XRP Price Surge: 27% Gain in a Week, Market Cap Rises

The recent XRP price surge has captured the attention of investors and analysts alike, marking a dramatic 27.9% increase within just one week. As XRP climbed to $2.84, its market cap soared to an impressive $167 billion, placing it firmly ahead of Tether as the third largest player in the cryptocurrency arena. With a trading volume of $14.24 billion reported over the past 24 hours, the excitement surrounding XRP is palpable in the cryptocurrency news cycles. This notable upward trend invites further scrutiny through XRP technical analysis, as traders grapple with the implications for future price predictions. As momentum continues, many are keen to understand what lies ahead for XRP amid fluctuating trading activity and market dynamics.

The remarkable rise in XRP’s value has garnered significant discussions among cryptocurrency enthusiasts, particularly following its impressive rebound that has fascinated many traders. This surge not only elevates XRP’s standing in the crypto realm but also stimulates conversations about its trading volume and current market cap. Observers of XRP’s performance are increasingly turning to technical analysis tools to refine their strategies and make informed predictions. As investors ponder the next price milestones for this prominent digital currency, insights into XRP’s market movements hold the potential to shape trading decisions in the coming days. The broader implications of this cryptocurrency’s ascent are thus critical to both novice and seasoned market participants.

XRP Price Surge: A 27% Weekly Increase

In a remarkable week for XRP, the cryptocurrency surged by 27.9%, reaching an impressive price point of $2.84. This significant rally has not only amplified investor interest but has also increased the cryptocurrency’s market cap to a whopping $167 billion. This surge has propelled XRP ahead of Tether, solidifying its position as the third-largest cryptocurrency in the market. Traders have been actively monitoring this surge, especially since XRP recorded a trading volume of $14.24 billion in the last 24 hours, showcasing the heightened level of trading activity and investor confidence.

The recent price movements exhibit a strong bullish sentiment from investors, especially following the breakouts above previous resistance levels. Stakeholders and analysts alike are keeping a close eye on XRP’s price dynamics, suggesting potential bullish targets moving forward. The recent volatility has led to increased discussions and analyses regarding XRP’s future price prediction, as many anticipate the potential for further gains if the uptrend continues. In combination with factors like market trend and trading volume, the current wave of enthusiasm around XRP could indicate a sustained bullish cycle.

Understanding XRP’s Market Capitalization Dynamics

With the market cap reaching $167 billion, XRP’s valuation reflects a compelling narrative of recovery and bullish prospects in the cryptocurrency ecosystem. Market capitalization is a crucial metric not just for investors but for the overall health of a cryptocurrency. As XRP surged past Tether in market ranking, it demonstrated not only its appeal but also the shifting dynamics within the crypto trading landscape. This competition among cryptocurrencies emphasizes the fluid nature of market leadership in the digital economy.

XRP’s increasing market cap also has implications for its liquidity and trading volume. A higher market cap coupled with robust trading volume can signal a healthy trading environment, attracting institutional investors and savvy traders alike. Analyzing XRP’s market dynamics, particularly its trading volume alongside market cap, allows investors to gauge potential entry and exit points. If XRP continues to consolidate above key support levels, its upward trajectory may entice more participants into the market, further enhancing its capitalization.

XRP Trading Volume Insights

XRP’s trading volume has reached significant heights, recently clocking in at $14.24 billion over 24 hours. This level of trading activity indicates a strong interest among investors and traders, reflecting the cryptocurrency’s robust market presence. It is essential to analyze this trading volume in conjunction with price movements, as it offers insights into trader sentiment and market stability. The high trading volume serves not only as an indicator of liquidity but can also inform traders about potential price movements and reversals.

The steep increase in trading volume suggests that XRP is entering a consolidation phase, reinforcing the idea that the cryptocurrency is firmly supported above critical price levels. A sustained high trading volume can create favorable conditions for further bullish movements, as it indicates strong buying pressure. Investors are advised to monitor fluctuations in trading volume closely, as significant changes could either reinforce the current trend or signal an impending correction. This dynamic interplay between price action and volume is critical for making informed trading decisions.

Analyzing XRP Technical Patterns

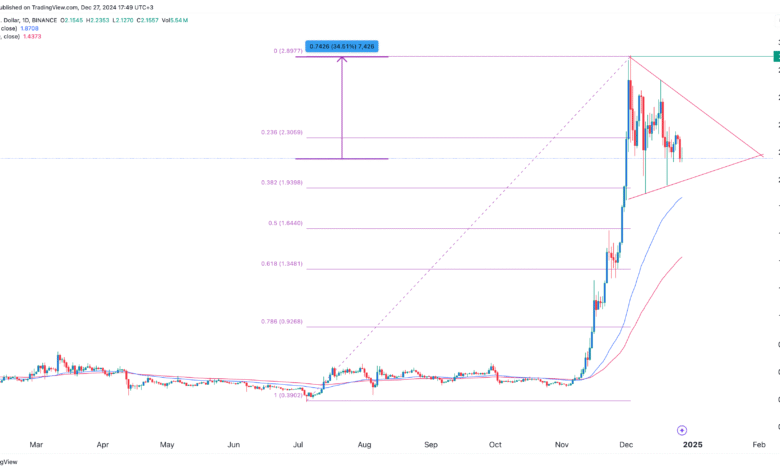

Technical analysis of XRP reveals several intriguing patterns, particularly as it navigates the consolidation phase following its recent price surges. Using indicators like the Relative Strength Index (RSI) and Moving Averages, traders can gain insights into potential future price movements. Currently, XRP shows mixed signals from oscillators, with the RSI hovering in overbought territory, suggesting that while bullish momentum is present, caution is warranted for near-term traders.

Traders might look into the support and resistance levels identified in XRP’s recent price action—such as the critical support at $2.75 and resistance near $2.90. Understanding these technical patterns can greatly aid investors in strategizing their entries and exits in the crypto market. Depending on how XRP interacts with these levels amidst changing trading volumes, the cryptocurrency could either continue its upward trajectory or face significant retracements.

XRP Price Prediction and Market Trends

Looking ahead, XRP’s price prediction is contingent upon several factors, including technical indicators and overall market sentiment. Analysts believe that if XRP maintains its position above $2.75 and breaks through the $2.90 resistance level with bullish volume, the road to $3.20 may be clear. However, should XRP fail to uphold the current support levels, it could indicate a deeper pullback that may revisit the $2.50 or even $2.20 marks.

Furthermore, it’s essential to consider the broader cryptocurrency ecosystem, as movements in Bitcoin and Ethereum often set the tone for altcoin performance. A solid price prediction for XRP must take into account not only its individual technical metrics but also its correlation with the market-wide conditions. As XRP navigates through its current price range, vigilance and adaptability will be integral for traders looking to capitalize on potential future gains.

Institutional Interest and XRP

XRP’s recent breakout above the $2.30 range seems to have garnered substantial institutional interest, as indicated by the spike in volatility and trading volume. Institutional investors are often attracted by a cryptocurrency’s ability to demonstrate resiliency in price and market cap growth. The current bullish narrative around XRP, coupled with evident institutional participation, could foster a more sustainable competitive edge in the market, enhancing its credibility as a leading digital asset.

In light of increasing institutional interest, XRP’s long-term prospects appear favorable. With investments from larger players, the cryptocurrency sector benefits from increased stability and investor confidence. Future institutional investment could accelerate XRP’s growth and potentially elevate its market cap even further. Analysts will continue to monitor how this interest evolves and what impact it may have on XRP’s future trading actions and pricing behaviors.

Technicals Behind XRP’s Recent Trend

Examining the technical aspects of XRP’s recent upward trend reveals consistent bullish signals across multiple timeframes. The alignment of key moving averages, such as the EMA and SMA, indicates a strong foundation for continued upward momentum. Investors looking at these technical indicators may find confidence in the bullish trend, which has been supported by favorable price actions and positive sentiment in the broader market.

However, traders must remain aware of potential pitfalls, particularly regarding overbought conditions signaled by oscillators like the RSI. While technical indicators can highlight the likelihood of a continued upward trend, they also serve as warnings of potential corrections. As XRP approaches critical resistance points, traders should factor in different technical signals to inform decisions, ensuring that strategies are adaptable to changing market conditions.

Market Sentiment Surrounding XRP

Market sentiment plays a pivotal role in the performance of cryptocurrencies, including XRP. The increasing enthusiasm surrounding XRP’s recent gains illustrates how sentiment can influence trading volumes and price stability. Positive news and price predictions contribute to rising bullish sentiment, drawing in new investors who hope to capitalize on upward patterns. As market sentiment swells, XRP’s trading volume has seen significant spikes, aligning with its growing market cap.

However, as with any asset, shifts in sentiment can quickly alter price dynamics. Despite XRP’s current rally, caution is warranted, as news or market events can swiftly change trader perspectives. Observing market sentiment alongside technical analysis can help traders gauge the potential for continuations or reversals. Staying informed about cryptocurrency news and trends will be critical as XRP navigates through its current price action.

XRP vs. Other Major Cryptocurrencies

As XRP continues to establish itself as the third-largest cryptocurrency by market cap, it is essential to analyze its positioning against major players like Bitcoin and Ethereum. While XRP has experienced an impressive surge recently, understanding its competitive dynamics may shed light on its long-term viability. Comparisons of market cap and trading volume with other cryptocurrencies can help gauge XRP’s relative strength and investor confidence.

Moreover, studying the correlation between XRP and other leading cryptocurrencies can provide insights into market trends. Trends seen in Bitcoin and Ethereum often influence the performance of altcoins, including XRP. Therefore, XRP’s ability to maintain its position amidst these influential market dynamics can highlight its resilience and underlying fundamentals that differentiate it from other cryptocurrencies.

Frequently Asked Questions

What factors contributed to the XRP price surge this week?

The recent XRP price surge, which saw a remarkable 27.9% increase, was driven by strong trading volume of $14.24 billion and an influx of institutional interest, indicated by large green candles on the charts. Additionally, the market capital increased to $167 billion, allowing XRP to surpass Tether.

How does XRP’s market cap now compare to that of Tether?

As of now, XRP’s market cap has climbed to $167 billion, surpassing Tether’s market cap, making XRP the third-largest cryptocurrency by market capitalization. This surge indicates heightened investor confidence and interest in XRP.

What is the outlook for XRP price prediction in the short term?

XRP price predictions in the short term appear bullish if it maintains levels above $2.75 and breaks the resistance at $2.90 with sufficient trading volume. Analysts suggest that subsequent targets could range from $3.20 to $3.40, but caution is urged due to potential overbought conditions.

What does XRP’s trading volume tell us about market activity?

XRP’s trading volume of $14.24 billion highlights significant market activity and investor engagement. A high trading volume is often a positive indicator, suggesting strong interest and potentially driving more price movement, especially during surges.

What technical analysis signals should traders watch for with XRP now?

Traders should closely monitor XRP’s price stabilization around the $2.70-$2.80 range, with key indicators like the RSI indicating overbought conditions. Patterns of higher lows suggest accumulation, while a break above $2.90 with rising volume could trigger further bullish momentum.

What are the risks associated with the recent XRP price surge?

Despite the bullish indicators, risks include the possibility of a price pullback if XRP fails to hold the $2.75-$2.60 support range. Oscillators like the Stochastic and CCI are showing sell signals, indicating that corrective moves could occur if selling pressure increases.

How can traders leverage the recent XRP price surge in their strategies?

Traders can consider long positions around the $2.70-$2.80 mark, keeping a tight stop-loss at approximately $2.74 to manage risk. However, caution is advised for entries above $2.87 unless accompanied by an increase in trading volume to confirm the upward trend.

What does the consolidation phase in XRP’s price mean for future movements?

The consolidation phase observed in XRP’s price movement suggests that the market is digesting previous gains rather than reversing. This is usually a positive sign, indicating potential for further price increases, especially if the price holds above critical support levels.

| Key Metric | Details |

|---|---|

| Recent Price Surge | XRP surged 27.9%, reaching $2.84. |

| Market Capitalization | XRP’s market cap now stands at $167 billion, overtaking Tether. |

| Trading Volume (24h) | XRP recorded a trading volume of $14.24 billion. |

| Price Range (Last 24h) | Intraday price range was between $2.61 and $2.91. |

| Technical Analysis Summary | Positive momentum indicators and bullish moving averages suggest potential for higher prices if resistance levels are broken. |

| Risks | Several oscillators signal caution; possibility of a pullback if support levels break. |

Summary

The recent XRP price surge highlights a significant moment in the cryptocurrency market, as XRP has gained an impressive 27.9% in just one week, elevating its market cap to $167 billion, thereby surpassing Tether. This performance indicates strong investor confidence, reinforced by bullish technical indicators, although caution remains due to potential volatility in price movements. Traders should monitor support and resistance levels carefully to navigate the challenges and opportunities presented by this dynamic cryptocurrency.