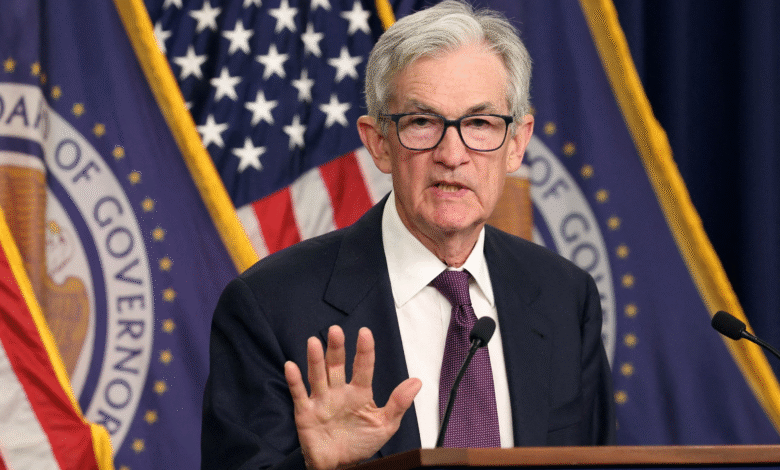

Jerome Powell Perjury Accusations Spark Controversy

The recent accusations of perjury against Federal Reserve Chairman Jerome Powell have ignited significant controversy, raising questions about accountability within the country’s foremost financial institution. Florida Representative Anna Paulina Luna publicly alleged that Powell misled Congress during a Senate Banking Committee hearing regarding a renovation project that ballooned to $2.5 billion. This fallout follows an escalating conflict characterized by the Trump Powell tensions, as the former president has long expressed dissatisfaction with Powell’s approach to monetary policy. Furthermore, the Department of Justice (DOJ) is now being urged to investigate these perjury claims, generating speculation about the motivations behind Luna’s allegations. With whispers of a potential Powell renovation scandal, the implications of these accusations could have far-reaching effects on the stability of the Federal Reserve and its leadership.

In a politically charged climate, the perjury allegations against Jerome Powell highlight the complex dynamics at play within the Federal Reserve. As accusations surface from notable figures like Anna Paulina Luna, questions arise over whether these claims stem from genuine concerns surrounding Powell’s management of controversial renovation projects. The backdrop of Trump’s ongoing criticism of Powell adds another layer of intrigue to the situation, especially as tensions mount over fiscal policy direction. Moreover, the call for a DOJ investigation into purported false statements made during congressional testimony emphasizes the seriousness of these charges. As the narrative unfolds, the overarching themes of accountability and governance in relation to the Federal Reserve’s leadership come sharply into focus.

A Deep Dive into the Jerome Powell Perjury Accusations

The recent perjury accusations against Jerome Powell, the Chairman of the Federal Reserve, are stirring significant controversy in the Washington political landscape. Florida Republican Congresswoman Anna Paulina Luna has taken to social media to call for a Department of Justice (DOJ) investigation into whether Powell misled lawmakers during a recent Senate Banking Committee hearing. The tension surrounding these allegations is compounded by the ongoing criticism from President Donald Trump, who has openly suggested Powell could face dismissal from his post due to dissatisfaction with his monetary policy decisions.

At the core of these perjury accusations lies a substantial renovation project concerning the Federal Reserve’s buildings, which has been suggested by critics to be an extravagant misuse of funds. Luna’s claims echo sentiments of a broader Federal Reserve controversy, where critics argue about the accountability of Fed leadership. If evidence arises that indicates Powell committed perjury, the implications for his tenure could be profound, further complicating the intricate relationship between the Fed and current White House administration.

Federal Reserve Renovation Scandal: Unpacking the Details

The Federal Reserve renovation scandal primarily revolves around the significant expenditures related to the remodeling of the Eccles Building in Washington, D.C. Critics, including Russell Vought, Director of the White House’s Office of Management and Budget, assert that Powell provided misleading statements during official testimony regarding the extent of the renovations. Vought’s allegations highlighted that Powell had denied any substantial renovations had occurred prior to 1999; however, Vought contends that such claims contradict the historical renovation records.

With accusations flying between the administration and the Fed, this scandal raises crucial questions about government accountability and transparency. The Federal Reserve’s financial management practices have been under scrutiny, and as the narrative unfolds, the public’s demand for clarity and truth grows. Should the DOJ choose to investigate, the findings could have far-reaching effects, shaking the foundations of confidence in the Federal Reserve amid prevailing economic uncertainties.

The Political Implications of Powell’s Indictment

The accusations against Jerome Powell are not merely administrative complaints; they are deeply intertwined with the political machinations of the Trump administration. Trump’s frustration with Powell’s resistance to lower interest rates has created a charged atmosphere where accusations of perjury serve as a tool to undermine Powell’s authority. This unprecedented confrontation signals the lengths to which political figures might go to protect their economic agendas, raising concerns about the independence of the Federal Reserve.

Anna Paulina Luna’s move to push for this investigation appears to be a politically motivated strategy to rally support among Trump’s base. As Trump continues to criticize Powell publicly, tensions within financial policy circles intensify. Therefore, whether this leads to Powell’s resignation or a censure will significantly influence the Fed’s operational autonomy in the future, ultimately impacting U.S. fiscal policy.

Anna Paulina Luna’s Role in the Federal Reserve Controversy

Anna Paulina Luna’s involvement in the Jerome Powell perjury accusations has put her in the spotlight as a controversial figure in the current political landscape. By calling for a DOJ investigation against Powell, Luna positions herself as a fierce advocate of accountability within the government’s financial institutions. This action not only aligns with Trump’s grievances against the Fed Chair, but it also showcases her willingness to engage in high-stakes political battles that could elevate her status among Trump’s loyal supporters.

Her allegations serve dual purposes: they aim to hold Powell accountable for his management of the Federal Reserve while also perpetuating the political narrative gripping the Trump administration’s agenda. In this context, Luna’s move has sparked discussions about the balance of power between Congress and the Federal Reserve, as well as the public’s trust in these institutions amidst a backdrop of political maneuvering.

Trump-Powell Tensions: What Does It Mean for the Federal Reserve?

The ongoing tensions between President Trump and Jerome Powell represent a defining conflict in contemporary economic governance. As Trump unrelentingly criticizes Powell for what he perceives as failure to implement aggressive monetary policies, he ignites speculation regarding Powell’s stability as Fed Chairman. This battle is emblematic of the broader challenges that autonomous institutions face when intertwined with political narratives, raising concerns for financial experts and citizens alike.

The repercussions of Trump-Powell tensions stretch beyond personal grievances; they directly impact the Federal Reserve’s credibility and policy-making abilities. Should the administration successfully undermine Powell’s position, it could set a risky precedent that may jeopardize the independence of the Fed, which is essential for maintaining an effective and stable economic environment. Such developments could lead to altered economic policies that could reshape U.S. financial frameworks in the years to come.

Assessing the DOJ Investigation on Perjury Accusations

The potential DOJ investigation into Jerome Powell regarding the perjury charges has raised numerous questions about the intersection of law and governance, particularly in the context of the Federal Reserve. If the DOJ determines to pursue this investigation, it could uncover significant insights into Powell’s testimonies and the broader culture of accountability that surrounds such pivotal institutions. This scrutiny is vital as it advocates for transparency and may lead to reforms within governmental procedures.

Furthermore, the outcome of such investigations can shape public perception toward regulators and their actions. In a time when trust in governmental institutions is waning, a careful and impartial investigation into the perjury accusations could either mitigate concerns or exacerbate the ongoing Federal Reserve controversy. The implications of the DOJ’s findings could also influence future interactions between the executive branch and the Federal Reserve, resulting in long-lasting ramifications for the nation’s financial governance.

The Financial Community Reacts to the Accusations

The financial community’s response to the accusations against Jerome Powell has been notably divided. On one hand, some analysts and economists express concern that these political maneuvers may distract Powell and the Federal Reserve from their critical role in managing monetary policy. Uncertainty regarding Powell’s position could lead to volatility in markets as investors react to the political drama rather than economic fundamentals.

Conversely, there are voices within the financial elite that argue such accusations might be part and parcel of a necessary political discourse encouraging accountability among public officials. As the specter of scandal looms over Powell’s leadership, many are monitoring how this scenario will unfold, particularly in light of the perplexing relationship President Trump has established with Fed policy-making.

The Public’s Perception of the Federal Reserve Amid Accusations

As the Jerome Powell perjury accusations permeate media channels, public perception of the Federal Reserve is undergoing a significant shift. Many citizens are beginning to connect the dots between political narratives and the actions taken by financial institutions, raising awareness about the influence of political incentives on economic decisions. This growing scrutiny could have profound implications for how the Fed is viewed in terms of transparency and accountability.

Moreover, the public’s reaction could influence regulatory reforms if there’s a perception that the Fed is not operating with the best interests of the economy at heart. As individuals and organizations call for greater accountability, it becomes imperative for the Federal Reserve to build a narrative of trustworthiness and integrity amid this brewing controversy, lest it faces long-term damage to its credibility and effectiveness.

Looking Ahead: The Future of Jerome Powell and the Federal Reserve

As the ramifications of the perjury accusations against Jerome Powell unfold, it is crucial to consider what this might mean for the future of the Federal Reserve. If Powell manages to successfully navigate these allegations while maintaining support within the Board and among lawmakers, he may continue to influence monetary policy without severe repercussions. However, if evidence surfaces that implicates him in wrongdoing, it could usher in significant changes in leadership dynamics within the Central Bank.

This uncertainty about Powell’s future also raises questions about the potential for redesigning regulatory frameworks that govern Federal Reserve operations. Shifts in leadership can ultimately lead to shifts in monetary policy, affecting interest rates, inflation control, and economic growth. Therefore, whether Powell stands firm or is forced to resign will not only contribute to the ongoing narrative surrounding the Trump administration but could redefine the operational landscape of the Federal Reserve for years to come.

Frequently Asked Questions

What are the Jerome Powell perjury accusations about?

The Jerome Powell perjury accusations stem from Florida Congresswoman Anna Paulina Luna, who has criminally referred Powell to the DOJ for allegedly lying about a $2.5 billion Federal Reserve renovation project. Luna claims Powell’s testimony during a Senate hearing misled lawmakers about the history of the Eccles building’s renovations.

How did Anna Paulina Luna accuse Jerome Powell of perjury?

Anna Paulina Luna accused Jerome Powell of perjury in a post on social media, saying she would forward her allegations to the DOJ. Her accusation is tied to statements Powell made during a June hearing regarding the renovations of Federal Reserve buildings under his oversight, which Luna asserts were misleading.

What elements of the Federal Reserve renovation scandal are associated with Powell’s testimony?

The Federal Reserve renovation scandal involves claims made by Russell Vought, a former OMB director, who accused Powell of lying about the renovations of the Eccles Building. Vought argues that Powell’s assertions that the building had never been renovated contradict previous renovations conducted between 1999 and 2003.

How could the DOJ investigation address the perjury accusations against Jerome Powell?

The DOJ investigation into the perjury accusations against Jerome Powell would assess whether Powell made false statements under oath regarding the Federal Reserve’s renovation project. If the investigation finds substantial evidence of perjury, it could lead to legal consequences for Powell.

What is the context behind the tensions between Trump and Jerome Powell regarding the Federal Reserve?

Tensions between Trump and Jerome Powell center around the Fed Chair’s decisions on interest rates and monetary policy. Trump has publicly criticized Powell for not cutting rates, labeling him as ‘dumb’ and has hinted at wanting to replace him. This backdrop plays a role in the accusations contributing to what many see as a politically charged environment.

What are the implications of the allegations against Jerome Powell for the Federal Reserve?

The implications of the allegations against Jerome Powell could be significant, as they may undermine the credibility of the Federal Reserve. If proven, perjury could threaten Powell’s position and lead to instability within the central bank, impacting monetary policy and public trust.

How is the media covering the Jerome Powell perjury accusations and related disputes?

Media coverage of the Jerome Powell perjury accusations has focused on the political ramifications and the allegations made by Anna Paulina Luna, emphasizing the tension between the Trump administration and Powell. Reports highlight the specifics of the renovation project and the potential legal ramifications of the accusations.

| Key Point | Details |

|---|---|

| Accusation of Perjury | Anna Paulina Luna alleges that Jerome Powell committed perjury regarding the Federal Reserve’s renovation project. |

| Renovation Controversy | The renovation project exceeded the budget and is viewed as a potential strategy to remove Powell from his position. |

| Vought’s Allegations | Russell Vought claims Powell lied about past renovations of the Eccles Building and authorized extravagant amenities. |

| Powell’s Defense | Powell denied the allegations and clarified that renovations are aimed at accessibility without luxurious features. |

| Political Pressure | There are implications that Powell is being pressured by Trump and his allies regarding monetary policy. |

| Overall Context | The ongoing situation reflects a clash between the Trump administration and the Federal Reserve. |

Summary

Jerome Powell perjury accusations have stirred significant controversy as Congresswoman Anna Paulina Luna claims the Federal Reserve Chairman lied about a high-budget renovation. This situation intertwines with political tension, particularly from the Trump administration, which seeks to undermine Powell’s credibility for potential removal. As this story unfolds, the implications of these allegations may play a critical role in the future of monetary policy and the central bank’s leadership.