Premarket Stock Moves: Paramount, C3.ai, Nvidia, and AMC

In the fast-paced world of finance, premarket stock moves can set the tone for the trading day ahead. Today’s premarket activity features notable players such as Paramount Skydance and C3.ai, whose fortunes have shifted dramatically as they navigate market challenges. Paramount Skydance saw a 4% increase, fueled by its exciting acquisition of UFC rights from TKO Group, while C3.ai faced a staggering drop of nearly 32%, following disappointing financial forecasts. Nvidia has also made waves, reflecting on its recent trading updates that revealed cooperative agreements with the U.S. government. Meanwhile, AMC Entertainment reported better-than-expected results, boosting its shares by 8%, showcasing how earnings reports can influence premarket dynamics.

As traders digest early market signals, the pre-open trading landscape is often characterized by significant fluctuations among key stocks. Highlighted among these are the performances of media giant Paramount Skydance and the artificial intelligence firm C3.ai, both of which have become focal points in recent market discussions. With the tech sector, particularly companies like Nvidia, continually evolving due to regulatory dealings, the anticipation surrounding these movements can affect investor sentiment broadly. The latest insights into AMC Entertainment’s financial health and its stock trajectory illustrate how earnings announcements can create ripples even before the market opens. By monitoring these shifts closely, observers gain a clearer perspective on the broader economic environment and the forces at play in today’s trading session.

Premarket Stock Moves: Insights and Analysis

The premarket stock moves reflect the immediate market reactions to overnight news and events affecting various companies. In particular, investor sentiment fluctuates wildly based on developments such as earnings reports and strategic acquisitions. Recently, stocks of Paramount Skydance surged by 4% after acquiring the U.S. rights to UFC from TKO Group, signaling a positive outlook for the media company. In contrast, C3.ai faced a steep decline of nearly 32% after issuing guidance that fell below investor expectations, highlighting the fierce nature of market dynamics.

These premarket movements serve as crucial indicators for market participants, often setting the tone for the day’s trading. With large players like Nvidia and AMD trimming their valuations slightly after regulatory agreements with the Trump administration, it’s evident that policy changes can significantly impact stock performance. Observing these premarket shifts enables investors to make informed decisions, particularly those who are active in volatile sectors like technology and entertainment.

Major Players: Paramount Skydance and AMC Entertainment

Paramount Skydance’s recent acquisition of TKO Group’s UFC rights marks a significant milestone in media consolidation, reflecting a strategic move to enhance its content library. With the rights secured for seven years starting in 2026, investors responded positively, leading to a 4% rise in stock prices. This move not only strengthens Paramount’s position in the competitive landscape of media and entertainment but also suggests potential future revenue growth as the popularity of UFC continues to surge.

Conversely, AMC Entertainment’s stocks jumped 8% following stronger-than-anticipated second-quarter results. By breaking even when excluding one-time costs, the company surpassed the market’s pessimistic forecasts of a loss. This rebound emphasizes the resilience of AMC in a troubled industry, showcasing its ability to attract audiences post-pandemic. The market’s positive response also underscores a potential recovery trajectory as cinema-goers return, which is vital for sustaining longer-term growth for the entertainment leader.

C3.ai: Analyzing the Dramatic Stock Drop

C3.ai’s nearly 32% plunge in the premarket can be attributed to dismal fiscal guidance that took the market by surprise. Revenue expectations of only $70.2 million to $70.4 million, juxtaposed against significant anticipated losses, cast doubts on the company’s strategic direction and ability to navigate the AI sector’s rapid evolution. Such steep losses suggest that the company may be struggling to convert its innovative technology into profitable business models, a crucial aspect that investors watch closely.

The sudden downturn of C3.ai also illustrates the broader challenges in the technology space, especially among AI companies, where investors are increasingly discerning about valuation and performance metrics. As the demand for artificial intelligence services grows, firms like C3.ai must balance ambitious growth strategies with sustainable financial practices. This ongoing narrative makes the company’s stock especially volatile, reflecting broader market trends in tech investments.

Impact of Nvidia’s Trading Update on Stock Performance

Nvidia’s stock performance has faced a slight dip of about 1% in the premarket following a significant trading update involving regulations with the Trump administration. By agreeing to remit 15% of revenue from chip sales to China, Nvidia and AMD have opened themselves to a new regulatory environment, which could introduce headwinds in their operational strategies. This agreement underscores the complex landscape of U.S.-China trade relations and its ramifications on tech stocks.

These developments signal to investors that while Nvidia remains a leader in chip manufacturing, external policy shifts can cause fluctuations in stock performance. As these companies navigate their international business dealings, particularly in sensitive markets like China, maintaining investor confidence will be essential. The careful management of investor relations and transparent communication regarding potential impacts can determine how well Nvidia rebounds from these premarket setbacks.

CoreWeave: Price Target and Market Sentiment

CoreWeave’s stock lifted nearly 4% after JPMorgan reaffirmed its overweight rating and raised the price target for the company. This positive momentum indicates strong investor confidence in CoreWeave’s business model and growth potential, especially in the cloud infrastructure domain. With increasing demand for cloud services, this boost can attract more investors looking for robust positions in the tech industry.

However, despite this optimistic outlook, experts caution that CoreWeave’s volatility means that investors should exercise a degree of risk tolerance. The fluctuations within the stock market, particularly in tech stocks, necessitate a careful analysis of market trends and an understanding of individual company fundamentals. As CoreWeave continues to evolve within this landscape, maintaining consistent communication about growth and strategic moves will help to solidify investor trust.

AMC Entertainment Results: Key Takeaways

AMC Entertainment’s recent results have led to significant stock appreciation, with shares surging by 8%. This upswing is attributed to the company’s successful navigation of post-pandemic theater-goer trends, as evidenced by better-than-expected earnings. With revenue hitting $1.4 billion, surpassing forecasts, AMC’s ability to attract audiences back to theaters reflects an underlying resilience in the film industry.

The company’s financial performance illustrates the importance of adapting to changing consumer behaviors, particularly as streaming services continue to grow. By breaking even—which analysts had not anticipated—it signals that AMC may be tackling its previous fiscal challenges effectively, hinting towards a potential revitalization of the cinema business model moving forward. Investors may continue to monitor AMC closely as it embarks on a recovery path amidst industry shifts.

Intel’s Strategic Movements and Stock Performance

Intel’s stock saw a premarket increase of about 3%, largely influenced by CEO Lip-Bu Tan’s impending visit to the White House. Given the political scrutiny surrounding Intel’s operations, particularly concerning ties with Chinese businesses, this visit could solidify regulatory relations, benefiting the company’s standing in the U.S. market. Investors view this move as a potential stabilizer amid ongoing geopolitical tensions.

However, perceptions of leadership changes and political relationships can introduce volatility to Intel’s trading prospects. Clarity in corporate governance and a commitment to transparency will serve as vital components in restoring investor confidence. As the geopolitical landscape evolves, especially in technology, Intel’s navigation through these complexities will be critical in determining its stock trajectory.

Cryptocurrency Stocks Surge Amid Bitcoin Jump

As the price of bitcoin approaches its all-time high, leading crypto-related stocks such as Coinbase and MicroStrategy have experienced appreciable gains, each rising around 3%. This upward momentum reflects broader market enthusiasm surrounding cryptocurrencies, particularly following transformative regulatory measures that allow for alternative assets in retirement plans. Because of this supportive environment, cryptocurrency investments are gaining traction among institutional investors.

The recent surge in investor interest toward crypto stocks signals a growing acceptance of digital currencies within traditional financial structures. As firms like Robinhood also witnessed a bump in their shares, it showcases the interconnectedness of cryptocurrency valuations and trading platform performances. Investors may find considerable opportunities in this market evolution, with a keen eye towards developments in regulations and technology.

Nexstar and Tegna: Examining Acquisition Talks

Recent news of Nexstar’s advanced discussions to acquire Tegna indicates a significant consolidation move within the media industry. Despite a slight dip of less than 1% in Nexstar’s shares, Tegna’s stock skyrocketed by 29%, illustrating market speculation surrounding the potential benefits of this acquisition. Such strategic mergers highlight the ongoing trend of media companies seeking to enhance their content offerings and operational synergies.

The implications of this acquisition may extend beyond immediate financial metrics, affecting viewer engagement and advertising revenues in the long term. As both companies navigate this potential transaction, investors should closely monitor the progress and explore how it could reshape the competitive landscape of local broadcasting. Transparency in communication and diligent integration planning will prove crucial for maximizing shareholder value in the future.

Rumble’s Stock Surge: AI Cloud Computing Interest

Rumble’s impressive 12% jump in stock price after the announcement of a potential all-stock bid for Northern Data highlights the growing interest in AI cloud computing. As Rumble positions itself as a player in this arena, it reflects a strategic pivot towards leveraging emerging technologies, which could unlock new revenue streams. Such movements can attract investors keen on forward-looking companies in the tech sector.

However, the announcement also caused Northern Data shares to tumble, signaling market skepticism about the offer’s valuation and strategic fit. Investors will have to weigh the risks and opportunities this move entails, as Rumble firms up its identity in a competitive landscape. The success of this endeavor will ultimately depend on effective execution and the perceived viability of Rumble’s long-term strategies in the evolving tech domain.

Frequently Asked Questions

What are the key premarket stock moves for Paramount Skydance and TKO Group?

In premarket trading, shares of Paramount Skydance surged 4% after they acquired the U.S. rights to TKO Group’s UFC for a seven-year term starting in 2026. TKO Group’s shares also recorded a gain of about 2%.

Why did C3.ai stock drop significantly in premarket trading?

C3.ai experienced a sharp decline of nearly 32% in premarket trading due to disappointing fiscal first-quarter guidance. The company projected revenues between $70.2 million and $70.4 million, with expected non-GAAP losses ranging from $57.7 million to $57.9 million.

What impact did the Nvidia trading update have on its stock in premarket?

Nvidia shares fell approximately 1% in premarket trading following the company’s trading update about a new agreement with the Trump administration regarding revenue from chips sold to China, which raised concerns among investors.

What were the premarket results for AMC Entertainment?

AMC Entertainment’s shares jumped 8% in premarket trading after the company reported second-quarter results that exceeded analysts’ expectations. Unlike anticipated losses, AMC broke even after excluding one-time costs, with revenues reaching $1.4 billion, surpassing the consensus estimate.

How did analysts view CoreWeave’s price target in premarket trading?

CoreWeave saw its shares rise nearly 4% in premarket trading after JPMorgan maintained its overweight rating and increased the company’s price target. Analysts expressed optimism about the potential for continued growth in CoreWeave’s business pipeline despite market volatility.

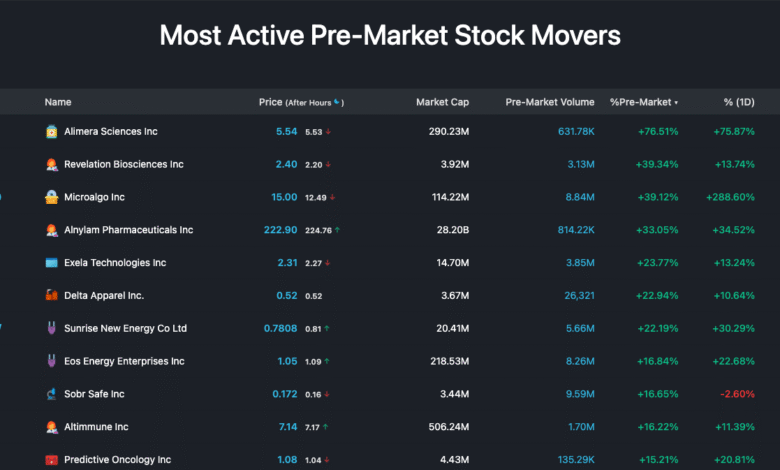

| Company | Stock Movement | Key Event |

|---|---|---|

| Paramount Skydance, TKO Group | +4% | Acquired U.S. rights to TKO Group’s UFC for seven years starting 2026. |

| C3.ai | -32% | Issued weaker guidance for Q1, expecting revenues of $70.2M to $70.4M. |

| Nvidia, Advanced Micro Devices | -1% | Entered agreement to pay U.S. government 15% of revenue from chips sold to China. |

| AMC Entertainment | +8% | Exceeded analysts’ expectations with Q2 results, breaking even after adjustments. |

| CoreWeave | +4% | JPMorgan maintains overweight rating and lifts price target. |

| Intel | +3% | Increased shares ahead of CEO’s meeting at the White House. |

| Coinbase, Robinhood, MicroStrategy | +2% to +3% | Shares rose as Bitcoin neared all-time highs amid new regulatory actions. |

| Nextstar, Tegna | Nexstar – <1%, Tegna +29% | Nexstar in talks to acquire Tegna, leading to a surge in Tegna’s shares. |

| Rumble | +12% | Considering an all-stock bid for Northern Data worth $1.2 billion. |

| Tesla | +2% | Requested an electricity license to supply U.K. households. |

Summary

Premarket stock moves indicated a volatile day in the market with notable activity from various companies. Paramount Skydance and AMC Entertainment saw significant gains, bolstered by strategic acquisitions and strong earnings. In contrast, C3.ai faced a steep decline due to disappointing revenue forecasts. The landscape for stocks like Nvidia and Intel was impacted by regulatory developments affecting the semiconductor industry. Overall, these premarket stock moves reflect the dynamic nature of the market and highlight the factors affecting investor sentiment.