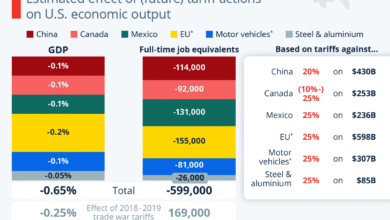

Mortgage Refinancing Demand Surges 23% Amid Rate Changes

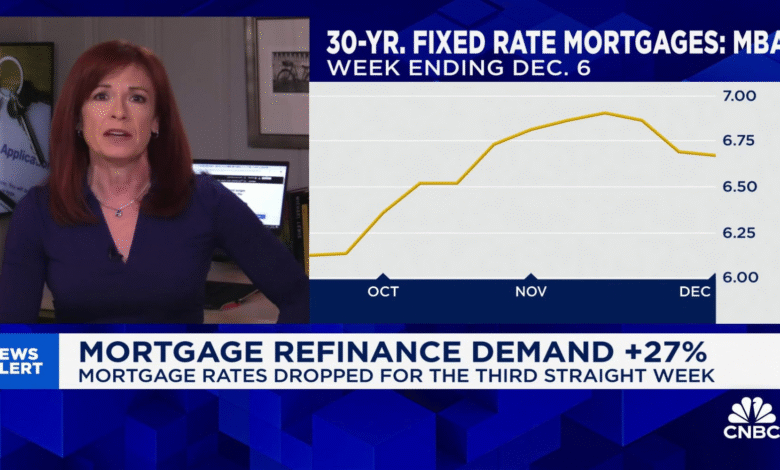

Mortgage refinancing demand has surged significantly, recording a remarkable 23% increase just last week. This uptick in refinance applications signals that homeowners are eager to capitalize on lower mortgage rates, which have dipped to an average of 6.67% for 30-year fixed-rate mortgages. The growing interest in home loan refinancing reflects a shift in the mortgage market, as many are also exploring adjustable-rate mortgages as a viable option. As the refinance share of total mortgage activity rises to 46.5%, it’s clear that borrowers are taking proactive steps to manage their financial futures amidst shifting economic conditions. This renewed enthusiasm in refinancing also points to a broader trend where homeowners seek to reduce their overall costs by harnessing the current favorable rates available.

The recent spike in mortgage refinancing activity showcases a significant trend in the financial landscape, indicating that many homeowners are taking advantage of current favorable conditions. With the refinance sector accounting for nearly half of all mortgage applications, this indicates a clear strategy shift among consumers as they look to optimize their home financing options. Many are now considering various products such as adjustable loans to mitigate monthly payments. The increased volume of mortgage applications reflects a growing demand for home loan alterations and financial adjustments in a fluctuating market. As borrowers navigate this intricate terrain, understanding the nuances of refinancing will be essential for making informed mortgage decisions.

Current Trends in Mortgage Refinancing Demand

The mortgage refinancing demand has seen a notable increase recently, with homeowners eager to capitalize on lower interest rates. The latest reports indicate a dramatic 23% surge in refinancing applications, signaling a shift in the mortgage market as homeowners weigh their options. This behavior is driven largely by the decrease in average contract interest rates for 30-year fixed-rate mortgages, which recently fell to 6.67%. Such changes make refinancing an attractive option for many, especially for those who may wish to reduce their monthly payments or consolidate debt.

Moreover, the share of refinance activity in overall mortgage applications has risen significantly, now accounting for 46.5%. This increased demand illustrates consumers’ awareness of potential savings. Historically, homeowners have leveraged refinancing to take advantage of favorable market conditions. Currently, with the average loan size increasing and adjustable-rate mortgages (ARMs) gaining traction, it’s clear that many borrowers are willing to take calculated risks for the benefits of refinancing.

The Appeal of Adjustable-Rate Mortgages in Current Market Conditions

Adjustable-rate mortgages (ARMs) are experiencing a resurgence, attracting a growing number of borrowers in the current low-rate environment. Reports indicate that applications for ARMs increased by 25%, reaching their highest level since 2022. This trend reflects a broader shift in consumer behavior, where borrowers are increasingly open to the variable nature of ARMs in exchange for potentially lower initial rates. As traditional fixed-rate mortgages maintain relatively high rates, the allure of lower ARM rates is compelling for many homeowners looking to refinance.

However, this comes with inherent risks as ARMs typically have lower fixed rates for an initial period before adjusting to current market conditions. As noted in the Mortgage Bankers Association’s report, the average contract interest rate for 5/1 ARMs decreased to 5.80%, appealing to those seeking lower monthly payments upfront. Still, it remains vital for borrowers to consider their long-term financial situations and potential interest rate fluctuations down the line, ensuring they are fully aware of the implications of choosing an ARM over a conventional fixed-rate mortgage.

Understanding these risks associated with ARMs is crucial, especially as the mortgage market continually evolves. Borrowers must assess their financial stability, future expectations regarding interest rates, and their comfort level with potential payment adjustments when selecting this type of loan.

Impact of Mortgage Rates on Homebuying Applications

Despite the favorable shifts in refinancing demand, the mortgage rates have not spurred an equivalent increase in applications for home purchases. The data reveals that applications for obtaining mortgages to purchase a home increased by just 1% last week, though they were still 17% higher than this time last year. This indicates a gradual, yet ongoing recovery in the homebuying segment, albeit at a modest pace compared to refinancing activity.

While mortgage rates have shown some modest stability lately, the historical high prices of homes continue to hinder potential homebuyers. Though some areas witness price corrections, nationally, home prices remain elevated compared to average incomes, making affordability a significant concern. Homebuyers must navigate these high prices while interacting with the prevailing level of mortgage rates, which may feel burdensome despite any slight gains in buying activity. A thorough understanding of the current mortgage landscape is therefore crucial for prospective buyers aiming to secure a favorable deal.

Analyzing the Factors Driving Mortgage Refinancing Growth

The recent surge in mortgage refinancing can be attributed to several intersecting factors, prominently featuring decreasing mortgage rates. With the average interest rate for 30-year fixed-rate mortgages at 6.67%, many homeowners are seizing this opportunity to potentially lower their monthly payments or refinance into smaller loan sizes. The broader economic environment, characterized by fluctuating inflation rates, also plays a role. As fixed mortgage rates adjust in response to economic indicators, consumers are left to evaluate their refinancing options under changing conditions.

Additionally, the increasing share of refinancing applications suggests that consumers are reacting intelligently to current market signals. As rates decrease, the mortgage market becomes more competitive, encouraging borrowers to explore refinancing as a viable alternative to home purchasing amidst high prices. Given that refinancing applications accounted for nearly half of all mortgage activity, it is crucial to consider how fluctuations in the overall economic landscape and monetary policy might continue to influence borrowing behavior moving forward.

Risks Associated with Riskier Mortgage Products

As refinancing demand rises, there is a noticeable increase in interest toward riskier mortgage products such as adjustable-rate mortgages (ARMs). While these loans can offer substantial initial savings, they come with inherent risks associated with future rate adjustments. Homeowners who opt for ARMs should thoroughly evaluate their long-term plans, as these types of loans can lead to increased payment amounts if market rates rise significantly after the fixed-rate period concludes. Being well-informed about loan structures is paramount in navigating these potential pitfalls.

Moreover, the current mortgage landscape shows that borrowers with larger loan sizes tend to be more sensitive to rate movements—indicating careful consideration of their financing choices. They may be more adept at absorbing fluctuating payment scenarios associated with ARMs. However, for first-time buyers or those on tighter budgets, the risks of a rate hike could pose a daunting challenge. Thus, understanding the intricacies of different mortgage products is vital not just for maximizing savings, but also for maintaining financial stability.

Shifts in Consumer Preferences Towards Home Loan Refinancing

Shifting attitudes among homeowners have also influenced the growing preference for home loan refinancing. As economic conditions fluctuate, homeowners are increasingly motivated to improve their financial situations by leveraging lower interest rates. The recent surge in refinancing demand is evident in the spike of applications seen last week. Homeowners are reassessing their financial goals, opting not only for refinancing but also for consolidating debt—leading to a rise in total mortgage application volume.

Such changes reflect a proactive approach to managing financial health, encouraging seasoned homeowners to consider refinancing as a tool for navigating economic uncertainty. As consumer preference shifts, lenders must adapt to meet the evolving needs of borrowers. The mortgage market’s flexibility in offering various refinancing options will be key in attracting a broader audience looking to optimize their home financing solutions.

The Role of Economic Indicators on Mortgage Market Trends

Economic indicators play a crucial role in shaping the trends within the mortgage market. Recent inflation reports have highlighted mixed outcomes, influencing market expectations for future mortgage rates. Interest rates and economic conditions are intertwined, impacting consumer sentiment and borrowing behaviors. As the market reacts to economic news, potential homebuyers and those interested in refinancing must remain attentive to these indicators, which can affect their financial decisions.

Furthermore, the Federal Reserve’s monetary policy plays a critical part in dictating borrowing costs. As indicated by industry experts, potential rate cuts by the Fed could lead to even more favorable conditions for refinancing. Homeowners keen on taking advantage of this potential pivot must stay updated on economic forecasts and market trends to time their refinancing decisions effectively, ensuring they optimize their mortgage arrangements amid shifting economic landscapes.

Future Outlook for Mortgage Refinancing and Home Purchases

Looking ahead, the future of mortgage refinancing and home purchases hinges greatly on the direction of interest rates and economic trends. With refinancing demand currently strong, it will be essential to monitor how changing market dynamics may influence borrower behavior. Interest rates are the primary motivators behind refinancing activity, and any shifts could lead to either further increases or decreases in demand for refinancing applications.

Potential homebuyers must also navigate the delicate balance between interest rates and home prices moving forward. As affordability continues to be a pressing concern, understanding how these factors interrelate will be vital for consumers looking to enter the housing market. Hence, both existing homeowners and prospective buyers are urged to remain informed and adaptable, ensuring they can make sound financial decisions in an evolving mortgage landscape.

Frequently Asked Questions

What factors are driving the recent increase in mortgage refinancing demand?

The recent increase in mortgage refinancing demand can be attributed to falling mortgage rates, particularly a decrease in the average contract interest rate for fixed-rate mortgages. The refinance share of mortgage activity surged to 46.5% of total applications as homeowners look to save on monthly payments, especially with applications to refinance a home loan jumping 23% for the week.

How do adjustable-rate mortgages factor into the mortgage refinancing demand?

Adjustable-rate mortgages (ARMs) are becoming increasingly attractive in today’s mortgage market, contributing significantly to the surge in mortgage refinancing demand. With ARM rates having decreased and being lower than fixed-rate loans, borrowers are more inclined to opt for these riskier products for potential short-term savings. ARM applications increased by 25%, reflecting this shift in demand.

What does the recent mortgage refinancing demand say about homeowners’ financial strategies?

The rise in mortgage refinancing demand indicates that homeowners are actively seeking ways to reduce expenses, even if it entails taking on more risk through adjustable-rate mortgages. This trend highlights a broader strategy among borrowers to capitalize on lower mortgage rates, as evidenced by the 23% jump in refinance applications.

Is the increase in refinance applications a sign of a strong mortgage market?

Yes, the increase in refinance applications to 46.5% of total mortgage activity signals a robust mortgage market. The overall volume of mortgage applications, including refinancing and home purchases, rose by 10.9% last week, suggesting that consumers are responding favorably to current mortgage rates.

How has the average loan size changed with the increase in mortgage refinancing demand?

As mortgage refinancing demand has surged, particularly among larger loans, the average loan size has grown significantly to $366,400. This increase indicates that more borrowers with substantial loans are initiating refinancing, likely due to their heightened sensitivity to fluctuations in mortgage rates.

What impact do falling mortgage rates have on refinancing demand?

Falling mortgage rates directly stimulate refinancing demand, as homeowners aim to secure lower interest payments. With the average interest rate for 30-year fixed-rate mortgages dipping to 6.67%, many are choosing to refinance their existing loans, driving a notable rise in overall applications.

What should homeowners consider before joining the mortgage refinancing demand?

Homeowners should evaluate their current mortgage terms versus potential savings from refinancing, including the stability of fixed-rate loans versus the risks associated with adjustable-rate mortgages. Additionally, they should assess their financial goals, how long they plan to remain in their home, and the associated costs of refinancing.

| Key Points | |

|---|---|

| Average Interest Rate (30-year fixed) | 6.67% (down from 6.77%) |

| Refinance Share of Mortgage Activity | 46.5% (up from 41.5%) |

| Purchase Mortgage Applications | Increased by 1% YoY in August (up 17%) |

| Refinance Applications Jump | Increased by 23% from last week |

| ARM Applications Growth | Increased by 25% to the highest level since 2022 |

| Current Market Trends | Mortgage application volume rose 10.9% last week |

| Average Refinance Loan Size | $366,400 (significantly higher due to rate sensitivity) |

Summary

Mortgage refinancing demand has recently surged, with a remarkable 23% increase noted in the latest week. This rise reflects homeowners’ pursuit of cost savings through refinancing, underpinned by a decrease in mortgage rates. The trend toward riskier loans, such as adjustable-rate mortgages, is also evident, as borrowers seek to capitalize on lower rates. This dynamic suggests a growing willingness among homeowners to explore refinancing options in a shifting economic landscape.