Premarket Stock Movements: Block, Pinterest, Verizon, and More

Premarket stock movements often set the stage for market sentiment as investors react to overnight news and earnings reports. Recent headlines highlight several notable players such as Block, which saw its shares surge 10% ahead of its inclusion in the S&P 500 index. Additionally, Pinterest enjoyed a boost following a stock upgrade from Morgan Stanley, driven by expectations of improved monetization strategies. Meanwhile, Verizon’s earnings exceeded analyst forecasts, prompting a 5% uptick in its stock price. With stocks like Cleveland-Cliffs also gaining after a less severe earnings report than anticipated, traders are keenly watching these premarket indicators for potential investment opportunities.

The early hours of stock trading can reveal key trends and shifts in investor confidence, often referred to as premarket trading movements. This crucial period includes significant updates regarding companies like Block, which is slated to join the S&P 500, and Pinterest, which recently received a favorable stock assessment from Morgan Stanley. Earnings announcements, such as those from Verizon, frequently drive market reactions, while additional insights on firms like Dollar Tree and Cleveland-Cliffs contribute to the overall landscape. As stocks fluctuate before the market opens, analysts and traders alike analyze these developments to guide their strategies for the day ahead.

Premarket Stock Movements: Key Highlights

In the world of stock trading, premarket movements can signal major shifts in market sentiment. This morning, several stocks are making headlines as investors react to new data and analyst assessments. Block, for instance, is up by 10% after being confirmed for inclusion in the prestigious S&P 500 index, indicating a strong trajectory ahead for the fintech firm. The upcoming transition may draw more institutional investors, propelling the stock even higher as it captures the market’s attention.

Pinterest saw a notable increase of over 5% in premarket trading, propelled by an upgrade from Morgan Stanley indicating a more favorable outlook on its performance. With the mention of strong engagement and revenue growth stemming from GPU enabled investments, investors are encouraged about Pinterest’s strategic positioning in the social media landscape. Such analyst ratings often lead to increased buying activity, suggesting a reinvigorated confidence in the company’s potential.

Block Stock News: A Closer Look at Market Movements

Block has been the subject of much attention this week, especially with its impending entry into the S&P 500. This move is not just a badge of honor, but a significant economic signal that usually leads to increased trading volume and enhanced visibility among investors. Analysts view this development favorably as it may provide a solid foundation for further growth. As companies transition into such recognized indices, they often experience heightened scrutiny and support from institutional investors.

Having recently replaced Hess, acquired by Chevron, Block’s growth trajectory appears promising. Market analysts suggest that boosting its market capitalization as a component of the S&P could attract an influx of investment. This positive sentiment around Block reinforces a broader trend in fintech stocks, emphasizing the increasing reliance on digital payment solutions within the financial industry.

Pinterest Stock Upgrade: Analysts Weigh In

The recent upgrade of Pinterest’s stock to overweight from equal weight reflects analysts’ confidence in the company’s future prospects. Morgan Stanley’s Brian Nowak points to its valuation as ‘attractive,’ suggesting that current prices do not fully reflect Pinterest’s growth potential, particularly in the face of its recent engagement and monetization strategies. This is crucial as social media companies navigate changing consumer preferences and advertising landscapes.

In his report, Nowak referenced Pinterest’s investments in GPU technology and its strategies to enhance user engagement. These developments illustrate Pinterest’s commitment to innovation, which is paramount in maintaining user interest and generating revenue. The market’s positive reception of this upgrade can potentially lead to significant upward momentum for Pinterest’s stock in both the short and long term.

Verizon Earnings: A Strong Performance in Telecommunications

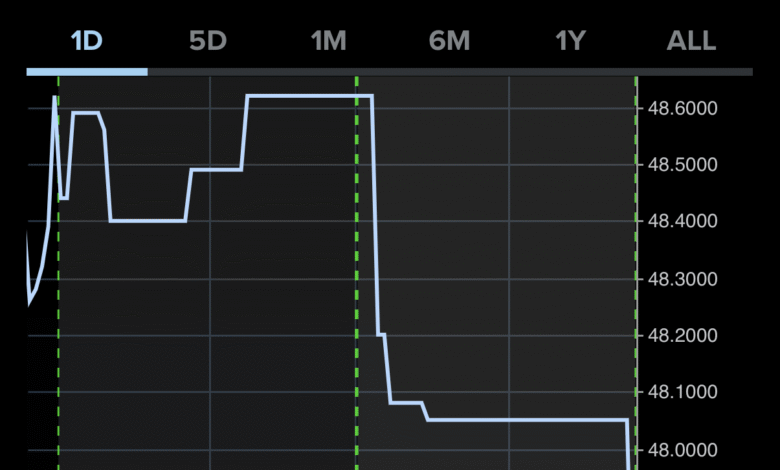

Verizon’s stock climbed 5% following the release of its second-quarter earnings, which exceeded Wall Street estimates both in revenue and earnings per share. The telecommunications giant reported earnings of $1.22 per share on revenues hitting $34.5 billion, beating expectations of $1.18 earnings per share on $33.74 billion in revenue. This solid performance showcases Verizon’s resilience and ability to adapt in a highly competitive market.

Investors are encouraged by Verizon’s consistent growth in earnings, signaling stability that is often sought after in the telecom sector. Despite industry challenges, such as rising costs and increased competition, Verizon’s proactive strategies in expanding its 5G network and enhancing customer service have paid off. Analysts expect continued long-term growth, further reinforcing Verizon’s position in the telecommunications landscape.

Dollar Tree Stock Analysis: Growth Outlook

Dollar Tree shares gained 2% after being upgraded to overweight from equal weight by Barclays, who expressed optimism for a clearer growth narrative within the company. The dollar store model has proven resilient throughout economic uncertainty, and Dollar Tree’s commitment to maintaining low prices alongside strategic expansions has placed it in a strong position as consumers lean towards value shopping.

Analysts highlight that investors should watch Dollar Tree closely as it navigates its growth strategy, including potential new store openings and enhanced inventory management systems. Their proactive steps aim to ensure sustained profitability and customer satisfaction, making Dollar Tree an attractive option for investors focusing on companies with solid fundamentals during uncertain economic times.

Cleveland-Cliffs Earnings Report: Market Reaction

Cleveland-Cliffs shares surged 7% following the release of their second-quarter earnings report, which showed a narrower-than-expected loss. Analysts had anticipated a loss of 74 cents per share, but the company reported a loss of only 50 cents per share. This turnaround suggests effective cost management and operational efficiency, critical for companies in the manufacturing sector, especially amid fluctuating steel prices.

The company’s ability to meet revenue expectations also reflects broader industrial stability. Cleveland-Cliffs’ progress is indicative of a burgeoning steel market, with growing demand for infrastructure projects contributing to an optimistic outlook for subsequent quarters. Investors are now keenly focused on how Cleveland-Cliffs leverages its resources to capitalize on market dynamics moving forward.

Market Trends and Analyst Ratings: Understanding Stock Movements

Today’s premarket activity reveals an interesting interplay of analyst ratings and market movements across various stocks. For example, the sentiment around Pinterest and Dollar Tree indicates that stock upgrades can significantly influence investor behavior and stock prices. These movements often reflect broader market trends, where stocks are responding to economic indicators and company performance.

It’s essential for investors to keep a close watch on analyst upgrades and downgrades, as they can serve as leading indicators for potential market shifts. The recent trends with companies like Block and Verizon illustrate how earnings reports and upgrades shape market perspectives, offering valuable insights into investment strategies.

Economic Influences on Stock Performance: Trends Overview

The current economic climate is having a significant impact on stock performance across multiple sectors. Investors are navigating through inflation concerns, changing consumer behaviors, and various economic indicators that influence their trading decisions. Stocks like Block and Verizon are gaining traction due to stable earnings reports and strategic upgrades, highlighting the importance of economic health in driving market confidence.

As companies adapt to evolving economic conditions, it’s crucial for stocks to exhibit resilience and growth potential. For instance, Cleveland-Cliffs and Dollar Tree have positioned themselves uniquely in their respective markets, serving needs that remain robust during economic fluctuations. Watching how these dynamics unfold will provide a clearer picture of long-term market health.

Future Stock Predictions: Insights and Expert Opinions

Looking ahead, analysts are paying close attention to the stocks making notable moves today. Predictions surrounding Block and Verizon suggest that their upward trajectories may continue, particularly if they can maintain their recent momentum and investor confidence. These forecasts are integral as they help guide both short-term trading strategies and long-range investment planning.

Investor sentiment will be influenced not only by expert opinions but also by upcoming earnings reports and market trends as companies navigate through ongoing economic challenges. The ability of firms like Pinterest and Dollar Tree to outperform expectations could set the tone for market optimism or caution, demonstrating how critical these movements are in shaping the future of stock performance.

Frequently Asked Questions

What are the key factors influencing premarket stock movements for Block, Pinterest, and Verizon?

Premarket stock movements for companies like Block, Pinterest, and Verizon are influenced by significant announcements and upgrades. For instance, Block saw a 10% surge due to its impending inclusion in the S&P 500, while Pinterest rose over 5% following a stock upgrade by Morgan Stanley. Verizon’s stock increased by 5% as its earnings exceeded analysts’ expectations, indicating strong financial performance.

How did premarket stock movements affect Dollar Tree’s stock analysis?

Dollar Tree’s premarket stock movements indicate a positive outlook, having gained 2% after an upgrade to overweight by Barclays. This analysis suggests that analysts believe Dollar Tree has a ‘cleaner growth story’ ahead, making it a favorable investment option in the current market.

Which earnings reports influenced premarket stock movements for Cleveland-Cliffs and Verizon?

Cleveland-Cliffs experienced a 7% gain in premarket trading due to a narrower-than-expected loss in its second-quarter earnings report, while Verizon’s stock increased by 5% after reporting earnings and revenue that surpassed analysts’ projections. Both companies’ strong earnings reports were crucial for their premarket stock movements.

What impact do analyst upgrades have on premarket stock movements for companies like Pinterest and Dollar Tree?

Analyst upgrades play a significant role in premarket stock movements. For instance, Pinterest’s shares jumped over 5% following an upgrade to overweight by Morgan Stanley, highlighting the influence of analyst sentiment on investor confidence. Similarly, Dollar Tree’s 2% gain post-upgrade reflects how positive ratings can stimulate investor interest and drive stock prices higher.

How do premarket stock movements indicate market sentiment for Domino’s Pizza and Sarepta Therapeutics?

The premarket stock movements for both Domino’s Pizza and Sarepta Therapeutics reflect divergent market sentiments. Domino’s stock rose nearly 4% after reporting better-than-expected same-store sales, indicating investor optimism. Conversely, Sarepta Therapeutics tumbled 8% following negative news regarding its gene therapy approval, demonstrating how adverse developments can swiftly alter market perception and investor decisions.

What role do financial forecasts and earnings reports play in premarket stock movements for Verizon?

Financial forecasts and earnings reports are crucial for premarket stock movements, as seen with Verizon. The company’s stock rose by 5% in premarket trading after posting earnings per share of $1.22, surpassing expectations, along with revenue that also outperformed forecasts. This positive financial performance is often a strong indicator of future investor confidence and stock valuation.

| Company | Premarket Movement | Reason for Movement |

|---|---|---|

| Block | +10% | Joining S&P 500, replacing Hess. |

| +5% | Upgraded by Morgan Stanley to overweight due to valuation and engagement improvements. | |

| Dollar Tree | +2% | Upgrade to overweight from Barclays, optimistic growth outlook. |

| Target | -1% | Downgraded to underweight by Barclays, expected sales lag. |

| Domino’s Pizza | +4% | Beat earnings expectations with a sales increase. |

| Cleveland-Cliffs | +7% | Narrower than expected loss in Q2; revenue met expectations. |

| Verizon | +5% | Beat earnings estimates on Q2 performance. |

| Sarepta Therapeutics | -8% | FDA retracting its support for a gene therapy prompted downgrades. |

| Invesco | +2% | Upgraded to buy amid strategic fund transition announcement. |

Summary

Premarket stock movements today have shown significant fluctuations with various companies making headlines. Notable gains were seen in stocks like Block and Pinterest, while Sarepta Therapeutics experienced a steep decline following regulatory news. Key factors influencing these movements included upgrades and downgrades by analysts, earnings reports, and strategic changes within the companies. As investors prepare for the market opening, these premarket stock movements reflect broader market sentiments and company-specific developments.