Stocks Making Big Moves Midday: Apple, McDonald’s & More

Stocks making big moves midday are grabbing the attention of investors and market watchers alike, with some notable names leading the charge. Apple stock news is making headlines as the tech giant surged over 5% following a major investment announcement, while Grocery Outlet earnings exceeded expectations, sending shares soaring by an impressive 38%. McDonald’s revenue report highlighted solid growth, contributing to a 2% increase in its stock price, as consumer appetite remains strong. Meanwhile, Viasat stock surged more than 24% as the company delivered unexpected earnings results, further demonstrating the dynamic nature of today’s market updates. As these significant movements unfold, investors are on the lookout for opportunities to capitalize on the shifting trends in the stock market.

Midday trading sessions are often marked by notable fluctuations in stock prices, reflecting a variety of market dynamics. Recent developments have put a spotlight on major players such as Apple, whose recent performance has drawn keen interest following their latest financial disclosures. Additionally, companies like Grocery Outlet have surprised analysts with impressive quarterly earnings, leading to significant price jumps. Insights from the McDonald’s revenue report have also kept traders engaged, alongside the recent surge in Viasat’s stock, showcasing the breadth of activity happening in the market. These movements highlight the importance of staying informed and agile as traders navigate the fast-paced world of stock exchanges.

Stocks Making Big Moves Midday: Notable Performers

Investors are closely monitoring stocks making big moves midday, as they often indicate significant shifts in market sentiments. Among today’s top performers is Apple, which saw a remarkable gain of over 5% following a confirmation of increased investment in the U.S. The tech giant is set to inject $100 billion into the American economy over the next four years, bringing its total commitment to $600 billion. Such substantial investments not only enhance Apple’s position in the tech industry but also signal broader economic confidence, positively impacting associated market trends.

Meanwhile, Viasat has soared more than 24% after exceeding analysts’ earnings expectations. The company reported fiscal first-quarter earnings that surprised investors, showcasing robust revenue growth. As the sector for communications services continues to evolve, Viasat’s strong performance exemplifies how strategic investments can lead to unprecedented stock surges, attracting attention from both investors and market analysts alike.

Grocery Outlet Earnings Surprise: What It Means for Investors

Grocery Outlet’s impressive 38% rally after the release of its second-quarter earnings report serves as a testament to the stock’s strong market position. The company reported earnings of 23 cents per share, surpassing the FactSet consensus of 17 cents. This positive earnings surprise has instilled confidence among investors, suggesting that discount retailers can thrive even in competitive and fluctuating market environments.

Furthermore, Grocery Outlet’s robust full-year earnings guidance has also surpassed estimates, further strengthening its appeal to investors. As consumers continue to seek value in their grocery shopping, companies like Grocery Outlet that successfully fulfill this need are well-positioned to capture significant market share, making it a stock to watch closely.

Fast Food Giants: McDonald’s Revenue Report Surprises

McDonald’s shares experienced a modest increase of over 2% after the release of a second-quarter revenue report that exceeded expectations. The fast food titan reported adjusted earnings of $3.19 per share on revenue of $6.84 billion, outperforming analysts’ predictions. This positive surprise highlights McDonald’s ability to adapt to changing consumer preferences and maintain its dominance in the fast-food sector.

The uptick in McDonald’s stock amid competitive pressure from other fast-food chains underscores the resilience of established brands in securing market share. Investors are likely to keep a keen eye on the company’s future strategies, especially in light of rising food costs and changing consumer behaviors. Additionally, successful marketing campaigns and menu innovations could further bolster sales and profits moving forward.

Tech Sector Update: Arista Networks and Advanced Micro Devices

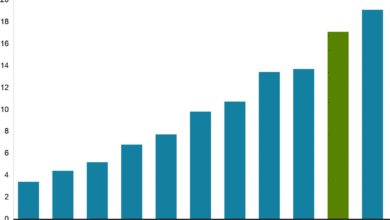

In the tech sector, Arista Networks has reported a significant increase of 17% following better-than-expected second-quarter results. This performance highlights the company’s strong foothold in the networking technology market and indicates robust demand for its products. Investors are often interested in tech stocks due to their potential for rapid growth, and Arista’s recent success reinforces positive sentiment in this high-stakes sector.

Conversely, Advanced Micro Devices (AMD) shares dropped more than 6% after a disappointing second-quarter earnings report. Such volatility underscores the challenges tech companies can face amid fierce competition and fluctuating market dynamics. Investors should remain vigilant on AMD’s upcoming strategies to regain market confidence, as innovation remains paramount in the semiconductor industry.

Biotech Sector Challenges: Scholar Rock and BridgeBio Pharma

The biotech sector has faced its own set of challenges, as demonstrated by Scholar Rock’s decline of 6% following a sizable increase in research and development expenses. Investors in biotech companies often contend with high volatility, compounded by the uncertainties surrounding clinical trials and regulatory approvals. Scholar Rock’s recent financial results highlight the delicate balance between investment in innovation and the pressure of managing operational costs.

Similarly, BridgeBio Pharma saw shares fall more than 11% after reporting a wider second-quarter loss than analysts anticipated. This downturn emphasizes the necessity for biotech firms to demonstrate not only scientific progress but also sound financial management. As these companies navigate complex regulatory landscapes, transparency and effective communication with investors will be crucial for maintaining confidence in the sector.

Uber Technologies and Opendoor Technologies: Mixed Results

Uber Technologies reported a slight dip of 1% after aligning its second-quarter earnings with expectations, despite exceeding revenue forecasts. Such mixed signals can create uncertainty for investors, who are always on alert for signs of growth in such a competitive sector. Uber’s ability to navigate fluctuating market conditions and regulatory challenges will be essential for its continued success and recovery post-pandemic.

On the contrary, Opendoor Technologies faced a considerable drop of more than 22% despite heavy trading volume after a weaker-than-expected third-quarter outlook was issued. Investor sentiment in tech stocks can shift rapidly based on guidance reports, emphasizing the importance for companies to provide realistic forecasts and effective investor relations strategies. The contrasting narratives of Uber and Opendoor remind market participants of the inherent unpredictability in the tech-driven landscape.

Market Impact of Snap and Lumber Market Updates

Snap saw a dramatic pullback of nearly 18% after its second-quarter revenue fell short of analysts’ expectations. This decline illustrates the significant impact market expectations can have on stock performance. For investors, understanding the nuances of a company’s earnings call and its broader implications on market sentiment can be vital for making informed trading decisions. The social media landscape is competitive, and maintaining user engagement is critical for Snap’s recovery.

On another note, lumber prices have been fluctuating due to changing market demand and supply constraints, reflecting ongoing dynamics in the building material sector. Investors in related stocks should stay informed about lumber market updates, as these commodities can influence broader construction sector performance. Keeping an eye on raw material costs is essential for stakeholders to track potential impacts on profitability in related industries.

Looking Ahead: Market Trends and Insights

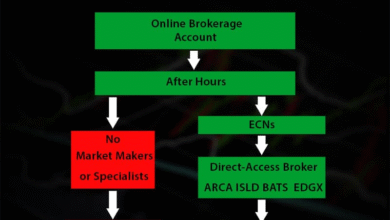

As we look ahead, understanding market trends is crucial for investors seeking to navigate potential opportunities and risks. Stocks making big moves midday often serve as indicators of underlying market health, providing valuable insights into investor sentiment and economic conditions. Recognizing which sectors are experiencing growth can help investors tailor their strategies effectively.

Additionally, keeping tabs on notable earnings reports and market updates, such as those provided by major players like Apple and McDonald’s, can serve as bellwethers for broader market movements. The interconnectivity of market players underscores the importance of comprehensive research in making informed investment decisions, especially in volatile environments.

Investment Strategies for Today’s Market

Investing in today’s market requires careful consideration of both economic indicators and company performance metrics. With stocks making significant moves, a diversified portfolio remains key to mitigating risks associated with volatility. Innovative strategies that integrate both growth and value stocks can help investors navigate uncertain times while positioning themselves for potential upside.

Moreover, staying informed about earnings surprises, such as those from Grocery Outlet and McDonald’s, can provide actionable insights for investors looking to capitalize on market opportunities. Regularly reviewing and adjusting one’s investment strategy based on current trends and company reports can foster resilience in an investment portfolio.

Frequently Asked Questions

What stocks are making big moves midday today?

Today, stocks making big moves midday include Apple, Viasat, McDonald’s, and Grocery Outlet. Each of these companies has experienced significant price changes due to recent earnings reports and market developments.

How did Apple stock perform midday?

Apple stock gained more than 5% midday after a White House official announced an additional $100 billion investment in the U.S., totaling $600 billion over the next four years.

What were the earnings results for Grocery Outlet that influenced its midday stock movement?

Grocery Outlet’s stock surged 38% midday following a strong second-quarter earnings report, earning 23 cents per share, surpassing the FactSet estimate of 17 cents.

Why did Viasat experience a stock surge?

Viasat stock surged over 24% midday after reporting better-than-expected fiscal first-quarter earnings of 17 cents per share, on revenue of $1.17 billion, which exceeded analysts’ predictions.

How did McDonald’s revenue report affect its midday stock price?

McDonald’s shares increased more than 2% midday after its second-quarter earnings surpassed expectations, reporting adjusted earnings of $3.19 per share on $6.84 billion in revenue.

What impact did the earnings guidance from Bloomin’ Brands have on their midday stock movements?

Bloomin’ Brands’ stock plunged 28.4% midday as the company provided weak guidance for the upcoming quarters, overshadowing a better-than-expected earnings report.

Which stocks had significant drops midday and why?

Several stocks showed significant drops midday, including Snap, which fell nearly 18% due to revenue missing analysts’ expectations, and Opendoor Technologies, which plummeted over 22% following a weaker-than-expected third-quarter outlook.

What’s the significance of midday stock updates for investors?

Midday stock updates are crucial for investors to assess real-time market trends, earnings impacts, and potential investment decisions based on the volatility and performance of key companies like Apple and Viasat.

How do earnings reports influence stocks making big moves midday?

Earnings reports often drive stock volatility; companies like Grocery Outlet and McDonald’s saw substantial midday gains after reporting results that exceeded analyst expectations, while others faced declines due to disappointing guidance.

Where can I find updates on stocks making big moves midday?

You can find updates on stocks making big moves midday through financial news websites, stock analysis platforms, and market research tools that track real-time stock performance and relevant earnings announcements.

| Company | Change (%) | Key Points |

|---|---|---|

| Apple | +5% | Confirmed $100 billion U.S. investment, total $600 billion over four years. |

| Grocery Outlet | +38% | Q2 earnings exceeded expectations at 23 cents/share, guidance improved. |

| Bloomin’ Brands | -28.4% | Weak guidance overshadowed better-than-expected earnings. |

| Viasat | +24% | Surpassed expectations with $1.17 billion revenue and earnings of 17 cents/share. |

| Scholar Rock | -6% | R&D expenses increased, leading to wider-than-expected losses. |

| Capri Holdings | +11% | Fiscal Q1 results beat estimates across the board. |

| Limbach | -19% | Revenue missed high estimates, and operating cash decreased. |

| McDonald’s | +2% | Q2 earnings of $3.19/share and revenue of $6.84 billion exceeded forecasts. |

| Walt Disney | -2% | Mixed quarterly results, despite adjusted earnings exceeding expectations. |

| Snap | -18% | Q2 revenue fell short of analyst expectations. |

| Arista Networks | +17% | Better-than-expected results in second quarter. |

| Opendoor Technologies | -22% | Weaker-than-expected Q3 outlook despite high trading volume. |

| Uber Technologies | -1% | Reported in line with expectations, revenue beat forecasts. |

| Advanced Micro Devices | -6% | Disappointing Q2 earnings that fell short of estimates. |

| Rivian Automotive | -2% | Announced wider losses in Q2. |

| Upstart Holdings | -17% | Strong earnings but missed revenue expectations. |

| Hinge Health | +10% | Reported stronger-than-expected Q2 revenue. |

| Lucid Group | -9% | Adjusted production outlook for 2025 to lower estimates. |

| BridgeBio Pharma | -11% | Reported wider-than-expected losses in Q2. |

| Super Micro Computer | -21% | Weaker-than-expected fourth-quarter results. |

| Match Group | +8% | Stronger-than-expected outlook for Q3. |

Summary

Stocks making big moves midday provide a snapshot of the market dynamics, showcasing which companies are experiencing significant gains or losses during the trading day. For instance, Apple and Grocery Outlet saw impressive gains due to solid earnings reports and positive guidance, while Bloomin’ Brands and Super Micro Computer faced sharp declines due to disappointing forecasts. Keeping an eye on these fluctuations can offer valuable insights into market trends and investor sentiment.