Tokenized Assets: Compliance is Key in Digital Securities

In the rapidly evolving world of finance, tokenized assets are transforming the way we perceive ownership and investment. As Wall Street embraces blockchain technology, the importance of compliance under SEC regulations has never been clearer. Commissioner Hester Peirce of the U.S. Securities and Exchange Commission (SEC) has emphasized that, regardless of innovation, maintaining adherence to federal securities laws is crucial for the future of digital securities. This shift towards proper governance will shape which players thrive as different tokenization models emerge. Understanding these dynamics is vital for investors looking to navigate the complexities of tokenized assets and build a secure financial future.

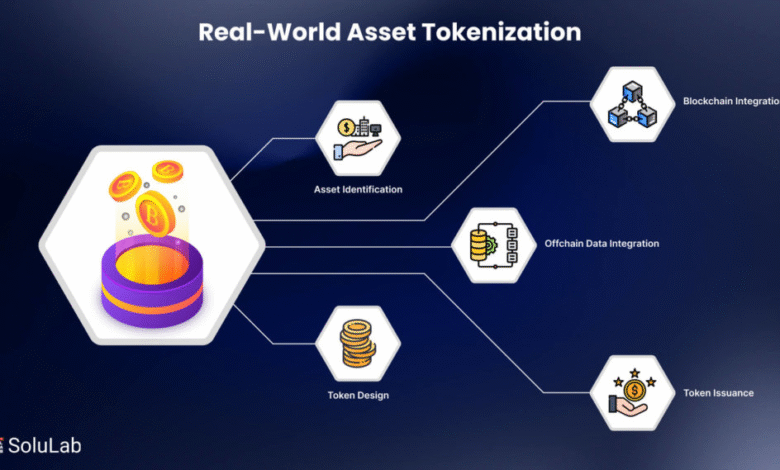

Tokenized assets, often referred to as blockchain-backed securities or digital representations of ownership, are gaining traction among investors and financial institutions alike. These innovative financial instruments promise to streamline asset transactions and enhance liquidity, yet they come with a unique set of compliance challenges. U.S. regulators, particularly the SEC, are closely scrutinizing this landscape to ensure that all market participants adhere to existing securities frameworks. With the insights from figures like Hester Peirce, it’s evident that the evolution of tokenization will depend not only on technological advancements but also on a robust framework of blockchain compliance. As firms experiment with various digital investment models, understanding the legal implications becomes critical in navigating this new terrain.

Navigating SEC Regulations for Tokenized Assets

The landscape of tokenized assets is rapidly evolving, presenting both opportunities and challenges for investors and issuers alike. As the SEC tightens its grip on compliance, market participants must navigate a complex web of regulations designed to protect investors and maintain market integrity. Commissioner Hester Peirce’s remarks highlight the necessity for adherence to federal securities laws in all transactions involving tokenized securities. This regulatory scrutiny is particularly pertinent as firms explore various tokenization models, which involve creating and trading digital versions of assets that, while innovative, still carry the legal definitions and requirements of their traditional counterparts.

Moreover, companies looking to tokenize their offerings must exhibit a thorough understanding of their legal obligations under SEC guidelines. With the potential for certain tokens to be classified as security-based swaps, firms must be proactive in ensuring their compliance mechanisms are robust enough to address the dynamic nature of digital securities. The stakes are high; companies risk significant penalties if they inadvertently operate outside of established legal frameworks. Therefore, continuous education and communication with the SEC about tokenization strategies and compliance practices can help mitigate risks significantly.

The Importance of Blockchain Compliance in the Digital Securities Market

As the realm of digital securities gains momentum, blockchain compliance has emerged as a focal point of discussion among regulators and participants in the financial ecosystem. With innovation accelerating at a historic pace, it is crucial for companies to prioritize compliance frameworks that align with evolving SEC regulations. Hester Peirce has underscored that achieving compliance will be the differentiator in the competitive landscape of tokenized assets—a race where only those who fully understand the legal ramifications of their tokenization models stand a chance to thrive.

In order to effectively navigate the complicated regulatory environment surrounding digital securities, firms must be equipped with a deep understanding of the compliance requirements pertaining to their specific token structures. This encompasses not only understanding the foundational securities laws but also embracing new compliance techniques that reflect the unique characteristics of blockchain technology. By collaborating with regulatory bodies and engaging in open dialogue with the SEC, market participants can work towards establishing a more comprehensive compliance framework that supports innovation while ensuring the protection of investors.

Innovative Tokenization Models and Regulatory Challenges

The exploration of innovative tokenization models presents fresh avenues for capital formation, yet these ventures are not without regulatory challenges. Participants across the financial spectrum are rapidly experimenting with diverse strategies, from tokenizing corporate shares to utilizing custodial solutions that provide entitlements. Each of these models carries its own set of operational risks and legal complexities that could place companies at odds with existing SEC guidelines. For example, certain token structures can blur the lines between traditional securities and novel financial instruments, making it imperative for firms to engage deeply with regulatory frameworks.

Additionally, as emphasized by Commissioner Peirce, there is a critical need for vigilance regarding the legal implications of these tokenization strategies. Firms must rigorously assess how their tokens interact with both existing regulations and the broader market context. The SEC has specifically cautioned against misclassifying asset types and has drawn attention to the possibility of certain tokenized offerings being treated as synthetic instruments. As a result, businesses must invest time and resources into ensuring their tokenization initiatives are not only innovative but also compliant with the stringent requirements established by the SEC.

Engaging with the SEC: A Path to Compliance and Innovation

Engagement with the SEC is becoming increasingly vital for firms looking to innovate within the domain of tokenized assets. Hester Peirce has notably urged market participants to proactively communicate with the SEC, especially when existing regulatory frameworks do not adequately address the nuances of blockchain technology. Such dialogue can foster a more adaptable regulatory landscape that acknowledges innovation while safeguarding investor interests. This is particularly relevant as market demands shift and new tokenization models emerge, challenging the incumbent systems in place.

Moreover, firms that are transparent about their token structures and seek guidance from the SEC stand a better chance of navigating the compliance maze successfully. Open discussions can lead to better clarity on regulatory expectations and potentially pave the way for exemptions or adjustments tailored to innovative tokenization practices. This proactive engagement is essential, as it not only positions companies favorably in terms of compliance but also demonstrates a commitment to operating within the legal framework of the U.S. securities market as technological advancements unfold.

Federal Securities Laws: The Backbone of Tokenized Securities

Despite the allure of blockchain’s transformative potential, Hester Peirce firmly asserts that federal securities laws remain the guiding principle governing tokenized securities. This fundamental understanding is crucial for participants in the digital securities space, as it reaffirms that tokenized assets are not exempt from the comprehensive legal oversight established by the SEC. Companies venturing into tokenization must recognize that while they may leverage groundbreaking technology, the essence of their offerings remains bound by traditional securities regulations.

This legal framework ensures that all market participants are held to a standardized set of rules designed to protect investors and sustain market integrity. Failing to adhere to these federal regulations could lead to severe repercussions, including fines and reputational damage. Therefore, businesses seeking to explore the tokenized asset market must develop strategies that incorporate compliance as a foundational pillar. By prioritizing adherence to existing laws, they can create a stable environment that supports responsible innovation.

Understanding the Implications of Digital Securities

Tokenization has the potential to reshape the landscape of finance, yet it does come with consequential implications regarding compliance and investor protection. As digital securities begin to proliferate, understanding how these instruments fit into existing federal law becomes critical for market participants. Hester Peirce’s assertions reiterate the necessity for investors and issuers to acknowledge the nature of tokenized securities and their legal ramifications.

For investors, this means being diligent in assessing the compliance status of tokenized offerings, ensuring that they are engaging with legitimate and fully compliant securities. For issuers, it emphasizes the importance of structuring their token offerings in a manner that complies with the regulatory framework. Failure to address these implications may lead to market instability and a loss of investor confidence, highlighting the need for transparency and robust compliance practices in the burgeoning field of digital securities.

The Role of Hester Peirce in Advancing Blockchain Compliance

As an influential figure within the SEC, Hester Peirce plays a pivotal role in shaping the conversation around blockchain compliance and digital securities. Her advocacy for a more nuanced understanding of tokenization demonstrates a commitment to balancing innovation with regulatory oversight. Peirce’s approach encourages firms to pursue creative advancements in tokenization without losing sight of the foundational legal principles that govern securities transactions.

Peirce’s willingness to adapt traditional regulatory frameworks in light of new technological realities is a critical element in fostering an environment conducive to innovation. Her call for companies to engage with the SEC regarding compliance issues showcases her belief in a collaborative approach to regulation. This proactive stance underlines the importance of dialogue between regulators and market participants in creating a healthier ecosystem for tokenized assets and ensuring that compliance remains at the forefront as the market evolves.

The Future of Tokenized Assets Under Regulatory Scrutiny

Looking ahead, the future of tokenized assets will inevitably be influenced by ongoing regulatory scrutiny and the rigorous enforcement of compliance standards. The series of statements made by Hester Peirce highlight the SEC’s commitment to maintaining a clear regulatory framework that protects investors while allowing for innovation in the digital securities space. As more firms enter the market and explore diverse tokenization models, they must be prepared for an environment where regulatory expectations are paramount.

Ultimately, the trajectory of tokenized assets depends on a balanced approach—where innovation can thrive alongside robust compliance mechanisms. As the SEC continues to evaluate and adapt to the needs of this rapidly evolving market, it is imperative for participants to prioritize compliance in all aspects of their tokenization strategies. This focus will not only bolster investor confidence but will also pave the way for the sustainable growth of the digital securities market, solidifying the intersection of blockchain technology and traditional finance.

Conclusion: Compliance as a Catalyst for Tokenization

In conclusion, as the excitement surrounding tokenized assets escalates, the undeniable emphasis on compliance will be the beacon that guides this new market. Hester Peirce’s message serves as a powerful reminder that while innovation in tokenization models is essential, it cannot supersede the vital framework of federal securities laws. To succeed in the digital securities race, participants must embrace compliance and work tirelessly to align their practices with regulatory expectations.

As the marketplace evolves, the commitments made by market participants to uphold these standards will influence the long-term viability of tokenized assets. Therefore, the fusion of understanding compliance within tokenized models will not merely ensure regulatory adherence but will also foster a healthy marketplace where innovation can flourish, benefitting both investors and issuers alike.

Frequently Asked Questions

What role does blockchain compliance play in the success of tokenized assets?

Blockchain compliance is crucial for the success of tokenized assets as it ensures that market participants adhere to federal securities laws. As emphasized by SEC Commissioner Hester Peirce, compliance will determine the winners in the digital securities market, as innovation alone cannot replace legal obligations.

How do SEC regulations affect the trading of digital securities?

SEC regulations impact the trading of digital securities by reaffirming that tokenized securities are still classified as securities. Market participants must comply with these regulations to legally transact in tokenized assets, ensuring transparency and investor protection.

What are the different tokenization models used for assets?

Various tokenization models include the conversion of traditional shares into digital format, custodians tokenizing entitlements, and creating instruments backed by custodial assets. Each model presents distinct operational and legal challenges that must align with blockchain compliance requirements.

Why is regulatory compliance critical for tokenized assets under SEC jurisdiction?

Regulatory compliance is critical for tokenized assets under SEC jurisdiction because it ensures that these innovative financial instruments are legally recognized and appropriately regulated. Non-compliance can lead to significant penalties and restrict market access, making it essential for participants to understand and adhere to relevant SEC regulations.

What implications arise from Hester Peirce’s statements on tokenization and NFTs?

Hester Peirce’s statements highlight that while tokenization can innovate financial markets, it does not change the legal status of the assets involved. This indicates that Risk and regulatory scrutiny for tokenized assets, including NFTs, can arise based on their structure and potential classification as securities.

How can firms ensure their tokenized assets comply with SEC regulations?

Firms can ensure their tokenized assets comply with SEC regulations by closely monitoring the legal classification of their tokens, engaging with regulatory authorities like the SEC for guidance, and building their tokenization models in line with existing securities laws to avoid legal pitfalls.

What risks are associated with different tokenization strategies in digital securities?

Different tokenization strategies carry various risks including counterparty exposure and regulatory uncertainty. Market participants must conduct thorough risk assessments to identify potential legal and operational challenges associated with their chosen tokenization models.

What should investors know about the legal status of tokenized securities?

Investors should understand that tokenized securities maintain the same legal status as traditional securities, meaning they are subject to federal securities laws. This legal foundation is essential for ensuring investor protection and market integrity.

| Key Points |

|---|

| Tokenized assets are gaining popularity among investors. |

| Compliance with federal securities laws is essential for market participants. |

| Tokenized securities are still defined as securities under federal law. |

| Tokenization can enhance capital formation but does not change the legal status of the underlying assets. |

| Different tokenization strategies have distinct legal and operational risks. |

| Some token structures may face limitations as security-based swaps or synthetic instruments. |

| The SEC is open to updating regulatory frameworks to accommodate blockchain innovations while keeping legal foundations intact. |

Summary

Tokenized assets are revolutionizing the financial landscape as they gain traction on Wall Street. The SEC’s clear stance on compliance underscores the crucial balance between innovation and regulation in the evolving world of digital securities. As firms navigate the complexities of tokenized assets, understanding federal securities laws and their implications becomes paramount. With well-structured token models, market participants can harness the potential of blockchain technology while ensuring adherence to legal requirements, paving the way for a compliant and thriving tokenized asset market.