Crypto in 401(k) Plans: New Investment Opportunities Ahead

The recent surge of interest in cryptocurrency has led to a historic development: the inclusion of crypto in 401(k) plans. On August 7, 2025, a landmark executive order paved the way for U.S. retirement savers, allowing them to diversify their portfolios with alternative assets like digital currencies within their 401(k) investment options. This significant change opens the door for over 90 million Americans to enhance their retirement savings through cryptocurrency, responding to a growing demand for innovative investment opportunities. As regulations evolve, it is essential for plan sponsors to understand the implications of offering these digital assets in 401(k) plans, balancing potential rewards with fiduciary responsibilities. This transformation reflects a broader trend toward integrating cryptocurrency into mainstream financial practices, emphasizing the importance of staying informed about developments like the executive order on crypto.

The integration of digital currency into retirement savings plans signifies an exciting shift in financial planning strategies. By opening the door to cryptocurrency within traditional 401(k) frameworks, this movement embraces alternative investment options that were previously limited to high-net-worth individuals and institutional investors. With the executive order facilitating this change, retirement investors now have the potential to explore a new realm of growth opportunities through their employer-sponsored accounts. This evolution not only reflects the changing landscape of personal finance but also underscores the increasing acceptance of digital assets alongside conventional investment vehicles. As individuals navigate these uncharted waters, understanding the complexities and responsibilities involved in incorporating digital assets into retirement strategies will be paramount.

Understanding the Executive Order on Crypto and 401(k) Plans

On August 7, 2025, the White House’s executive order, “Democratizing Access to Alternative Assets for 401(k) Investors,” marked a pivotal moment in U.S. retirement planning. By explicitly allowing digital assets such as cryptocurrencies into 401(k) plans, this order opens new avenues for investors to diversify their retirement portfolios. The inclusion of crypto in 401(k) plans signifies a groundbreaking shift, as it challenges traditional investment paradigms and introduces a wider range of opportunities for retirement savers.

The executive order is particularly noteworthy not only for its immediate implications but also for its potential to reshape the landscape of retirement investment options. For the first time, over 90 million Americans can explore cryptocurrency retirement savings as a legitimate part of their financial future. This development highlights a growing acceptance of digital assets as valuable investment opportunities, reflecting a broader trend toward integrating alternative assets in retirement plans and democratizing investment access.

Historical Context of 401(k) Investment Options

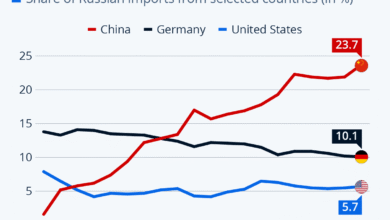

Historically, 401(k) investment options were largely limited to stocks, bonds, and mutual funds, providing little room for diversification through alternative assets. This narrowing of choices restricted many investors from exploring emerging investment vehicles like cryptocurrencies. The recent executive order represents a monumental policy shift that acknowledges the changing dynamics of investment opportunities and the necessity for the retirement industry to adapt to modern financial landscapes.

As the U.S. grapples with advancements in digital financial technologies, the integration of alternative assets, especially crypto, into retirement plans becomes increasingly important. This shift towards offering a broader range of 401(k) investment options empowers everyday investors by giving them a chance to engage with the evolving asset classes that could bolster their retirement savings significantly.

Regulatory Actions Following the Executive Order

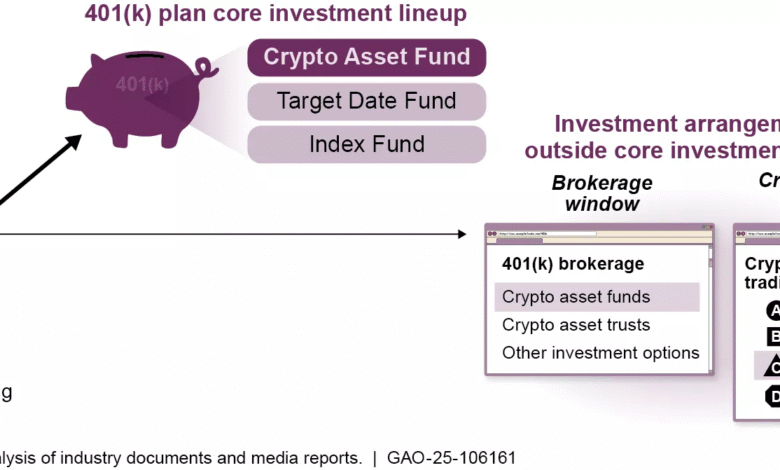

The executive order not only broadens the horizons for 401(k) investors by including crypto and other alternative assets but also prompts essential regulatory actions to support this transition. Significant steps, such as the reexamination of the Employee Retirement Income Security Act (ERISA) guidance, focus on how fiduciaries will handle these new investment options. This move is crucial to ensure that fiduciary responsibilities are clearly defined, allowing financial advisors and plan sponsors to operate confidently.

The directive for the Department of Labor and other regulatory bodies to clarify standards and procedures will enable a smoother integration of alternative assets into retirement plans. By establishing criteria for weighing fees against potential returns in various assets, including cryptocurrency retirement savings, the order sets the stage for a structured approach to handle these dynamic investments, ensuring that stakeholder interests are safeguarded.

Opportunities and Risks of Including Digital Assets in 401(k) Plans

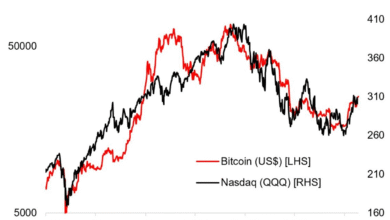

Integrating digital assets into 401(k) plans presents both exciting opportunities and inherent risks. While cryptocurrencies offer the potential for substantial returns, their volatility and regulatory uncertainties demand a cautious approach. For plan sponsors, the challenge lies in incorporating these alternative investments while adhering to ERISA guidelines, ensuring fiduciaries fulfill their responsibilities without exposing themselves to elevated litigation risks.

However, with enhanced regulatory frameworks, plan sponsors can offer cryptocurrency options with greater confidence. This allows them to balance innovation with investor protection. A thorough due diligence process and robust participant education programs will be necessary to navigate the complexities of digital asset investments in retirement planning, ultimately enhancing the potential for growth and security in retirement savings.

The Future of Alternative Assets in Retirement Planning

The executive order supporting alternative assets, including cryptocurrency, heralds a new era for retirement planning. With over $9 trillion in 401(k) assets now potentially accessible to digital investment opportunities, the financial landscape is poised for transformation. This growth in alternative asset inclusion can lead to greater diversification, reducing risk and potentially yielding higher returns for retirees.

As institutional investors increasingly begin to recognize the value of digital assets, the future of retirement planning will likely be characterized by a blend of traditional and alternative investment avenues. This hybrid approach can provide a comprehensive investment strategy that accommodates various risk appetites and financial goals, fostering a more resilient retirement savings structure for millions of Americans.

Preparing for Change: Insights for Plan Sponsors

As the landscape of retirement investing evolves, plan sponsors must adapt to the newly available investment options, including cryptocurrency. This requires not only understanding the regulatory guidance that will emerge but also proactively developing compliant product offerings. By preparing for these changes, sponsors can set their plans apart and attract participants eager to explore innovative investment opportunities.

Education plays a critical role in this adaptation. As employees gain access to alternative assets in their retirement plans, providing comprehensive information about the risks and benefits of investing in crypto will be essential. By fostering a better understanding of digital assets among plan participants, sponsors can empower individuals to make informed decisions that will enhance their long-term financial outcomes.

Potential Impact of Crypto in 401(k) Plans

The inclusion of cryptocurrency in 401(k) plans has the potential to reshape the investment landscape fundamentally. This change not only democratizes access to alternative assets but also encourages a surge in participation rates among younger investors typically more inclined to engage with digital assets. By facilitating easier access to crypto investments, the executive order will likely inspire a new generation of investors to take advantage of these opportunities within their retirement portfolios.

Moreover, the rise of crypto in 401(k) plans could have a ripple effect on the financial ecosystem as a whole. Increased participation in digital asset investments may encourage traditional financial institutions to innovate and offer better products suited for the evolving market. As demand for cryptocurrency retirement savings grows, we may witness further regulatory clarifications that enhance investor protections and promote a robust framework for digital trading, ultimately benefiting the entire industry.

Challenges in Regulating Cryptocurrency for Retirement Investments

While the integration of digital assets into 401(k) plans offers numerous benefits, it also presents significant challenges in regulation and oversight. Policymakers must navigate the complexities of defining digital assets and establishing clear guidelines to protect investors. The volatility and rapid evolution of cryptocurrencies can lead to unexpected fluctuations in fund performance, requiring robust regulatory responses to mitigate potential risks associated with these assets.

Additionally, as various government agencies collaborate to create a cohesive framework for digital asset regulation, the uncertainty surrounding compliance requirements may deter some plan sponsors from offering these investment options. It is imperative for regulators to clarify guidance regarding the fiduciary responsibilities of plan sponsors when introducing cryptocurrencies to retirement plans. This proactive approach will not only enhance trust among investors but also foster a stable environment for the growth of alternative assets in retirement investing.

Conclusion: The Evolving Retirement Landscape with Crypto

The recent executive order is a momentous step in evolving the retirement landscape by allowing for cryptocurrency investment in 401(k) plans. As U.S. retirement savers begin to explore the opportunities presented by digital assets, this shift towards alternative assets will reshape how individuals think about long-term savings. The promise of crypto-based retirement savings could pave the way for greater financial independence and adaptive investment strategies.

In conclusion, as the regulatory framework surrounding crypto and 401(k) plans evolves, both plan sponsors and investors must remain vigilant and informed. By embracing these changes and understanding the implications of integrating alternative asset classes, we can collectively work towards a more inclusive, diversified, and prosperous future in retirement investing.

Frequently Asked Questions

What changes did the executive order on crypto introduce for 401(k) investment options?

The executive order issued on August 7, 2025, allows U.S. retirement savers to include digital assets like cryptocurrencies in their 401(k) investment options. This historic change enables over 90 million Americans to diversify their retirement savings with alternative assets, such as crypto, private equity, and real estate, effectively expanding traditional investment portfolios.

How can I include cryptocurrency in my 401(k) retirement savings plan?

Once the regulations stemming from the executive order are implemented, you will be able to allocate a portion of your 401(k) funds to cryptocurrencies. It’s essential to consult with your plan sponsor or financial advisor to understand the specific guidelines and investment options available for integrating digital assets into your retirement savings.

What are the risks associated with adding digital assets to 401(k) plans?

Including cryptocurrency in 401(k) plans carries several risks, including higher volatility, lower liquidity, and complex valuation challenges. Therefore, plan sponsors need to establish robust due diligence processes and implement stringent allocation limits to mitigate these risks.

What is the significance of allowing alternative assets in retirement through the executive order?

The executive order marks a significant shift in retirement investment strategy by recognizing that alternative assets like cryptocurrencies can offer diversification and growth potential. This shift opens the nearly $9 trillion 401(k) market to digital assets and provides everyday investors access to investment opportunities once limited to institutions and wealthy individuals.

What are the fiduciary responsibilities regarding crypto in 401(k) plans?

Fiduciaries managing 401(k) plans must carefully weigh the benefits and risks of including cryptocurrencies. They need to clarify the standards for asset allocation decisions, ensure compliance with ERISA, and protect participants’ interests while navigating the higher fees and complexities associated with digital assets.

Will plan sponsors face regulatory challenges when offering cryptocurrencies in 401(k) plans?

Yes, while the executive order aims to facilitate the inclusion of cryptocurrencies in retirement plans, it also emphasizes compliance with fiduciary duties, which may prompt changes in regulatory guidance. Plan sponsors must stay updated on new rules to navigate potential liabilities effectively.

How can employers prepare for the integration of crypto into their 401(k) plans?

Employers should begin by developing compliant product offerings and participant education programs focused on digital assets. Regularly monitoring the evolving regulatory landscape and collaborating with financial advisers will be crucial for successfully integrating cryptocurrencies into existing 401(k) plans.

What will be the potential impact of the executive order on individuals’ retirement savings?

The executive order’s potential impact on retirement savings is transformative by allowing individuals to invest in cryptocurrencies through their 401(k) plans. This opens up new avenues for growth and diversification, making cryptoinvestment a viable option for millions of savers seeking to enhance their long-term financial security.

| Key Point | Details |

|---|---|

| Executive Order Date | August 7, 2025 |

| Main Purpose | To allow investments in alternative assets, including cryptocurrencies, in 401(k) plans. |

| Impact on Investors | Gives access to over 90 million Americans for crypto investments through their employer-sponsored 401(k) plans. |

| Regulatory Actions | Reexamination of ERISA guidelines and clarification of fiduciary duties regarding alternative investments. |

| Fiduciary Responsibilities | Plan sponsors must ensure rigorous due diligence and robust disclosures due to the risks associated with alternative assets like crypto. |

Summary

Crypto in 401(k) Plans marks a revolutionary shift in retirement investing, allowing American workers to diversify their retirement portfolios with cryptocurrencies and other alternative assets. The executive order issued on August 7, 2025, opens the door for millions to tap into the burgeoning digital asset market through their 401(k) retirement accounts. This change not only enhances investment opportunities but also requires plan sponsors to navigate new regulatory landscapes and fiduciary responsibilities, emphasizing the importance of informed decision-making for the security and profitability of retirement funds.