Inflation Expectations: Key Insights from the New York Fed

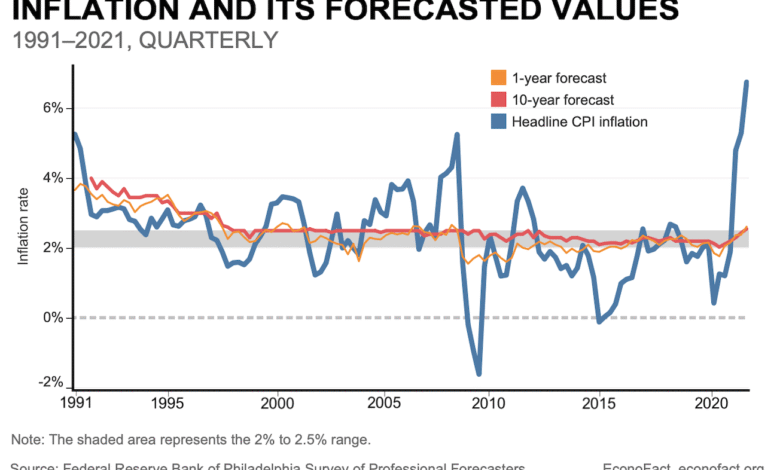

Inflation expectations play a crucial role in shaping economic behaviors and consumer confidence. According to the New York Fed inflation data, the latest Survey of Consumer Expectations indicates that respondents expect inflation to stabilize at 3% over the next year. This outlook mirrors the expectations from earlier this year and highlights a consistent trend amidst evolving economic conditions. Despite some softening in the overall inflation forecast, consumers are bracing for notable price increases in specific categories such as medical care, education, and gas. Understanding these inflation forecast 2025 predictions is essential as they impact purchasing decisions and long-term financial planning.

The term “price stability perceptions” encompasses how consumers anticipate future price trends and economic fluctuations. Recent survey data reveal that these perceptions have remained relatively stable, indicating a cautious optimism regarding inflation rates. While general inflation may experience a shift, the survey results emphasize ongoing concerns about rising costs in critical sectors, such as healthcare and education. As consumers adjust their spending strategies, keeping an eye on the various factors influencing these anticipations, including tariff impact on inflation and overall economic sentiment, becomes essential. Such insights are invaluable for businesses and policymakers alike as they navigate the complexities of a changing economic landscape.

Current Inflation Expectations: Consumer Insights

The latest findings from the New York Fed’s Survey of Consumer Expectations reveal that respondents anticipate an inflation rate of 3% for the upcoming year. This projection mirrors the figures reported in January, indicating a stable outlook among consumers despite broader economic fluctuations. The persistence of this inflation expectation highlights a degree of confidence among the public regarding their financial futures, suggesting that consumers are adjusting their spending and saving behaviors in response to a consistent inflation forecast.

Moreover, various individual categories reflect pronounced inflation expectations. For instance, consumers expect a significant 4.2% increase in gas prices, along with a formidable 9.3% rise in medical care costs. This data not only captures current sentiment but also serves as a critical marker for businesses in adapting their pricing strategies to align with consumer expectations. As inflation predictions remain steady, the stability of these figures provides a clearer roadmap for both policymakers and economic analysts.

The Impact of Tariffs on Inflation Projections

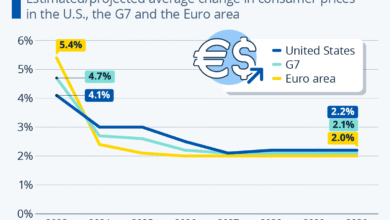

Earlier this year, fears that President Trump’s tariffs could lead to soaring inflation were predominant in consumer discourse. However, recent findings from the New York Federal Reserve indicate that these apprehensions have significantly waned. The survey shows a modest decline in inflation expectations overall, attributed to the administration’s pivot from aggressive tariff policies to a more diplomatic negotiation strategy with trading partners. Consequently, the anticipated inflation rate has softened, from a concerning peak to a steadier 3%, reflecting a decreased perceived risk associated with tariff-induced price hikes.

Furthermore, it is essential to recognize the complexities tariffs introduce to inflation metrics. Although tariffs were initially feared to have strong inflationary effects, recent data suggest that their influence remains minimal over the broader consumer price index, which only saw a 0.1% rise in May. This indicates that the market may be adjusting to current tariff levels without significant disruption to overall price stability, further informing inflation forecasts for 2025 and beyond.

Understanding Consumer Expectations for Pricing in Key Sectors

A critical aspect of the New York Fed’s consumer expectations survey is its focus on projected price increases in essential sectors. While the overall inflation outlook is stable, consumers anticipate marked increases, particularly in healthcare, education, and rent. For instance, a projected rise of 9.1% in college education costs and similar expectations for rent highlight the ongoing pressures in these areas, underscoring the necessity for effective financial planning among families.

These projections are especially notable as they coincide with shifting consumer behaviors amid economic changes. As families prepare for these price hikes, the anticipated inflation in these categories emphasizes the importance of budget adjustments and financial education. Understanding these expectations allows businesses and policymakers to better address the challenges faced by consumers, particularly in managing their financial planning amidst rising prices.

Inflation Forecasts and Employment Metrics: A Holistic View

The intersection of inflation expectations and employment metrics showcases a nuanced understanding of the economic landscape. The recent consumer survey indicated a stable expectation for inflation over the next three to five years, remaining at 3% and 2.6%, respectively. This stability comes at a time when employment metrics have shown improvement, including a decrease in expectations for a rising unemployment rate. Such trends indicate that a buoyant job market could bolster consumer confidence, allowing individuals to support sustained economic growth despite inflation worries.

Furthermore, as the unemployment forecast stabilizes, with an average expectation for job loss dropping to 14%, there is a burgeoning sense of optimism in consumer sentiment. This optimism is fundamentally linked to inflation forecasts, as a strong employment outlook can alleviate some financial anxieties associated with rising prices. Collectively, this data provides invaluable insights into the intricate relationship between job security and inflation expectations, emphasizing the importance of maintaining a balanced economic strategy.

Long-term Inflation Expectations: Key Insights for 2025

As stakeholders contemplate the inflation landscape for 2025, understanding long-term consumer expectations becomes paramount. The New York Fed’s survey indicates a cautiously optimistic outlook, with inflation expectations stabilizing. These projections not only reflect immediate consumer sentiment but also pave the way for potential monetary policy adjustments that the Fed may consider in response to sustained inflation trends.

Looking ahead, the anticipated inflation rate of 3% across various time horizons sets a benchmark for financial institutions, consumers, and policymakers alike. It challenges all parties to prepare for potential shifts in economic conditions and to adjust strategies accordingly. The alignment of expected inflation with employment trends will guide both business planning and consumer behavior, making it essential for all economic players to closely monitor these evolving trends.

Navigating Price Increase Expectations: Strategies for Consumers

With rising inflation expectations, particularly in essential industries, consumers are tasked with developing effective strategies to navigate potential price increases. The projected 9.3% rise in medical care costs and significant hikes in education and rent necessitate more proactive budgeting and financial planning among families. Understanding their personal finance options will empower consumers to make informed decisions that can mitigate the impact of these anticipated changes.

Additionally, consumers must remain vigilant about market trends and pricing strategies employed by businesses, particularly in sectors most affected by inflation. Adjusting consumption patterns and exploring alternative purchasing options could serve as proactive measures against the anticipated increase in prices. By being aware of these projected shifts, consumers can better protect their financial well-being and adapt to the changing economic landscape.

The Role of Consumer Surveys in Shaping Economic Policy

Consumer expectations surveys, like the one conducted by the New York Federal Reserve, play a pivotal role in informing economic policy decisions. The insights gathered provide valuable indicators of public sentiment regarding inflation, spending, and job security. As policymakers evaluate strategies to stabilize the economy, understanding the expectations of consumers enables them to craft responses rooted in real-time data that reflect economic realities.

Moreover, these surveys help central banks gauge the effectiveness of their monetary policies. By tracking changes in consumer expectations regarding inflation over time, the Federal Reserve can tailor its strategies to better manage economic conditions. In essence, consumer surveys bridge the gap between individual financial experiences and broader economic policy, highlighting the importance of continuous dialogue between policymakers and the public.

Future of Inflation Trends: Analyzing Key Variables

Analyzing the future of inflation involves recognizing various dynamic factors, including consumer expectations, employment metrics, and external influences such as tariffs and global trade agreements. Survey data suggests an evolving economic path, with inflation forecasts stabilizing around the 3% mark for the upcoming year. This consistency reflects an intertwined relationship between consumer sentiment and broader economic conditions, guiding both spending behaviors and investment strategies.

In addition to consumer projections, external variables such as shifts in energy prices and geopolitical events will inevitably influence future inflation trends. Keeping a close watch on these factors will be critical in shaping predictions for 2025 and beyond. By understanding how these variables interact with established consumer expectations, economists and analysts can better anticipate fluctuations and prepare for potential economic shifts that may arise.

Adapting Business Strategies to Inflation Expectations

As inflation expectations remain a notable concern, businesses must adapt their strategies to respond effectively to changing market conditions. The anticipated price increases across various sectors underscore the necessity of adjusting pricing models and enhancing supply chain efficiencies to contain costs. Understanding consumer expectations—such as the predicted 4.2% rise in gas prices—will allow companies to make informed pricing decisions while maintaining competitive advantages.

Additionally, communication with consumers about pricing changes is key to maintaining trust and loyalty amidst rising costs. By being transparent about the factors influencing price increases, businesses can foster positive relationships with their customers. This proactive approach not only prepares companies for future economic shifts but also safeguards their market positioning in a climate of evolving inflation expectations.

Frequently Asked Questions

What are consumer expectations of inflation based on the New York Fed’s inflation survey?

The New York Fed’s Survey of Consumer Expectations indicates that respondents expect inflation to be around 3% over the next twelve months. This expectation has remained stable since January, despite variations in overall inflation metrics.

How do tariff impacts affect inflation expectations in the U.S.?

According to the latest findings from the New York Fed’s inflation forecast, concerns about tariffs significantly increasing inflation have subsided. Recent surveys show that tariffs have not led to major inflation changes, with respondents foreseeing a steady inflation rate of around 3%.

What is the inflation forecast for 2025 based on consumer expectations?

The inflation forecast for 2025 indicates that consumers expect a consistent rate of 3% in the short term. Over the next three to five years, inflation expectations remain at 3% and 2.6% respectively, according to the New York Fed survey.

What are the price increase expectations in key categories according to the consumer expectations survey?

The consumer expectations survey indicates anticipated price increases in various categories: gas prices are expected to rise by 4.2%, medical care by 9.3%, and both college education and rent by about 9.1%. Additionally, food prices are expected to increase by 5.5%.

How have inflation expectations changed in light of recent economic conditions?

Inflation expectations have softened slightly, with the overall projection declining to 3% from a peak of 3.6% earlier in the year. Despite these changes, forecasts remain consistent for several key categories, suggesting persistent consumer concern about future price increases.

How reliable are inflation expectations from the New York Fed consumer survey?

The inflation expectations from the New York Fed consumer survey are considered reliable, as they are based on responses from a diverse group of consumers. These insights reflect real-time perceptions and anticipated changes in the economy, making them a valuable tool for understanding future inflation trends.

| Key Point | Detail |

|---|---|

| Projected Inflation Rate | 3% a year from June 2023, unchanged since January. |

| Current Economic Climate | Concerns over tariffs have reduced, with inflation forecasts softening overall. |

| Gas Prices Expectation | Expected to rise by 4.2%. |

| Medical Care Inflation Expectation | Anticipated increase of 9.3%, the highest since June 2023. |

| Education and Rent Inflation Expectation | Both expect to rise by 9.1%. |

| Food Price Inflation Expectation | Unchanged at an anticipated 5.5% rise. |

| Unemployment Expectations | Expectations for higher unemployment decreased, with average job loss expectation at 14%. |

Summary

Inflation expectations are critical as they guide consumer behavior and economic policy. According to the latest New York Fed’s Survey of Consumer Expectations, while the forecast for overall inflation has softened, consumers still predict a 3% inflation rate twelve months ahead. This reflects a decreasing concern about tariff impacts, although significant price increases are anticipated in essential categories like gas, medical care, education, and rent. Economic factors, including improved employment metrics, play a role in shaping these expectations.