RWA Tokenization: Revolutionizing Digital Asset Custody

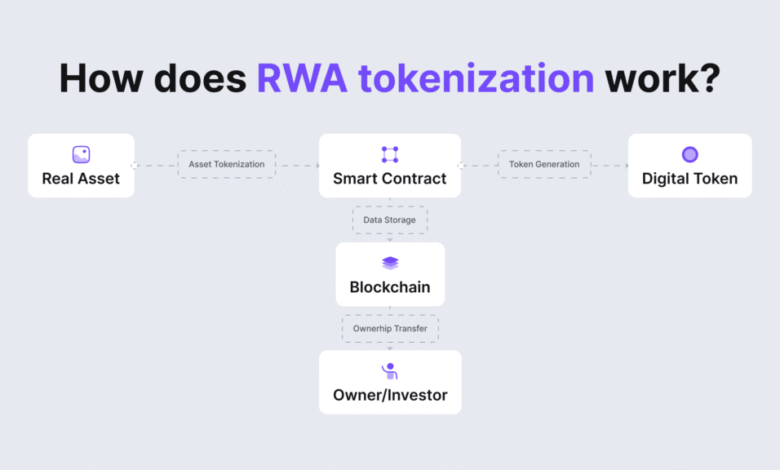

RWA tokenization is rapidly transforming the financial landscape, paving the way for a $19 trillion revolution in the realm of institutional-grade custody. As more assets—ranging from real estate to gold and equities—shift onto blockchain platforms, the importance of digital asset custody becomes paramount in ensuring security and compliance. Ripple’s innovative approach underscores how RWA tokenization not only enhances liquidity and transparency but also broadens access to markets previously seen as complex and unapproachable. With projections indicating that tokenized assets could reach remarkable valuations in the coming years, stakeholders are increasingly looking to the emerging structures that support this evolution. By harnessing cutting-edge technologies, the future of financial transactions is being reshaped, providing new opportunities for institutions and investors alike.

The term ‘real-world asset tokenization’ encapsulates the modern shift towards digitizing physical assets, presenting fresh avenues for investment and liquidity in various sectors. As the landscape evolves, concepts like tokenized securities and asset-backed tokens are gaining traction, emphasizing the need for robust custodial frameworks to support these innovations. From facilitating property transactions to enabling trade finance through digital representations, the application of tokenization is broadening significantly across industries. In this context, the role of digital asset custody becomes crucial, ensuring that these digital representations are protected and compliant with regulatory standards. Consequently, as we delve deeper into the realm of asset tokenization, the emphasis on security and institutional trust remains more relevant than ever.

The Importance of Ripple Custody in Digital Asset Security

Ripple’s commitment to providing top-tier digital asset custody services plays a crucial role in the evolving landscape of tokenization. As the industry shifts towards a more decentralized financial system, the need for robust security measures has never been greater. With their cutting-edge technology, Ripple is positioning itself as a leader in the secure storage of tokenized assets. This is particularly important for institutions that need to trust that their investments are protected against cyber threats and fraud.

The Ripple Custody service is designed with institutional-grade security, ensuring that private keys, which are critical for accessing digital assets, are meticulously safeguarded. This level of protection is essential as more entities begin to tokenize their assets, particularly real estate and equities, which are historically illiquid and vulnerable to market fluctuations. By fostering a secure environment for tokenized assets, Ripple enhances investor confidence and paves the way for widespread adoption.

RWA Tokenization and Its Impact on Global Markets

Real-world asset (RWA) tokenization is revolutionizing how traditional assets are perceived and traded. As more institutions recognize the advantages of this innovative approach, the volume of tokenized assets is set to skyrocket, with projections indicating a market worth nearly $19 trillion by 2033. This transformation opens doors to increased liquidity, allowing investors to buy, sell, and trade assets with unprecedented speed and efficiency.

Additionally, the tokenization process enhances transparency, as blockchain technology provides an immutable ledger that captures every transaction. This level of clarity is particularly appealing to institutional investors who are often required to comply with stringent regulations. As countries like Dubai lead the way with supportive regulatory frameworks, other regions are likely to follow suit, further driving the adoption of RWA tokenization across treasuries, gold, and the real estate market.

In tandem with this market shift, institutional-grade custody solutions are vital for ensuring that asset owners can safely engage with tokenized markets. Without sufficient security and regulatory compliance, the potential for tokenization to unlock growth and opportunity could be significantly hampered.

Tokenized Assets: A New Frontier for Real Estate Investment

Tokenization of real estate offers a transformative avenue for investment, providing increased access and liquidity in what has traditionally been a slow-moving sector. By leveraging Ripple’s custody solutions, companies such as Ctrl Alt can issue and manage tokenized property deeds securely on the XRP Ledger. This not only enhances the buying process for investors but also lowers the barrier to entry for individuals who wish to invest in real estate without committing substantial capital.

Furthermore, significant initiatives like the Dubai Land Department’s Tokenization Project highlight the growing acceptance and operational efficiencies that come with blockchain technology. These developments affirm that real estate tokenization is not merely a trend but a structural shift, enabled by advancements in digital asset custody. The ripple effect of this innovation can facilitate a broader participation model in real estate, where diverse investors can own fractions of properties, ultimately democratizing access to real estate markets.

The Role of Custody Providers in Tokenization

Custody providers play an essential role in the tokenization lifecycle, serving as the backbone that ensures digital assets remain protected. Institutions entering the tokenized asset space must prioritize choosing a custodian that offers state-of-the-art security and adheres to regulatory compliance. This requirement aligns with the rising complexities in the digital asset landscape, where each transaction and asset transfer demands a structure that is both efficient and secure.

Providers must also adapt to evolving market demands by offering scalable solutions that can handle the influx of tokenized assets. As more institutions turn to tokenization for treasuries, equities, and real estate, they require custodians that can support high volumes of transactions while maintaining integrity and security. The combination of rigorous security protocols and responsiveness to market changes is crucial for building trust and facilitating growth in the digital asset arena.

Benefits of Institutional-Grade Custody for Tokenized Assets

Institutional-grade custody is more than just a safeguard; it represents a fundamental shift in how traditional assets are managed. For institutions involved in the tokenization of real-world assets, relying on reputable custodians like Ripple provides numerous advantages. This system allows for better compliance with regulatory standards, ensuring that tokenized assets are not only protected but also operate within the legal frameworks established by various jurisdictions.

Moreover, institutional-grade custody solutions contribute to the liquidity and marketability of tokenized assets by enhancing investor confidence. When custodians implement strong protocols for safeguarding private keys and transaction integrity, it signals to the market that tokenization is a viable asset management strategy. Consequently, this confidence directly influences the growth of the tokenized assets market, paving the way for institutional participation on a large scale.

Regional Trends in RWA Tokenization

Regional adoption trends in real-world asset tokenization showcase the global nature of this new financial paradigm. In North America and Europe, efforts are ongoing to promote tokenized treasuries and money market funds, reflecting a growing curiosity and openness toward digital asset innovations. On the other hand, Latin America is making strides in agricultural receivable tokenization to strengthen rural credit systems, indicating that tokenization applications extend beyond conventional assets.

Southeast Asia is exploring trade receivable solutions to enhance supply chain finance, demonstrating how RWA tokenization can be tailored to address specific regional financial challenges. These diverse approaches underline the versatility of tokenization and custodial solutions in meeting various market needs while promoting broader financial inclusion globally.

Challenges and Opportunities in RWA Tokenization

Despite the vast opportunities presented by RWA tokenization, several challenges remain that could hinder wide-scale adoption. Legal complexities, particularly surrounding the ownership and transfer of tokenized assets, must be navigated carefully to ensure compliance with existing property laws. Furthermore, achieving interoperability between traditional financial systems and blockchain-based solutions presents another hurdle that stakeholders must collaboratively address.

However, the advantages of tokenizing real-world assets, such as increased liquidity and enhanced access for a broader audience, outweigh these challenges. Institutions that take advantage of the continuing evolution toward digital asset custody—while tackling regulatory hurdles—stand to unlock significant new revenue streams and reshape their operational models for future success.

The Future of Digital Asset Custody and Tokenization

The future of digital asset custody and tokenization is bright, as advancements in technology and growing acceptance accelerate the adoption of digital assets across various sectors. Institutions are now more aware of the benefits of integrating digital custody solutions within their operations. The convergence of traditional finance with blockchain technology has created a fertile ground for new business models, enabling seamless access to tokenized assets.

In the coming years, as the market grows towards a projected value of $19 trillion, entities that prioritize secure custody solutions will thrive. The integration of innovative technologies and robust custody frameworks is critical for ensuring the successful implementation of tokenization strategies. Overall, the trajectory of institutional-grade custody tied to the evolving landscape of RWA tokenization promises to create a versatile and dynamic financial ecosystem.

Navigating Regulatory Landscapes for Tokenization

In the rapidly evolving realm of tokenization, understanding and navigating regulatory landscapes is paramount for institutions looking to participate. Ripple’s efforts to enhance legal frameworks through partnerships and advocacy showcase the company’s commitment to creating an environment conducive to secure and compliant tokenized operations. This proactive approach is crucial as different jurisdictions begin to establish their regulations regarding digital assets.

Compliance not only fosters trust with investors but also significantly mitigates potential legal challenges that may arise from non-compliance. As tokenization continues to advance, institutions must remain vigilant in adapting to changing regulations while maintaining robust security practices. By engaging regulators and implementing best practices, entities can ensure they are well-positioned to capitalize on opportunities in the tokenization market.

Frequently Asked Questions

What is RWA tokenization and its significance?

RWA tokenization refers to the process of converting real-world assets, such as real estate or equities, into digital tokens on a blockchain. This transformation enhances liquidity, transparency, and accessibility in financial markets, marking a pivotal shift towards a $19 trillion industry.

How does Ripple custody contribute to RWA tokenization?

Ripple custody provides institutional-grade digital asset custody solutions that secure tokenized assets, ensuring compliance with regulations and safeguarding private keys. This is essential for the growth of RWA tokenization, as it establishes the trust needed for investors and institutions to participate.

What are the benefits of tokenized assets through RWA tokenization?

Tokenized assets facilitate greater liquidity and market access while enhancing transparency and reducing transaction friction. RWA tokenization allows assets like real estate and treasuries to be traded more easily, unlocking substantial value across global markets.

Can you provide an example of RWA tokenization in action?

An example of RWA tokenization is the Dubai Land Department’s Real Estate Tokenization Project, where property deeds are secured using Ripple Custody on the XRP Ledger. This initiative exemplifies how RWA tokenization can transform traditional real estate transactions.

What is the forecasted market value for tokenized real-world assets by 2033?

By 2033, the market value for tokenized real-world assets is projected to reach nearly $19 trillion. Significant contributions are expected from tokenized client assets like real estate and equities, potentially exceeding $3.7 trillion and $2 trillion respectively.

How is institutional-grade custody relevant to the RWA tokenization process?

Institutional-grade custody is crucial for RWA tokenization as it provides the necessary security, regulatory compliance, and operational standards required to manage digital assets safely. This creates a reliable framework that encourages more participation in tokenized markets.

What trends are shaping the RWA tokenization landscape?

Trends shaping RWA tokenization include increased adoption in North America and Europe for tokenized treasuries, and in Latin America for agricultural receivable tokenization. Southeast Asia is also implementing solutions for trade receivables, highlighting the diverse applications of RWA tokenization.

What are the challenges faced in RWA tokenization?

Challenges in RWA tokenization include ensuring regulatory compliance, maintaining transparency, securing private keys, and addressing legal complexities associated with bringing illiquid assets onto the blockchain. These hurdles must be overcome for widespread adoption and growth in the market.

How do real estate projects exemplify the benefits of RWA tokenization?

Real estate projects, such as those in Dubai, showcase RWA tokenization by enabling fractional ownership and easier transaction processes, which increase liquidity and attract global investors. These projects demonstrate how tokenization can revolutionize asset classes traditionally considered illiquid.

What is the role of Ripple in enhancing digital asset custody for RWA tokenization?

Ripple plays a vital role in enhancing digital asset custody by providing secure and compliant custody solutions that support the growing demand for RWA tokenization. Their technology ensures that tokenized assets meet high-security standards and fosters broader market acceptance.

| Key Point | Details |

|---|---|

| Market Potential | The RWA tokenization market is estimated to reach nearly $19 trillion by 2033. |

| Institutional Custody | Institutional-grade custody is essential for the tokenization of real-world assets, providing security and regulatory compliance. |

| Global Trends | Regions like North America and Europe are leading in tokenized treasuries, while Latin America focuses on agricultural receivables. |

| Case Study | The Dubai Land Department’s project uses Ripple Custody for securing property deeds through tokenization. |

| Benefits of Tokenization | Tokenization unlocks liquidity, enhances transparency, and broadens market access for various assets. |

| Conclusion of Report | Strong private key protection and regulatory compliance are crucial for successful custody services in RWA tokenization. |

Summary

RWA tokenization is transforming the financial landscape by promoting a secure and efficient way to manage real-world assets. As institutions embrace digital asset custody, they are well-poised to tap into the vast potential of a $19 trillion market by 2033. With innovations like the Dubai Land Department’s real estate project leading the way, the integration of blockchain technology with traditional assets is paving the way for enhanced liquidity, transparency, and widespread market access. The urgency for strong regulatory compliance and security measures underscores the commitment required to harness this groundbreaking shift in the global economy.