Berkshire Hathaway Earnings Report: A 4% Decline

Berkshire Hathaway earnings report revealed a slight dip in operating profits for the second quarter, primarily affected by the ongoing repercussions of U.S. tariffs as indicated by Warren Buffett. The conglomerate, which encompasses a variety of sectors including insurance and retail, posted operating profits of $11.16 billion, reflecting a 4% decrease from the previous year. Despite this downturn, there was an uptick in income from various divisions, but the cautionary statements regarding the potential negative impacts of tariffs on its operations and equity securities stance captured attention. Moreover, the earnings report highlighted a considerable $3.8 billion loss linked to its investment in Kraft Heinz, illustrating the complexities of the consumer goods market in turbulent times. As Buffett prepares for a future transition in leadership, the financial landscape’s challenges weigh on this influential company, making this report a critical point of reference for investors and analysts alike.

In its latest financial disclosure, Berkshire Hathaway showcased a complex performance landscape amidst turbulent international trade dynamics and economic factors. The earnings update underscored the volatility experienced by Warren Buffett’s vast business empire, recording a marginal decline in operational revenue tied to pressing U.S. tariff strategies. Despite achieving higher profits in select sectors, the report pointedly discussed market uncertainties that could hinder future profitability. Notably, the conglomerate’s investments took a significant hit due to a marked decline in the value of its stake in Kraft Heinz, an asset that has struggled in the competitive consumer sector. As Buffett’s leadership transitions approach, this report does not just reflect quarterly performance, but also hints at the challenges and strategic recalibrations that lie ahead.

Berkshire Hathaway Earnings Report Overview

Berkshire Hathaway’s recent earnings report highlights a slight decline in its second-quarter operating earnings, which decreased by 4% compared to the previous year. The conglomerate reported an operating profit of $11.16 billion, a figure that reflects challenges stemming from a drop in insurance underwriting. Despite this setback, Berkshire’s various wholly owned businesses, including railroads and energy, showcased growth, indicating resilience in sectors less impacted by tariff-related pressures. The earnings report underscores the complex landscape in which Berkshire operates, with operating profits influenced by both operational performance across its sectors and the broader implications of trade policies.

The report also emphasizes significant uncertainties affecting Berkshire’s business outlook, with a striking warning regarding the potential impacts of U.S. tariffs on its operations. As President Trump’s administration navigates complex international trade dynamics, Berkshire’s leadership indicates that these factors could lead to negative consequences across its diverse business portfolio and equity investments. This emphasizes the inherent risks in Warren Buffett’s investment philosophy, particularly in terms of managing risks associated with global economic volatility.

Impact of U.S. Tariffs on Berkshire Hathaway

Berkshire Hathaway’s leadership has openly communicated the potential ramifications of steep U.S. tariffs and changing international trade policies on the conglomerate’s businesses. According to their earnings report, the pace of tariff-related challenges has accelerated, leading to concerns about future operational risks. Warren Buffett and his team have highlighted the pressing need to assess not only the immediate effects on their existing businesses but also the potential long-term impacts on profitability. As a conglomerate heavily invested in multiple sectors, the full spectrum of tariff implications must be navigated carefully.

Moreover, the uncertainties surrounding international trade and tariffs affect not just Berkshire Hathaway’s operational framework but also its expansive investment portfolio. With a deep involvement in equity securities, any adverse implication from tariffs could pose significant threats to future earnings. The company’s cautious stance and focus on monitoring these developments are likely to influence investment strategies moving forward. As companies face increasing operational costs due to tariffs, Berkshire may need to refine its approach to capital allocation, particularly in sectors most affected by these new economic realities.

Warren Buffett’s Strategic Insights Amidst Challenge

Warren Buffett’s strategic vision has long navigated through economic uncertainties, and this earnings report is no exception. As the CEO prepares to step down in 2025, Buffett’s insights into market dynamics remain crucial. The report sheds light on his reflections regarding U.S. tariffs and their possibly detrimental effects on Berkshire Hathaway’s diverse operations. His emphasis on maintaining a strong cash reserve reflects an approach that prioritizes flexibility during periods of economic strife, enabling the conglomerate to weather potential downturns while seeking valuable investment opportunities during market volatilities.

In his capacity as chairman, Buffett continues to influence the investment strategies of Berkshire Hathaway. The commitment to understanding complex market signals and maintaining a diversified portfolio underpins the company’s resilience. Current challenges, such as the ongoing Kraft Heinz loss, highlight the intricacies of managing investments in turbulent market conditions. Through transparency in the earnings report, Buffett’s leadership conveys a message of cautious optimism and strategic foresight that future CEO Greg Abel will likely carry forward.

Berkshire Hathaway’s Diverse Business Performance

Despite the overall decline in operating earnings, Berkshire Hathaway’s diverse business segments showed varying degrees of profitability in the second quarter. Key sectors, including railroads, energy production, and manufacturing, recorded improved earnings, demonstrating their ability to adapt and thrive in changing market conditions. This performance reaffirms Berkshire’s strategy of maintaining a multifaceted portfolio, which not only mitigates risks but also positions the conglomerate for growth, even when faced with pressures from external economic factors.

The operational success witnessed in these segments emphasizes the strength of Berkshire Hathaway’s business model, which is designed to leverage a range of industries for balanced performance. This adaptability in core sectors serves as a stabilizing force for the company, as emerging challenges from tariffs and market fluctuations threaten other investments. By focusing on core areas exhibiting growth, Berkshire can sustain its earnings levels, despite bearing the brunt of higher uncertainty from external economic policies.

Risks from Equity Securities Investments

Berkshire Hathaway’s investment strategy has traditionally included a significant focus on equity securities. However, as highlighted in the earnings report, the anticipated negative impacts from tariffs pose substantial risks to these investments. The ongoing volatility in equity markets, coupled with the uncertainty around trade policies, has led Berkshire to adopt a more cautious investment approach, reflected in their decision to be a net seller of stocks for the 11th consecutive quarter. Selling off $4.5 billion in equities underscores the need for a reassessment of valuation and potential risks tied to future performance.

Warren Buffett’s historical approach has often advocated for patience and careful analysis before making investment decisions, especially in times of economic turbulence. The lingering uncertainty regarding tariffs and their impact on listed companies may compel Berkshire Hathaway to maintain a conservative posture in its equity investments. By closely monitoring the evolving trade landscape and adjusting the investment portfolio accordingly, Berkshire aims to protect its wealth from external shocks while still capitalizing on promising opportunities within the equity markets.

Kraft Heinz’s Underperformance Impact on Berkshire

Berkshire Hathaway’s recent report included a noteworthy mention of the $3.8 billion loss attributed to its investment in Kraft Heinz, which has raised concerns over the performance of this particular asset. The pervasive challenges faced by Kraft Heinz, including pressures on its grocery business and changing consumer preferences, have caused significant anxiety among Berkshire investors. As a consumer goods giant, Kraft Heinz’s struggles illustrate the risks associated with investing in companies reliant on traditional business models amid transformative market dynamics.

In light of these challenges, there are discussions surrounding a potential spinoff of Kraft Heinz’s grocery business, a move that could reshape its future prospects. The loss has drawn attention to the importance of agile corporate strategies, and two Berkshire executives recently resigned from the board of Kraft Heinz, indicating a possible shift in leadership and operational focus. For Berkshire Hathaway, managing such underperforming investments is crucial for maintaining overall profitability as the company moves forward in an evolving marketplace.

The Future Leadership of Berkshire Hathaway

Warren Buffett’s forthcoming retirement has introduced a new chapter in Berkshire Hathaway’s leadership, with Greg Abel set to succeed as CEO. As Buffett prepares to transition, this earnings report serves as a reminder of the vast legacy he leaves behind, along with the strategic insights gained during his tenure. Abel’s ascension to the leadership role will not only signify continuity in the company’s core philosophy but will also challenge him to navigate the complexities of a rapidly changing global economy, particularly with regard to tariff implications and investment strategies.

With Buffett remaining as chairman, the board will benefit from his experience and guidance, particularly during this transitional phase. The conglomerate’s future path will depend heavily on how Abel and the leadership team adapt to contemporary market challenges while upholding the values that have positioned Berkshire Hathaway as a formidable player in diverse sectors. This evolution within Berkshire’s leadership presents an opportunity to innovate and recalibrate investment strategies, ensuring the company remains resilient in the face of uncertainties and competitive pressures.

Evaluating Berkshire’s Cash Reserves Strategy

Berkshire Hathaway’s cash reserves, which currently stand at $344.1 billion, have long been viewed as a pillar of financial strength for the conglomerate. Although slightly lower than previous levels, these substantial reserves enable Berkshire to weather potential market disturbances and seize investment opportunities as they arise. In the context of rising market volatility due to tariffs and trade tensions, Buffett’s approach emphasizes maintaining liquidity to respond to both challenges and possible acquisitions during downturns.

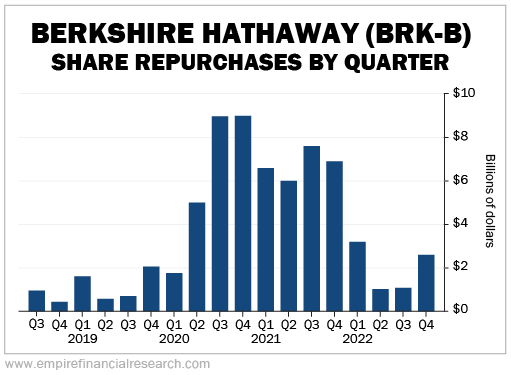

The strategic management of cash reserves also reflects Berkshire’s cautious approach to investment and operational expansions. Without repurchases of its shares during the first half of 2025, the focus remains on conservative capital management, reaffirming Buffett’s long-standing philosophy on ensuring the company is prepared for dynamic market conditions. As uncertainties continue to loom, this cash cushion may provide vital support for future investments or buffer losses incurred from underperforming ventures such as Kraft Heinz.

Berkshire Hathaway’s Investment Response to Market Trends

Berkshire Hathaway’s approach to responding to prevailing market trends is exemplified in its recent earnings report. The conglomerate’s decision to divest $4.5 billion in equities indicates a strategic pivot in response to current market volatility. As economic indicators shift due to U.S. tariffs and international trade complications, it’s clear that Berkshire is reassessing its investment position while prioritizing stability as a core objective. The consistency in being a net seller reflects caution as well as a desire to minimize exposure to underperforming assets.

Additionally, this shift in investment strategy aligns with Warren Buffett’s existing philosophy of valuing businesses and avoiding the pitfalls of speculative investments. Given the unpredictable nature of the current economic climate, Berkshire’s calculated response to reduce its equity holdings while maintaining substantial cash reserves indicates strategic foresight. This adaptive behavior prepares the conglomerate to capitalize on future opportunities, ensuring it stands firm when navigating through fluctuating market conditions.

Frequently Asked Questions

What were the highlights of the latest Berkshire Hathaway earnings report?

The latest Berkshire Hathaway earnings report revealed a slight decline in second-quarter operating earnings, dropping by 4% year over year to $11.16 billion. This decline was largely attributed to lower insurance underwriting, while other sectors such as railroad and energy showed profit increases. Furthermore, the report flagged potential negative impacts from U.S. tariffs on the company’s operations and investments.

How did U.S. tariffs impact Berkshire Hathaway profits according to the earnings report?

According to the earnings report, U.S. tariffs have created significant uncertainty and are likely to have adverse effects on various operating businesses of Berkshire Hathaway. These tariffs were cited as a primary concern that could hinder future profitability, affecting both the company’s operating units and its investments in equity securities.

What was Warren Buffett’s outlook on equity securities in the latest earnings report?

Warren Buffett expressed concerns about the potential risks posed by tariffs in the latest Berkshire Hathaway earnings report. The report highlighted that there could be negative consequences for investments in equity securities due to the uncertainties in trade policies. Buffett’s strong cash reserves remain a positive indicator amid this uncertainty.

What losses did Berkshire Hathaway report in relation to Kraft Heinz?

The Berkshire Hathaway earnings report indicated a significant $3.8 billion loss from its investment in Kraft Heinz. This underperforming asset prompts discussions of potential strategies, including a spinoff of Kraft Heinz’s grocery business, as the company grapples with its challenges.

Who is set to succeed Warren Buffett as CEO according to the latest earnings report?

Greg Abel, currently the vice-chairman of non-insurance operations, is slated to succeed Warren Buffett as CEO at the end of 2025, as mentioned in the latest Berkshire Hathaway earnings report. Buffett, aged 94, will continue to serve as chairman of the board.

What investment strategies did Berkshire Hathaway employ in the first half of 2025?

In the first half of 2025, Berkshire Hathaway was a net seller of stocks for the eleventh consecutive quarter, selling approximately $4.5 billion in equities. This reflects a strategic shift as Buffett continued to hold substantial cash reserves while also refraining from stock repurchase activities despite a drop in share prices.

| Key Point | Details |

|---|---|

| Second-Quarter Earnings Decline | Berkshire’s operating profit decreased by 4% year-over-year to $11.16 billion. |

| Impact of Tariffs | The company warned that steep U.S. tariffs may negatively impact its businesses. |

| Higher Profits in Other Sectors | Despite insurance underwriting losses, profits in railroads, energy, manufacturing, service, and retail sectors increased. |

| Cash Reserves | Berkshire’s cash reserves stand at $344.1 billion, slightly down from $347 billion at end of March. |

| Stock Market Activity | Berkshire was a net seller of stocks for the 11th quarter, selling $4.5 billion in equities. |

| Loss on Kraft Heinz Investment | Berkshire recorded a $3.8 billion loss from its stake in Kraft Heinz. |

| Leadership Transition | Warren Buffett announced plans to step down as CEO in 2025; Greg Abel will succeed him. |

Summary

The Berkshire Hathaway earnings report reveals the company faced a slight decline in operating earnings due to a variety of factors, including the adverse effects of U.S. tariffs and a decrease in insurance underwriting. Despite these challenges, several business sectors reported increased profits. Warren Buffett’s cash reserves remain robust, even as the company has been net selling in the stock market. Furthermore, with a notable loss in its investment in Kraft Heinz, Berkshire is navigating significant changes ahead as Buffett plans his eventual succession. The outlook for the company’s performance includes substantial uncertainties linked to evolving international trade policies. Overall, Berkshire Hathaway’s resilience amidst trials showcases its foundational strength and strategic foresight.