Bitcoin ETFs Surge with Massive Inflow Amid BTC Record

Bitcoin ETFs have emerged as a powerful attraction in the financial markets, especially highlighted by a staggering inflow of $1.2 billion on June 10, coinciding with Bitcoin (BTC) reaching a new all-time high. This extraordinary bullish trend has been marked by the largest single-day inflow recorded this year, with seven different ETFs contributing to the impressive total. Notably, Blackrock’s IBIT led the charge, bringing in $448.49 million, showcasing significant institutional demand for Bitcoin. Meanwhile, trading activity surged, pushing total trading volume to $6.31 billion and net assets of Bitcoin ETFs to a notable record high of $143.86 billion. The overall performance of crypto ETFs indicates a robust appetite among investors, extending to Ether ETFs, which have also garnered substantial attention and inflows.

Innovations in cryptocurrency investment vehicles have brought forth a wave of digital asset funds, commonly known as Bitcoin exchange-traded funds (ETFs). These funds provide a convenient way for institutional and retail investors to gain exposure to Bitcoin’s upward momentum, as demonstrated by their recent record-breaking inflows. Such funds have gained traction particularly during periods of heightened interest in the cryptocurrency market, as witnessed with the support for Ether ETFs as well. The surge in investments reflects not only a broader acceptance of digital currencies but also a growing demand among institutional players looking to diversify their portfolios with these emerging financial products. The ongoing performance of crypto ETFs, including Bitcoin and Ether variants, is set to play a pivotal role in how digital assets are integrated into mainstream finance.

Historic Inflows in Bitcoin ETFs Drive Market Performance

On June 10, 2025, Bitcoin ETFs achieved a monumental feat by attracting a record inflow of $1.2 billion, coinciding perfectly with Bitcoin (BTC) reaching a new all-time high. This remarkable surge in investments reflects the growing optimism around cryptocurrencies and represents the largest single-day inflow recorded so far this year. A total of seven ETFs registered significant contributions, showcasing a robust bullish sentiment predominating in the market.

Among the standout performers, Blackrock’s IBIT ETF led the charge, amassing an impressive $448.49 million. Fidelity’s FBTC followed closely with $324.34 million, while Ark 21shares’ ARKB also made headlines with a noteworthy inflow of $268.70 million. These contributions not only highlight the dominant role of institutional players in driving Bitcoin ETF performance but also underscore the heightened interest from investors seeking exposure to cryptocurrencies amid rising asset prices.

The Impact of Institutional Demand on Bitcoin Market Trends

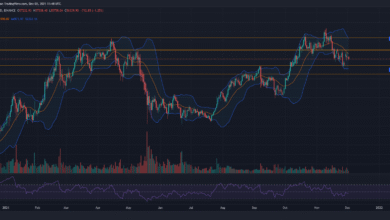

Institutional demand for Bitcoin has been on the rise, significantly influencing market dynamics. The remarkable inflow into Bitcoin ETFs is indicative of a broader acceptance of digital assets among institutional investors. As reported, total trading volume skyrocketed to $6.31 billion, with net assets reaching an unprecedented high of $143.86 billion, accounting for 6.37% of Bitcoin’s overall market capitalization. This trend hints at a robust belief in the longevity and potential of Bitcoin as a mainstream asset class.

Investors are increasingly turning to ETFs as a variant of investment that offers exposure to Bitcoin’s growth while mitigating some associated risks. The influx of institutional money signifies confidence in Bitcoin’s long-term viability, further stimulating investor interest and market participation. The increasing popularity of Bitcoin ETFs is shaping the investment landscape, attracting a diverse array of investors seeking to benefit from Bitcoin’s potential price appreciation.

Ether ETFs Follow Bitcoin’s Footsteps with Significant Inflows

While Bitcoin ETFs have captured considerable attention, Ether ETFs are also experiencing substantial inflows. On the same day of Bitcoin’s record inflow, Ether ETFs garnered a commendable $383.10 million. Blackrock’s ETHA emerged as the frontrunner, attracting $300.93 million. This rising interest in Ether ETFs underscores the growing acceptance of Ethereum as a viable alternative investment to Bitcoin, appealing to investors looking for diversity in their cryptocurrency portfolios.

The positive trends in Ether ETFs, driven by investor enthusiasm, highlight the expanding landscape of crypto-focused investment products. Fidelity’s FETH and Grayscale’s Ether Mini Trust also contributed significantly to this momentum, suggesting that institutional demand for cryptocurrencies is not limited to Bitcoin. As Ethereum’s ecosystem continues to evolve, with innovations such as smart contracts and decentralized finance (DeFi), its popularity within the ETF space is likely to rise, further challenging Bitcoin’s dominance.

Analysis of the Overall Crypto ETF Performance in 2025

In analyzing the overall performance of crypto ETFs in 2025, the numbers present a clear picture of the market’s growth trajectory. The impressive inflows into Bitcoin and Ether ETFs signal a strong bullish sentiment across the crypto landscape. The data indicates a shift where institutional investors are allocating more capital to digital assets, reflecting a broader trend toward crypto adoption. These developments suggest a strong foundation for future growth in the asset class.

Moreover, the apparent resilience of crypto ETFs against market fluctuations, demonstrated by the limited outflows—such as Grayscale’s GBTC encountering a relatively minor $40.17 million outflow—indicates a sense of stability returning to the market. As net inflows increase, the crypto ETF market may become an essential component of investment strategies for both institutional and retail investors seeking exposure to the burgeoning digital asset space.

Exploring the Factors Behind Bitcoin’s All-Time High

Bitcoin’s recent all-time high is attributed to several key factors, with institutional demand being the most significant. The influx from Bitcoin ETFs can be seen as a direct response to the growing interest in cryptocurrencies as an asset class. Low interest rates and inflationary pressures have prompted investors to seek alternative stores of value, further elevating Bitcoin’s appeal. This shifting sentiment can create a perfect storm, fostering conditions conducive for Bitcoin price surges.

Furthermore, the heightened trading volumes and record net assets in Bitcoin ETFs suggest an increasing level of participation in the cryptocurrency market. Investors now see Bitcoin not only as a speculative asset but as a legitimate part of their investment portfolios. This trend signals a maturation of the cryptocurrency market, as more people begin to recognize Bitcoin’s potential role in hedging against economic uncertainties.

The Role of Bitcoin ETFs in Institutional Investing

Bitcoin ETFs have become pivotal in facilitating institutional investment in digital assets. These funds provide a safer and more regulated method for institutions to gain exposure to Bitcoin, mitigating some of the risks associated with direct ownership of cryptocurrencies. By removing barriers to entry, Bitcoin ETFs have redefined the landscape of institutional investing, making this asset class more accessible to a broader range of investors.

As more institutions choose to invest via ETFs, we may witness a paradigm shift in how digital assets are perceived in the financial world. This may encourage more traditional financial firms to launch similar products, ultimately contributing to the maturation of the cryptocurrency market. The future looks promising as Bitcoin ETFs enhance liquidity and transparency, reinforcing institutional confidence in Bitcoin as a long-term investment.

Outflows in Bitcoin ETFs: Implications for Investor Confidence

Despite the overwhelming inflows recorded, the outflows seen in certain Bitcoin ETFs, like Grayscale’s GBTC, warrant attention. A minor outflow of $40.17 million, while small in comparison to total inflows, can still shake investor confidence if not properly addressed. These outflows could signal caution among some investors or shifting strategies, which may reflect broader market sentiments.

Nevertheless, the dominant trend remains strongly positive, and these outflows may simply be a natural aspect of market dynamics in the cryptocurrency space. Investors are likely rebalancing their portfolios or seeking liquidity temporarily rather than signaling a lack of faith in Bitcoin’s future potential. Understanding the underlying reasons for these fluctuations can help investors navigate the complex waters of crypto investments with greater confidence.

Future Predictions: The Evolution of Bitcoin and Ether ETFs

Looking ahead, the evolution of Bitcoin and Ether ETFs appears promising, with projections indicating continued growth in inflows. As institutional investors increasingly embrace these products, we can expect a ripple effect, further pushing the adoption of cryptocurrencies as legitimate investments. This trend is likely to enhance both Bitcoin and Ether’s market standing, accelerating their acceptance as integral diversifiers within investment portfolios.

Moreover, advancements in regulatory frameworks and product offerings will likely lead to more innovative ETF structures that cater to the changing preferences of investors. As more companies attempt to enter the ETF space, competition will spur enhancements in product features and transparency, thereby appealing to a broader audience. Ultimately, the futures of Bitcoin and Ether ETFs are aligned with the greater adoption of cryptocurrencies in mainstream finance.

Navigating the Cryptocurrency Market: Investment Strategies

Navigating the rapidly evolving cryptocurrency market requires an informed approach, particularly for investors considering Bitcoin and Ether ETFs. With the significant market movements and impressive inflows, it’s essential for investors to strategize well and diversify their portfolios. Successful investors should weigh the unique characteristics of each ETF, understanding the specific assets and exposure it offers, as well as the management fees associated with each fund.

Furthermore, keeping an eye on market trends, regulatory changes, and macroeconomic factors is critical. Those interested in Bitcoin ETFs should also be aware of the competitive landscape and the emergence of new products that might fit their strategies better. By staying informed and considering various investment angles, investors can better position themselves to capitalize on the growing momentum of ETFs in the cryptocurrency space.

Frequently Asked Questions

What are Bitcoin ETFs and how do they relate to Bitcoin ETF inflow?

Bitcoin ETFs, or exchange-traded funds, provide investors with exposure to Bitcoin without needing to hold the cryptocurrency directly. Recently, Bitcoin ETFs saw record inflows, surpassing previous highs, indicating growing interest and investment in this asset class. For instance, on June 10, Bitcoin ETFs recorded a massive $1.2 billion inflow, demonstrating robust institutional demand.

How did the recent Bitcoin all-time high impact Bitcoin ETF performance?

The recent all-time high of Bitcoin positively impacted Bitcoin ETF performance, as evidenced by a surge in inflows. The price rally attracted more investors seeking to capitalize on Bitcoin’s upward momentum, resulting in a significant increase in trading volumes and net assets within Bitcoin ETFs.

What contributed to the largest single-day inflow in Bitcoin ETFs for 2025?

The largest single-day inflow in Bitcoin ETFs for 2025 was driven by a combination of factors, including Bitcoin hitting a new all-time high and strong institutional interest. On June 10, 2025, Bitcoin ETFs attracted $1.2 billion in inflows, with major players like Blackrock and Fidelity leading the way in attracting substantial investments.

Which Bitcoin ETF saw the highest inflow recently and how does it reflect institutional demand?

Blackrock’s IBIT ETF reported the highest inflow, attracting $448.49 million on June 10, 2025. This significant inflow not only illustrates the strength of institutional demand for Bitcoin ETFs but also highlights investor confidence in Bitcoin’s growth potential and market stability.

What trends are observed in Ether ETFs alongside Bitcoin ETFs?

Ether ETFs have seen substantial activity alongside Bitcoin ETFs, reflecting a broader trend in the cryptocurrency market. Recently, Ether ETFs experienced inflows totaling $383.10 million, signaling strong institutional interest in Ether as well. This trend suggests that investors are diversifying their crypto portfolios beyond Bitcoin.

How did total trading volume of Bitcoin ETFs change following the recent record inflows?

Following the recent record inflows into Bitcoin ETFs, total trading volume surged to $6.31 billion. This increase in trading volume underscores heightened investor activity and interest in Bitcoin ETFs as market confidence grows with Bitcoin’s price advancements.

What implications does the recent Bitcoin ETF inflow have for the future of cryptocurrency investing?

The recent Bitcoin ETF inflow suggests a bullish outlook for cryptocurrency investing, highlighting increased institutional participation. As Bitcoin ETFs attract significant capital and investors show a growing appetite for digital assets, this trend may pave the way for further innovations and developments within the cryptocurrency market.

How is institutional demand for Bitcoin reflected in the performance of Bitcoin ETFs?

Institutional demand for Bitcoin is clearly reflected in the performance of Bitcoin ETFs, especially with record inflows indicating robust interest. The overall net assets for Bitcoin ETFs reached $143.86 billion, constituting 6.37% of Bitcoin’s total market capitalization, showcasing the increasing integration of institutional investments in the crypto space.

| ETF Name | Inflow Amount (in million USD) | Remarks |

|---|---|---|

| Blackrock IBIT | $448.49 | Largest inflow among ETFs. |

| Fidelity FBTC | $324.34 | Significant contribution. |

| Ark 21shares ARKB | $268.70 | Third largest inflow. |

| Grayscale Bitcoin Mini Trust | $81.87 | Notable inflow. |

| Bitwise BITB | $77.15 | Active participation. |

| Vaneck HODL | $15.24 | Minor inflow. |

| Valkyrie BRRR | $3.21 | Smallest inflow. |

Summary

Bitcoin ETFs have seen unprecedented growth, particularly noted on June 10 when they surpassed previous records with a staggering inflow of $1.2 billion. This surge aligns with Bitcoin achieving new all-time highs, reflecting heightened interest and institutional investment in the cryptocurrency sector.