Dollar-Cost Averaging Bitcoin: Last Chance by 2025

If you’re considering a strategy to invest in Bitcoin, dollar-cost averaging (DCA) presents an intriguing opportunity. DCA is an investment method that allows individuals to consistently buy Bitcoin over time, regardless of its price fluctuations. By setting aside a specific amount, such as $250 each week, you can steadily accumulate Bitcoin, thereby easing the anxiety associated with market timing. With 2025 projected as a pivotal year in the Bitcoin landscape, employing a smart bitcoin investment strategy today could place you on a path to owning a full Bitcoin in the long run. As analysts examine 2025 Bitcoin projections, now is the time to embrace the DCA strategy to maximize your holding potential in this volatile market.

When it comes to building your Bitcoin portfolio, consistently buying Bitcoin through a systematic investment approach can be both rewarding and pragmatic. This practice, often referred to as a systematic accumulation strategy, involves making periodic purchases of Bitcoin irrespective of its market value, allowing investors to take advantage of market volatility. The focus on this method is gaining traction as experts highlight that engaging in such an accumulation endeavor in 2025 will be vital for achieving full Bitcoin ownership. As the cryptocurrency market continues to evolve, adopting a disciplined investment routine can help you navigate the challenges ahead while ensuring you’re well-positioned for future gains.

Understanding Dollar-Cost Averaging Bitcoin

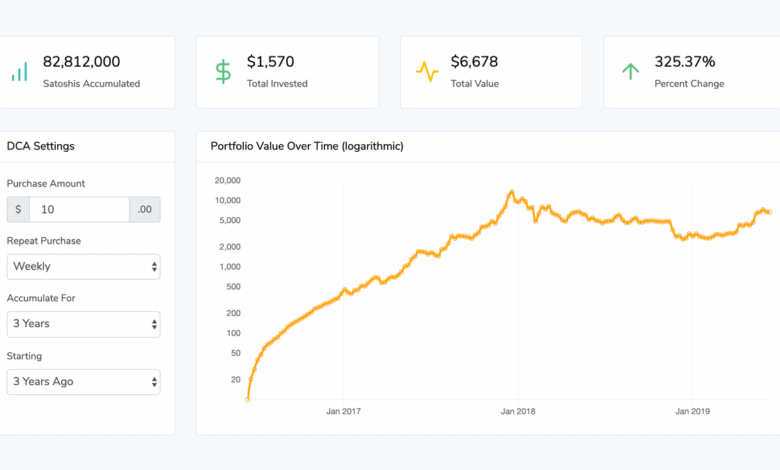

Dollar-Cost Averaging (DCA) in Bitcoin is a strategic investment approach that allows individuals to mitigate the risks associated with price volatility. By committing to purchase a consistent dollar amount of Bitcoin at regular intervals—irrespective of its price fluctuations—investors can avoid the pitfalls of trying to time the market. This method facilitates gradual accumulation, allowing even novice investors to build their Bitcoin holdings over time without the stress of making significant one-time investments.

This approach is especially beneficial given Bitcoin’s divisibility, meaning investors can buy fractions of a Bitcoin known as satoshis. So, whether Bitcoin is worth $30,000 or $115,000, implementing a DCA strategy can help investors achieve their goals of accumulating Bitcoin while spreading their capital across market conditions, thus reducing the emotional toll of trading.

The Long-Term Benefits of DCA Strategy Bitcoin

Investing in Bitcoin through a DCA strategy can lead to significant long-term benefits. The historical data showcases that Bitcoin has appreciated in value over the long haul, making it increasingly profitable for consistent investors. By following a disciplined DCA approach, investors can grow their wealth incrementally, circumventing the inherent volatility that often frightens many away from the cryptocurrency market.

As Bitcoin prices surge, the DCA strategy allows individuals to benefit from lower average costs per Bitcoin acquired. This can be particularly potent during bear markets where prices dip significantly, providing an opportunity to purchase more satoshis for each dollar invested. Over time, as Bitcoin continues to be adopted and its price potentially soars, early DCA investors may find themselves reaping substantial rewards from their strategic accumulation efforts.

2025 Bitcoin Projections: The Last Chance for DCA?

As analysts project that 2025 could represent a pivotal year for Bitcoin investors, understanding the implications of these forecasts is essential. According to projections, a DCA strategy starting in 2025 will allow investors to still feasibly accumulate a full Bitcoin in ten years. However, as Bitcoin’s value rises, the effort required to acquire a complete coin will significantly increase in subsequent years.

Starting from 2026, maintaining the same investment pace may no longer suffice, potentially extending the timeline to 15 years or more. Thus, for those considering DCA as a long-term investment strategy, 2025 may be the last feasible year to leverage this method effectively and fully realize the objective of owning a complete Bitcoin before prices climb beyond reach.

Navigating Bitcoin’s Volatility With a DCA Strategy

Bitcoin is notorious for its price volatility, which can be daunting for investors. However, implementing a Dollar-Cost Averaging strategy comes with the built-in advantage of fluctuating market conditions. When Bitcoin prices are low, regular DCA investments allow a larger accumulation of Bitcoin holdings, positioning investors to benefit from any future price surges.

Moreover, during bull markets, this strategy helps to soften the impact of investing larger sums in high price conditions. Investors can rely on the steady accumulation over time, leading to a more balanced investment portfolio that may yield promising returns as market dynamics shift.

The Role of Bear Markets in DCA Accumulation

Bear markets can significantly alter investment outcomes when employing a Dollar-Cost Averaging strategy. When Bitcoin faces downturns, each dollar spent goes further in accumulating satoshis, thus allowing investors to stack Bitcoin more rapidly than they would in a bull market. This dynamic offers a silver lining, especially for those who maintain their investment strategy despite market declines.

During these challenging periods, a well-planned DCA strategy may turn potential losses into opportunities for growth, as the effective cost per Bitcoin lowers. Investors who stay committed during bear markets are more likely to find themselves well-positioned when the market rebounds.

Strategies for Effective DCA in Bitcoin Investments

Novice Bitcoin investors should consider specific strategies to optimize their dollar-cost averaging investments effectively. Establishing a clear budget and committing to it, regardless of market conditions, is crucial. Furthermore, regularly assessing one’s long-term investment goals can help investors remain focused and disciplined, avoiding impulsive decisions fueled by short-term price movements.

Additionally, selecting a reliable platform for purchasing Bitcoin can streamline the DCA process, making it easier to execute consistent transactions without significant fees or delays. This attention to detail ensures that the accumulation of Bitcoin remains steady and aligned with broader investment objectives.

Why DCA is Ideal for Bitcoin Investment Strategy

The Bitcoin investment landscape can seem intimidating, especially for those new to cryptocurrency. A Dollar-Cost Averaging strategy aligns perfectly with a solid Bitcoin investment approach by promoting regular contributions over attempting to time market highs and lows. This method instills discipline in investing habits, thus encouraging individuals to stay the course, especially as the market faces inevitable fluctuations.

Furthermore, since Bitcoin’s price is continually changing, a DCA strategy allows investors to take advantage of lower price points, effectively lowering their average cost per Bitcoin over time. Such an investment discipline is often cited as a key factor contributing to long-term wealth creation within the cryptocurrency space.

Accumulating Bitcoin: The Challenge Ahead

As we approach 2025, aspiring Bitcoin investors face a major challenge: accumulating enough Bitcoin to secure ownership before prices escalate beyond reach. High projections indicate that post-2025, the required investment to acquire one full Bitcoin through DCA will increase substantially. Therefore, those who delay their investment strategies may find themselves at a disadvantage.

It becomes essential for investors to act decisively and consider commencing their DCA strategy sooner rather than later. The potential to accumulate Bitcoin at today’s prices may vanish, turning the once-accessible goal into a more challenging endeavor as time progresses.

Potential Risks of Delaying DCA Investments in Bitcoin

Investors examining their Bitcoin investment strategies might consider the risks associated with delaying the implementation of a DCA approach. As Bitcoin’s popularity grows and institutional interest rises, the price could skyrocket, making entry points increasingly challenging for new investors. Thus, procrastination could translate to missed opportunities for significant gains.

Investors should recognize that every day spent contemplating the strategy is a day potentially lost toward effective accumulation. The longer one waits, the more expensive Bitcoin might become, highlighting the importance of early and consistent investments to maximize potential returns.

The Future of Bitcoin and DCA Strategies

Looking ahead, the future of both Bitcoin and DCA strategies holds potential for investors willing to commit to long-term investment practices. As projections for Bitcoin’s growth become more optimistic, employing a disciplined DCA strategy will likely remain one of the most practical and effective methods to accumulate Bitcoin over time.

Moreover, as the cryptocurrency market continues to evolve, the principles of dollar-cost averaging can help investors navigate emerging trends and challenges. Staying informed and adaptive will be critical in making the most of Bitcoin’s potential as a transformative asset class.

Frequently Asked Questions

What is the dollar-cost averaging (DCA) strategy for Bitcoin?

The dollar-cost averaging (DCA) strategy for Bitcoin involves consistently purchasing a fixed dollar amount of Bitcoin at regular intervals, regardless of its price. This approach allows investors to gradually accumulate Bitcoin over time, mitigating the effects of volatility.

Why should I use a DCA strategy for buying Bitcoin?

Using a DCA strategy for buying Bitcoin helps reduce emotional decision-making and market timing risks. By investing a set amount regularly, investors can accumulate Bitcoin steadily, providing a disciplined approach to long-term investment.

How much Bitcoin can I accumulate with a DCA strategy starting in 2025?

If you start a DCA strategy of $250 per week in 2025, you can reasonably expect to accumulate a full Bitcoin in about ten years. However, if you begin in 2026, this would likely take 15 years or more due to projected price increases.

What are the 2025 Bitcoin projections and their impact on DCA?

The 2025 Bitcoin projections predict a price around $115,000. This high price point makes DCA increasingly important for investors seeking full Bitcoin ownership, as only consistent small purchases can help achieve this goal over time.

How do bear markets affect dollar-cost averaging Bitcoin?

Bear markets can actually enhance the effectiveness of a dollar-cost averaging strategy for Bitcoin. During downturns, each dollar invested buys more satoshis, accelerating the accumulation process, which is beneficial for DCA investors.

What is the estimated time to accumulate one Bitcoin using DCA in various future years?

According to projections, a $250 weekly DCA strategy will take about 10 years in 2025, 15 years in 2026, nearly 20 years by 2028, and will require about $1,000 per week starting in 2033 to accumulate one Bitcoin in the same time frame.

Can the DCA strategy help me in a bull market for Bitcoin?

In a bull market, the DCA strategy may slow down your Bitcoin accumulation because each installment buys fewer satoshis at higher prices. Hence, higher contributions or extended time frames may be necessary to reach the goal of owning a full Bitcoin.

Is dollar-cost averaging a realistic Bitcoin investment strategy for the future?

Yes, dollar-cost averaging continues to be a realistic Bitcoin investment strategy for the future, especially for those who may find whole Bitcoin ownership unattainable due to rising prices. The method promotes steady accumulation over time.

What factors contribute to diminishing returns in the DCA strategy for Bitcoin?

Diminishing returns in the DCA strategy for Bitcoin are influenced by rising Bitcoin prices and the increasing difficulty to accumulate a full Bitcoin. As prices rise, the amount of Bitcoin that can be purchased with the same dollar amount decreases, extending the time required to achieve full ownership.

How does the power law model relate to Bitcoin and DCA?

The power law model, used in Bitcoin projections, describes exponential growth. It indicates that as Bitcoin demand increases and supply diminishes, the price and time to accumulate Bitcoin through DCA strategies will also be impacted, often resulting in longer durations to achieve investment goals.

| Key Points | Details |

|---|---|

| DCA Strategy Timeline | 2025 is the last year to realistically DCA to 1 Bitcoin in 10 years. |

| Investment Amounts | $250/week DCA starting in 2025 can achieve this. In 2026, the same DCA will require 15 years. |

| Bear Markets Advantage | In bear markets, DCA is more effective as lower prices allow for more satoshis to be purchased. |

| Projected Bitcoin Prices | By 2026, expected price is $208,000; by 2029 it may exceed $390,000; and $520,000 by 2033. |

| Future DCA Needs | Post-2025, higher weekly contributions will be needed to maintain the 10-year goal for 1 BTC. |

Summary

Dollar-Cost Averaging Bitcoin is an essential strategy for investors looking to accumulate Bitcoin steadily over time. As the analysis indicates, 2025 will present the last prime opportunity for average investors to DCA to a full Bitcoin in a decade. With increasing prices and diminishing returns associated with Bitcoin, early and consistent investment will prove crucial. Given the potential market fluctuations, savvy investors may find bear markets advantageous for stacking more satoshis effectively. Therefore, those with aspirations to own Bitcoin should consider adopting a DCA strategy soon to maximize their chances of success.