MEXC Stock Futures: Trade US Stocks with Zero Fees

MEXC Stock Futures represent a groundbreaking approach to trading U.S. equities, as they harness the power of cryptocurrency for seamless transactions. With their zero-fee trading model, MEXC enables users to engage with stock futures in a way that eliminates traditional brokerage barriers while utilizing USDT for settlement. This innovative platform is paving the way for the seamless integration of crypto and traditional finance, appealing to both seasoned traders and newcomers. Not only do these futures offer exposure to popular U.S. shares, but they also empower traders with bi-directional trading capabilities and significant leverage options. As the MEXC exchange enhances user experience and accessibility, it signals a transformative shift in the landscape of trading equity markets.

The launch of MEXC’s stock derivatives signifies a notable evolution in market accessibility for investors worldwide. By offering no-fee trading of U.S. equity futures through a cryptocurrency framework, MEXC merges the realms of digital assets and conventional finance, creating a unique trading experience. Users can now interact with popular stock pairs while enjoying the benefits of instant transactions and reduced costs, all within the supportive environment of a leading crypto exchange. This development not only democratizes trading but also introduces innovative financial instruments that elevate user engagement. The introduction of USDT stock futures at MEXC underscores a significant trend toward integrating traditional market dynamics with advanced crypto solutions.

MEXC Stock Futures: A Game Changer for Investors

MEXC’s launch of stock futures marks a revolutionary shift in the trading landscape, particularly for investors seeking to navigate both crypto and traditional finance. By providing a platform where users can engage with U.S. stocks without the usual brokerage entanglements, MEXC simplifies the investment process significantly. This unique offering not only eliminates trading fees but also facilitates transactions in USDT, making it an attractive option for crypto enthusiasts looking to diversify their portfolios into equity markets.

Moreover, the strategic move to incorporate features such as leverage and bi-directional trading allows traders to maximize their potential returns while minimizing entry barriers. The ability to trade nine major U.S. stock pairs enhances the appeal for both seasoned investors and newcomers alike, as it offers them more options to explore. This initiative emphasizes MEXC’s commitment to bridging the gap between traditional equities and cryptocurrency, making it a frontrunner in this evolving financial landscape.

The Advantages of No-Fee Trading on MEXC

No-fee trading is emerging as a cornerstone of MEXC’s product offering, substantially reshaping how investors approach the stock market. By abolishing traditional fees associated with stock trading, MEXC not only reduces costs but also fosters a more transparent trading environment. For investors who are wary of hidden charges often levied by brokerage firms, MEXC presents a refreshing alternative that reinforces the notion of accessibility in trading. This cost-saving attribute significantly enhances user confidence, encouraging more people to participate in the dynamic world of equity markets.

In addition, the no-fee structure serves to democratize trading, allowing even those with limited capital to engage with U.S. stocks. This strategic advantage not only lowers the entry threshold but also promotes active participation among various demographics, including younger investors and those who might have previously avoided traditional stock exchanges due to hefty fees. The elimination of these costs is crucial for MEXC’s mission to redefine how trading should be perceived in the realm of both crypto and traditional finance.

How MEXC Merges Crypto and Traditional Finance

MEXC is tirelessly working to create a seamless connection between the worlds of cryptocurrency and traditional finance. By integrating stock futures with USDT, MEXC facilitates a direct pathway for crypto traders to explore equity investments without needing to switch from their preferred payment modes. This integration symbolizes a broader trend towards financial inclusivity, where individuals can navigate multiple financial avenues through a single platform, catering to both seasoned traders and crypto novices.

Furthermore, the alignment with trading hours of established platforms like NASDAQ and NYSE ensures that MEXC users experience real-time market movements and price updates, attracting those who value precision in their trading endeavors. Such functionalities are crucial in mitigating off-hour volatility, providing traders with the confidence to execute strategies effectively. The commitment to marrying the innovative aspects of cryptocurrency with the time-tested reliability of traditional financial instruments positions MEXC at the forefront of this transformative movement.

Navigating the U.S. Equity Markets with MEXC

Engaging with U.S. equity markets has traditionally required investors to go through various intermediaries, often deterring many from participating. MEXC’s new stock futures offering eliminates this hurdle, allowing users to trade directly using cryptocurrencies like USDT. This revolutionary approach not only simplifies the trading process but also brings the liquidity of cryptocurrency into the U.S. stock market, giving investors the dual advantages of both worlds.

Through its user-friendly interface, MEXC enables even novice traders to comfortably navigate the complexities often associated with stock trading. Coupled with features like bi-directional trading, users can speculate on stock price movements in either direction—buying the stock they believe will rise or shorting stocks they foresee will drop. This flexibility is crucial in today’s fast-paced financial landscape, helping traders adapt their strategies in real-time.

Leveraging Technology in Stock Futures Trading

MEXC harnesses advanced technology to enhance the trading experience for its users. The platform features millisecond-level execution, which is critical for traders who need to capitalize on fleeting market opportunities. Quick execution can be the difference between profit and loss, especially in the highly volatile world of stock trading. By investing in cutting-edge technology, MEXC demonstrates its commitment to providing a superior trading infrastructure that traditional brokerage firms often struggle to match.

Additionally, real-time risk notifications empower traders by keeping them informed of potential market movements and large price fluctuations. This real-time feedback loop enhances decision-making, allowing traders to react swiftly to changes in the market. By merging such technological advancements with a no-fee trading model, MEXC positions itself as a pioneering platform for both crypto traders and traditional investors looking to navigate the complexities of stock futures.

MEXC Exchange: Pioneering Innovation in Trading

As a leading global cryptocurrency exchange, MEXC is at the forefront of innovation in the trading sector. Its exploration into stock futures indicates a commitment to not only expanding its offerings but also redefining how trading is conducted. This pioneering spirit resonates with users who are eager to explore investment opportunities beyond typical trading paradigms. MEXC’s approach reveals that it is not just a trading platform but a catalyst for change, helping bridge the gap between disparate financial sectors.

Moreover, MEXC’s ability to introduce features that adhere to market needs reflects its deep understanding of its user base. By eliminating trading fees and enabling USDT settlements, MEXC addresses common pain points faced by traders in both the crypto and traditional arenas, setting itself apart from competitors. This forward-thinking mentality positions MEXC as more than just an exchange—it serves as a comprehensive financial ecosystem that enhances user engagement and satisfaction.

Empowering Users Through Enhanced Trading Experience

MEXC’s commitment to user empowerment is evident in its focus on delivering a superior trading experience. Features like user-friendly interfaces and synchronized trading hours are designed with the trader in mind, ensuring that they can engage with the markets as effectively as possible. Understanding that ease of use is crucial for success, especially for new traders, MEXC has prioritized this aspect in its stock futures product offering.

In addition, MEXC’s focus on providing tools and resources that educate traders on market dynamics aligns with its mission to empower users. By equipping them with vital information and responsive trading systems, MEXC enhances not only the trading experience but also users’ overall understanding of how to navigate both equity markets and cryptocurrency effectively.

Risks and Considerations in Stock Futures Trading

While MEXC’s stock futures offering presents exciting opportunities, it is essential for traders to understand the inherent risks associated with this type of trading. Futures trading, particularly in volatile markets like equity and cryptocurrency, can lead to significant losses if not managed correctly. Therefore, it is critical for traders to conduct thorough market analysis and develop robust risk management strategies before engaging in such trading activities.

Moreover, traders should also remain vigilant about market conditions and regulatory changes that might impact their investments. MEXC does provide users with risk notifications and market insights, but individuals must take personal responsibility for their trading decisions. By maintaining an informed approach, traders can better navigate the challenges presented by stock futures trading and seize opportunities effectively.

The Future of Trading: Insights from MEXC

The landscape of investing is continuously evolving, and MEXC is leading this transformation through innovative products like no-fee stock futures. As financial markets increasingly converge, the lines separating traditional finance from the cryptocurrency space are blurring. MEXC’s pioneering efforts signify a future where blended trading experiences could become the norm, spotlighting the potential for hybrid financial products that appeal to a diverse range of investors.

Looking ahead, the emergence of stock futures is just the beginning. MEXC aims to continue refining and expanding its offerings, fostering an ecosystem that encourages participation from various investor categories. With advancements in technology and an unwavering commitment to user satisfaction, MEXC is not only shaping its future but also redefining what is possible in the realms of investment and trading.

Frequently Asked Questions

What are MEXC Stock Futures and how do they work?

MEXC Stock Futures allow users to trade major U.S. stocks using USDT without needing a traditional brokerage account. This innovative product combines the advantages of cryptocurrency with traditional finance and offers features like zero trading fees, bi-directional trading, and up to 5x leverage.

How does no-fee trading on MEXC Stock Futures benefit users?

The no-fee trading on MEXC Stock Futures eliminates the usual brokerage costs, allowing users to maximize their profits when trading U.S. equities. It provides a cost-effective way for traders to engage with both crypto and traditional finance markets.

Can I trade U.S. stocks on MEXC without a brokerage account?

Yes, MEXC Stock Futures allows you to trade U.S. stocks directly using USDT without the need for a traditional brokerage account. This feature simplifies the trading process and lowers entry barriers for users.

What are the trading hours for MEXC Stock Futures compared to traditional exchanges?

MEXC Stock Futures mirrors the trading hours of major U.S. stock markets, including NASDAQ and NYSE. This alignment minimizes off-hour volatility and provides a real-world trading experience for users.

What leverage options are available when trading MEXC Stock Futures?

MEXC Stock Futures offers up to 5x leverage, enabling traders to amplify their positions when investing in popular U.S. stock pairs. This feature accommodates various trading strategies and risk appetites.

How do MEXC Stock Futures integrate cryptocurrency and traditional finance?

MEXC Stock Futures bridge the gap between cryptocurrency and traditional finance by allowing users to trade U.S. equities using USDT, thereby merging the benefits of both financial ecosystems while providing a seamless trading experience.

What user-friendly features does MEXC provide for stock futures trading?

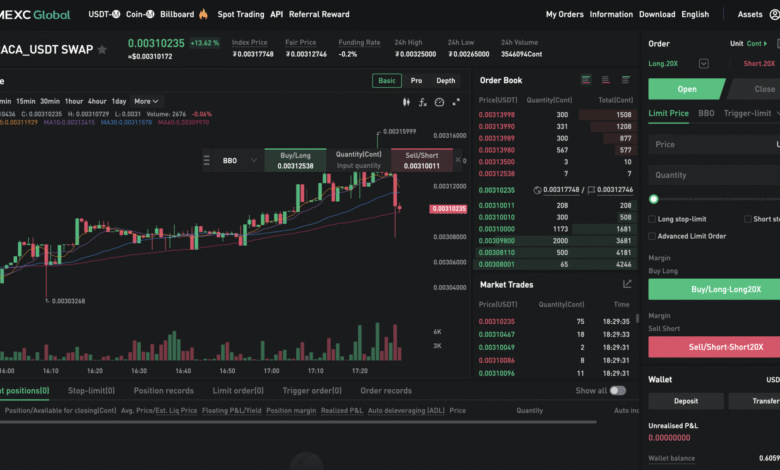

MEXC provides a user-friendly interface along with millisecond-level execution and real-time risk notifications for stock futures trading. These features enhance the overall trading experience and improve decision-making for users.

What major U.S. stock pairs are supported by MEXC Stock Futures?

The initial launch of MEXC Stock Futures supports nine major U.S. stock pairs, offering traders diverse options to invest in popular equities while leveraging the advantages of zero fees and USDT settlement.

| Key Points | |

|---|---|

| MEXC launches stock futures with no fees. | Allows trading of U.S. stocks using USDT, eliminating brokerage requirements. |

| Supports nine major U.S. stock pairs and offers 5x leverage. | Features bi-directional trading, allowing short and long positions. |

| User-friendly interface with millisecond execution times. | Real-time risk notifications and synchronized trading hours with major U.S. exchanges. |

| Aims to bridge cryptocurrency and traditional finance with reduced costs. | Tracy Jin emphasizes empowering users with high-quality investment products. |

Summary

MEXC Stock Futures represents a groundbreaking step in the evolution of trading by allowing users to engage with U.S. equities without traditional brokerage barriers or fees. This innovative service not only merges cryptocurrency with traditional finance but also offers enhanced trading experiences through features like high leverage, real-time notifications, and synchronized trading hours with U.S. markets, paving the way for easier access to diverse financial products.