Bitcoin Nasdaq Correlation: Risks Amid TechBubble2 Warning

The correlation between Bitcoin and Nasdaq has become a focal point for investors, especially in light of recent market analysis by economist Henrik Zeberg. He describes Bitcoin as a “highly risk-prone asset” that mirrors the fluctuations of the Nasdaq, igniting concerns amidst a rising sentiment dubbed “TechBubble2.” Market crash predictions imply that if the Nasdaq suffers a downturn, Bitcoin may follow suit with a significant loss in value. This connection is crucial for understanding Bitcoin investment risks, as both assets appear tethered amidst the complexities of current economic conditions. Investors must heed these warnings to navigate potential pitfalls in the cryptocurrency and tech sectors alike.

Exploring the relationship between cryptocurrency and technology stocks uncovers significant insights, particularly as Bitcoin faces increased scrutiny in the financial landscape. Henrik Zeberg has articulated concerns surrounding Bitcoin, indicating that its dynamics reflect trends seen in the Nasdaq market, where fears of a new tech bubble are rampant. This intertwining of digital currency fluctuations with traditional market indices emphasizes the importance of comprehensive market evaluations. Additionally, the potential implications of a downturn serve as a reminder of the investment hazards associated with Bitcoin. By understanding these correlations, investors can better strategize to mitigate risks while capitalizing on market opportunities.

Understanding the Bitcoin-Nasdaq Correlation

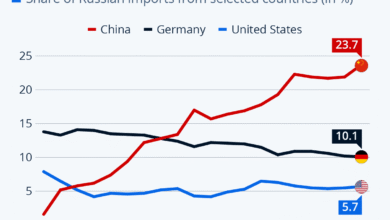

The correlation between Bitcoin and the Nasdaq has gained considerable attention, particularly during periods of market volatility. Economist Henrik Zeberg emphasizes this link, arguing that movements in the Nasdaq can directly influence Bitcoin’s price behavior. As the tech sector faces fluctuations, Bitcoin investors must remain vigilant, as downturns in tech stocks often lead to parallel declines in Bitcoin’s value. This relationship underscores the importance of analyzing market trends, especially in environments characterized by speculative enthusiasm, such as the current TechBubble2 scenario.

Moreover, the Bitcoin-Nasdaq correlation is crucial for investors looking to navigate potential market declines. As both asset classes react similarly to external economic pressures, understanding their interactions can help investors make informed decisions. The potential for a significant decline, especially if the Nasdaq experiences a downturn, reinforces the necessity of a comprehensive market analysis. Investors should utilize tools like market analysis reports and economic indicators to better gauge the risks involved. By doing so, they can safeguard their investments against unforeseen market corrections.

Risks Associated with Bitcoin Investment

Investing in Bitcoin comes with its fair share of risks, as highlighted by Henrik Zeberg. He categorizes Bitcoin as a ‘highly risk-prone asset,’ cautioning investors to be aware of the speculative nature that often surrounds cryptocurrencies. The allure of significant returns can sometimes cloud judgment, leading to uninformed investment decisions. When the market is characterized by bubble-like behavior, as Zeberg suggests with the TechBubble2 phenomenon, being aware of these risks becomes even more critical.

Furthermore, the volatility of Bitcoin prices must be taken into account. The potential for large price swings can result in substantial financial losses. Investors should perform thorough market analysis and consider their risk tolerance before diving into Bitcoin investments. This includes examining past price patterns, potential market crash predictions, and investing strategies that can mitigate risk exposure. Comprehensive education about the Bitcoin market and awareness of current trends can help investors navigate this complex landscape.

TechBubble2: An Overview of Current Market Conditions

The concept of TechBubble2, proposed by economist Henrik Zeberg, highlights the rapidly evolving market conditions reminiscent of previous technology booms. As many tech stocks reach unprecedented valuations, there are emerging concerns about potential overvaluation and the implications this has for investors, particularly those in the cryptocurrency space. The TechBubble2 hypothesis posits that complacency among investors could result in a significant market correction if underlying economic principles fail to support these high stock prices.

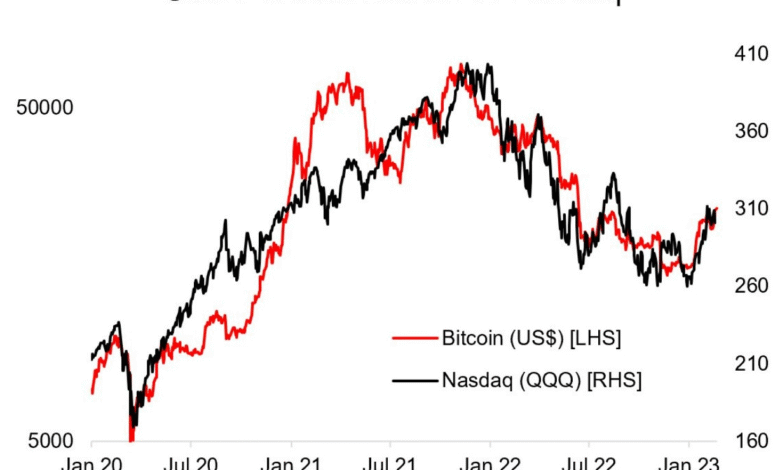

Additionally, understanding TechBubble2 requires a close examination of economic indicators and valuation metrics. For instance, the Buffett Indicator, which currently stands at an alarming 170%, indicates that equities may be significantly overpriced relative to the economic output. This precarious landscape serves as a warning for Bitcoin investors, who need to recognize that a downturn in tech stocks could simultaneously affect Bitcoin prices, creating a volatile and challenging investment atmosphere.

Evaluating Market Crash Predictions

The risk of a market crash looms large in discussions surrounding the Bitcoin and Nasdaq relationship, especially in the wake of predictions made by analysts like Henrik Zeberg. He warns that a downturn in the Nasdaq could precede a broader market correction, affecting not only tech stocks but also Bitcoin, which has become increasingly tied to stock market performance. By analyzing current trends and market dynamics, investors can better prepare themselves for potential downturns that could severely impact their portfolios.

Moreover, technical analysts have begun to observe warning signs indicative of a market correction. Patterns such as broadening tops suggest increasing volatility, while sentiment indicators reveal growing investor unease. Such conditions could foreshadow a significant shift in market momentum, making it essential for both stock and Bitcoin investors to stay informed and agile in their strategies. Embracing a robust risk management approach can help mitigate the impacts of any adverse market conditions that may arise.

The Role of Economic Context in Bitcoin Investment

Understanding the broader economic context is critical for making informed Bitcoin investment decisions. Henrik Zeberg emphasizes the necessity of considering economic variables alongside the investment allure of cryptocurrencies. Investors must remain cognizant of factors such as inflation rates, interest rates, and economic growth indicators, as these can all heavily influence market dynamics and asset valuation. The interplay between economic conditions and Bitcoin’s performance, especially amid the backdrop of TechBubble2 concerns, cannot be overstated.

Consequently, successful investment strategies in Bitcoin should incorporate a macroeconomic analysis. By assessing the potential impact of global events on both the Nasdaq and Bitcoin, investors can navigate uncertain waters more effectively. This necessitates a proactive approach to investment education and market research, enabling investors to weigh potential risks against prospective rewards in the dynamic and often unpredictable cryptocurrency landscape.

Market Volatility and Investment Strategies

Market volatility is a defining characteristic of both the Nasdaq and Bitcoin, particularly in periods marked by speculative investment behaviors. The recent assertions by Henrik Zeberg regarding the potential for significant market downtrends highlight the importance of understanding how volatility can affect investment strategies. Investors ought to formulate strategies that account for market fluctuations, ensuring they are prepared to adapt as conditions change.

Implementing diversified investment strategies may serve as an effective method to buffer against volatility. By spreading investments across various asset classes, including stocks, bonds, and cryptocurrencies, investors can mitigate risks associated with sudden market downturns. Furthermore, having an exit strategy and being prepared for potential losses is essential, especially in a market atmosphere characterized by rapid changes and unforeseen corrections.

Analyzing Bitcoin Price Trends in Relation to Tech Stocks

An in-depth analysis of Bitcoin price trends reveals a compelling relationship with tech stocks, particularly those listed on the Nasdaq. Economist Henrik Zeberg’s observations underscore the significance of these correlations, as they guide investors in their decision-making processes. When tech stocks rise, Bitcoin’s price often follows suit, illustrating a symbiotic relationship influenced by market sentiment and investor behavior.

Monitoring Bitcoin’s price trends in relation to tech stocks empowers investors to identify opportunities and potential risks. By employing technical analysis tools, investors can decipher key price levels, support and resistance zones, and momentum signals that may indicate future movement. This analytical approach enables investors to stay ahead of market trends, making timely decisions that could capitalize on rising prices while protecting against inevitable downturns.

The Influence of Market Sentiment on Bitcoin Investment

Market sentiment plays a crucial role in shaping investor behavior, particularly in the dynamic cryptocurrency space. As Henrik Zeberg points out, periods of ‘bubble euphoria’ can lead to heightened optimism and speculative buying, often disconnected from fundamental value. Such conditions can precipitate significant price swings, creating both opportunities and risks for Bitcoin investors. Understanding the underlying sentiment can thus guide investment strategies, helping to balance the allure of potential profits against the risks of sudden market corrections.

To navigate market sentiment effectively, investors should employ sentiment analysis tools and indicators that measure investor psychology. By recognizing patterns of fear and greed within the market, investors can position themselves more strategically, either capitalizing on bullish trends or retreating before possible downturns. Ultimately, a nuanced understanding of sentiment dynamics in conjunction with traditional market analysis will enhance the decision-making process for anyone investing in Bitcoin or related assets.

Future Outlook for Bitcoin Against Market Trends

As the cryptocurrency landscape continues to evolve, understanding Bitcoin’s future outlook in relation to market trends is paramount. Economist Henrik Zeberg’s concerns regarding the correlation between Bitcoin and the Nasdaq highlight the importance of closely monitoring tech stock performance and economic indicators. With the possibility of an impending recession and increasing market volatility, investors need to assess how these trends may shape the trajectory of Bitcoin prices and investment strategies.

Looking ahead, investors should remain proactive, keeping abreast of market developments that could influence Bitcoin’s valuation. This could include monitoring changes in regulatory environments, advancements in technology, and shifts in consumer behavior toward digital currencies. By integrating these elements into their investment process, investors can position themselves better to capitalize on potential growth opportunities while also safeguarding against possible downturns associated with broader economic shifts.

Frequently Asked Questions

What is the correlation between Bitcoin and Nasdaq’s performance?

The correlation between Bitcoin and Nasdaq’s performance is significant, as highlighted by economist Henrik Zeberg. He argues that as tech stocks on the Nasdaq experience volatility, Bitcoin often mirrors these fluctuations. This relationship suggests that a downturn in the Nasdaq could lead to a decline in Bitcoin’s value, positioning it as a highly risk-prone asset.

How does the Nasdaq TechBubble2 impact Bitcoin investments?

The term ‘TechBubble2’ refers to the current market conditions that resemble previous tech bubbles, which could adversely affect Bitcoin investments. According to Henrik Zeberg, an economic downturn in the Nasdaq could trigger substantial declines in Bitcoin’s value, marking it as a highly speculative and risky investment.

Are Bitcoin investment risks related to Nasdaq’s market trends?

Yes, Bitcoin investment risks are closely tied to Nasdaq’s market trends. As indicated by Henrik Zeberg, the performance of Bitcoin is heavily influenced by Nasdaq fluctuations, especially during economic corrections. Investors must be aware of potential market crashes in the tech sector, as these could lead to significant losses in Bitcoin holdings.

What warnings does Henrik Zeberg give regarding Bitcoin and Nasdaq correlation?

Henrik Zeberg warns that investors should be cautious of ‘bubble euphoria’ surrounding Bitcoin, especially in relation to its correlation with the Nasdaq. He highlights that as the tech sector faces challenges, Bitcoin may also suffer, urging investors to prepare for possible market corrections.

Why is understanding Bitcoin’s market analysis important amid Nasdaq fluctuations?

Understanding Bitcoin’s market analysis is crucial amid Nasdaq fluctuations, as asserted by Henrik Zeberg. By recognizing the interconnectedness of these markets, investors can better assess the risks and potential downturns, leading to more informed investment decisions.

What metrics indicate the possibility of a market crash affecting Bitcoin?

Metrics like the ‘Buffett Indicator’, which measures the market cap-to-GDP ratio, suggest a potential market crash that could impact Bitcoin significantly. With current levels around 170%, much higher than pre-dot-com bubble levels, analysts warn of overvaluation risks that could translate to sharp declines in Bitcoin’s value.

How might a recession affect Bitcoin and the Nasdaq?

A recession could have dire consequences for both Bitcoin and the Nasdaq, as explained by Henrik Zeberg. The market top for tech stocks and Bitcoin may coincide with economic downturns, leading to increased volatility and potential asset value decreases. Investors should prepare for possible corrections in this scenario.

What alternate views exist about Bitcoin’s future amid Nasdaq correlations?

While Henrik Zeberg outlines the risks associated with Bitcoin’s correlation with the Nasdaq, some experts argue that current market conditions differ from previous bubbles and are supported by solid corporate fundamentals, such as strong profit margins. These contrasting views suggest ongoing debates about Bitcoin’s future amid Nasdaq dynamics.

| Key Points | |

|---|---|

| Economist Henrik Zeberg’s Concerns | Bitcoin is a ‘highly risk-prone asset’ linked to Nasdaq movements. |

| Correlation with Nasdaq | Zeberg suggests Bitcoin’s price is closely tied to the Nasdaq Index, both influenced by similar market conditions. |

| TechBubble2 Concerns | Zeberg describes the current market as part of ‘TechBubble2’, indicating potential risks akin to past tech bubbles. |

| Market Indicators | Metrics like the Buffett Indicator suggest stocks are overvalued, echoing concerns of a market bubble. Current market cap-to-GDP ratio is at 170%. |

| Warning Signs of Correction | Indicators of potential downturn include broadening top patterns in stock indexes indicating increased volatility. |

| Experts’ Diverging Views | While some warn of a bubble, others cite strong corporate fundamentals supporting the current market conditions. |

| Investment Strategy Advice | Investors should consider risks associated with Bitcoin along with its potential rewards, especially under changing economic conditions. |

Summary

The Bitcoin Nasdaq correlation indicates that Bitcoin’s price movements are intricately linked to the performance of the Nasdaq index. Economist Henrik Zeberg warns that potential downturns in the tech sector could lead to severe declines in Bitcoin’s value. As we navigate through market conditions reminiscent of historic bubbles, understanding the relationship between Bitcoin and Nasdaq is vital for making informed investment decisions.