Bitcoin Price Prediction: AI Chatbots Forecast Future Trends

Bitcoin price prediction has become a focal point for investors and enthusiasts as the cryptocurrency landscape continues to evolve. Recent analysis, driven by advanced AI chatbots, suggests a bullish trend for Bitcoin, projecting substantial increases in price over the next few years. With Bitcoin currently valued at around $117,836, many forecasts indicate a jump to between $145,000 and $250,000 by the end of 2025, fueling excitement in the cryptocurrency community. Factors such as the upcoming halving, increased institutional adoption, and macroeconomic trends play crucial roles in shaping these Bitcoin price analyses. As we delve into the future value of Bitcoin, understanding these dynamics becomes essential for anyone looking to navigate the crypto market effectively.

As the cryptocurrency market continues to captivate investors globally, the future trajectory of Bitcoin remains a hot topic of discussion among analysts and traders alike. Predictions concerning Bitcoin’s valuation, often referred to as Bitcoin forecast or Bitcoin price analysis, are increasingly influenced by sentiments driven by innovative technologies like AI chatbots. These intelligent models provide unique insights, projecting potential highs and lows that shape the outlook for Bitcoin’s future. Key drivers behind these forecasts encompass factors such as supply and demand dynamics, market psychology, and emerging trends in economic stability. Thus, comprehending these nuanced cryptocurrency predictions could empower investors to make informed decisions as they strategize in this ever-fluctuating digital asset landscape.

Bitcoin Price Prediction: Insights from Leading AI Chatbots

The recent challenge of forecasting Bitcoin’s price by various AI chatbots highlights a predominantly bullish sentiment among artificial intelligence models regarding the future of Bitcoin. Many of these models forecast an impressive surge in Bitcoin’s price, with predictions ranging significantly—from a conservative estimate of $145,000 to a highly optimistic outlook of $1 million by 2030. These predictions stem from critical market factors, such as the anticipated effects of the next Bitcoin halving and increasing institutional investment in cryptocurrency assets.

For instance, ChatGPT predicts Bitcoin will reach $185,000 by the end of 2025, citing factors like the upcoming halving in April 2024 and expected institutional inflows. This bullish scenario aligns well with the economic principles of supply and demand, where a reduced supply post-halving could catalyze price increases, indicating that Bitcoin’s future value may indeed be brighter than skeptics believe.

AI Models and Their Predictions: A Deep Dive into Bitcoin’s Future

The consensus among the AI models analyzed displays a complex yet optimistic forecast for Bitcoin. While fluctuations are expected, nearly all models anticipate significant price increases each year as we approach the end of the decade. For example, Deepseek projects that the price could potentially peak at $1 million by 2030, fueled in part by the scarcity of Bitcoin as well as the psychological impact of market trends following halving events. Similarly, Venice AI’s projections underscore the potential for massive price escalation due to the increasing adoption of Bitcoin as a mainstream digital asset.

This profound interest from both retail and institutional investors suggests that Bitcoin is standing on the brink of a transformative period. As we witness a shift towards more intelligent algorithms utilized in the cryptocurrency sphere, the synergy between advanced AI chatbots and crypto market analysis could yield even more accurate Bitcoin price analyses, providing better foresight for investors looking to navigate this volatile landscape.

The Role of Artificial Intelligence in Bitcoin Market Analysis

Artificial intelligence is becoming an indispensable tool for analyzing cryptocurrency markets, particularly in Bitcoin price predictions. The utilization of AI chatbots enables investors to receive insights grounded in comprehensive data analysis that factors in historical trends, market conditions, and potential future catalysts such as government regulations or technological advancements. These chatbots provide a unique vantage point by aggregating vast amounts of information and detecting patterns that traditional analysis may overlook.

Moreover, as AI continues to evolve, its application in making cryptocurrency predictions will likely become more refined. The intersection of AI technology with market analytics will not only enhance the precision of Bitcoin forecasts but also aids in anticipating market shifts, allowing traders and investors to make more informed decisions in a fast-paced crypto environment.

Cryptocurrency Predictions: How AI is Shaping the Future

The landscape of cryptocurrency predictions is being reshaped by advanced AI algorithms that leverage machine learning to provide insights into Bitcoin’s future. These predictions are not mere guesses; they are backed by extensive data and predictive modeling. With the recent bullish trends in Bitcoin price analysis, the forecasts from AI chatbots can help investors navigate the complexities of cryptocurrency trading, identifying potential entry and exit points in a volatile market.

Furthermore, as these technologies mature, they will catalyze new opportunities for investors and provide a clearer picture of the cryptocurrency ecosystem. By collating data from multiple sources and employing complex algorithms, AI-driven predictions can also adjust in real-time to market conditions, giving traders an edge in the highly competitive Bitcoin landscape.

Understanding the Impact of Bitcoin’s Halving Events on Price Predictions

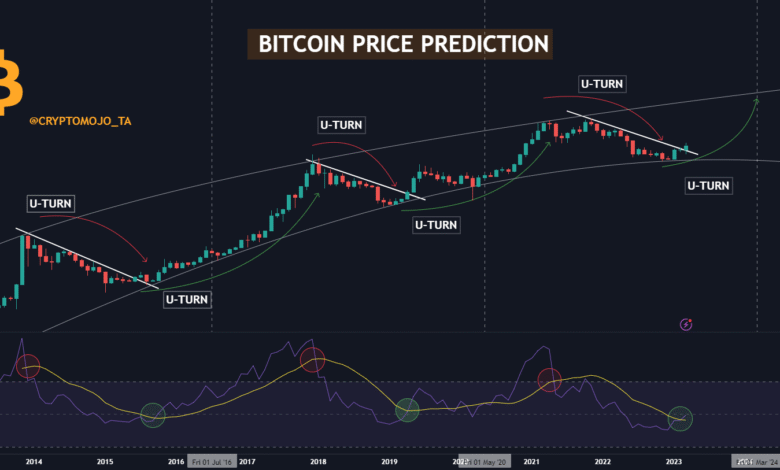

Bitcoin halving events have historically marked significant turning points in the price of Bitcoin, and the upcoming halving in 2024 is no exception. As the supply of new bitcoins is cut in half, market sentiment often shifts favorably, driving prices upward. This behavior is echoed in the AI chatbots’ predictions where many models show steep price increases leading into and following the halving events. For example, predictions for 2025 vary widely but all suggest a substantial deficit in supply as demand surges, hence the bullish forecasts.

The understanding of these cycles is crucial not only for investors but also for analysts predicting Bitcoin’s future value. By recognizing the impact of halving events, stakeholders can formulate strategies that align with projected price movement, leveraging the historical significance of these occurrences within the context of the cryptocurrency market.

Market Consolidation Years: Historical Insights

Examining the historical patterns of Bitcoin reveals that consolidation years often follow periods of heightened volatility and price spikes. Several AI models, such as those from Copilot and Qwen, predict that after reaching new highs, Bitcoin will likely encounter consolidation phases in 2026 and 2029. This aligns with historical trends in which Bitcoin’s price experiences retracement periods following peaks, allowing the market to absorb the changes before the next surge.

Understanding these consolidation phases helps investors strategize for profit-taking opportunities and buying into dips. By being aware that these patterns are a recurring theme in cryptocurrency cycles, investors can approach their Bitcoin portfolio with a more informed and balanced outlook.

Institutional Investment: A Driving Force in Bitcoin’s Forecast

The increasing interest from institutional investors is significantly influencing Bitcoin’s price predictions. Many AI chatbots highlight this trend in their analysis, attributing parts of their bold predictions to the growing acceptance of Bitcoin as a viable investment asset among larger financial institutions. As more institutional players enter the market, the liquidity and overall market dynamics can change dramatically, leading to new heights in Bitcoin valuations.

Furthermore, institutional adoption tends to provide a sense of legitimacy and stability to Bitcoin, which can encourage retail investors to enter the market. This influx of capital is pivotal in driving Bitcoin prices upward and could explain why many AI models project aggressive price targets for the coming years.

AI Chatbots: The Future of Financial Predictions

The emergence of AI technology in financial predictions, particularly regarding Bitcoin, signals a new era for investors seeking data-driven insights. AI chatbots are programmed to analyze and process data far beyond human capability, which opens up opportunities for more accurate and timely cryptocurrency predictions. These advancements enable clearer foresight into Bitcoin’s price trajectory through enhanced statistical modeling and analysis.

As this technology progresses, we can expect it to become increasingly integral to trading strategies while providing a competitive edge to savvy investors. The potential for AI-driven analytics to reshape the landscape of cryptocurrency predictions cannot be overlooked, especially as more individuals seek reliable methods for navigating market fluctuations.

The Future Value of Bitcoin: Analyzing Expert Predictions

The future value of Bitcoin has become a hot topic among both seasoned investors and industry newcomers. Many AI chatbots forecast a positive long-term outlook, suggesting that Bitcoin could potentially reach milestones upwards of $1 million by the end of the decade. Such predictions are built on fundamental concepts of scarcity, technological adoption, and macroeconomic conditions that suggest Bitcoin’s relevance will only grow as time progresses.

However, these predictions emphasize that while the potential for high returns exists, there are also risks involved in investing in cryptocurrency. Thorough market analysis, combined with the insights from AI models, can help investors approach Bitcoin’s future value with realistic expectations, preparing them for both bullish trends and bearish corrections that may arise in the dynamic market.

Frequently Asked Questions

What are the latest Bitcoin price predictions for 2025 to 2030?

Recent analyses show a range of bullish Bitcoin price predictions for the years 2025 to 2030, with estimates varying from $145,000 to $1,000,000. Most AI chatbots forecast Bitcoin’s value peaking at around $185,000 to $250,000 in 2025, followed by a potential rise to $450,000 by 2030, driven by factors like supply constraints and institutional adoption.

How do AI chatbots forecast Bitcoin’s future value?

AI chatbots forecast Bitcoin’s future value through complex algorithms that analyze market data, historical trends, and macroeconomic factors. They often consider elements such as Bitcoin halving events, market sentiment, and investor behavior to provide predictions. For instance, several models suggest strong upward trends leading to significant price increases by 2030.

What factors influence Bitcoin price analysis and predictions?

Bitcoin price analysis and predictions are influenced by multiple factors, including market demand, supply scarcity due to halving events, technological advancements, and regulatory changes. Additionally, macroeconomic conditions and investor sentiment play crucial roles in driving Bitcoin’s price trajectory.

What is the significance of the Bitcoin halving in price predictions?

The Bitcoin halving is a critical event that reduces the rate of new BTC creation, leading to increased scarcity. This event is often correlated with significant price rallies in the past, making it a vital factor in many Bitcoin price predictions. Analysts expect price surges post-halving, as seen in previous cycles.

Are long-term Bitcoin price forecasts reliable?

Long-term Bitcoin price forecasts can provide insights but should be taken cautiously. While many AI-driven models predict bullish trends, external factors such as economic instability and regulatory changes can impact actual outcomes. It’s important to view these predictions as optimistic scenarios rather than certainties.

What do experts say about Bitcoin’s price in 2030?

Experts project Bitcoin’s price in 2030 to potentially reach between $450,000 and $1,000,000, depending on market conditions and adoption rates. Predictions highlight the importance of supply shocks and increasing institutional interest driving the price higher in this timeframe.

How accurate are cryptocurrency predictions, particularly for Bitcoin?

Cryptocurrency predictions, especially for Bitcoin, can vary widely in accuracy due to market volatility. While AI models offer educated forecasts based on historical data and trends, sudden market shifts, changes in investor sentiment, and regulatory developments can dramatically affect outcomes.

What should investors consider when looking at Bitcoin price forecasts?

Investors should consider various factors such as market volatility, underlying technology, macroeconomic conditions, and the credibility of the sources providing Bitcoin price forecasts. It’s wise to conduct comprehensive research and remain aware of the risks associated with investing in cryptocurrencies.

Can AI chatbots provide better Bitcoin price predictions than traditional analysts?

AI chatbots can analyze vast amounts of data quickly and often provide unique insights into Bitcoin price predictions. However, combining AI predictions with traditional analyst expertise can yield a more comprehensive understanding of market trends and enhance decision-making for investors.

What are the potential price ranges for Bitcoin as projected by AI in the next five years?

AI models are projecting Bitcoin’s price to range from approximately $145,000 to over $1,000,000 by the end of 2030. The anticipated growth is driven by factors such as increasing adoption, halving events, and macroeconomic pressures that could affect supply and demand.

| Year | Predictions by AI Models | Key Drivers |

|---|---|---|

| 2025 | $185,000 (ChatGPT) / $250,000 (Deepseek) / $145,000 (Copilot) / $210,644 (Le Chat) / $180,000 (Qwen) | Halving effects, increasing institutional interest, market momentum |

| 2026 | $155,000 (ChatGPT) / $150,000 (Deepseek) / $142,500 (Le Chat) / $250,000 (Qwen) | Market correction, investor behavior, institutional interest |

| 2027 | $210,000 (ChatGPT) / $220,000 (Deepseek) / $200,000 (Le Chat) / $300,000 (Qwen) | Supply shocks, continued accumulation by investors |

| 2028 | $325,000 (ChatGPT) / $300,000 (Deepseek) / $325,000 (Le Chat) / $400,000 (Qwen) | Post-halving demand spike and historical trends |

| 2029 | $285,000 (ChatGPT) / $600,000 (Deepseek) / $457,500 (Le Chat) / $500,000 (Qwen) | Profit-taking, continued interest from major players |

| 2030 | $450,000 (ChatGPT) / $1,000,000 (Deepseek) / $500,000 (Le Chat) / $1,000,000 (Qwen) | Scarcity, global economic instability, sustained interest |

Summary

Bitcoin price predictions indicate significant optimism for the future of cryptocurrency, with experts forecasting considerable increases in BTC values through 2030. Many AI models predict Bitcoin could reach prices above $1 million per coin, driven by key factors such as market demand, institutional investment, and halving events. As Bitcoin continues to capture the interests of both investors and traders alike, these predictions highlight a strong bullish sentiment within the crypto community. Overall, the outlook for Bitcoin’s pricing trajectory remains exceptionally promising.