Trade Talks: Crunch Time as Trump’s August 1 Deadline Nears

Trade talks are heating up as President Donald Trump approaches his August 1 trade deadline, urging countries worldwide to strive for a resolution, particularly with the European Union. This vital period not only represents a potential turning point in US-China trade relations but also poses implications for global economic growth that businesses are closely monitoring. With tariffs looming and negotiations intensifying, stakeholders are anxious about the outcomes of these discussions that could reshape the economic landscape. The optimism surrounding a possible EU trade agreement has fueled market speculation, but uncertainty prevails due to mixed signals from key players. As Trump suggests the likelihood of a deal stands at a mere 50-50, the stakes are high as we anticipate the market’s reaction in the coming week.

Negotiations concerning international trade are entering a critical juncture as President Trump sets his sights on an imminent August deadline. The implications of this deadline extend beyond mere policy discussions; they affect the global economic scenery as nations navigate the complexities of trade agreements. As the U.S. engages in strategic dialogues with both the European Union and China, the outcomes could significantly influence future commerce relationships and economic stability worldwide. Observers are keenly watching for signals that could lead to a trade truce, while businesses adapt to the changing landscape brought on by tariffs and regulatory shifts. With heightened anticipation surrounding potential agreements, this period could mark a pivotal moment in international economic dynamics.

The Importance of the August 1 Trade Deadline

As President Donald Trump’s August 1 trade deadline approaches, the significance of this date cannot be overstated. This deadline serves as a critical juncture for nations worldwide aiming to negotiate a trade truce with the United States. The focus is particularly magnified on the European Union, which has been on the frontline of recent trade discussions. With potential tariffs looming, the EU is under immense pressure to finalize agreements that could mitigate economic backlash and foster more robust US-EU trade relations.

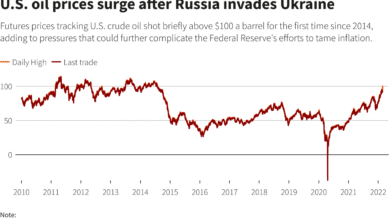

The implications of failing to reach an agreement by this deadline could have profound impacts on global economic growth. As businesses in various sectors, particularly the automotive and pharmaceutical industries, prepare for the possibility of increased tariffs, stock markets remain volatile. Investors are keenly aware of the stakes involved, and each new report from the negotiation tables is met with high anticipation, influencing market sentiments both in the Eurozone and the United States.

US-China Trade Relations Take Center Stage

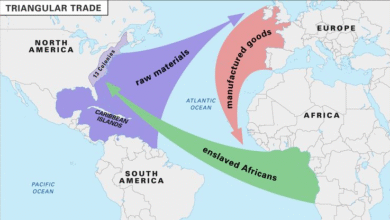

In the lead-up to the August 1 deadline, trade discussions between the United States and China are expected to take the limelight. The scheduled meetings in Stockholm will be highly scrutinized, as they could have substantial implications for US-China trade relations and by extension, European interests. Any developments from these talks could either facilitate progress ahead of the August deadline or exacerbate existing tensions, affecting forecasts for global economic stability.

Furthermore, the outcomes of these talks may trickle down to impact the EU’s negotiation strategies. If the US and China reach any compromises, it might embolden the European Union to engage more assertively in its discussions with the Trump administration. However, the delicate balance of power in these negotiations means that a deteriorating relationship between the US and China could leave Europe in a more precarious position as it grapples with its own trade agreements.

The EU’s Response to Trade Uncertainties

In light of the mounting trade pressures, the European Union has reiterated its readiness to activate its Anti Coercion Instrument, also known as the ‘trade bazooka,’ should the August 1 deadline conclude without an agreement. This move signifies the EU’s commitment to safeguard its economic interests amidst escalating tariffs and trade tensions. The looming possibility of retaliatory measures highlights the EU’s strategic planning in navigating these complex trade landscapes.

The readiness of the EU to deploy this instrument reflects how crucial it is for Europe not only to participate in these trade talks but also to be prepared for any fallout. As companies such as VW and Michelin face downgrades in their forecasts due to tariffs, the urgency for swift resolutions grows. The stakes are high as the EU simultaneously seeks to maintain competitive market conditions and foster a stable economic environment ahead of the deadline.

Earnings Reports and Market Reactions

The upcoming week will also see a significant influx of earnings reports from major corporations in Europe, making this period a critical one for stakeholders and investors. High-profile companies like UBS, AstraZeneca, and Heineken will release their figures, shedding light on how trade uncertainties are shaping financial performance. Depending on whether these reports exceed or fall short of expectations, market reactions could vary significantly, either amplifying or tempering investor anxieties ahead of the trade deadline.

Additionally, how these corporations discuss the impact of tariffs in their earnings calls will be of great interest. Investors are looking for indicators that might signal a shift in consumer behavior or supply chain adjustments, influenced by ongoing trade negotiations. For instance, if companies report measurable negative impacts directly attributable to trade tensions, this could prompt a reassessment of stock valuations across affected sectors, particularly in light of the larger economic framework impacting global growth.

Monitoring Eurozone Growth and Inflation Data

As critical economic indicators are set to be released next week, attention turns to the GDP growth rates in key Eurozone countries like France, Spain, Germany, and Italy. These figures will provide a clearer picture of how trade negotiations and market uncertainties are influencing regional economies. The relationship between trade stability and economic growth is particularly salient amid the discussions surrounding the August 1 deadline.

The European Central Bank’s decisions and strategies in response to these data releases will also be closely monitored. Following a hawkish hold on interest rates, the ECB is poised to react to whatever signals emerge from these economic reports. High inflation rates alongside stagnant growth could force the ECB to take decisive action, which could further complicate the trade dynamics between the EU and the US as they seek to stabilize their economies.

Global Economic Growth Amid Trade Tensions

The intersection of trade talks and global economic growth paints a complex picture as countries navigate the uncertainties presented by the impending August 1 deadline. Economic forecasts have been under pressure due to the potential for increased tariffs and the ripple effects they could have on international markets. A lack of clarity in US-China negotiations might dampen global growth prospects as businesses and consumers adjust to shifting trade policies.

Despite the challenges, some experts are optimistic that resolution in trade negotiations could pave the way for stronger economic growth globally. If the EU and the US can find common ground, it could provide a much-needed boost to investor confidence and invigorate market activity across both sides of the Atlantic. The interconnectedness of today’s global economy means that successful trade agreements can foster opportunities and innovation, reigniting growth trajectories that have been stalled by ongoing uncertainties.

Potential Impact on Corporate Strategies

In response to the uncertainty surrounding the August 1 trade deadline, many companies are reevaluating their corporate strategies and risk management practices. The uncertainty of tariffs and trade agreements has prompted businesses, particularly in manufacturing and technology, to assess their supply chains and cost structures meticulously. To mitigate potential risks, firms may explore diversifying their manufacturing bases or renegotiating contracts to ensure compliance with evolving trade regulations.

Additionally, firms may invest in lobbying efforts to influence trade negotiations in their favor, highlighting the urgent need for a balanced approach that fosters growth without sacrificing competitiveness. As companies navigate the tumultuous waters of US-China relations and EU trade discussions, adaptive corporate strategies will become essential in safeguarding their bottom lines and sustaining business growth in a challenging trade environment.

The Role of Media in Trade Reporting

As trade talks intensify in the lead-up to the August 1 deadline, media coverage will play a crucial role in shaping public perception and investor confidence. The dynamic nature of trade discussions requires accurate reporting to ensure that stakeholders are informed about real-time developments and implications. Continuous analysis and commentary can influence market reactions, particularly in a climate of uncertainty where every word from trade representatives and political leaders is scrutinized.

Furthermore, media narratives can create pressure on negotiators to reach favorable outcomes, as public sentiment often sways political decisions. The cycle of news reporting becomes symbiotic with the trade discussions, wherein the portrayal of the negotiation’s progress can either boost market enthusiasm or contribute to panic selling in the face of setbacks. Hence, media outlets must balance reporting responsibilities with the potential repercussions their narratives might yield in the broader economic context.

Looking Ahead Post-Deadline: Scenarios and Predictions

As the August 1 deadline approaches, speculation is rife about potential outcomes from the ongoing trade negotiations. If an agreement is reached, it could signal a turning point for US-EU relations, possibly leading to a renewed sense of stability in the markets and a boost in consumer confidence. Conversely, if tensions escalate without resolution, the ramifications could reverberate through global markets, leading to far-reaching economic consequences and potentially inciting retaliatory measures.

What’s crucial in the days following the deadline will be how all parties choose to engage with one another, especially in the context of existing economic agreements. The outcomes of these trade negotiations could set the tone for future dealings between the US, EU, and China, making it imperative for stakeholders to stay vigilant and responsive as events unfold. Ultimately, the August 1 deadline may just be the beginning of a more extended dialogue on trade relations and their impact on global economic growth.

Frequently Asked Questions

What are the implications of the August 1 trade deadline for the US-China trade relations?

The August 1 trade deadline is critical for US-China trade relations as it coincides with high-stakes negotiations aimed at a potential trade truce. This deadline demands urgent discussions to resolve tariffs and trade barriers that have hampered economic cooperation. If no agreement is reached, it may exacerbate tensions and affect global economic growth.

How could President Trump’s trade talks impact the recent EU trade agreement discussions?

President Trump’s trade talks may significantly influence the EU trade agreement discussions, especially as both bilateral trade relationships are under scrutiny. The deadline set for August 1 encourages a swift resolution, as the EU is facing pressures to align on tariffs, which could either pave the way for a mutually beneficial agreement or lead to increased tensions, impacting economic stability.

What is the significance of global economic growth amid ongoing trade talks?

Global economic growth is intertwined with ongoing trade talks, as agreements reached during negotiations can bolster economic confidence and investment. Conversely, unresolved trade disputes can hinder growth prospects, leading to decreased consumer spending and business investment, reflecting the urgent need for successful US-China and EU trade relations.

How are corporations reacting to the uncertainty surrounding trade talks and tariffs?

Corporations are increasingly vocal about the uncertainty surrounding trade talks, as many, including major European companies like VW and Michelin, have downgraded forecasts due to potential tariffs. This reflects a heightened concern that unresolved trade tensions could adversely affect profit margins and overall economic performance.

What role do earnings reports play in the context of trade talks leading to the August 1 deadline?

Earnings reports are particularly vital in the context of trade talks as they provide a snapshot of corporate health and sentiment in relation to ongoing trade tensions. Companies preparing to report their earnings are closely monitoring developments, as trade agreements or the lack thereof could directly influence their financial outlook.

What strategies does the EU plan to implement if trade talks fail before the August 1 deadline?

The EU is prepared to implement its Anti Coercion Instrument, a strategy designed to respond robustly if trade talks fail by August 1. This contingency reflects a commitment to protect its economic interests and counteract any unilateral trade measures that may arise, underscoring the serious implications of the deadline.

Why is August 1 highlighted as a crucial date for trade talks?

August 1 is highlighted as a crucial date for trade talks because it marks President Trump’s latest deadline for countries, particularly the EU and China, to reach a trade truce. The outcome of negotiations by this date could significantly impact tariffs, trade agreements, and overall international market stability.

What potential outcomes can result from the August 1 trade talks?

The potential outcomes of the August 1 trade talks range from a successful agreement that alleviates tariffs and boosts cooperation to a failure that could escalate tensions and lead to further economic instability. The implications of these outcomes extend beyond the US and affect global economic growth and market sentiment.

| Key Points |

|---|

| Deadline of August 1 for international trade truce talks with the U.S., focusing on the EU. |

| U.S.-China talks complicate the situation for Europe, scheduled for Monday and Tuesday. |

| Concerns over tariff impacts causing downgrades among European companies like Puma and VW. |

| Upcoming earnings reports from major companies can influence market sentiment. |

| EU’s growth and inflation data to be released, critical for understanding economic conditions. |

Summary

Trade talks are reaching a pivotal moment as the August 1 deadline looms. With the U.S. negotiations at the forefront, and intertwined discussions with China, the outcomes of these talks could significantly impact the global economy, especially for European nations. The pressure mounts as key corporate responses and economic data emerge, shaping the path forward in this critical juncture for international trade.