Premarket Stock Movements: Nvidia, Wells Fargo, and More

Premarket stock movements are often a telling sign of how the stock market may perform once trading begins. Investors and analysts keenly watch these early shifts in stock prices as companies like Nvidia and Wells Fargo make headlines with significant premarket activity. Today’s premarket stock news reveals a mix of surprises and expected declines, as Nvidia experiences a surge due to new chip sales, while Wells Fargo sees a dip following a lowered income guidance. Keep up with the latest stock market updates, as companies like Trade Desk prepare to join the prestigious S&P 500, leading to notable movements in share prices. Monitoring these early trends can provide valuable insights for both short-term traders and long-term investors alike.

The early hours of the trading day showcase essential indicators of market sentiment, often reflected through premarket trading. These initial fluctuations can hint at potential trends and shifts within the financial landscape, as top performers and laggards emerge before the opening bell. Prominent players like Nvidia and Wells Fargo dominate the headlines with substantial gains and losses, respectively, hinting at broader market reactions. Keeping an eye on premarket developments, including announcements related to corporate earnings and strategic moves, can help investors align their strategies ahead of the regular trading session. As companies like Trade Desk prepare for inclusion in major index listings, analyzing these shifts can be pivotal for making informed investment decisions.

Premarket Stock Movements: Key Highlights

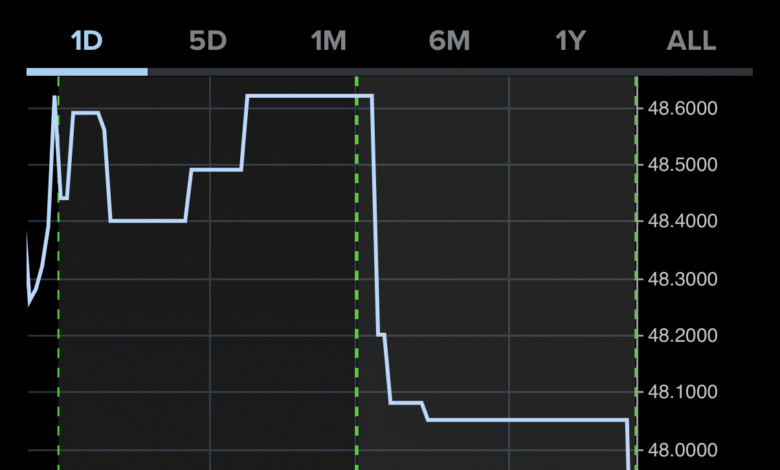

In the premarket trading session, several major stocks have caught investors’ attention, which can significantly influence market sentiment as the opening bell approaches. Nvidia has seen a notable upward movement, with a reported 4% increase after the company announced plans to resume sales of their H20 AI chip to China. This decision marks a significant turn in the company’s operations and is expected to impact supply and demand in the tech industry. Furthermore, Trade Desk has surged 14% in premarket trading following the news that it will join the S&P 500, showcasing how index inclusion can energize investor interest and stock valuations.

Wells Fargo, on the other hand, faces some turbulence, with a 3% drop in its premarket stock movements after lowering its net income guidance for the year. Such forecasts can sway investor confidence, particularly when they overshadow otherwise positive earnings reports. Moreover, BlackRock’s stock fell by approximately 3%, driven by revenue figures that failed to meet analyst expectations. These movements serve as a critical reminder of how forecasts and earnings announcements can dramatically alter market positions ahead of the regular trading session.

Nvidia’s Premarket Surge and Market Implications

Nvidia’s impressive premarket movement is indicative of its resilience in the face of regulatory challenges and competitive pressures in the semiconductor industry. The announcement regarding the sale of their H20 AI chips to China after acquiring necessary licenses has energized traders and institutional investors alike. Such news not only boosts Nvidia’s stock price but also positively influences the broader tech sector, potentially lifting other semiconductor stocks, as seen with Advanced Micro Devices and Broadcom, which also reported gains. Stocks often move in tandem within sectors, highlighting the interconnected nature of the technology market.

The preeminent role Nvidia plays in the AI and tech supply chains showcases how pivotal they are for driving future innovations and revenue streams. As the demand for AI technologies skyrockets, Nvidia’s strategy could lead to a substantial increase in market share and profitability. Its performance in the stock market is closely watched not just by investors, but also by analysts who analyze broader trends in tech investments. Positive movements in Nvidia’s stock can bolster confidence across the tech sector, and by extension, influence overall market performance.

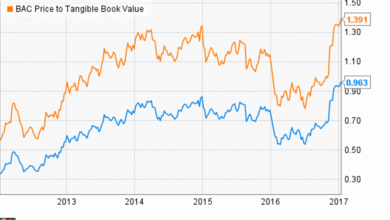

Wells Fargo: Analyzing the Stock Drop in Premarket

Wells Fargo’s premarket stock decline is a telling indicator of the challenges financial institutions face in today’s economic landscape. The bank’s decision to revise its net income guidance for 2025 down to levels consistent with 2024 expectations triggered a wave of selling among investors. These projections are particularly disheartening given that markets had anticipated a modest growth outlook, which underscores the volatility in financial stock movements. Despite posting better-than-expected second-quarter profits, the future forecast loomed larger in investors’ minds, leading to a significant drop.

Such shifts in guidance can lead to a reevaluation of the stock’s valuation by analysts, impacting Wells Fargo’s market position. The downgrade highlights the importance of forward-looking statements by corporate management and how they can override short-term performance metrics. Investors often look for clarity and confidence in a bank’s outlook, and uncertainty can translate into caution in trading. As Wells Fargo navigates these challenges, it will need to focus on regaining investor trust and reassuring them of its financial health moving forward.

Trade Desk’s Big Break: Joining the S&P 500

The recent news surrounding Trade Desk’s inclusion in the S&P 500 has driven a remarkable 14% leap in its premarket share price. This significant jump reflects investor enthusiasm and optimism regarding the stock’s future performance. Being included in the S&P 500 not only lends credibility to the company but also opens up access to a broader range of institutional investment, which can lead to increased buying pressure. Stocks that are part of this prestigious index often attract attention from funds that track or replicate its performance.

Such movements highlight the competitive landscape of digital advertising, where companies like Trade Desk have become major players. As ad spending continues to shift towards digital platforms, Trade Desk’s strong position within the S&P 500 could bolster its visibility and market power. The potential for sustained growth through strategic partnerships and innovations in the digital advertising space makes Trade Desk a compelling proposition for investors. The surge in premarket stock movements emphasizes the impact of index membership on investor psychology and market traction.

Market Updates: Key Investors to Watch

As market dynamics shift based on earnings reports and industry news, investors will want to keep an eye on key players such as BlackRock and Citigroup. BlackRock’s revenue miss amid broader market uncertainty could elicit responses from analysts forecasting a change in investment strategy or allocation. Understanding how global economic factors affect this asset manager’s future will be critical for traders looking for insights into market trends and potential adjustments in their portfolios.

Similarly, Citigroup’s minimal change in premarket stock price, despite beating earnings expectations, illustrates how investor sentiment can sometimes diverge from performance metrics. With ongoing discussions regarding economic stability, investors should remain alert to opportunities and risks that may surface from these financial institutions’ evolving business strategies. Keeping tabs on stock market updates, particularly in the financial sector, will be essential to making informed trading decisions.

Solar Stocks Facing Challenges Amid Downgrades

Solar energy stocks, particularly SolarEdge Technologies and Enphase Energy, witnessed declines in premarket trading as they experienced downgrades from JPMorgan. These downgrades came in the wake of an impressive rally in solar stocks, gaining over 110% in the past three months. Downgrades can serve as a critical signal for investors, indicating concerns about future profitability and market conditions. The response in premarket trading demonstrates how investor confidence can shift rapidly with analyst recommendations.

With solar companies facing scrutiny and potential downturns, key indicators to watch will be market share gain and margin expansion. Investors are increasingly cautious, looking for solid fundamentals to support continued growth in a sector that has been volatile. As solar stocks navigate these challenges, investors should weigh analysts’ insights against broader market trends to make informed decisions. The current landscape serves as a reminder of how quickly market sentiment can shift based on perceptions of growth sustainability.

Tech Sector Insights: The Influence of Regulatory News

The tech sector remains a hotbed of volatility, especially when regulatory news influences stock behavior. The recent fluctuations in Nvidia’s stock, linked to changes in U.S. regulations regarding chip sales to China, underscore the delicate balance tech companies must maintain. Investors should be keenly aware of how government policies can impact revenue streams, particularly in the semiconductor industry, which is heavily tied to global supply chains. Nvidia’s ability to navigate these regulations successfully is crucial for maintaining investor confidence.

Additionally, as tech companies pivot towards AI-driven solutions, the importance of regulatory compliance becomes even more pronounced. Market participants will need to closely follow any further announcements regarding other semiconductor manufacturers, as stricter regulations could lead to increased competition and market disruptions. The interplay between innovative capabilities and regulatory frameworks will play a vital role in shaping the future profitability of tech stocks.

Financial Services on the Move: Outlook for Leading Banks

As we analyze premarket movements, leading banks such as JPMorgan Chase and Bank of New York Mellon exhibit mixed performance that investors should consider. JPMorgan experienced a slight drop despite robust earnings driven by strong investment banking and trading revenue. This nuanced response suggests that the market may be pricing in uncertainties about future economic conditions despite positive quarterly results. Investors closely tracking these shifts can glean insights into broader financial market trends.

Conversely, Bank of New York Mellon’s ability to exceed earnings expectations by a significant margin yet still show limited premarket movement highlights the complexities involved in financial stock evaluations. Investors must remain attuned to how shifting economic conditions and banks’ strategic directions could influence future profits. Increased net interest income could signal recovery and opportunities for growth, reinforcing the need for investors to evaluate both current performance and future projections carefully.

General Market Trends: The Broader Economic Landscape

The overall market is currently navigating through a complex landscape of economic indicators and corporate earnings. With stocks like CoreWeave and Albertsons posting gains amid broader market uncertainties, it serves as a reminder that individual company performance can diverge significantly from market expectations. Observing trends across sectors, investors may identify emerging opportunities that defy prevailing market sentiment, particularly in the technology and consumer goods sectors.

Furthermore, understanding macroeconomic factors such as interest rates, inflation, and economic growth rates will be influential as businesses adapt to changing market conditions. As we observe premarket stock movements, acknowledging these broader economic trends becomes paramount for investors looking to build resilient portfolios. Engaging with market analyses and updates can provide critical insights into how these factors interact with individual stock performances.

Frequently Asked Questions

What are the latest premarket stock movements for Nvidia?

Nvidia shares experienced a significant premarket stock movement, rising 4% after the company announced it would soon resume sales of its H20 AI chip to China, pending necessary licenses from the U.S. government.

How did Wells Fargo stock change during the premarket session?

Wells Fargo saw a premarket stock change of a 3% decrease after the company revised its 2025 net income guidance downward, despite reporting better-than-expected second-quarter profits.

Can you provide an update on Trade Desk’s premarket performance?

Trade Desk shares surged 14% in premarket trading following the announcement that it would be added to the S&P 500 index, replacing Ansys in the stock market.

What factors influenced premarket stock news for BlackRock?

BlackRock’s premarket stock news included a drop of approximately 3% after the company reported second-quarter revenue that fell short of Wall Street expectations, reaching $5.42 billion compared to the forecast of $5.46 billion.

How did the stock market updates reflect the changes for Citigroup?

In the latest stock market updates, Citigroup shares rose less than 1% in the premarket after posting second-quarter earnings of $1.96 per share, which surpassed analyst predictions.

What is the significance of Nvidia’s premarket movement for investors?

Nvidia’s premarket movement is significant for investors as it indicates renewed opportunities in the AI sector, especially with the company’s plans to resume sales of its key semiconductor product to China.

What were the impacts of JPMorgan Chase’s earnings on premarket stock trading?

JPMorgan Chase’s earnings beat analyst expectations, leading to a slight decrease of less than 1% in premarket stock trading, reflecting cautious optimism among investors.

How did solar energy stocks perform in the premarket?

Solar energy stocks, including SolarEdge Technologies and Enphase Energy, fell nearly 2% in premarket trading following a downgrade by JPMorgan, illustrating market volatility in that sector.

What should investors be aware of regarding premarket stock movements on major earnings reports?

Investors should keep an eye on premarket stock movements related to major earnings reports, as companies like Wells Fargo and BlackRock show how earnings surprises can significantly influence stock prices.

Why are premarket stock movements important for trading strategy?

Premarket stock movements are vital for trading strategy as they can provide early insight into market sentiment and potential price trends based on earnings, economic indicators, and company announcements.

| Company | Premarket Movement | Key Details |

|---|---|---|

| JPMorgan Chase | -0.9% | Beat earnings expectations due to strong investment banking and trading revenue. |

| Wells Fargo | -3% | Lowered 2025 net income guidance despite better-than-expected second-quarter profits. |

| Citigroup | +0.6% | Second-quarter earnings and revenue exceeded expectations. |

| BlackRock | -3% | Second-quarter revenue missed Wall Street expectations. |

| CoreWeave | +7% | Announced $6 billion investment in an AI data center in Pennsylvania. |

| LM Ericsson | -2% | Revenue fell short of analyst consensus in the second quarter. |

| Bank of New York Mellon | -0.9% | Adjusted earnings exceeded analyst expectations. |

| Albertsons | +0.5% | Narrow earnings beat and reaffirmed full-year earnings guidance. |

| State Street | -2% | Reported lower net interest income than expected. |

| Nvidia | +4% | Set to resume sales of AI chips to China after receiving U.S. licenses. |

| Trade Desk | +14% | Set to join S&P 500, replacing Ansys. |

| SolarEdge Technologies & Enphase Energy | -2% | Downgraded to neutral by JPMorgan. |

| National Fuel Gas | +4% | Received double upgrade to buy from underperform. |

Summary

Premarket stock movements today show a mix of gains and losses across major firms. Nvidia and Trade Desk are among the leaders, reporting strong upward movements due to significant announcements. Conversely, companies like Wells Fargo and BlackRock faced premarket declines following mixed earnings reports. Investors should closely monitor these developments as they can set the tone for market activity throughout the day.