Cava Same-Store Sales Decline Leads to Stock Plummet

Cava same-store sales decline has become a pivotal concern for the fast-casual dining industry, as the company struggles to meet expectations following a lackluster second quarter. On Tuesday, management slashed their full-year forecast for same-store sales growth to a mere 4% to 6%, down from the previously optimistic 6% to 8%. This announcement triggered a sharp drop in Cava’s stock price, which plummeted over 20% in after-hours trading, reflecting investor anxiety over the company’s future. Despite an overall net restaurant sales surge of 20%, the disappointing same-store sales have raised questions about Cava’s financial outlook and its ability to sustain restaurant sales growth amidst challenging market conditions. With other fast-casual chains also reporting struggles, Cava’s performance will be closely watched by analysts and investors alike, highlighting the fluctuating landscape of the restaurant sector.

The recent downturn in Cava’s comparable sales has raised eyebrows across the restaurant community, as many anticipated a robust performance from the fast-casual chain. Cava’s projected figures for same-store sales have taken a hit, placing it in a tough position not only against competitors but also in terms of overall market confidence. As industry participants grapple with shifting consumer preferences and fluctuating market dynamics, the challenges faced by Cava emphasize broader trends within the dining sector. Many fast-casual establishments are under increasing pressure to innovate and adapt, especially in light of Cava’s reduced financial forecasts and the ripple effects felt throughout the industry. As the focus shifts towards operational efficiency and customer engagement, Cava’s next moves will be critical in navigating this tumultuous landscape.

Cava Same-Store Sales Decline: An Overview

Cava’s recent announcement of a lowered full-year forecast for same-store sales growth comes as a significant blow to the restaurant chain, particularly amidst a competitive fast-casual dining landscape. Originally projecting a 6% to 8% growth, the revised estimate of 4% to 6% reflects a cautious approach following a tough second quarter. This adjustment is significant because same-store sales metrics are critical for evaluating a restaurant’s performance over time without the influence of new locations, and can greatly affect investor confidence and stock market reactions.

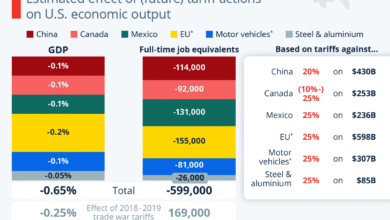

During the second quarter, Cava reported only a 2.1% increase in same-store sales, a stark contrast to the 14.4% growth achieved in the previous year. While net restaurant sales expanded by 20% to reach $278.2 million, this surge was largely attributed to the opening of new locations rather than strong existing customer retention. Wall Street’s anticipated growth of 6.1% puts additional pressure on Cava, highlighting potential areas of concern regarding their customer engagement strategies and overall market performance.

Cava Financial Outlook After Q2 Results

In light of Cava’s revised predictions, stakeholders are keenly observing the company’s financial outlook. With adjusted EBITDA expected to remain in the range of $152 million to $159 million, Cava aims to reassure investors of its underlying profitability despite recent setbacks. This guidance suggests that while same-store sales may not meet initial projections, the chain maintains a robust operational framework, allowing it to sustain healthy profit margins in a challenging industry.

However, the 20% drop in shares following the earnings report reflects investor anxiety regarding the long-term sustainability of such growth levels. For Cava to navigate the shifting tides within the fast-casual segment, focusing on maintaining restaurant-level profit margins between 24.8% and 25.2% will be crucial. By effectively managing costs and operational efficiency, Cava can potentially stabilize its stock performance and mitigate pressures from both internal challenges and broader industry competitors.

Recent Developments Concerning Cava Stock

Cava’s stock has faced considerable turbulence this year, dropping 40%, exacerbated by the recent after-hours plummet of over 20% following their disappointing earnings announcement. This significant downturn highlights broader trends within the fast-casual dining sector, where firms such as Chipotle and Sweetgreen are also grappling with challenges related to same-store sales declines. The stock market’s reaction emphasizes growing concerns from investors regarding consumer preferences and spending habits, particularly in a recovering economy.

Investors and market analysts are analyzing Cava’s stock drop closely, as confidence in the company’s ability to rebound from its current predicament will depend on effective strategic decisions moving forward. Cava’s engagement in a $25 million Series B funding round for the automation startup Hyphen could signal a proactive approach to enhancing operational efficiencies. As these innovations take root, they may present new avenues for growth that could help restore investor trust and stabilize stock prices in the long term.

Competitive Landscape for Fast-Casual Chains

The fast-casual dining segment has been marked by increasing challenges as chains like Cava, Chipotle, and Sweetgreen report declining same-store sales. This trend raises questions about consumer behavior in this competitive market and the broader economic factors at play. Cava’s own efforts to maintain sales growth, despite its recent forecast revisions, underline the difficult landscape many chains face as they strive to attract and retain customers in a saturated environment.

With consumers becoming more discerning and their preferences evolving rapidly, fast-casual chains must pivot strategically to drive traffic. Initiatives such as menu innovation, enhanced marketing strategies, and improved customer service can play crucial roles in boosting sales. Also, learning from the setbacks experienced by peers could help Cava position itself more favorably in an ever-changing dining industry.

Cava’s Plans for Growth amid Industry Challenges

Despite the current hurdles it faces, Cava is actively seeking growth opportunities to combat industry-wide sales declines. Their participation in the funding round for Hyphen indicates a commitment to technology-driven solutions that could streamline service and improve customer experiences. By automating processes, Cava aims to increase order accuracy and enhance operational efficiency, crucial aspects for maintaining a positive dining experience as customer traffic fluctuates.

In a market where many chains struggle with sales growth, Cava’s initiative emphasizes the importance of adapting to consumer needs. By investing in technology and optimizing its operational framework, Cava is positioning itself to better meet the demands of its customers, which could ultimately lead to improved same-store sales numbers as it rebounds from recent challenges.

The Impact of Market Dynamics on Cava’s Performance

Cava’s performance is inevitably influenced by broader market dynamics, including shifting consumer preferences and competitive pressures. Many fast-casual chains face a tightening economic environment, prompting diners to rethink their dining-out habits, often opting for value instead of experience. With these dynamics at play, Cava’s strategy must involve not only focusing on internal operations but also keenly observing market trends to predict and adapt to consumer behavior efficiently.

As competitors like Chipotle and Sweetgreen also navigate similar challenges, Cava has the opportunity to differentiate itself through innovative offerings and strategic marketing. Keeping a close eye on its competitors allows Cava to pivot quickly, ensuring it remains relevant and desirable to its target audience, which is essential for recovering from its recent sales forecasts.

Adjusting to Consumer Trends: Cava’s Response

As Cava adjusts its strategies in response to evolving consumer trends, it becomes imperative for the restaurant chain to understand the underlying factors affecting the market. Recognizing that patrons are looking for more than just convenience, but also a value-driven experience, Cava needs to reassess its menu offerings and customer engagement tactics to align more closely with current expectations. By enhancing the overall dining experience, Cava can potentially reverse its same-store sales trajectory.

Moreover, Cava’s commitment to exploring innovative culinary options could resonate well with health-conscious consumers, providing an edge in a saturated fast-casual industry. Moving forward, leveraging consumer preferences can help Cava craft unique brand positioning that encourages loyalty and attracts new customers, ultimately propelling sales growth to align with its long-term objectives.

Reinforcing Financial Confidence at Cava

In reaffirming its financial projections amid the recent downturn, Cava seeks to strengthen investor confidence despite current market pressures. Maintaining expected adjusted EBITDA values allows stakeholders to appreciate the underlying profitability of the chain, which is crucial for guiding future business strategies. Cava’s approach indicates a stabilizing influence, which could allay fears following the disappointing sales forecasts.

As Cava works to fortify its operational efficiency and navigate challenges, reinforcing financial confidence is essential in retaining and attracting investors. Continuous communication regarding growth strategies, coupled with transparent reporting on performance metrics, will play a significant role in rebuilding trust, especially in light of the volatile stock performance the company has experienced this year.

Cava’s Vision for Sustainable Growth

Ultimately, Cava’s vision must encompass a sustainable growth strategy that goes beyond short-term gains. The current same-store sales decline highlights the need for a robust plan that addresses not just immediate challenges, but also the path forward. Bolstering restaurant-level profit margins, exploring technological advancements, and refining customer experiences can collectively propel Cava towards a more prosperous future.

With an eye on long-term outcomes, Cava’s ability to adapt to both industry feedback and consumer trends will be pivotal in determining its success. By focusing on both innovation and customer satisfaction, the fast-casual restaurant is well-positioned to reclaim market share and improve its overall performance in the increasingly competitive landscape.

Frequently Asked Questions

What caused the recent decline in Cava’s same-store sales?

Cava’s recent decline in same-store sales can be attributed to disappointing second-quarter results, where the company reported a growth of only 2.1% compared to a projected 6.1%. While their net restaurant sales increased by 20% overall due to new openings, the flat traffic during the quarter raised concerns about future performance.

How has Cava’s stock been affected by the same-store sales decline?

Cava’s stock experienced a significant drop of over 20% in after-hours trading following the announcement of the same-store sales decline. The stock has fallen approximately 40% this year, driven by the lowered sales growth forecast and disappointing financial results.

What is Cava’s revised forecast for same-store sales growth this year?

Cava has revised its full-year same-store sales growth forecast to between 4% and 6%, down from its previous estimate of 6% to 8%. This adjustment reflects their latest performance and the challenges faced in the fast-casual segment.

What are the implications of Cava’s same-store sales growth for investors?

The decline in same-store sales growth suggests that investors should carefully evaluate Cava’s financial outlook. While the company continues to project strong EBITDA and maintain profit margin forecasts, the reduced sales expectations could impact future earnings and stock performance.

How does Cava’s performance compare to other fast-casual chains facing a sales decline?

Cava’s same-store sales growth, though disappointing, is notable as other fast-casual chains like Chipotle and Sweetgreen are also reporting declines. Chipotle experienced a 4% same-store sales drop, emphasizing the broader challenges within the fast-casual industry.

What future strategies is Cava implementing to improve sales performance?

To bolster its performance, Cava is participating in a $25 million Series B funding round for Hyphen, a restaurant automation startup. This investment aims to enhance order accuracy and speed, potentially helping to drive customer traffic and improve same-store sales.

What is Cava’s projected adjusted EBITDA despite the sales decline?

Despite the decline in same-store sales, Cava projects adjusted EBITDA between $152 million and $159 million for the full year. This forecast indicates the company’s expectation of maintaining operational profitability even amidst challenging sales conditions.

| Key Point | Details |

|---|---|

| Same-Store Sales Growth Lowered | Cava revised its full-year same-store sales growth forecast to 4%-6% from the previous 6%-8%. |

| Second Quarter Performance | Net income was $18.4 million (16 cents/share), a decrease from $19.7 million (17 cents/share) year-on-year. |

| Sales Increase | Net restaurant sales rose by 20% to $278.2 million, primarily due to new restaurant openings. |

| Comparative Same-Store Sales | Same-store sales increased by only 2.1% in Q2, against expectations of 6.1%. |

| Market Reaction | Cava’s shares dropped over 20% in after-hours trading, contributing to a 40% decline in stock value for the year. |

| Industry Trends | Other fast-casual chains, like Chipotle and Sweetgreen, are also experiencing declines. |

| Future Projections | Cava estimated adjusted EBITDA of $152-$159 million and maintained restaurant-level profit margin projections. |

| Investment Announcement | Cava is participating in a $25 million funding round for Hyphen, focusing on restaurant automation. |

Summary

Cava same-store sales decline has led the company to adjust its full-year growth forecast, reflecting the challenges faced in the current market. After a disappointing second quarter, where same-store sales only rose by 2.1%, Cava has revised its expectations downward from a projected 6%-8% to 4%-6%. This shift indicates broader struggles within the fast-casual dining segment, as other competitors are encountering similar sales challenges. With a significant after-hours stock drop of over 20% following these announcements, the implications of Cava’s revised outlook may resonate throughout the industry, as brand performance becomes increasingly scrutinized by investors amid a turbulent economic landscape.