Ripple Share Ownership: Linqto Addresses Viral Misinformation

Ripple share ownership is a topic stirring considerable debate, particularly in light of recent clarifications from Linqto, a secondary-market investment platform. The company has confirmed its ownership of 4.7 million Ripple shares, amidst growing scrutiny and misinformation affecting the cryptocurrency space. As Ripple shares news circulates, Linqto addresses false claims that have emerged, emphasizing the necessity of relying on verified information over social media speculation. Moreover, the ongoing regulatory challenges and the complexities surrounding Ripple shareholding clarification have put all eyes on this popular cryptocurrency investment. With Linqto navigating the storm of public and regulatory pressure, the implications of Ripple’s market misinformation could have lasting impacts on investor confidence and the future of digital asset ownership in the market.

The dynamics of Ripple’s equity distribution have come under the spotlight as investors seek clarity amidst uncertainties. The shareholding structure of Ripple, particularly in connection with Linqto’s investment platform, highlights the intricacies often inherent in private equity markets. Recent assertions concerning the stability of Ripple’s shares have prompted a need for transparent communications regarding ownership rights. As discussions evolve around Ripple stock and its associated holdings, the veracity of claims made online is more crucial than ever. Understanding the nuances of secondary market transactions and their implications for stakeholders will be critical as the landscape continues to shift.

Understanding Ripple Share Ownership in the Current Market

Ripple share ownership has become a topic of intense discussion and scrutiny, particularly as misinformation spreads across social media platforms. Linqto has asserted that it holds 4.7 million shares in Ripple, a fact central to understanding the dynamics of Ripple’s presence in the private equity market. With the buzzing concerns around share ownership and market stability, clarity on such holdings is vital for investors who may feel uncertain due to the noisy chatter surrounding private equity investments.

The regulatory landscape surrounding Ripple and its shares has also been evolving, adding layers of complexity. Recent statements from Ripple’s CEO, Brad Garlinghouse, have fallen under the spotlight, especially clarifying that Ripple’s relationship with Linqto is indirect at best, and that Linqto’s share ownership was acquired through secondary market transactions. Investors need to be especially cautious, as misinformation, whether intentional or not, can significantly alter public perception and influence market trends.

Linqto’s Response to Ripple Shares News: Transparency Amidst Misinformation

In the face of rampant misinformation circulating about Ripple shares, Linqto reacted promptly by reiterating its stability and transparency as an investment platform. The CEO of Linqto publicly addressed false claims about the company’s share ownership in Ripple, underscoring the importance of relying on accurate and verified information available on their official channels. Their disclosure aims to reassure investors regarding the security of their investments, as circulating rumors can inadvertently spark fear and uncertainty.

The clarification from Linqto comes amidst growing scrutiny from regulatory bodies and the public alike. In their messaging, Linqto emphasized the need for investors to be vigilant and to question unverified reports that could mislead them regarding the ownership of Ripple shares. This commitment to transparency is crucial in restoring investor confidence and quelling the noise generated by misinformation, particularly as Linqto faces its own legal challenges and scrutiny from federal officials.

The Role of Linqto in Ripple Shareholding Clarification

Linqto plays a pivotal role in clarifying Ripple shareholding amidst ongoing market speculation and regulatory scrutiny. By confirming their ownership of 4.7 million Ripple shares, Linqto aims to dispel any doubts regarding its investment’s legitimacy and stability. This kind of transparency is particularly essential not only for Linqto’s customers but also for the broader investor community that may be affected by misleading statements regarding share ownership.

Additionally, the ongoing investigation by the SEC and DOJ into Linqto’s operations raises questions about the legitimacy of various transactions in the secondary markets. Clarifications from Linqto are crucial as they navigate these issues, keeping stakeholders informed while necessary legal proceedings unfold. The challenges reveal the importance of maintaining clear communication regarding asset ownership to help mitigate confusion and misinformation in the marketplace.

Legal Implications for Linqto Regarding Ripple Shares

As Linqto faces investigations from regulatory bodies concerning its operations and potential legal transgressions, the implications for its ownership of Ripple shares grow increasingly pronounced. The claims surrounding Ripple share ownership and the legitimacy of their acquisitions could lead to significant legal challenges, especially if findings suggest misrepresentation or violations of securities laws. This scenario is concerning for investors who hold shares transferred through Linqto’s platform.

Legal complications tied to Ripple shares also emphasize the broader significance of adhering to regulations and ensuring ownership rights are clearly established. The shadow cast by potential legal battles not only affects Linqto’s reputation but also the market value of the Ripple shares it claims to hold. Investors must remain informed about these evolving legal circumstances, as they could ultimately impact their financial positioning within the Ripple investment landscape.

Mitigating Ripple Market Misinformation: A Call for Investor Vigilance

The rise of misinformation in the Ripple market highlights the imperative need for investors to practice diligence and require verified sources for their information. Linqto’s public statement serves as an essential reminder for investors to be wary of unverified claims that can alter perceptions, impact their financial decisions, and create volatility in share values. This call for vigilance is especially relevant in a landscape where rumors can spread rapidly and influence market psychology.

Additionally, platforms like Linqto must take proactive steps to educate their users about verifying information before making investment decisions. Encouraging investors to look beyond social media posts and instead rely on authoritative sources can enhance market integrity and reduce the influence of speculative misinformation. Building this awareness among investors is essential in fostering a healthier investment atmosphere where knowledge prevails over fear.

Ripple and Its Strategic Approach to Share Ownership Communication

Ripple has adopted a strategic approach to communicating its share ownership practices amidst the whirlwind of misleading information. By publicly distancing itself from Linqto’s internal issues, Ripple aims to dissociate itself from any potential fallout that may arise from Linqto’s ongoing legal challenges. This careful navigation reflects a broader strategy to maintain its own credibility and investor trust in a time when market uncertainty reigns.

Moreover, Ripple’s emphasis on transparent communication regarding its stake in the market plays a critical role in maintaining investor confidence. By openly discussing who owns Ripple shares and clarifying its business relationships with platforms like Linqto, Ripple is working hard to reduce anxiety among its shareholders. This level of transparency is essential in keeping the marketplace informed and in minimizing the chaos caused by misinformation, thereby stabilizing its share value in the competitive landscape.

Investing in Ripple via Linqto: Risks and Recommendations

Investing in Ripple through Linqto presents unique risks that potential shareholders must acknowledge, especially in light of current regulatory scrutiny and misinformation circulating in the market. Stakeholders are urged to conduct thorough due diligence before committing funds, including the advisability of understanding Linqto’s business model and its implications on Ripple share ownership. Given the current climate, mindful investing practices are more important than ever.

Simultaneously, investors should stay attuned to updates regarding the regulatory environment and any changes in Linqto’s operational status that may impact their investments. With rising legal challenges and monitoring from the SEC, it is crucial to remain informed about factors that could influence the broader market for Ripple shares. This strategic awareness can provide investors with an edge in navigating the complexities of the investment landscape.

The Future of Ripple Shares: Trends and Predictions

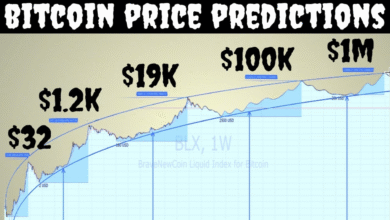

The future of Ripple shares hinges on various factors, particularly how Linqto navigates its current challenges and what implications these might have for secondary market transactions. As regulatory bodies continue their scrutiny, the outcome of these investigations will likely dictate the market’s direction and the stability of Ripple share ownership as a whole. Analysts anticipate that developments in this space will inform investor strategies going forward.

Furthermore, the technological advancements and partnerships Ripple pursues may also significantly influence future trends regarding its share ownership. As Ripple navigates through regulatory and market pressures, innovation within its operations can potentially enhance its market position, thereby positively affecting the value of Ripple shares. Investors should keep a close watch on Ripple’s initiatives and the accompanying market responses to gauge the possible implications for their investments.

Frequently Asked Questions

What is the current status of Ripple share ownership amidst recent news?

Ripple share ownership remains stable despite widespread rumors. Linqto has confirmed it still holds 4.7 million Ripple shares through Liquidshares LLC, refuting viral misinformation circulating on social media about the sale of these shares.

How does Linqto’s involvement affect the perception of Ripple shares?

Linqto’s recent confirmation of its 4.7 million Ripple shares reassures investors about their stake. The platform emphasizes that their ownership remains unchanged and warns customers to rely on verified information to avoid falling for market misinformation.

What clarification has Linqto provided regarding Ripple shareholding?

Linqto has clarified that it has not sold its Ripple shares, responding to false claims made on social media. The company stands firm with its ownership status amidst scrutiny and reassures investors of the security of their Ripple share ownership.

Is Linqto’s investment platform secure for purchasing Ripple shares?

While Linqto maintains it has 4.7 million Ripple shares, the platform is facing regulatory scrutiny, including investigations by the SEC and DOJ. Investors should exercise caution and verify information directly from Linqto regarding Ripple share purchases.

What implications does misinformation have on Ripple shares?

Misinformation about Ripple share ownership can create unnecessary fear and uncertainty in the market. Linqto warns customers to be cautious of unverified claims, highlighting the importance of relying on credible sources for information about Ripple shares.

Did Ripple directly sell shares to Linqto?

No, Ripple confirmed that Linqto acquired its 4.7 million shares through secondary market transactions with existing shareholders, not through direct sales or business relationships with Ripple.

What should investors do to stay informed about Ripple shares news?

Investors should rely on Linqto’s official announcements and website for accurate information related to Ripple share ownership and avoid basing decisions on unverified social media reports.

How are legal actions affecting Ripple share ownership perceptions?

Increasing regulatory scrutiny and Linqto’s Chapter 11 bankruptcy filing may influence market perceptions of Ripple shares. It’s essential for investors to stay updated on developments to make informed decisions regarding their shareholdings.

What are the risks associated with Ripple share investments through Linqto?

Investing in Ripple shares via Linqto could carry risks due to ongoing investigations into the platform’s practices and ownership clarity. Potential investors should carefully evaluate these risks before making investment decisions.

How does Ripple respond to Linqto’s shareholding claims?

Ripple has clarified that it does not control Linqto’s business operations and has ceased approving Linqto’s secondary market transactions since late 2024. This separation aims to address any confusion about Ripple’s direct involvement with Linqto.

| Key Point | Details |

|---|---|

| Linqto’s Share Ownership | Linqto affirms ownership of 4.7 million Ripple shares via Liquidshares LLC. |

| Response to Misinformation | Linqto addressed false claims related to its Ripple shares made by Capsign’s CEO on social media. |

| Regulatory and Legal Matters | Investigations by SEC and DOJ concerning Linqto’s compliance and share ownership legitimacy. |

| Public Guidance | Linqto advises customers to rely on official communications to avoid misinformation. |

| Operational Issues | Linqto has filed for Chapter 11 bankruptcy amid ongoing investigations and internal problems. |

Summary

Ripple share ownership has been under the spotlight as Linqto faces scrutiny regarding misinformation and regulatory pressures. The firm has confirmed that it holds 4.7 million Ripple shares, countering claims of ownership made by a competitor. As legal investigations unfold, it becomes increasingly critical for investors to be informed through verified sources to understand their stake in the market.