Bitcoin CEO Salary: First in Japan Paid Entirely in BTC

The topic of Bitcoin CEO salary has recently gained significant attention, particularly with the news that Remixpoint, a Japanese company, is setting a precedent by paying its CEO entirely in bitcoin. This bold move aligns executive compensation directly with the value of Bitcoin, resonating with contemporary trends in CEO compensation in Bitcoin and emphasizing the importance of shareholder value. By adopting a crypto-centric corporate strategy, Remixpoint is not just innovating in financial compensation; it’s also setting an example for others in the industry. The decision reflects the growing trend of companies integrating digital currencies and aligning their treasury management with the evolving landscape of blockchain technology. As such, this pioneering approach highlights the potential for Bitcoin payment systems to redefine traditional corporate structures.

In a groundbreaking development for corporate governance, companies are beginning to rethink executive remuneration structures regardless of traditional currencies. The approach taken by Remixpoint stands out as it embraces the notion of linking CEO pay to cryptocurrencies, particularly Bitcoin. By opting for full compensation in bitcoin, the company signals its commitment to aligning its leadership’s interests with the rapidly evolving market of digital assets. This move opens up discussions around remuneration strategies in the crypto realm and draws attention to the significance of Bitcoin in reshaping financial management and treasury strategies in the corporate world. As more firms explore these innovative frameworks, the implications for corporate finance and blockchain integration will continue to unfold.

The Future of CEO Compensation in Bitcoin

The recent move by Remixpoint to pay its CEO entirely in Bitcoin marks a significant evolution in corporate salary structures. With the increasing adoption of cryptocurrencies in mainstream finance, executives’ compensation packages are starting to reflect this trend. Paying salaries in Bitcoin aligns the interests of CEOs with shareholders by directly linking their compensation to the performance of the crypto asset. This also showcases a pioneering shift in how modern businesses are integrating digital currencies into their corporate strategies.

As Bitcoin continues to gain traction as a store of value, more companies may consider adopting similar structures for executive compensation. This strategy not only potentially enhances shareholder value but also attracts tech-savvy investors who appreciate innovation in financial practices. It offers a dual benefit: aligning leadership incentives with the next generation of financial instruments while cultivating a forward-thinking corporate image.

Bitcoin Treasury Management and Corporate Strategy

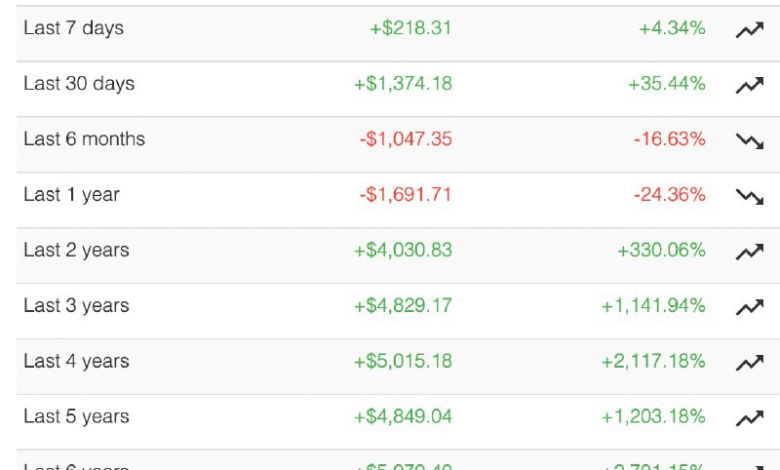

Effective treasury management is critical for any organization, particularly those engaging with volatile assets like Bitcoin. Remixpoint’s decision to integrate Bitcoin into its treasury strategy opens doors to new methodologies for managing corporate assets. Strategies might involve not just holding Bitcoin but also actively managing these assets to capitalize on market movements and investor sentiment. With a solid accumulation plan in place, Remixpoint aims to leverage Bitcoin’s appreciation over time, which could fortify its balance sheet.

Incorporating Bitcoin into corporate treasury strategies requires a sophisticated approach, balancing potential risks with remarkable upside potential. Companies leveraging Bitcoin can also diversify their asset allocation, potentially decreasing dependency on traditional fiat currency. As businesses increasingly adopt cryptocurrencies, establishing frameworks for effective treasury management will become essential, encouraging a broader embrace of digital currencies across various sectors.

CEO Compensation Trends in the Crypto Industry

The decision by Remixpoint to pay its CEO in Bitcoin is reflective of a growing trend within the crypto industry that emphasizes performance-based compensation. As digital currencies rise in prominence, CEO compensation in this sector is increasingly tied to cryptocurrency performance rather than traditional currencies. This shift underscores the belief that corporate success should be directly correlated with the performance of the assets that drive the business.

Industry leaders are recognizing that traditional compensation packages may not suffice in a rapidly evolving marketplace. By linking executive pay to cryptocurrency assets, companies can create a more engaged leadership that is directly incentivized to promote shareholder value. This trend could have ripple effects across industries, prompting other corporations to reconsider their compensation structures in the face of the crypto revolution.

The Impact of Bitcoin Payments on Shareholder Value

Remixpoint’s innovative approach to CEO compensation via Bitcoin emphasizes the potential impact on shareholder value. By opting for a compensation package that aligns directly with Bitcoin’s performance, the company positions itself to attract investors who value alignment between executive incentives and corporate performance. This could lead to enhanced investor confidence, boosting the company’s market reputation and, consequently, its stock value.

Moreover, shareholder feedback has played a crucial role in this decision. Investors increasingly desire assurance that their interests are being prioritized at the executive level, and Bitcoin payments could serve as a compelling mechanism to signal this commitment. As more companies adopt similar practices, the reliance on Bitcoin as a measure of performance will likely continue to grow, strengthening its stature within corporate governance.

Remixpoint’s Crypto Corporate Strategy: A Case Study

Remixpoint’s corporate strategy marks a forward-thinking approach by intertwining its operations with cryptocurrency. By embracing a Bitcoin-centric framework, the company not only enhances its market positioning but also sets a precedent for how other firms can operate. This case study highlights the adaptability of businesses in an age where traditional financial systems are being disrupted by innovations in digital currencies.

The incorporation of crypto payments into corporate strategies signals a broader acceptance of digital assets as viable components of business operations. Remixpoint’s proactive approach serves as a model for other organizations looking to innovate while fostering deeper connections with their investors. This strategy illustrates that companies engaging with cryptocurrencies are well-poised to navigate the future of finance.

Why Bitcoin is Becoming a Preferred Asset for Corporations

Bitcoin’s growing reputation as a stable and appreciating asset has led many corporations to reconsider their investment strategies. Companies like Remixpoint are recognizing Bitcoin not only as a payment method but as a reserve asset that can help safeguard against economic fluctuations. The asset’s decentralized nature provides an attractive alternative to traditional fiat currencies, which may lack the same level of long-term security.

Additionally, Bitcoin’s limited supply reinforces its potential as a hedge against inflation, making it an appealing asset for corporate treasuries. Firms are now evaluating how Bitcoin can play a role in their asset allocation, recognizing its potential to add value and increase financial autonomy in an unpredictable market.

The Role of Leadership in Shaping Crypto Strategy

Leadership plays a crucial role in shaping and defining a company’s strategy regarding cryptocurrencies. In the case of Remixpoint, the decision to issue the CEO’s salary entirely in Bitcoin reflects the strategic vision of its leadership to embrace innovation and disrupt traditional pay structures. Effective leadership will drive the adoption of such strategies, ensuring alignment between executive goals and market realities.

As the crypto landscape evolves, leaders must remain adaptable and forward-thinking to harness the benefits of cryptocurrencies. They need to communicate effectively with stakeholders about the rationale behind integrating digital assets into the corporate strategy. By establishing trust and setting a clear vision, leadership can guide the successful implementation of a crypto-centric corporate approach.

Investor Influence in Executive Compensation Decisions

Investor sentiment is increasingly shaping corporate practices, especially in the context of executive compensation. With the rise of cryptocurrencies, investors are advocating for compensation strategies that align better with company performance and market realities. Remixpoint’s move to compensate its CEO in Bitcoin can be seen as a direct response to such investor calls, showcasing a willingness to adapt to investor expectations.

Furthermore, as shareholders demand more transparency and alignment in executive compensation, companies must navigate these preferences to maintain investor confidence. This shift towards a more performance-based compensation structure using cryptocurrencies is likely to grow, fostering healthier relationships between investors and executives.

Navigating Corporate Compliance with Bitcoin Salaries

Transitioning to a salary structure based on Bitcoin involves navigating complex regulatory and compliance landscapes. Remixpoint has taken steps to ensure that its innovative approach complies with local tax laws while still fulfilling its commitment to executive compensation in cryptocurrency. Understanding and adhering to regulatory requirements is essential for companies exploring similar paths.

As the legal frameworks surrounding cryptocurrencies continue to evolve, companies must remain vigilant in ensuring compliance while pursuing innovative strategies. Balancing effective treasury management with legal adherence allows firms to leverage the benefits of cryptocurrencies without exposing themselves to undue risks.

The Ripple Effect of Bitcoin CEO Salaries on Global Markets

Remixpoint’s decision to pay its CEO entirely in Bitcoin could have a ripple effect beyond Japan, influencing global companies to reevaluate how they approach executive compensation. As more firms witness the potential benefits linking CEO pay to an appreciating asset like Bitcoin, it may catalyze a broader trend across the corporate landscape. This could lead to increased acceptance and integration of cryptocurrencies within standard business practices.

By establishing this policy, Remixpoint not only sets a precedent but may inspire other firms to explore similarly innovative strategies. This could culminate in an era where digital assets become mainstays in corporate finance, prompting changes in investor expectations and market dynamics as they adapt to a more crypto-friendly business environment.

Frequently Asked Questions

What is the Bitcoin CEO salary at Remixpoint?

At Remixpoint, the CEO salary is paid entirely in Bitcoin, making it a pioneering move in Japan’s corporate landscape. Although the payment is technically made in yen to comply with local laws, it is immediately converted to Bitcoin, reflecting the company’s commitment to a Bitcoin treasury management strategy.

How does CEO compensation in Bitcoin work at Remixpoint?

Remixpoint’s CEO compensation utilizes a unique model where the entire salary is switched to Bitcoin right after the payment is processed. This aligns executive compensation with the company’s Bitcoin-centric corporate strategy and reinforces shareholder interests.

What implications does Remixpoint’s Bitcoin CEO salary have for corporate strategy?

The decision to implement a Bitcoin CEO salary signals Remixpoint’s strategic alignment with its shareholder base, aiming to enhance value through Bitcoin treasury management. This approach showcases how companies can integrate crypto into their executive compensation models to reflect a commitment to digital assets.

Why did Remixpoint choose to pay its CEO completely in Bitcoin?

Remixpoint decided to pay its CEO fully in Bitcoin to strengthen shareholder alignment and demonstrate its dedication to a crypto-centric corporate strategy. This move comes in response to investor requests for enhanced executive alignment with Bitcoin’s value.

Is Remixpoint the first company to pay its CEO in Bitcoin?

Yes, Remixpoint is the first publicly listed company in Japan to pay its CEO completely in Bitcoin, illustrating a trend towards innovative crypto compensation strategies in corporate governance.

What does the move to CEO compensation in Bitcoin say about crypto adoption in Japan?

Remixpoint’s adoption of Bitcoin CEO salary highlights an increasing acceptance of cryptocurrency in traditional finance. This milestone reflects the evolving landscape of corporate governance in Japan and sets a precedent for other companies considering similar crypto corporate strategies.

How does paying CEO salary in Bitcoin affect shareholder value at Remixpoint?

By paying its CEO in Bitcoin, Remixpoint aims to directly link executive incentives with shareholder outcomes, potentially boosting shareholder value through increased alignment on the firm’s Bitcoin treasury management initiatives.

What legal considerations are involved in Bitcoin CEO salary payments in Japan?

Although Remixpoint pays its CEO in Bitcoin, they comply with local corporate and tax laws by executing the payment in yen. The yen amount is converted to Bitcoin, ensuring legal adherence while promoting a digital asset strategy.

Can other companies follow Remixpoint’s example of paying CEO salaries in Bitcoin?

Yes, other companies can emulate Remixpoint’s model of paying CEO salaries in Bitcoin, as it demonstrates a viable integration of cryptocurrencies in corporate compensation, thus encouraging further adoption of digital assets in executive pay structures.

What are the benefits of CEO compensation in Bitcoin for Remixpoint?

For Remixpoint, the benefits of CEO compensation in Bitcoin include attracting crypto-savvy investors, enhancing corporate governance through alignment of interests, and leveraging Bitcoin as a core asset in its treasury management strategy.

| Key Point | Details |

|---|---|

| Remixpoint’s Policy | The CEO will receive 100% of their salary in bitcoin. |

| First in Japan | First public company in Japan to pay its CEO in bitcoin. |

| Alignment with Shareholders | The initiative is designed to align executive incentives with shareholder value. |

| Compliance with Laws | Salary paid in yen but converted to bitcoin immediately. |

| Confidence in Bitcoin | Remixpoint believes in bitcoin as a key corporate asset. |

| BTC Accumulation Plan | Creating a $215 million BTC accumulation plan. |

| Next-Generation Treasury Strategies | Investigating innovative treasury strategies involving digital assets. |

Summary

The topic of Bitcoin CEO salary has taken a significant turn with Remixpoint’s announcement of paying its CEO entirely in bitcoin. This groundbreaking move not only establishes a new precedent within the corporate sector in Japan but also underscores the growing importance of cryptocurrency in aligning executive compensation with shareholder interests. By converting the salary into bitcoin, Remixpoint blends traditional financial practices with a forward-thinking approach to asset management, demonstrating confidence in bitcoin as a fundamental corporate resource.