XRP Weekly Loss: A Look at Recent Crypto Market Trends

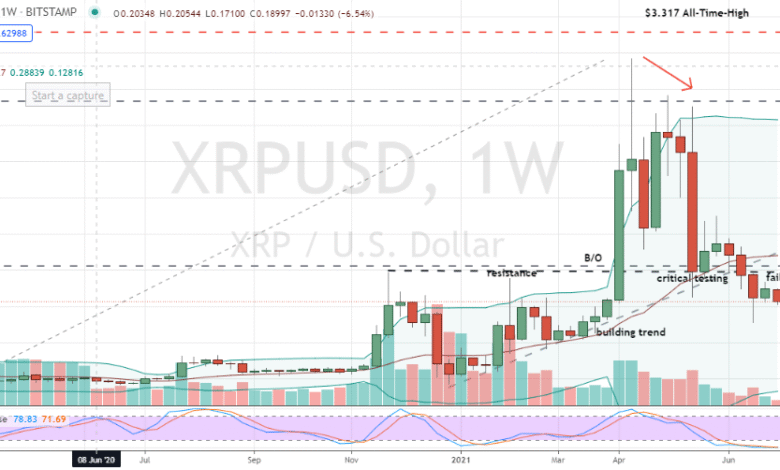

This week marked a challenging period for XRP, as it experienced a noticeable weekly loss that further highlighted the volatility of the cryptocurrency market. Starting off at $3.45, XRP climbed briefly to a peak of $3.64, only to tumble over 13% to $2.99, leading to an overall decline of nearly 8% by the week’s end. This steep drop solidified XRP’s position as the top loser among its peers, despite the excitement surrounding anticipated XRP price predictions. As crypto market trends shift unpredictably, the performance of other coins like BCH, which surged 8.7%, raises questions about the resilience and competitiveness of altcoin gains. Cryptocurrency news outlets continue to report on these fluctuations, reflecting the ongoing dynamism in digital asset investments and the impact of such losses on trader sentiment.

In recent days, XRP has taken the lead as one of the notable losers in the crypto landscape, drawing attention with its significant weekly downturn. After an initial ascent that brought it close to its all-time high, this prominent altcoin’s sharp decline has left many analysts re-evaluating their projections. Meanwhile, the performance of BCH has captured headlines as it rises remarkably against this backdrop, offering a stark contrast to XRP’s challenging circumstances. As traders digest these developments, insights into cryptocurrency performance and market sentiment continue to highlight the complexities and rapid changes characteristic of the digital currency sphere. With varying degrees of success across different altcoins, the conversation surrounding potential gains and losses persists, keeping investors on their toes.

XRP Weekly Loss: Analyzing the Factors Behind the Decline

XRP experienced a significant setback last week, closing at $3.18 after starting off the week at $3.45. This marked a notable loss of just under 8%, making it the leading digital asset in terms of weekly decline. Various factors contributed to XRP’s swift drop, including market volatility and shifts in investor sentiment. The cryptocurrency market’s trends are often unpredictable, but the steep decline of XRP could also be linked to external pressures such as regulatory news and market performance of major cryptocurrencies like Bitcoin and Ethereum.

Another contributing factor to XRP’s dip may include profit-taking behavior among traders who had previously benefited from a rally in altcoin prices. As XRP momentarily peaked at $3.64, some investors may have chosen to cash out, leading to increased sell pressure. The performance of BCH, on the other hand, indicates that not all altcoins are experiencing similar declines; as BCH surged an impressive 8.7% last week, XRP was set on a different trajectory. Analysts will continue to watch market trends closely to ascertain potential recovery patterns for XRP.

BCH and Its Remarkable Surge in a Mixed Market

BCH’s 8.7% upward momentum stands in stark contrast to XRP’s troubling performance last week. Having closed the week around $555, BCH’s resurgence demonstrates the term ‘crypto market trends’ in action; while some assets faltered, BCH capitalized on renewed interest and positive sentiment from investors. This surge might also reflect the growing bullish sentiment surrounding altcoins, as traders seek opportunities away from large-cap cryptocurrencies like Bitcoin.

Furthermore, BCH’s performance can be attributed to its increasing use cases and technological advancements. As more investors turn towards reliable altcoins for potential gains amidst fluctuating market conditions, BCH’s upward momentum serves as a beacon for those looking for alternatives. The combination of strengthened utility and increasing market confidence could enable BCH to continue its strong performance, possibly even outperforming other major players in the cryptocurrency space.

Exploring the Wider Impacts of Crypto Market Trends on XRP and BCH

The contrasting trajectories of XRP and BCH underscore the intricate dynamics within the cryptocurrency market. Market trends have an undeniable impact on investor behavior; as seen with XRP’s sharp decline amidst overall stable major currencies, while BCH’s gains may invite renewed interest in similar altcoins. Market analysts constantly review crypto market trends, forecasting that the performance of well-established coins can significantly influence the price patterns of altcoins, making them critical indicators for potential investors.

Moreover, cryptocurrency news plays a vital role in market trends, establishing an environment where sudden shifts can either stimulate a bullish movement or exacerbate bearish sentiments. With this in mind, investors who follow the broader landscape of news surrounding both XRP and BCH will be better positioned to make informed decisions amidst the market’s inherent volatility. The way that XRP responds to upcoming developments in the cryptocurrency landscape will be just as crucial as any fluctuations in BCH’s value.

Comparison: XRP vs. BCH — Performance Analysis

When it comes to performance analysis, XRP and BCH offer an intriguing comparison in this week’s crypto landscape. While XRP experienced a notable weekly loss of nearly 8%, BCH capitalized on its market conditions to emerge as a top performer with an impressive 8.7% gain. Such contrasting performances can be attributed to various factors, including market sentiment, trading volumes, and individual project developments that resonate with their respective investor bases. As both coins attract attention, observing their movements reveals the dynamic state of the cryptocurrency market.

Analyzing the reasons behind each coin’s performance also sheds light on broader market trends. XRP’s loss can be seen as a reaction to regulatory pressures and overall market hesitance towards major cryptocurrencies, contrasting sharply with BCH’s rise which likely reflects growing investor confidence in its utility and adoption. Moreover, BCH’s ability to rebound demonstrates its resilience, which is appealing for traders looking to diversify their portfolios during uncertain times. This ongoing tug-of-war between XRP and BCH performance illustrates just how varied the cryptocurrency ecosystem can be.

The Ripple Effect: What XRP’s Loss Means for Altcoins

XRP’s weekly loss does not simply impact its market standing; it creates ripple effects throughout the cryptocurrency ecosystem, particularly for altcoins. As the third-largest digital asset by market cap, XRP’s declines can influence traders’ perceptions and activities across other cryptocurrencies. Investors seeking safer alternatives might pivot towards gains seen in assets like BCH, prompting a divergence in buying behavior that could impact overall market patterns.

Consequently, XRP’s dip could also serve as a warning for altcoins and investors alike about the volatility that permeates the crypto space. Trends observed from the past few weeks indicate that while some altcoins might soar amidst unfavorable conditions for others, maintaining a diversified investment strategy is crucial. The interplay of gains and losses across various cryptocurrencies reaffirms the necessity for diligent follower research and awareness of market movements.”}]},{

Frequently Asked Questions

What factors contributed to XRP’s weekly loss this week?

XRP’s weekly loss, which concluded at just under 8%, can be attributed to a drastic price decline from a peak of $3.64 to a low of $2.99 within the week. Factors influencing this decline include market volatility and shifts in investor sentiment within cryptocurrency news outlets.

How does XRP’s weekly loss compare to other altcoin performances?

XRP’s weekly loss of nearly 8% positioned it as the steepest decline among the top 20 cryptocurrencies by market capitalization. In contrast, BCH experienced an impressive gain of 8.7%, highlighting the mixed performance across the crypto market trends this week.

Can XRP recover from its recent weekly loss?

While XRP faced a significant weekly loss, it demonstrated resilience by partially recovering to close at $3.18. Factors such as upcoming XRP price predictions and overall market trends could influence its potential for recovery in the following week.

What impact did BCH’s surge have on XRP’s weekly loss?

BCH’s surge of 8.7% during the same week that XRP faced a steep loss may have shifted investor attention away from XRP. This contrasting performance highlights the competitive nature of altcoin gains in the cryptocurrency market.

What are the implications of XRP’s steep weekly loss for investors?

XRP’s steep weekly loss indicates heightened risk and volatility, signaling investors to carefully reassess market conditions and trends. Keeping an eye on cryptocurrency news and market developments can help investors make informed decisions.

How can trends in the crypto market affect XRP’s weekly loss in the future?

Future trends in the crypto market, such as regulatory news, investor sentiment, and altcoin performance, will likely impact XRP’s weekly loss and recovery patterns. Understanding these trends is crucial for predicting potential price movements.

Will XRP’s recent performance affect its long-term price outlook?

XRP’s recent weekly loss may have short-term implications, but it does not definitively dictate the long-term price outlook. Continuous monitoring of XRP’s price prediction alongside market dynamics is essential for understanding its future potential.

| Key Point | Details |

|---|---|

| Starting Price of XRP | $3.45 at the beginning of the week |

| Peak Price of XRP | $3.64 on July 21 |

| Decline in XRP Price | Fell more than 13% to $2.99 |

| Weekly Closing Price of XRP | Closed at $3.18, a loss of under 8% |

| Performance of BCH | 8.7% gain to around $555 |

| Other Notable Gainers | BNB +6.7%, SUI +6.4% |

Summary

XRP weekly loss marked a tumultuous period for the cryptocurrency, leading the market’s decline after an initial rally. This week, XRP faced a significant drop, ultimately showcasing it as the asset with the steepest losses among top cryptocurrencies. While BCH surged impressively, XRP struggled to maintain its earlier highs, highlighting the volatile nature of the cryptocurrency market.