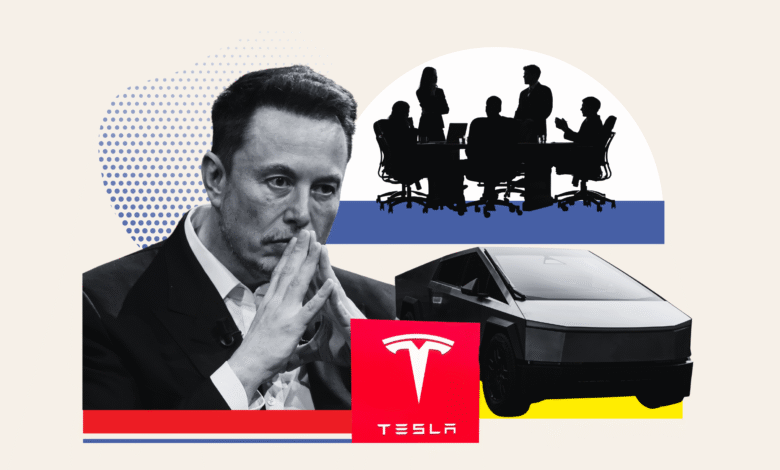

Elon Musk Tesla Board Proposals: ‘Shut Up’ to Dan Ives

Elon Musk Tesla board proposals have taken center stage as the controversial CEO clashed with analyst Dan Ives over strategic recommendations. Recently, Ives suggested three key initiatives aimed at enhancing governance, including a revamped pay package for Musk, stricter guidelines for his time commitment to Tesla, and increased oversight of his political activities. After Ives’s comments, Tesla stock faced a significant slide, plummeting nearly 7% and erasing $68 billion in market capitalization. Investors are understandably concerned, especially with Musk’s announcement of his new political party, which has raised eyebrows among stakeholders. Amidst this turmoil, Wedbush Securities maintained its price target while warning that Musk’s political ventures might necessitate immediate board action to restore investor confidence and stabilize Tesla’s rapidly shifting landscape.

The recent discourse surrounding the proposals made for Tesla’s board by Elon Musk highlights a broader conversation about corporate governance and executive accountability. Analysts have emphasized the need for new guidelines that not only redefine Musk’s compensation package but also establish clear boundaries on his engagement with political affairs, which seem to divert attention from the company’s core operations. In light of Dan Ives’s advocacy for such measures, many stakeholders are calling for reforms that prioritize Tesla’s market stability as it navigates a tumultuous financial period. As the CEO’s political ambitions loom large, the ripple effects on Tesla’s stock performance will be closely monitored by market watchers. This evolving situation underscores an urgent need for effective management strategies to safeguard investor interests amid the ongoing fluctuations in Tesla’s financial health.

Elon Musk’s Response to Dan Ives’ Recommendations

In a recent confrontation on social media, Tesla CEO Elon Musk unleashed his frustration towards Dan Ives, a prominent analyst known for his bullish outlook on Tesla. Ives had proposed a series of board recommendations aimed at refining Musk’s involvement with Tesla, which Musk dismissed curtly when he tweeted, “Shut up, Dan.” This interaction not only highlights the tension between Musk and financial analysts but also raises questions about the future direction of Tesla following a significant decline in stock value.

Musk’s abrupt dismissal of Ives’ suggestions—despite their potential benefits—echoes a broader ongoing challenge for Tesla. Ives suggested that the board could enhance governance by instituting a new CEO pay package and limiting Musk’s time commitments. The abrupt response may indicate Musk’s ambivalence towards relinquishing control or considering changes that would directly impact his authority, even amidst stock turmoil.

The Impact of Political Engagement on Tesla’s Stock

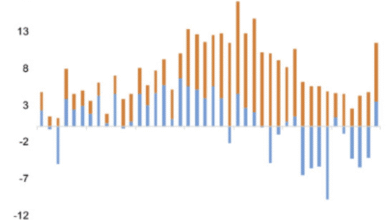

Elon Musk’s recent political engagement has stirred more than just controversy; it’s caused tangible effects on Tesla’s stock performance. After announcing the formation of his new political party, the America Party, Tesla shares took a nearly 7% hit, which translated to a staggering $68 billion decrease in market capitalization. Analysts, like Dan Ives from Wedbush Securities, have pointed out this correlation between Musk’s political activities and the fluctuations in Tesla stock prices, raising flags about the sustainability of investor confidence during critical company developments.

Investors and analysts alike are expressing concern about whether Musk’s political distractions are overshadowing Tesla’s potential growth. With Musk’s intense focus on his new political ambitions, questions arise regarding the long-term viability of Tesla’s stock in light of these tumultuous times. As Dan Ives noted, the urgent need for the Tesla board to reevaluate its governance structure grows increasingly relevant, especially given the negative repercussions observed in stock performance after Musk’s announcements.

Navigating Tesla’s CEO Pay Structure

The question of Elon Musk’s compensation package has become a focal point for discussion, particularly following Dan Ives’ recommendations for restructuring it. Musk’s previous pay package was invalidated, raising questions about the independence and governance of the board, which is essential in determining fair compensation. Analysts suggest that a reevaluated pay structure could include performance metrics aligned with company growth and stock stability, potentially reassuring investors who may be having doubts about management decisions.

Implementing a new pay package for Musk, as suggested by Ives, could lead to more stability for Tesla if designed to account for the recent market slides. With 25% voting control tied to his compensation, this proposal might provide a balance between stakeholder confidence and executive power. As outlined by Wedbush Securities, having stronger oversight could help in mitigating risks posed by Musk’s political activities, ultimately fostering a healthier environment for potential investors and stakeholders.

Stock Performance and Investor Sentiment

The sharp decline in Tesla’s stock on the heels of Musk’s political ventures has prompted a reevaluation of investor sentiment. Many are starting to question Musk’s dual role as both a political figure and a CEO, as evidenced by the significant losses that have impacted stockholder value. The once unwavering support for Tesla is beginning to wane, suggesting that investors are increasingly sensitive to corporate governance issues that could influence long-term performance.

Following Ives’ call for tighter oversight and strategic governance changes, analysts are taking a closer look at Tesla’s operational framework and its vulnerability to external factors, including Musk’s engagement in politics. Investors are seeking assurance that the company remains focused on innovation and growth rather than being distracted by personal or political pursuits, which can severely impact market confidence and consequently, stock prices.

The Role of Analysts in Tesla’s Future

Analysts such as Dan Ives play a crucial role in shaping the narrative around Tesla’s performance and future direction. Their insights help investors navigate market sentiments and make informed decisions, especially in times of volatility. Ives, who has consistently supported Tesla’s potential, has now called for a change to ensure Musk’s political activities do not compromise the company’s growth strategy, emphasizing the need for strategic checks and balances in Tesla’s governance structure.

Despite pushing for effective governance, analysts like Ives maintain their bullish stance on Tesla’s long-term prospects. The recommendations provided, including a new pay package and clearer guidelines for Musk’s time management, are intended to safeguard both the company and investor interests. Analysts will continue to monitor how well Musk balances his ambitions against the operational needs of Tesla, which could significantly influence market sentiment in the future.

Competitive Landscape in the EV Market

As Tesla navigates through its internal challenges, the competitive landscape in the electric vehicle (EV) market remains increasingly fierce. With other automakers ramping up their production of EVs and introducing innovative technologies, strong governance at Tesla becomes critical in maintaining its leadership position. Ives’ recommendations for a more structured board could help safeguard Tesla’s edge amidst rising competition and market uncertainties.

The stakes are high for Tesla, as maintaining its market share will require not only innovation but also strategic planning and execution. With new players entering the EV space, it is vital for Musk and the board to prioritize the company’s core business objectives over political engagements. This laser focus on the business will not only enhance investor confidence but will also secure Tesla’s future in an industry that is continually evolving.

Understanding Tesla’s Market Response

The market response to Tesla’s recent developments, particularly regarding Musk’s political initiatives, serves as a reminder of the interconnectedness of corporate governance and stock performance. Investor behavior is often swayed by CEO actions and statements, and the negative reaction to Musk’s announcements illustrates the critical need for Tesla to manage its narrative effectively. As analysts evaluate the situation, a unified strategy moving forward is essential to mitigate risk and reassure stakeholders.

Investors typically react sharply to news surrounding leadership changes or governance shifts, as this can signal the stability—or instability—of their investments. The recommendations outlined by Dan Ives are a proactive approach to address these worries by instituting clear guidelines that could lead to a more stable market reputation for Tesla. By focusing on governance and oversight, Tesla may regain investor confidence that appears to be wavering in light of recent events.

The Future of Tesla Amid Governance Debates

As debates surrounding corporate governance at Tesla continue to heat up, the future direction of the company hangs in the balance. With Musk’s political interests possibly diverting focus from Tesla’s core business, it has never been more essential for the board to implement effective oversight to maintain investor confidence and market stability. Experts like Ives assert that without proper governance structures, Tesla risks losing its innovative edge and investor trust.

Moving forward, the board’s ability to adapt to these challenges and enact Ives’ recommendations could ultimately determine Tesla’s operational effectiveness and sustainability in the volatile EV market. All eyes are on how executives will balance the demands of corporate leadership with the need for progressive governance and accountability, ensuring that Tesla can thrive amidst increasing competition and shifting market dynamics.

Frequently Asked Questions

What are Dan Ives’ recommendations regarding Elon Musk’s Tesla board proposals?

Dan Ives, a prominent analyst, has proposed three key recommendations for Tesla’s board concerning Elon Musk’s role: a new pay package that would enhance Musk’s voting control to 25%, guidelines on the amount of time Musk dedicates to Tesla, and oversight of his political activities. These proposals aim to stabilize Tesla’s governance amidst concerns over Musk’s distractions, such as his recent political endeavors.

How did Elon Musk respond to Dan Ives’ suggestions for Tesla’s board?

Elon Musk publicly dismissed Dan Ives’ recommendations for the Tesla board by tweeting, ‘Shut up, Dan.’ This reaction highlights Musk’s disdain for external criticism, even from bullish analysts like Ives, who aimed to enhance his influence within the company through proposed changes to his pay and oversight on political activities.

What impact did Musk’s announcement about a new political party have on Tesla’s stock?

Following Elon Musk’s announcement of creating a new political party, Tesla’s stock experienced a nearly 7% decline, translating to a loss of approximately $68 billion in market capitalization. This significant drop underscores the growing concerns among investors about Musk’s political distractions and their potential ramifications on Tesla’s performance.

Why is there uncertainty surrounding Elon Musk’s CEO pay package at Tesla?

Elon Musk’s CEO pay package is currently surrounded by uncertainty due to the invalidation of his 2018 package last year, which raised questions regarding the independence of the board that approved it. In light of Dan Ives’ recommendations and ongoing scrutiny over Musk’s political activities, the need for a new, clearly structured pay package is becoming increasingly important for shareholders.

What is Wedbush Securities’ stance on Tesla’s stock amidst Musk’s political activities?

Wedbush Securities has maintained its price target for Tesla despite the recent turmoil linked to Musk’s political activities. They emphasize that Musk’s distractions necessitate action from the Tesla board to ensure proper oversight and governance, reflecting the analysts’ belief that strong structural measures could stabilize investor confidence.

How have investors reacted to Elon Musk’s political activities in relation to Tesla?

Investors have shown growing concern regarding Elon Musk’s political activities, especially following significant drops in Tesla’s stock prices. Analysts suggest that such distractions may be causing fatigue among investors, who are increasingly wary of how Musk’s political engagements could impact his focus on Tesla’s core business and the company’s future trajectory.

| Key Points | Details |

|---|---|

| Musk’s Reaction to Ives | Musk told Ives to ‘Shut up’ after Ives suggested board recommendations. |

| Stock Impact | Tesla shares dropped nearly 7%, losing $68 billion in market cap following Musk’s announcement of a new political party. |

| Recommendations by Dan Ives | Ives proposed a new pay package, guidelines on Musk’s time at Tesla, and oversight on his political activities. |

| Musk’s Historical Pay Package | Musk’s 2018 compensation was invalidated due to board independence issues, raising concerns about future compensation. |

| Investor Sentiment | Analysts warn that Musk’s political distractions are causing investor fatigue and scrutiny at a crucial time. |

Summary

Elon Musk’s Tesla board proposals have generated significant discourse, particularly after Tesla’s CEO clashed with analyst Dan Ives over his recommendations. Ives criticized Musk’s political activities and provided suggestions aimed at stabilizing the company’s performance. With Tesla’s stock suffering a considerable drop, it is crucial for Musk and the board to navigate these challenges carefully to maintain investor confidence.