Israel Stock Market Growth: Resilience Amidst Conflict

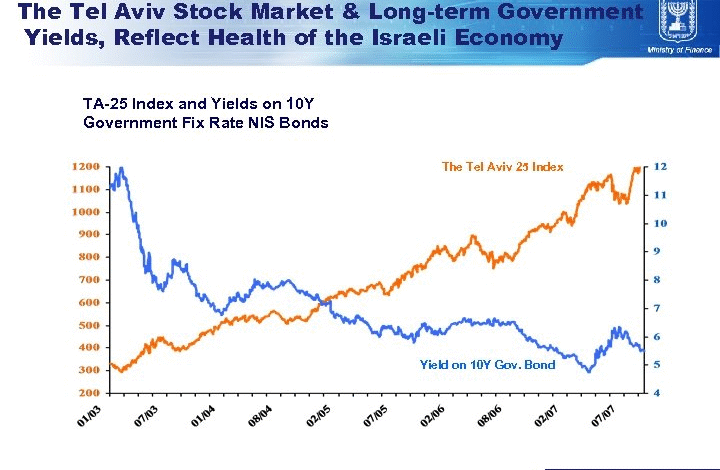

The remarkable growth of the Israel stock market has taken center stage, showcasing resilience even amidst significant turmoil. As the Tel Aviv Stock Exchange reaches new heights, it outpaces its neighbors in the Middle East, solidifying its reputation as a robust investment hub. This surge is not merely a reaction to geopolitical events but signals a greater confidence in the Israel economic forecast, driven by foreign investment in Israel and the strength of its burgeoning tech sector. Despite challenges like a contracting GDP and political unrest, investors have begun to view the regional landscape differently, inspired by updated Middle East investment trends. With projections of continued GDP growth and substantial foreign interest, the future looks increasingly promising for investors looking to capitalize on Israel’s market potential.

Exploring the current landscape of the Israeli equities market reveals a captivating narrative of recovery and potential. The growth trajectory of the Tel Aviv Stock Exchange has drawn attention, particularly amid ongoing conflicts, yet investor optimism remains palpable. Notably, the nation’s economic outlook reflects promising indicators, with analysts suggesting that foreign capital inflows will further invigorate this momentum. As Israel grapples with shifting political and economic dynamics, the interest in this unique market landscape echoes broader trends in international finance and emerging markets. The interplay between domestic factors and external perceptions will shape the future of Israel’s growth in the stock market, fundamentally altering investment strategies in the region.

Israel Stock Market Growth Narrative

The recent record highs in Israel’s stock market, particularly the Tel Aviv Stock Exchange (TASE), highlight a remarkable resilience amidst adversity. Over the past 22 months of conflict, the TASE has witnessed extraordinary growth, rebounding by over 200% from its lows following the October 2023 Hamas attack. Investors, despite the tumult, have displayed a robust appetite for risk, driven by renewed confidence in the stability of Israel’s economy and the underlying performance of its market sectors.

This surge can be attributed to various factors, including Israel’s burgeoning tech sector, which accounts for 20% of GDP and a substantial portion of exports. The ongoing influx of foreign investments has also bolstered the financial landscape, with billions flowing into the stock market as global investors seek out local opportunities. The combination of a recovering economy and a dynamic financial market has not only helped restore investor confidence but has also positioned Israel as a focal point for investment within the Middle East.

Tel Aviv Stock Exchange Rebound post-Conflict

The Tel Aviv Stock Exchange has demonstrated incredible resilience following significant dips in 2023, showing how markets can adapt to geopolitical tensions. After a sharp decline in the wake of conflict, the TASE’s recovery outpaced many forecasted expectations, exceeding its pre-war levels by early 2024. This swift rebound highlights the market’s inherent strength and the effectiveness of dynamic economic policies that encourage both domestic and foreign investment.

As highlighted in recent reports, the opening of over 161,000 new trading accounts in a single year reflects a growing public interest in the capital market. As individuals capitalize on lower prices, large trading volumes have surged, indicating an optimistic outlook on the future of the TASE. Such a surge in market activity not only reinstates investor confidence but also invites further investment in technology and innovation, crucial components of Israel’s economic engine.

Impact of Foreign Investment on Israel’s Economy

Foreign investment plays a pivotal role in shaping Israel’s economic landscape, and recent data underscores the trend. Reports indicate that foreign investors acquired approximately 2.5 billion shekels worth of TASE shares within a month, showcasing strong interest from global markets. Since the beginning of 2025, foreign acquisitions have reached an estimated 9.1 billion shekels, emphasizing the attractiveness of Israeli securities amid ongoing geopolitical tensions.

The influx of foreign capital has not only supported the stock market but has also had a positive impact on the real estate sector. This growth in outstanding liabilities to foreign investors reflects a combination of rising security prices and consistent net investment flows. With the backing of international investors, the Israeli economy is poised for continued expansion, demonstrating resilience in the face of challenges and a strong foundation for future growth.

Israel’s Economic Forecast Amid Political Turmoil

While Israel grapples with political strife and armed conflict, the overall economic forecast remains cautiously optimistic. Despite a contraction of nearly 20% at the end of 2023, the country’s GDP is projected to achieve a modest growth of 2% for the entire year, with a further anticipated growth of 1% in 2024. These figures suggest that despite the ongoing turmoil, economic fundamentals rooted in technology and foreign investment are stabilizing the situation.

According to forecasts from the OECD, Israel’s economic activity could grow by 4.9% by 2026. This upward trajectory is driven primarily by government spending, which acts as a counterbalance to private consumption drops caused by the conflict. The interplay of these factors presents a unique opportunity for recovery and growth, emphasizing the potential of Israel’s economy to rebound even in challenging times.

Middle East Investment Trends and Israel’s Role

As geopolitical landscapes shift in the Middle East, Israel finds itself at the forefront of evolving investment trends. In light of recent tensions and conflicts, global investors are increasingly looking to Israel for potential growth opportunities. The dynamics of the Israeli economy, especially its technological advancements and innovative capabilities in sectors like defense, make it a focal point for stakeholders looking to capitalize on emerging market trends in the region.

The attention Israel has garnered from foreign investment aligns with broader Middle East investment trends aiming to reshape national economies. With the normalization of relations with several Arab nations, Israel’s defense sector, in particular, has experienced heightened interest, signaling a broader acceptance and cooperation in the face of historical tensions. As these investment trends develop, they promise to redefine Israel’s economic landscape and position it as a leader in regional prosperity.

Investor Confidence and Economic Stability in Israel

Investor confidence is crucial for economic stability, and recent developments indicate a significant turnaround in perceptions of the Israeli market. Following a tumultuous period, many investors are reassessing risks associated with investing in Israel, believing that security concerns are diminishing. This renewed outlook is reflected in the influx of new trading accounts on the TASE, which has tripled since the previous year, marking a clear trend towards increased market engagement.

Furthermore, the tech sector’s vibrancy has become a key attraction for investors, as startups and established companies innovate and grow. Global firms recognize the potential of Israel given its focus on technology, research, and development. As investor interest strengthens, it not only fuels immediate growth in the TASE but also lays a foundation for long-term economic stability.

High-Tech Sector’s Contribution to Stock Market Growth

The high-tech sector has been a cornerstone of Israel’s economy, contributing significantly to its GDP and international trade. As highlighted by industry experts, technology-related products and services account for a remarkable 20% of Israel’s GDP. The ongoing conflict has redirected focus towards this sector, attracting more foreign investment as nations recognize the innovative capabilities Israel offers.

This surge in interest in the tech sector is reflected in the stock market’s performance, with tech stocks playing a dominant role in driving the TASE upwards. The resilience demonstrated by tech companies amid geopolitical tensions illustrates their importance—not merely to Israel’s economic health but as a model for other regions facing similar challenges.

The Role of Defense Sector in Israel’s Economic Resilience

Israel’s defense sector has emerged as a pivotal player in maintaining economic resilience amidst ongoing challenges. The increased foreign attention following recent conflicts showcases not only the strength of Israel’s defensive capabilities but also its ability to attract investment from nations worldwide. Events like the Abu Dhabi IDEX defense exhibition illustrate this growing interest, presenting Israel as a global leader in defense technologies.

Investment in the defense sector not only fuels economic growth but also reinforces national security. This dual benefit cements the sector’s role as a significant contributor to overall economic stability, thereby attracting further foreign investments and bolstering the confidence of domestic markets. As geopolitical tensions evolve, Israel’s defense sector remains a beacon of innovation and economic opportunity.

Strategic Government Spending and Economic Growth

Strategic government spending has proven crucial in navigating the economic uncertainties that accompany military conflict. The Israeli government’s initiatives to channel resources into infrastructure and public services are designed to spur immediate economic activity. Predicting a modest GDP growth of 1% for 2024 underscores the government’s commitment to maintaining economic momentum in the face of adversity.

By prioritizing investments that stimulate growth, Israel aims to bolster its resilience against external shocks. The governmental approach not only addresses immediate financial needs but also positions the economy for long-term sustainability, ultimately enhancing investor confidence. As such, strategic fiscal policies reflect a proactive adaptation to changing economic landscapes.

Frequently Asked Questions

What factors are driving Israel stock market growth despite ongoing conflict?

Israel stock market growth is significantly driven by substantial foreign investment and renewed global investor confidence following military conflicts, particularly with Iran. The Tel Aviv Stock Exchange (TASE) has rebounded strongly, surpassing pre-war levels as investors recognize the strength of the Israeli economy and its tech sector, which accounts for a large share of GDP.

How is the Tel Aviv Stock Exchange performing amid the Israeli wars?

Despite the challenges posed by ongoing wars, the Tel Aviv Stock Exchange has seen remarkable performance, rebounding over 200% from its low after the October 2023 conflict. This growth signifies resilience and investor optimism in the face of adversity, indicating strong economic fundamentals in Israel.

What is the current outlook for the Israel economic forecast considering recent events?

The Israel economic forecast is cautiously optimistic, projecting a modest growth of 1% for 2024, alongside a 4.9% increase in economic activity expected by 2026. Factors such as government spending and a recovering stock market contribute to this growth amid challenges posed by geopolitical tensions.

How significant is foreign investment in Israel’s stock market growth?

Foreign investment is crucial to Israel’s stock market growth, with billions of shekels in acquisitions fueling confidence and capital inflow. Recent reports indicate that foreign investors have injected approximately 9.1 billion shekels into the market, reflecting strong interest and belief in Israel’s economic stability.

What role does the Israeli tech sector play in stock market growth?

The Israeli tech sector plays a pivotal role in stock market growth, contributing 20% to the GDP and over half of the country’s international exports. The ongoing development and innovation in technology foster investor interest, making the sector a cornerstone of Israel’s economic success.

Why has there been a surge in trading accounts in the Israeli capital market?

The surge in trading accounts in the Israeli capital market, which tripled in 2024, reflects increased public engagement and a strategic entry into the market amidst lower price levels. Investors are capitalizing on perceived opportunities resulting from recent economic fluctuations, thereby boosting trading activities.

What implications does Israel’s GDP growth have for its stock market?

Despite a contraction of nearly 20% in late 2023, a projected GDP growth of 1% for 2024 indicates resilience in the Israeli economy. This economic stability provides a favorable backdrop for the stock market, as it enhances investor confidence and likely fosters further market growth.

How does the geopolitical situation affect Israel’s stock market and foreign investments?

Geopolitical situations, especially conflicts involving Israel, can create volatility in the stock market. However, as investors perceive decreasing risks related to Israel’s security and economy, this can lead to increased foreign investments, ultimately supporting stock market growth.

What trends are emerging in Middle East investment with regard to Israel?

Middle East investment trends are shifting favorably towards Israel, as it positions itself as a resilient economy amidst regional conflicts. Global investors are increasingly viewing Israel not just as a stable investment opportunity, but also recognizing its potential for future growth and development in various sectors.

| Key Point | Details |

|---|---|

| Israel Stock Market Growth | Israel’s stock market has reached record highs, outperforming other Middle Eastern markets amid conflict. |

| Impact of War | Despite ongoing wars and political turmoil, Israel’s economy showed resilience with gains in the stock market post-conflict. |

| Tel Aviv Stock Exchange (TASE) Recovery | After a 23% drop post-war declaration, the TASE rebounded to pre-war levels within a few months, showing over 200% recovery by mid-2024. |

| Foreign Investment | Significant foreign investments have bolstered the stock market, with billions in acquisitions recorded in 2025. |

| Economic Forecast | A modest GDP growth of 2% for 2023 is recorded, with expectations of 4.9% growth by 2026, driven by government spending and investor confidence. |

| Increased Trading Activity | New trading accounts surged threefold in 2024, reflecting heightened public engagement in the capital market. |

| Tech Sector Influence | The tech sector remains a key growth driver, contributing to 20% of GDP and fostering increased foreign interest in defense capabilities. |

| Currency Stability | The Israeli shekel appreciated against the dollar, indicating strengthening economic fundamentals. |

| Future Outlook | Analysts predict continued stock market growth, with expectations of stability in inflation rates and economic policies. |

Summary

Israel stock market growth has defied expectations during tumultuous times, demonstrating resilience and a strong rebound following conflicts. The recovery of the Tel Aviv Stock Exchange, alongside increased foreign investments and the growth of the technology sector, signals a promising outlook for Israel’s economy despite ongoing challenges. Forecasts indicate that investor confidence will continue to rise, further enhancing the stock market’s performance in the coming years.