the industry operates within legal boundaries.

Moreover, the register will serve as a crucial tool for taxation on cryptocurrency mining operations. By identifying the users of mining equipment, the government can enforce tax regulations more efficiently. It allows the Federal Tax Service to track revenue generated from mining activities and ensure compliance with taxation laws. As the crypto market continues to evolve, the register is expected to play a significant role in creating a structured environment for miners, thereby promoting a healthy and economically viable industry.

Regulatory Framework Supporting Legal Mining Operations

The introduction of the comprehensive register coincides with a broader regulatory framework that supports legal cryptocurrency mining operations in Russia. Previously, the lack of a clear legal structure made it difficult for miners to operate legitimately. However, the recent cryptocurrency mining law has provided the necessary guidelines for both individual and corporate miners to register with the Federal Tax Service. This legal backing is essential for fostering a compliant mining environment where businesses can flourish without engaging in illegal activities.

In addition to registration requirements, this legal framework emphasizes the importance of adhering to energy consumption limits set by the government. Miners must ensure that their operations do not surpass these thresholds to avoid penalties. Such regulations not only protect the energy grid but also promote sustainable practices within the industry. By aligning cryptocurrency mining activities with national energy policies, the government is taking a proactive approach to managing the environmental impact of digital currency mining.

Addressing Illegal Crypto Mining Operations

Illegal crypto mining operations pose significant challenges to both the economy and the energy infrastructure in Russia. These unregulated activities often lead to excessive energy consumption, which can strain power supplies and contribute to increased costs for consumers. The introduction of the mining equipment register is a strategic move to combat these illegal operations, as it allows authorities to identify and track miners who fail to register their equipment and adhere to government regulations.

By enhancing monitoring capabilities, the Russian government aims to deter illegal mining operations and ensure that all participants contribute to the national economy through taxes and fees. This not only promotes fairness within the industry but also protects legal miners from unfair competition posed by those operating outside the law. By tightening controls on unregistered activities, authorities can create a safer and more equitable environment for legitimate miners, fostering growth within the regulated sector.

Energy Consumption Limits for Cryptocurrency Miners

One of the critical aspects of Russia’s regulatory approach to cryptocurrency mining is the imposition of energy consumption limits. These limits are designed to prevent unnecessary strain on the nation’s power grid while promoting responsible mining practices. Miners, whether they are individuals or corporations, must adhere to these energy caps as part of their operational framework established by the government. This ensures that mining activities do not contribute to energy shortages or increased prices for consumers.

Furthermore, compliance with energy consumption limits can help miners reduce operational costs. By adopting energy-efficient technologies and strategies to stay within the government’s guidelines, miners can optimize their operations and potentially increase profitability. The focus on sustainable energy use not only benefits the individual miners but also supports the broader goal of promoting environmental responsibility within the cryptocurrency industry.

Taxation on Cryptocurrency Mining: New Obligations

Taxation on cryptocurrency mining has become a crucial element of Russia’s efforts to regulate the industry. With the introduction of the mining equipment register, miners are now required to report their earnings to the Federal Tax Service. This means that both individuals and entities engaged in mining need to maintain transparent records of their transactions and comply with taxation laws. As a result, the government’s move signifies a shift towards a more organized taxation framework that captures revenue generated from digital currencies.

Moreover, the taxation of cryptocurrency mining not only supports the government financially but also legitimizes the sector. By incorporating tax obligations into the mining regulatory framework, miners are encouraged to operate legally, which in turn helps eliminate the stigma associated with the industry. This evolution of the monetary landscape speaks volumes about Russia’s commitment to integrating cryptocurrencies into its economy while ensuring that miners contribute their fair share to the national coffers.

Monitoring Compliance in Cryptocurrency Mining

Monitoring compliance in cryptocurrency mining is essential for ensuring that miners adhere to the established regulations set forth by the government. The new mining equipment register acts as a mechanism for the authorities to oversee mining activities, enabling them to verify that operators are following the legal requirements. This proactive approach allows the government to identify potential violations early and take necessary actions to address them, ultimately ensuring a more compliant mining landscape.

Additionally, compliance monitoring can benefit miners who adhere to the laws by fostering a sense of trust between them and regulatory bodies. As miners operate transparently and responsibly, they reinforce the industry’s legitimacy, attracting potential investors and partners. This can lead to further growth and innovation within the sector, as stakeholders are more likely to engage with a regulated and compliant industry rather than one riddled with illegal operations.

Future Directions for Russia’s Crypto Mining Industry

The future of Russia’s cryptocurrency mining industry looks promising with the establishment of regulatory measures such as the mining equipment register. As the government continues to refine its approach to digital currency mining, it can expect to see increased participation from legal entities and individual entrepreneurs. This transition towards a more structured and regulated industry could attract international investment and foster the development of advanced mining technologies.

Furthermore, the developments in the crypto mining landscape in Russia may serve as a model for other countries looking to regulate their own mining sectors. By prioritizing sustainability, taxation, and compliance, Russia is taking significant steps toward creating a robust framework that balances economic growth with environmental considerations. As stakeholders adapt to these changes, the potential for innovation and expansion in the cryptocurrency space will be vast, leading to a more resilient and responsible industry.

Educational Initiatives for Miners

As Russia moves towards better regulation of cryptocurrency mining, educational initiatives for miners will play a crucial role in ensuring compliance with new laws and regulations. Providing training and resources to miners will help them understand their obligations regarding registration, taxation, and energy consumption limits, fostering a culture of responsibility within the industry. Education is vital for empowering miners to navigate the evolving landscape effectively.

Moreover, educational programs can aid in promoting the use of sustainable mining practices. With greater awareness of energy consumption and its implications, miners will be encouraged to adopt more efficient technologies and strategies that align with government regulations. Such initiatives can lead to a more environmentally friendly mining sector, ultimately contributing to a healthier ecosystem while also supporting economic development in Russia’s burgeoning cryptocurrency industry.

The Role of Technology in Compliance and Regulation

In the realm of cryptocurrency mining compliance and regulation, technology plays a fundamental role in facilitating adherence to newly imposed regulations. The use of advanced tracking and monitoring systems allows authorities to maintain oversight of mining operations effectively. By leveraging technology, the government can analyze electricity consumption and detect potential non-compliance with energy limits, ensuring that miners operate within legal parameters.

Additionally, technology can also assist miners in staying compliant with taxation laws. Automated reporting systems may simplify the process of documenting earnings and expenses, making it easier for miners to fulfill their obligations to the Federal Tax Service. As the crypto mining industry grows, embracing such technological solutions will be key to balancing regulatory requirements with operational efficiency, fostering a healthier ecosystem for all participants.

Frequently Asked Questions

What is the Russia crypto mining register and its main purpose?

The Russia crypto mining register is a comprehensive database established to monitor cryptocurrency mining operations in the country. Its main purpose is to identify electricity consumers involved in crypto mining, thereby enabling special regulations and taxation to combat illegal mining activities and ensure compliance with energy consumption limits.

How does the Russia crypto mining register help in regulating illegal crypto mining operations?

The Russia crypto mining register assists in regulating illegal crypto mining operations by providing authorities with detailed information on mining equipment used by operators. This transparency helps the Ministry of Energy and Federal Tax Service enforce regulations, reduce illegal consumption, and ensure that all miners adhere to taxation requirements.

What are the tax implications for miners registered in the Russia crypto mining register?

Miners registered in the Russia crypto mining register are subject to specific taxation on their mining activities. The newly established regulatory framework mandates that all miners, including those registered as legal entities or individual entrepreneurs, must report their earnings to the Federal Tax Service and comply with taxation policies.

Are there any energy consumption limits for cryptocurrency mining outlined in the Russia crypto mining register?

Yes, the Russia crypto mining register specifies energy consumption limits for miners. Individuals engaged in digital currency mining are required to adhere to these limits unless they are registered as entrepreneurs with the Federal Tax Service. This regulation is aimed at preventing energy overloads caused by excessive mining operations.

What significance does the Russia crypto mining register hold for the future of cryptocurrency mining regulations?

The Russia crypto mining register is significant as it lays the groundwork for a more structured and legally compliant cryptocurrency mining landscape in the country. By providing a framework for taxation and regulations, it encourages transparency and accountability within the industry, which can foster growth and attract legitimate investment in cryptocurrency mining.

| Key Point | Details |

|---|---|

| Creation of Equipment Register | Russia has created a comprehensive register of cryptocurrency mining equipment to enhance oversight. |

| Objectives of the Register | The register aims to identify electricity consumers involved in mining and facilitate special regulations and taxation. |

| Combatting Unregistered Mining | The initiative addresses the issue of unregistered mining operations that contribute to energy overloads and evade taxes. |

| Legal Framework | This move follows a cryptocurrency mining law that allows both legal entities and individual citizens to engage in mining. |

| Compliance with Regulations | Miners are required to report their digital currency earnings and must adhere to energy consumption limits set by the government. |

Summary

The establishment of the Russia crypto mining register represents a crucial step in regulating the burgeoning cryptocurrency industry. By facilitating oversight and taxation processes, this register not only addresses the critical issue of unregistered mining operations but also fosters a legal framework that supports compliant mining activities. In a country where energy consumption regulations are paramount, the Russia crypto mining register aims to ensure a transparent and legally bound mining environment, thereby paving the way for a more structured integration of cryptocurrency mining into the nation’s economy.