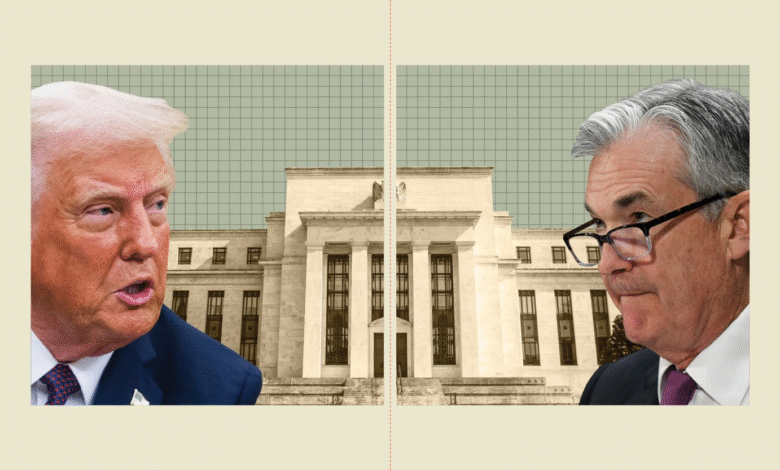

Trump Federal Reserve Criticism: Powell’s Future in Question

Trump Federal Reserve criticism has become a recurring theme as the former president openly voices his dissatisfaction with the central bank’s policies, particularly under Fed Chair Jerome Powell. Trump has consistently accused Powell of failing to adjust Federal Reserve interest rates in a timely manner, asserting that his decisions have hindered economic growth. “He’s done a bad job,” Trump stated, hinting at a possible replacement for Powell to better align the Fed’s approach with his administration’s monetary policy goals. The former president’s remarks on Powell’s job security further fuel speculation about the Fed chair’s future. As Trump navigates the complex landscape of economic leadership, his critiques underscore the contentious relationship between the White House and the Federal Reserve.

In the ongoing dialogue surrounding the nation’s monetary policy, many observers note the tension between President Trump and the Federal Reserve, reflecting broader concerns over economic governance. Trump’s dissatisfaction with the actions of the current Fed chair, Jerome Powell, has sparked debates about the effectiveness of interest rate policies and their impact on homebuyers and the overall economy. Moreover, the looming questions about Powell’s position and the Fed’s decision-making processes highlight the challenges of maintaining independence from political pressures. As discussions about the future of economic leadership evolve, the implications for both Trump’s administration and the Federal Reserve remain significant, making this a pivotal topic for financial analysts and policymakers alike.

Trump’s Ongoing Criticism of the Federal Reserve

President Donald Trump’s critical remarks about the Federal Reserve have been a recurring theme throughout his presidency. His most pointed criticisms have been directed at Chair Jerome Powell, whom he appointed but soon deemed ineffective. Trump has often expressed discontent with Powell’s cautious approach to adjusting Federal Reserve interest rates, arguing that a more aggressive stance would benefit the economy. This tension between the White House and the Fed has led many to speculate about Powell’s job security and Trump’s potential to make changes to the leadership at the central bank.

Despite Trump’s repeated assertions that Powell is doing a “bad job,” recent comments hint at a reluctance to take drastic action, such as firing him. Trump’s declaration that Powell will be out “pretty soon anyway” seems to suggest a belief that the chair’s term will naturally come to an end without immediate intervention. This mix of criticism and tempered action reflects Trump’s complex relationship with monetary policy and highlights ongoing concerns about the impact of Fed decisions on economic recovery and homeownership.

The Stakes of Powell’s Job Security

Amidst Trump’s outbursts, Powell’s job security remains a hot topic of discussion. Although Trump has threatened firing Powell, experts argue that such a move would undermine the traditional independence of the Federal Reserve. Powell’s current term as chair does not expire until May 2026, hinting that Trump’s criticisms may not culminate in immediate action, regardless of the frustrations expressed. However, the pressure from the administration presents a unique challenge for Powell, as he must navigate both the economic landscape and the political sentiments of the Trump administration.

The focus on Powell raises broader questions about the relationship between the Federal Reserve’s monetary policy and political influences. Many economists argue that the Fed’s independence is crucial for effective long-term economic planning, suggesting that hasty adjustments made under political pressure can lead to adverse economic consequences. As Trump continues to publicly critique Powell’s decisions about interest rates, concerns grow about how this dynamic affects the Fed’s credibility, public trust, and overall financial stability.

Trump’s Monetary Policy and its Impact

Trump’s approach to monetary policy has come under scrutiny, particularly his demands for lower interest rates. Throughout his presidency, he has repeatedly criticized the Fed for not acting fast enough to stimulate economic growth, demonstrating a clear preference for looser financial conditions. By questioning Powell’s rate decisions, Trump has positioned himself as a staunch advocate for aggressive monetary policies, suggesting that this could drive more immediate benefits to the American economy, particularly in sectors such as housing.

However, critics caution that the implications of such policies can be far-reaching, potentially leading to inflationary pressures if rates remain too low for too long. This tension highlights the ongoing debate surrounding the balance of economic growth versus inflation control. As Trump continues to focus on the implications of Federal Reserve interest rate decisions, the ramifications of his monetary policy views could have lasting effects on the Fed’s trajectory and its impact on everyday Americans.

The Federal Reserve’s Renovation Project Controversy

In addition to his ongoing remarks about interest rates, Trump has expressed concerns about the Federal Reserve’s spending on a significant renovation project for its Washington, D.C. headquarters. He questioned the necessity of spending $2.5 billion on building improvements when the Fed is facing criticism for its financial decisions. Such remarks reflect Trump’s broader frustrations with perceived wasteful spending, reinforcing his narrative that the Federal Reserve is out of touch with the needs of the average American.

This scrutiny of the Fed’s budgetary allocations comes at a time when many Americans are grappling with economic challenges. With high interest rates limiting home affordability and economic recovery in question, Trump’s concerns about the Fed’s financial priorities resonate with constituents who may feel the impact of such decisions firsthand. Moving forward, the dialogue surrounding the Fed’s spending and Trump’s critique will likely influence public perception of the central bank’s legitimacy and effectiveness.

Reactions from Administration Officials

While Trump has been vocal about his dissatisfaction with the Fed, some administration officials take a more tempered view of Powell’s actions. Treasury Secretary Scott Bessent mentioned that Powell has served the public well, which contrasts sharply with Trump’s abrasive stance. This divergence in opinions within the administration reflects the delicate balance needed between political expectations and the necessity for independent monetary policy making.

Additionally, Bessent’s call for a ‘major internal investigation’ at the Fed indicates a broader concern regarding the central bank’s direction and priorities. Such inquiries could potentially lead to critical assessments of monetary policy decisions while simultaneously addressing Trump’s accusations of spending mismanagement. Overall, this mixture of support for Powell’s tenure and critical reviews encapsulates the ongoing complexities faced by the Federal Reserve amidst a politically charged atmosphere.

The Economic Rhetoric of Trump versus Powell

Trump’s rhetoric often positions him as an economic advocate for the American people, painting the Federal Reserve and Powell as obstacles to prosperity. His characterization of Powell as someone who has failed to adequately respond to economic challenges presents a stark contrast to the Fed’s more calculated and cautious approach. This disconnect highlights the broader conflict between political influences and the economic pragmatism that typically guides central banking decisions.

Furthermore, Powell’s commitment to data-driven decision-making clashes with Trump’s demand for more immediate and favorable results. This tension can create challenges in effectively managing public expectations regarding monetary policy. The divergence between Trump’s economic rhetoric and Powell’s operational strategies underscores the complexities of governance when economic realities collide with political imperatives.

The Future of the Federal Reserve under Trump

The future of the Federal Reserve under the Trump administration seems uncertain, particularly as the relationship between the president and Powell remains strained. Trump’s criticism of the Fed’s actions suggests that he may push for changes in monetary policy that align more closely with his vision for the economy. As Trump’s electoral aspirations loom large, the pressure on Powell to implement favorable policies may increase.

However, Powell’s steadfastness to maintain the Federal Reserve’s independence may limit Trump’s ability to exert influence over key decisions. The potential for conflict between political ambitions and the necessity for balanced economic policies indicates that the future dynamics of the Federal Reserve will hinge on both Trump’s approach and Powell’s willingness to maintain the institution’s integrity. Regardless of the outcome, the interplay between these two powerful figures will undeniably shape the landscape of American monetary policy.

Repercussions of Trump’s Criticism on the Economy

Trump’s relentless criticism of the Federal Reserve has broader implications for the economy beyond his immediate influence. The uncertainty created by such public criticism can lead to volatility in financial markets, with investors closely monitoring the dynamics between the White House and the central bank. This potential instability can affect consumer confidence and spending patterns, which are crucial in driving economic growth.

Moreover, the potential for shifts in Federal Reserve policy as a reaction to Trump’s criticisms could lead to unintended consequences for various economic sectors. For instance, housing markets may face additional strains if the Fed responds too quickly to political pressures without adequately assessing inflationary risks. As such, the interplay between Trump’s commentary and the Fed’s decisions will undoubtedly shape the economic landscape long after his administration.

Navigating Political and Economic Realities as Fed Chair

For Jerome Powell, navigating the dual realities of political pressure from Trump and the responsibilities of his role as Fed chair presents unique challenges. Despite the need to make decisions that promote economic stability, Powell must also consider the implications of the president’s continuous public critique. While serving as Fed chair in a politically charged environment, Powell’s approach must reflect prudence and independence, balancing the demands of the White House with the principles of sound monetary policy.

This predicament illustrates the ongoing tug-of-war between the political sphere and economic stewardship. The decisions made by Powell in the coming months will be closely scrutinized as he faces pressure from both sides. Treading carefully amidst such expectations will be essential for sustaining the Federal Reserve’s credibility and effectiveness in fostering long-term economic health.

Frequently Asked Questions

What are Trump’s main criticisms of Jerome Powell and the Federal Reserve?

President Trump has criticized Jerome Powell, the Fed chair, for his cautious approach to Federal Reserve interest rates, claiming that he has acted too late in making necessary rate cuts. Trump believes that Powell’s decisions hinder economic growth and home buying, stating that the high rates limit opportunities for Americans. He has accused Powell of being political in his actions and causing unnecessary delays in monetary policy adjustments.

How has Trump expressed his thoughts on Powell’s job security?

While President Trump has indicated that he thinks Jerome Powell has done a bad job as Fed chair, he also mentioned that it is ‘highly unlikely’ he would attempt to fire Powell. Trump suggested that Powell would be out after eight months, hinting at a potential shift in leadership at the Federal Reserve. However, Powell’s term is officially set to end in May 2026.

What specific monetary policy decisions has Trump criticized from the Federal Reserve?

Trump has criticized the Federal Reserve for not lowering interest rates quickly and decisively. He has called for more aggressive monetary policy adjustments, suggesting that Powell has delayed necessary rate cuts, which he believes negatively impacts home buying and overall economic growth.

Why did Trump label Powell as ‘too late’ regarding monetary policy?

Trump labeled Powell as ‘too late’ because he believes the Fed chair has consistently missed opportunities to lower interest rates when economic conditions warranted them. He argues that this delay has prevented Americans from accessing affordable housing and has adversely affected the economy.

What recent concerns has the Trump administration raised about Federal Reserve spending?

The Trump administration has raised concerns regarding a $2.5 billion renovation project undertaken by the Federal Reserve in Washington, D.C. Officials, including Treasury Secretary Scott Bessent, have called for a major internal investigation into the Fed’s spending practices, arguing that there has been significant mission creep and questioning the necessity of such expenditures.

| Key Points |

|---|

| President Trump criticizes the Federal Reserve for its cautious approach to interest rate cuts. |

| He has suggested that Fed Chair Jerome Powell may not be suited for the job and hinted at wanting to replace him. |

| Trump claims Powell’s decisions are beneficial for political reasons rather than public welfare. |

| The Fed is currently undertaking a $2.5 billion renovation in Washington, D.C., which has raised concerns from the Trump administration. |

| Despite his criticism, Trump deems firing Powell as “highly unlikely.” |

Summary

Trump Federal Reserve criticism has been a continuous theme throughout his presidency, particularly targeting Chair Jerome Powell’s decisions. While expressing frustration over interest rates and Powell’s performance, Trump has also considered the implications of reshuffling the Fed’s leadership. Despite speculations, it appears that Trump is leaning towards accepting Powell’s tenure until its conclusion in May 2026, while still expressing dissatisfaction with Federal Reserve actions like the costly renovations.