Market Strategies 2025: Insights from Vanguard and BlackRock

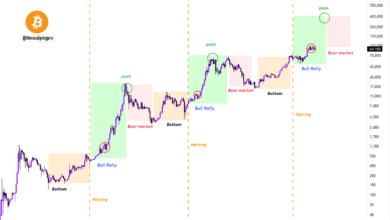

As we approach 2025, understanding effective market strategies is crucial for investors navigating the dynamic financial landscape. Market Strategies 2025 will emphasize the importance of adapting to evolving economic conditions, with experts like Roger Hallam from Vanguard advising a strong focus on fixed income amid anticipated stock market volatility. With inflation and interest rates projected to rise, investors must be prepared for various scenarios, including a potential deceleration in economic growth. Meanwhile, BlackRock’s insights highlight innovative approaches such as barbell strategies and buffer ETFs to enhance portfolio resilience. By leveraging these strategies, investors can position themselves effectively against future equity market trends and capitalize on market opportunities.

The upcoming investment climate in 2025 will significantly influence financial decision-making. Long-term investors are encouraged to consider innovative tactics to stay ahead, adapting to shifting economic signals like the fluctuating rates of inflation and interest. Renowned firms are unveiling advanced tactics—like those from Vanguard and BlackRock—geared toward balancing growth risks while maximizing potential returns. Concepts such as diversified portfolios and strategically timed reallocations will be paramount as we analyze projections for fixed income and equities. By focusing on robust investment frameworks and trends, stakeholders can effectively navigate the challenges presented by the market.

Vanguard Market Insights for 2025

As Vanguard prepares for the second half of 2025, the firm underscores the importance of maintaining a balanced portfolio that includes substantial exposure to fixed income assets. According to Roger Hallam, Vanguard’s global head of rates, a gradual deceleration in growth is anticipated, coupled with a cooling labor market. This environment suggests a strategic pivot for investors who need to focus on quality bonds that can provide stability against market volatility. Elevated inflation, combined with a potential shift in the Federal Reserve’s interest rate policy, may further solidify the case for fixed income allocation.

Vanguard’s launch of three new U.S. government bond ETFs this week, particularly the Vanguard Government Securities Active ETF (VGVT), signals a decisive move towards enhancing income generation for investors. With U.S. Treasuries represented heavily in the ETF, current yield trends, such as the decline in the 10-year Treasury rate from about 4.57% to 4.4%, may motivate long-term holders seeking safety and income during uncertain economic times. This strategy aligns with broader trends observed in fixed income forecasts, which predict a more favorable climate for bond investment.

BlackRock Investment Strategies for a Changing Market

BlackRock’s approach for the latter half of 2025 is multifaceted, focusing on resilience and opportunity amid an evolving economic landscape. Jay Jacobs emphasizes the effectiveness of a barbell strategy that leans on both conservative fixed income and selective equity investments. He foresees a significant infusion of previously stagnant cash into equity markets, as investors seek to capitalize on emerging opportunities while hedging against potential downturns. This dual approach not only mitigates risks associated with inflation and fluctuating interest rates but also targets growth sectors that show robust potential.

Among BlackRock’s innovative offerings are a range of buffer ETFs designed to protect against losses while allowing for modest upside potential. The iShares Large Cap Max Buffer June ETF (MAXJ) exemplifies this strategy, showcasing a cap of approximately 7% exposure to the S&P 500 over the coming year. This structure not only appeals to risk-averse investors but also aligns with broader equity market trends driven by macroeconomic factors such as artificial intelligence and infrastructure investment. Jacobs’ insights reflect a keen understanding of the need for strategic positioning as markets navigate geopolitical challenges and a fragmented economic environment.

Fixed Income Forecasts: Preparing for Challenges

In light of current market conditions, analysts suggest that a robust fixed income investment strategy may be essential for navigating uncertainties in the second half of 2025. As inflationary pressures persist and interest rates are managed by the Federal Reserve, investors are urged to assess their portfolios and consider increasing their allocations to bonds. Effective treasury management can provide a buffer against stock market fluctuations, offering both security and modest returns during periods of economic unease.

Moreover, the expected deceleration in economic growth could signal a shift in investor sentiment towards fixed income as a preferred asset class. With yields on government bonds responding to changes in market dynamics, investors are advised to stay informed about the implications of interest rate movements on their fixed income holdings. Maintaining agility in their investment strategies can provide significant advantages, allowing for timely adjustments that align with evolving market conditions.

Equity Market Trends and Future Opportunities

The equity market landscape for the latter half of 2025 is set to be influenced by a combination of macroeconomic conditions and investor sentiment. As Jay Jacobs from BlackRock hints towards emerging sectors, particularly in technology and infrastructure, new trends may underpin market resilience. Investors are likely to shift towards equities that align with substantial growth catalysts, emphasizing the importance of understanding market dynamics around sectors such as artificial intelligence, which remain at the forefront of investment discussions.

Furthermore, the interplay between inflation and interest rates is expected to shape which equity sectors could outperform. Companies positioned to benefit from changing consumer preferences and technological advancements might experience significant investor interest. Consequently, staying attuned to equity market trends could present opportunities for savvy investors looking to capitalize on these developments, helping them to build a forward-looking growth strategy.

Navigating Inflation and Interest Rates

Navigating the complexities of inflation and interest rates will be critical for both Vanguard and BlackRock clients moving through 2025. With inflation continuing to challenge purchasing power, investment strategies must adapt to protect asset values. The anticipated actions of the Federal Reserve, particularly in relation to interest rate adjustments, could significantly impact investment decisions. Maintaining a diversified portfolio that reflects these changing conditions is essential for preserving wealth and capital.

Investors are encouraged to monitor inflation trends closely, as rising prices could force adjustments in their investment allocations. The strategic selection of bonds and stocks, particularly those resilient to inflationary pressures, will be pivotal. This nuanced understanding of the current economic backdrop will empower investors to develop targeted strategies that effectively address their long-term financial goals in a shifting interest rate environment.

The Role of Buffer ETFs in Market Resilience

Buffer ETFs present a valuable tool for investors looking to navigate the complexities of the current market environment. As described by Jay Jacobs, these financial instruments—specifically designed to limit downside risk—align perfectly with the cautious optimism that characterizes market strategies for the second half of 2025. By offering defined protection levels, buffer ETFs allow investors to participate in potential upside without exposing themselves fully to market volatility, making them an attractive option during uncertain times.

Further, BlackRock’s approach to buffer ETFs highlights a growing trend towards defensive investment strategies that seek to balance risk and reward. As economic conditions shift, particularly with a looming potential recession, the ability to access equities with downside protection could appeal to investors hesitant to fully commit to risk-laden assets. Consequently, the adoption of buffer ETFs might become a cornerstone of strategic portfolio management for those anticipating fluctuations in market performance.

Allocation Strategies in the Current Economic Climate

Sound allocation strategies are crucial as investors position themselves for the second half of 2025. Both Vanguard and BlackRock emphasize the need for a meticulous approach that reflects the volatility of the market and the changing economic landscape. By optimizing the distribution of assets between fixed income, equities, and other growth sectors, investors can craft portfolios resilient to both market downturns and inflationary pressures.

Investors must consider their risk tolerance and overall financial goals when deciding on allocation strategies. By balancing traditional investments in fixed income with exposure to high-potential equities, particularly those fueled by macroeconomic trends, investors can aim to enhance returns while navigating uncertainty. Vigilance in monitoring market conditions and economic indicators will inform these strategies, ensuring that portfolios remain aligned with both short-term realities and long-term aspirations.

Technological Trends Shaping Infrastructure Investment

The growing emphasis on infrastructure investment is a response to evolving economic conditions and geopolitical factors impacting markets. As Jay Jacobs of BlackRock mentions, strong macro trends like infrastructure growth are increasingly seen as strategic bets in the equity markets. With significant government spending plans and a push for modernization across sectors, this creates a fertile ground for investors to capitalize on infrastructure-related equities that promise robust returns.

Technological advancements further enhance the appeal of infrastructure investments, as innovations in energy, transportation, and communication systems promise to redefine efficiency and performance. Investors are encouraged to track these developments closely, ensuring that their portfolios reflect the anticipated benefits of infrastructure expansions. By aligning investment strategies with this transformative sector, investors can position themselves favorably for substantial long-term gains while meeting pressing societal needs.

Investor Sentiment and Market Dynamics

Investor sentiment is a crucial indicator of market dynamics, particularly as we enter the latter half of 2025. The psychological component of investing can lead to rapid shifts in capital allocation, as seen in responses to inflation news and central bank communication. Both Vanguard and BlackRock highlight the importance of gauging market sentiment to inform strategic decisions, ensuring that client portfolios respond proactively to changing market conditions.

In times of uncertainty, such as economic slowdowns or geopolitical tensions, investor confidence can shift dramatically, influencing overall market performance. Analysts and investment firms must equip clients with insights to navigate these changes, ultimately fostering a resilient and adaptable investment approach. By understanding and anticipating shifts in investor sentiment, firms can better guide their clients through challenging economic periods.

Frequently Asked Questions

What are the key elements of Vanguard market strategies for 2025?

Vanguard’s market strategies for 2025 include maintaining a significant allocation to fixed income, especially as economic growth decelerates. Roger Hallam emphasizes that long-term investors should prepare for potential stock market weaknesses by investing in bonds. Vanguard is launching new U.S. government bond ETFs to enhance fixed income exposure, which they predict will perform well due to forthcoming interest rate cuts from the Federal Reserve.

How is BlackRock adapting its investment insights for the second half of 2025?

BlackRock’s investment insights for the latter half of 2025 focus on a barbell strategy that balances risk by combining safe assets with equities. Jay Jacobs suggests that investors will gradually re-enter equity markets as stagnant cash is deployed, particularly through buffer ETFs that offer downside protection while still providing upside potential. This strategy aims to cope with economic slowdown risks effectively.

What fixed income forecast can investors expect in 2025 according to Vanguard?

According to Vanguard, the fixed income forecast for 2025 looks promising as they anticipate a favorable environment for bonds. As the Federal Reserve is expected to reduce interest rates to support job preservation, investors may see better returns on fixed income assets, making them an attractive option in the current market climate.

What equity market trends are anticipated for mid-2025?

Mid-2025 is predicted to showcase notable equity market trends influenced by macroeconomic factors such as infrastructure growth and advancements in artificial intelligence. Both Vanguard and BlackRock highlight these sectors as focal points for investors, suggesting an opportunistic stance toward companies involved in infrastructure projects and innovative technology.

How are inflation and interest rates expected to impact market strategies in 2025?

Inflation and interest rates are central to 2025 market strategies, with both Vanguard and BlackRock acknowledging that rising inflation may lead to reduced interest rates as a countermeasure. This scenario could provoke a shift in investor behavior, favoring fixed income transactions initially, before re-establishing broader equity positions as economic conditions stabilize.

What role do buffer ETFs play in BlackRock’s strategy for 2025?

In BlackRock’s strategy for 2025, buffer ETFs serve a pivotal role by providing investors with a protective layer against market volatility while offering growth potential. These funds are designed to mitigate losses and attract investors looking to establish a foothold in equities amidst a cautious economic outlook, with products like the iShares Large Cap Max Buffer June ETF already gaining traction.

Why is it important to focus on fixed income in 2025 according to market experts?

Market experts, including those at Vanguard, stress the importance of fixed income in 2025 as a defensive move against anticipated stock market fluctuations. Given forecasts for economic deceleration and potential interest rate reductions, fixed income investments are projected to yield stable returns, offering a safe harbor for investors amid uncertainty.

| Key Point | Details |

|---|---|

| Market Performance Outlook | Weaker stock market performance is expected in the second half of 2025. |

| Vanguard’s Strategy | Maintain exposure to fixed income; optimistic about bonds due to anticipated interest rate cuts. |

| BlackRock’s Strategy | Recommending a barbell approach with buffer ETFs as a hedge against economic slowdown. |

| ETF Launches | Vanguard to launch three U.S. government bond ETFs, with a focus on Treasuries. |

| Yield Trends | The benchmark 10-year Treasury yield has slightly declined from 4.57% to 4.4%. |

| Investment Trends | Investors may focus on strong macro trends such as AI and infrastructure amidst market volatility. |

Summary

Market Strategies 2025 indicate a cautious approach is required for the upcoming months, as key players like Vanguard and BlackRock adapt their strategies to navigate shifting economic conditions. With expectations of a cooler labor market and rising inflation, investors are encouraged to shift towards fixed income and consider diversified ETF products that provide stability and growth potential against the background of economic uncertainty. Recognizing these market strategies early can help investors position themselves effectively as they prepare for the challenges and opportunities that await in 2025.