Bitcoin Price: Bullish Trend Holds as Market Eyes $120K Breakout

The Bitcoin price has captured the attention of investors as it approaches a critical psychological level, aiming for a breakout above $120K. Following a remarkable surge that brought it to an all-time high of $118,839, Bitcoin’s current trading value stands at $118,142, underpinned by a substantial market capitalization of $2.34 trillion. With a daily trading volume of $39.03 billion, market participants are intensely analyzing the implications of recent price movements, especially within the context of Bitcoin market analysis. Amid a prevailing Bitcoin bullish trend, traders are keenly observing whether this momentum will sustain, as many speculate on cryptocurrency price predictions that suggest additional upward potential. As fluctuations emerge, Bitcoin breakout analysis will be crucial in determining if the cryptocurrency can overcome its immediate resistance and maintain its trajectory toward new heights.

As Bitcoin’s value teeters on the brink of significant milestones, the cryptocurrency price landscape is poised for pivotal moments. Investors are closely monitoring Bitcoin’s trajectory, especially following its ascent past $118,000, which is generating insights into upcoming trends and trading behaviors. The recent activities in the Bitcoin marketplace highlight a passion among traders regarding Bitcoin’s future, particularly as it relates to trading volume and market dynamics. Analysts are dissecting patterns like the recent bullish movements while formulating their own predictions based on the current market landscape. This ongoing saga not only reflects the volatility typical of digital currencies but also underscores the intense speculation and strategic planning that define the world of cryptocurrency trading.

Understanding the Current Bitcoin Price Dynamics

Bitcoin’s price has shown remarkable resilience, catapulting to a new all-time high of $118,839 before experiencing a slight pullback to $118,142. As market dynamics evolve, understanding these price fluctuations is pivotal for traders aiming to capitalize on this cryptocurrency’s volatility. The market capitalization currently stands at a staggering $2.34 trillion, reflecting Bitcoin’s dominant position in the cryptocurrency space. With trading volumes reaching $39.03 billion over recent hours, the active market engagement underscores traders’ continued interest despite minor retracements.

The ongoing bullish trend is evident from Bitcoin’s stellar performance since its June low of $98,240, with a persistent trend of higher highs and higher lows. This indicates that investor sentiment remains strong, buoyed by institutional interest as evidenced by increased trading volumes during key breakout phases. As we analyze the market, it’s crucial to monitor how external factors, such as regulatory changes and macroeconomic indicators, may influence Bitcoin price movements and overall market sentiment.

Bitcoin Market Analysis: Is the Bullish Trend Sustainable?

Analyzing the current market landscape, Bitcoin seems poised to continue its upward trajectory, but investors should remain cautious. The significant breakout above the $110,000 resistance zone marked a bullish milestone, propelled by solid trading volumes, highlighting institutional backing. As Bitcoin now seeks to breach the psychological barrier of $119,000, clarity on market momentum is crucial for forecasting potential price directions. Any rejection near the previous all-time high could induce a correction, prompting traders to reassess their positions.

On the technical front, the price action observed on the 4-hour BTC/USD chart signifies the need for careful monitoring. A series of doji and small-bodied candlesticks suggest indecision among traders, reflecting a struggle between bulls and bears within the consolidation range of $117,000 to $118,000. This illustrates the vital importance of maintaining support levels to reinforce the bullish outlook. If Bitcoin can maintain trading volumes above these prices, the bullish trend is likely to endure, making future market movements increasingly significant for analysts and traders alike.

Trading Volume Insights: Key to Bitcoin’s Bullish Trend

One of the critical metrics for assessing Bitcoin’s health is trading volume, which has recorded fluctuations alongside price movements. The recent spike in volume during Bitcoin’s breakout above $112,000 was a strong indicator of buyer interest, with surplus trading activity suggesting institutional investment and a sustained bullish sentiment. However, the recent cooling of volume invites scrutiny, as diminished trading activity could lead to a halt in upward momentum, indicating potential bearishness on the horizon.

Analyzing the volume trends, the next significant move for Bitcoin relies heavily on resuming robust trading volumes. A consolidation phase can often precede significant price movements, meaning that traders must look for indications of renewed activity to confirm the potential for a sustained rally past the $119,000 mark. The interplay between volume, price movements, and external market conditions will dictate Bitcoin’s trajectory as we advance into the next trading phases.

Bitcoin Bullish Trend: Analyzing the Breakout Signals

The recent bull market for Bitcoin has gained momentum following its decisive breakout above the $110,000 to $112,000 range, and the ongoing bullish candles into July are testament to this positive trend. As an essential factor in technical analysis, a price movement characterized by higher highs and higher lows reinforces bullish sentiment among investors. Additionally, the combined support from various moving averages strengthens the overall outperformance of Bitcoin in this current market.

However, traders should remain vigilant regarding possible indicators of market correction. The psychological resistance at $118,839 must be carefully observed, as a rejection at this level could signal a potential pullback. Breakout traders are especially keen on observing heightened volumes that can lend credibility to any breakout attempts above this target. Overall, the analysis of breakout signals demonstrates the importance of aligning trading strategies with the current market trends for achieving favorable outcomes.

Cryptocurrency Price Prediction: Future of Bitcoin’s Market Position

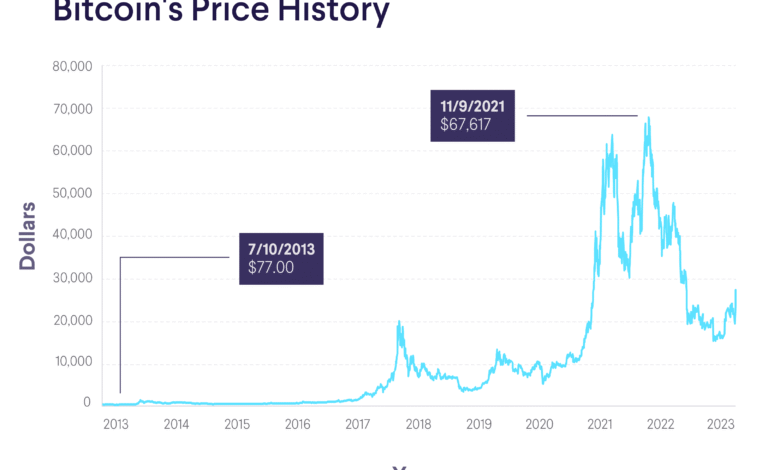

As Bitcoin continues to chart its course in the cryptocurrency landscape, price predictions become increasingly valuable for traders and investors. Current indicators suggest that a bullish sentiment prevails, heading into the anticipated $120K breakout. This projection is bolstered by historical price trends and sustained upward momentum observed since the marketplace’s resurgence from its previous lows. Forecasting models that account for both technical and fundamental analysis can provide traders with insights into potential price extensions.

Nevertheless, caution should be exercised as market conditions can evolve rapidly. With oscillators currently showing mixed signals and conflicting underlying sentiment, the prediction landscape remains complex. The journey to $120K isn’t guaranteed, and any substantial pullbacks could prompt recalibrations of these forecasts. As such, staying informed through comprehensive market analysis will be key in successfully navigating Bitcoin’s future price movements.

Analyzing Support and Resistance Levels in Bitcoin Trading

Support and resistance levels are crucial components of any trading strategy, especially in a fluctuating market like Bitcoin. Presently, the immediate support level rests around $117,500, vital for maintaining the bullish momentum observed recently. Should the price experience a dip, this region becomes a focal point for traders looking for entry opportunities. If support holds, it can provide a springboard for prices to move upward, pushing towards potential breakout scenarios.

Conversely, a break below $117,000 could signal a shift in trend, bringing previous levels of resistance into consideration for future price movements. Resistance around $118,839 poses another critical barrier that traders must monitor closely. Vigilance in tracking these levels can help inform strategic decisions, enabling traders to manage risks effectively while pursuing profit in the dynamic Bitcoin market.

Institutional Participation: A Driving Force Behind Bitcoin’s Upsurge

Big players in the financial markets have increasingly turned their attention to Bitcoin, with institutional participation acting as a key driver of the current bullish sentiment. The heightened activity from substantial institutional investors suggests confidence in Bitcoin’s long-term viability, further solidifying its standing as a leading cryptocurrency. This institutional influx correlates with increased trading volumes during breakout phases, contributing to Bitcoin’s rapid accumulation.

However, the influence of these institutional investors extends beyond just volume. Their market strategies often shape price dynamics, as significant purchases can lead to rapid price increases, while major sell-offs may induce volatility. Thus, observing the behavior of institutional participants is essential for understanding Bitcoin’s price movements and anticipating future market trends.

Bitcoin’s Technical Indicators: Gauging Market Sentiment

Technical indicators serve as essential tools for traders seeking to gauge market sentiment and make informed decisions about future Bitcoin movements. Currently, several oscillator readings highlight mixed signals, indicating a state of indecision among traders. With the RSI hovering at the verge of overbought conditions, caution is warranted; however, bullish signals from the MACD indicate underlying strength, reinforcing the bullish narrative.

Traders must consider these technical indicators holistically. Any adverse signals, particularly of a bearish nature from indicators like the CCI, should be taken seriously, as they may herald potential price corrections. Therefore, integrating technical analysis with comprehensive research and market understanding remains critical for navigating Bitcoin’s evolving landscape.

Market Sentiment Around Bitcoin: Emotion vs. Analysis

The emotional aspect of market sentiment can often overshadow analytical approaches within the Bitcoin trading scene. However, rational analysis backed by data and market trends remains indispensable for sound investment strategies. While the current bullish trend instills optimism amongst many traders, fear of potential pullbacks or corrections remains a constant undercurrent of caution in the market. Awareness of this emotional landscape can assist traders in making more reasoned decisions.

The interaction between trader psychology and market movements can create both opportunities and pitfalls. For instance, excessive euphoria during rapid price increases may lead to FOMO (fear of missing out), prompting unjustified buying sprees. Conversely, apprehension about a market downturn can lead to premature sell-offs. Hence, an equilibrium between emotion and analytical insight is crucial for sustained success in cryptocurrency trading.

Frequently Asked Questions

What factors are influencing the current Bitcoin price trend?

The current Bitcoin price trend is influenced by several factors including market analysis, trading volume, and institutional participation. After reaching a new all-time high of $118,839, Bitcoin’s price at $118,142 showcases a bullish trend supported by increased trading volume and a strong uptrend structure demonstrating higher highs and higher lows.

How does Bitcoin’s trading volume impact its price?

Bitcoin trading volume plays a critical role in price movement as it reflects market demand and investor sentiments. With a 24-hour trading volume of $39.03 billion, any significant changes in this volume can indicate potential breakouts or corrective phases in Bitcoin’s price, particularly as it navigates key resistance levels.

What is the significance of the $120,000 Bitcoin breakout analysis?

The $120,000 Bitcoin breakout analysis is significant as it represents a crucial psychological resistance level. Analysts are watching closely for Bitcoin’s ability to break above this level, which could propel prices further upward in a continued bullish trend, enhancing investor confidence and possibly leading to new all-time highs.

Are there any recent Bitcoin market analysis predictions?

Recent Bitcoin market analysis suggests that the bullish momentum may continue if the price breaks above $119,000 with sustained volume. However, traders should remain cautious due to mixed oscillator signals indicating potential overbought conditions and the risk of a price pullback if key support levels are breached.

What role does the bullish trend play in predicting the future Bitcoin price?

The bullish trend is crucial in predicting the future Bitcoin price as it serves as a foundation for potential price increases. The current bullish sentiment, characterized by strong moving averages and historical momentum, suggests that if Bitcoin can maintain above critical support levels, it may achieve further gains and even exceed recent highs.

How do market indecision and candlestick formations affect Bitcoin’s price?

Market indecision and candlestick formations indicate periods of uncertainty, which can lead to volatility in Bitcoin’s price. The presence of doji and small-bodied candles often suggests that traders are hesitant, which could lead to short-term consolidation or potential pullbacks unless strong buying momentum resumes.

What technical indicators are used in Bitcoin price analysis?

Technical indicators such as the relative strength index (RSI), moving averages, and the MACD are essential in Bitcoin price analysis. These indicators help assess market conditions, identify bullish or bearish signals, and aid traders in making informed decisions based on the strength or weakness of the current price trends.

What could lead to a short-term pullback in Bitcoin’s price?

A short-term pullback in Bitcoin’s price could occur if it fails to surpass the psychological resistance at $118,839 or if it breaks below significant support levels like $117,000. Additionally, declining volume and bearish signals from momentum indicators may signal that the rally is losing steam, prompting a correction.

How does Bitcoin’s market capitalization relate to its price fluctuations?

Bitcoin’s market capitalization, currently at $2.34 trillion, directly correlates with its price fluctuations. As the price of Bitcoin increases, the market cap grows, attracting increased attention from traders and investors, which can further drive price movements in the bullish trend.

What long-term outlook can we expect for Bitcoin’s price?

The long-term outlook for Bitcoin’s price remains positive, bolstered by the robust uptrend and favorable moving averages across all timeframes. If Bitcoin maintains momentum and successfully breaks resistance levels, it could see significant price growth, making it an attractive option for long-term investors.

| Key Point | Details |

|---|---|

| Current Bitcoin Price | $118,142 |

| Market Capitalization | $2.34 trillion |

| 24-hour Trading Volume | $39.03 billion |

| Recent All-Time High | $118,839 |

| Support Levels | $117,500 and $116,600 |

| Resistance Level | $119,000 |

| Market Sentiment | Mixed indicators—RSI: 74, Stochastic: 93, CCI: 239 |

| Trend Outlook | Overall bullish trend supported by moving averages |

| Bullish Notation | Bullish if breakout above $119,000 occurs |

| Bearish Notation | Risk of pullback if key support levels are broken |

Summary

Bitcoin Price remains at $118,142, showing a bullish trend amidst cautious trading strategies. The market’s attention is firmly fixed on the psychological barrier of $118,839 for potential breakout opportunities. While the current sentiment indicates strength, caution is advised as declining volumes suggest a possible short-term pullback. Overall, Bitcoin’s trajectory hints at further gains, contingent upon maintaining support levels and achieving substantial trading volume.